Is UZFX safe?

Business

License

Is UZFX A Scam?

Introduction

UZFX is a forex broker that positions itself as a platform for trading various financial instruments, including currency pairs, commodities, and indices. However, the legitimacy of UZFX has come under scrutiny, raising concerns among traders about its credibility and safety. In the volatile world of forex trading, where the potential for profit is accompanied by significant risks, it is crucial for traders to carefully evaluate their brokers before investing their money. This article aims to provide a comprehensive analysis of UZFX's safety and reliability by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile.

To conduct this investigation, we utilized various sources, including regulatory databases, customer reviews, and expert analyses. Our evaluation framework focuses on key aspects such as regulatory compliance, financial safety measures, trading costs, and user feedback, allowing us to present an objective assessment of whether UZFX is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. UZFX's regulatory situation is concerning, as it lacks proper oversight from recognized financial authorities. Below is a summary of UZFX's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | Revoked | Australia | Not Verified |

UZFX claims to be regulated by the Australian Securities and Investments Commission (ASIC); however, reports indicate that its license has been revoked. This lack of regulation raises significant red flags, as unregulated brokers operate without oversight, exposing traders to higher risks of fraud and financial loss. The absence of a reputable regulatory framework means that UZFX does not adhere to the stringent standards and practices that protect traders' interests.

Moreover, the lack of transparency regarding its regulatory status further complicates the assessment of its legitimacy. Traders are often advised to steer clear of brokers that are not regulated by recognized authorities, as these brokers may engage in unscrupulous practices that can jeopardize client funds. Given these findings, it is prudent to question whether UZFX is indeed safe or if it poses a risk to traders.

Company Background Investigation

Understanding the company behind a forex broker is essential for assessing its reliability. UZFX has a relatively obscure presence in the forex market, with limited information available about its history, ownership structure, and management team. The lack of transparency surrounding these aspects raises concerns about the broker's credibility.

UZFX appears to have been operating for a few years, but specific details about its founding, ownership, and management team are scarce. This lack of information can be indicative of a broker that may not prioritize transparency or accountability. A reputable broker typically provides clear information about its founders, management team, and corporate structure, allowing traders to assess their expertise and experience in the financial sector.

Furthermore, the absence of a well-defined corporate history can lead to doubts about the broker's stability and commitment to ethical business practices. Traders should be cautious when dealing with brokers that do not offer sufficient information about their background, as this could be a sign of potential issues down the line.

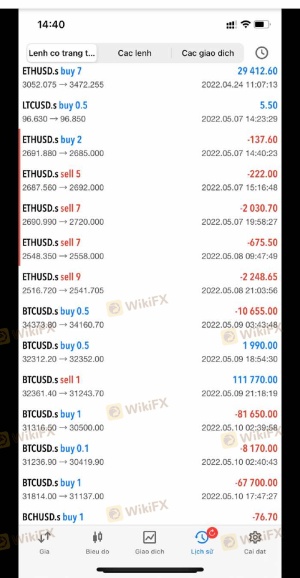

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is vital. UZFX's overall fee structure and trading conditions have drawn criticism, particularly regarding its spreads and commissions. Below is a comparison of UZFX's core trading costs:

| Cost Type | UZFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% | 0.3% |

The spreads offered by UZFX for major currency pairs are higher than the industry average, which may lead to increased trading costs for clients. Moreover, the broker's commission model lacks clarity, with some reports suggesting variable commissions that could be unfavorable for traders.

Additionally, the overnight interest rates charged by UZFX are also higher than average, which can significantly impact trading profitability, especially for those holding positions overnight. Traders should be aware of these costs and consider them when evaluating whether UZFX is safe for their trading activities.

Customer Funds Safety

The safety of customer funds is paramount when choosing a forex broker. UZFX's measures regarding fund security are questionable. Reports indicate a lack of adequate safeguards, such as segregated accounts and investor protection mechanisms. Here are key aspects of UZFX's fund safety measures:

Segregation of Funds: UZFX does not provide clear information about whether client funds are held in segregated accounts. This practice is essential for protecting traders' money in the event of the broker's insolvency.

Investor Protection: There is no indication that UZFX offers any form of investor protection, such as a compensation scheme. This absence of protection can leave traders vulnerable to financial losses.

Negative Balance Protection: UZFX has not demonstrated a commitment to providing negative balance protection, which is crucial for preventing clients from losing more money than they have deposited.

Given these findings, it is evident that UZFX does not prioritize customer fund safety. Traders should be wary of engaging with a broker that lacks robust security measures, as this could pose a significant risk to their investments.

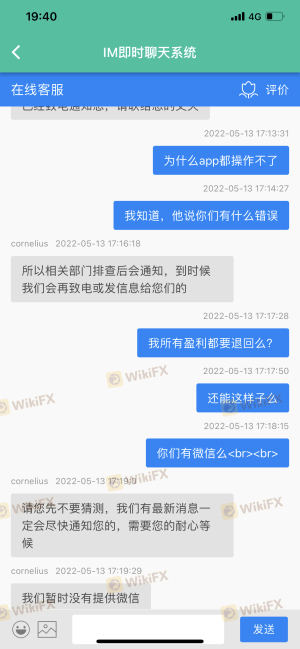

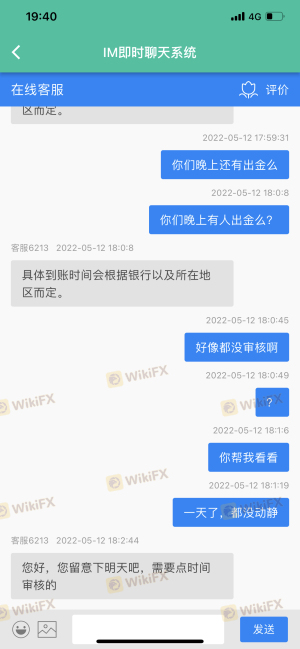

Customer Experience and Complaints

Customer feedback plays a vital role in assessing the reliability of a forex broker. UZFX has received numerous negative reviews from traders, with common complaints highlighting issues such as withdrawal problems, poor customer service, and lack of transparency. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| Lack of Transparency | High | Poor |

Many traders have reported difficulties in withdrawing their funds from UZFX, which is a significant red flag. Delays in processing withdrawals can indicate potential financial instability and a lack of operational integrity. Furthermore, the quality of customer service has been criticized, with users experiencing long response times and inadequate support.

For instance, one trader shared their experience of attempting to withdraw funds for weeks, only to receive vague responses from the support team. This lack of responsiveness can be frustrating for traders and raises concerns about the broker's commitment to client satisfaction.

Platform and Trade Execution

The performance of a trading platform is crucial for a positive trading experience. UZFX offers a proprietary trading platform, but user reviews indicate mixed experiences regarding its stability and execution quality. Traders have reported instances of slippage and rejections, which can negatively impact trading outcomes.

Moreover, the absence of well-known platforms like MetaTrader 4 or MetaTrader 5 may deter some traders who prefer established interfaces with advanced trading tools. The reliability of the platform is critical, as any technical issues can lead to missed trading opportunities and financial losses.

Risk Assessment

The overall risk of using UZFX appears to be high, given the concerns raised in previous sections. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Lack of proper regulation raises concerns. |

| Fund Safety | High | Insufficient safeguards for client funds. |

| Customer Service | Medium | Negative experiences reported by users. |

| Platform Reliability | High | Mixed reviews regarding execution quality. |

To mitigate these risks, traders should exercise caution when considering UZFX as their broker. It is advisable to conduct thorough research and consider alternative brokers with stronger regulatory oversight and better customer feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that UZFX exhibits several characteristics of a potentially unsafe broker. The lack of proper regulation, questionable fund safety measures, and numerous customer complaints indicate that traders should approach this broker with caution. It is essential for traders to prioritize their safety and financial security when choosing a forex broker.

For those seeking reliable alternatives, we recommend considering brokers that are well-regulated by reputable authorities, offer transparent trading conditions, and have a proven track record of positive customer experiences. Brokers such as ZFX, which operates under strict regulatory frameworks, may provide a safer trading environment.

In summary, is UZFX safe? The overwhelming evidence points towards a lack of safety and reliability, making it a broker to avoid for those serious about forex trading.

Is UZFX a scam, or is it legit?

The latest exposure and evaluation content of UZFX brokers.

UZFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UZFX latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.