Is ROCKFORT safe?

Pros

Cons

Is Rockfort Safe or Scam?

Introduction

Rockfort is a forex broker that positions itself within the competitive landscape of online trading, offering a variety of trading instruments such as forex, commodities, and cryptocurrencies. As the forex market continues to grow, the number of brokers has surged, making it critical for traders to carefully evaluate their options. A broker's legitimacy can significantly impact a trader's experience and financial safety. This article aims to provide a comprehensive analysis of Rockfort, focusing on its regulatory status, company background, trading conditions, customer safety, and user experiences. The findings are based on an extensive review of online resources, including user feedback and expert opinions.

Regulation and Legitimacy

The regulatory framework within which a broker operates is a vital indicator of its legitimacy. Rockfort claims to have affiliations with several regulatory bodies, including the Financial Markets Authority (FMA) in New Zealand. However, a closer look reveals inconsistencies in its licensing claims.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FMA | FSP509766 | New Zealand | Verified |

The FMA is known for its stringent regulatory standards, which can provide a level of assurance to traders. However, there are reports suggesting that Rockfort may also be linked to unregulated entities, raising questions about its overall compliance. The lack of transparency regarding its regulatory status and the presence of multiple names associated with the broker further complicate the evaluation. Given that unregulated brokers expose clients to significant risks, it is critical to approach Rockfort with caution.

Company Background Investigation

Rockforts history and ownership structure play a crucial role in assessing its credibility. Established in 2019, the broker claims to operate from New Zealand, but there is limited information available regarding its founders and management team. The absence of detailed information about the company's leadership raises concerns about transparency.

Moreover, the brokers website lacks comprehensive disclosures about its operational practices and financial standing. This lack of clarity can be alarming for potential investors, as it may indicate an attempt to obscure critical information. A reputable broker typically provides clear information about its management team and operational history, which Rockfort fails to do.

Trading Conditions Analysis

Understanding the trading conditions offered by Rockfort is essential to gauge its competitiveness in the market. The broker claims to provide a variety of trading instruments and account types, but the specifics of its fee structure remain ambiguous.

| Fee Type | Rockfort | Industry Average |

|---|---|---|

| Spread for Major Pairs | 1.0 - 1.5 pips | 0.5 - 1.0 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | 0.5% - 2.5% | 0.5% - 1.5% |

The spreads offered by Rockfort are higher than the industry average, which could erode potential profits for traders. Additionally, the lack of a transparent commission structure raises concerns about hidden fees that may not be disclosed until after account creation. This opacity can lead to unexpected trading costs, making it essential for traders to scrutinize the fee structure before proceeding.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. Rockfort claims to implement various security measures, such as segregating customer funds from operational funds. This practice is crucial in ensuring that client money is protected in case of financial difficulties faced by the broker.

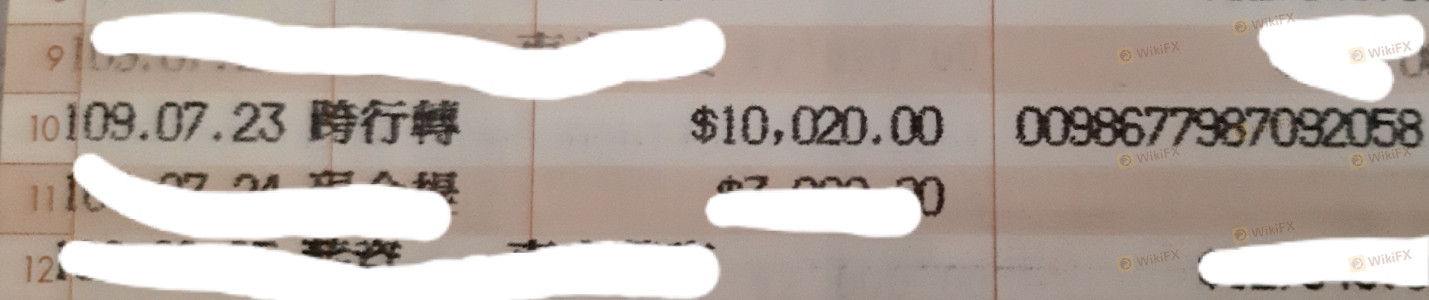

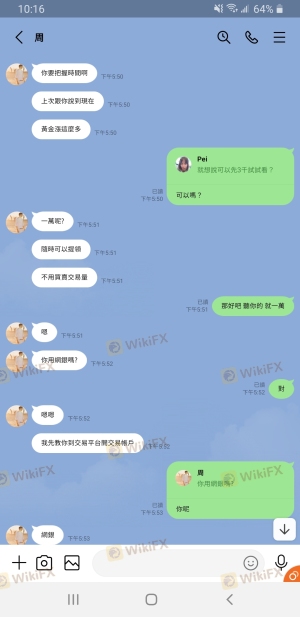

However, the absence of investor protection schemes or negative balance protection policies is alarming. In cases where a broker is unregulated, the risk of losing funds due to mismanagement or fraudulent activities increases significantly. Historical complaints and reports of withdrawal issues from users further exacerbate these concerns, indicating that while Rockfort may have some safety measures in place, they may not be sufficient to ensure complete fund security.

Customer Experience and Complaints

Analyzing customer feedback is vital for understanding the overall user experience with Rockfort. Many users have reported issues related to withdrawal delays and lack of responsive customer support. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Support | Medium | Fair |

Specific cases highlight the struggles users face when attempting to withdraw their funds. For instance, one user reported waiting over a month for their withdrawal request to be processed, while another mentioned that customer support was unresponsive to their inquiries. Such patterns of complaints can severely impact a trader's trust in the broker, raising questions about whether Rockfort is genuinely committed to customer satisfaction.

Platform and Execution

The trading platform offered by Rockfort is another critical aspect to consider. The broker utilizes the widely recognized MetaTrader 4 (MT4) platform, which is generally known for its reliability and user-friendly interface. However, user reviews indicate that there are concerns regarding order execution quality, including instances of slippage and rejections.

A lack of transparency around how orders are executed can lead to mistrust among traders. If there are indications of platform manipulation, it can create an environment where traders feel their interests are not adequately protected. Assessing the execution quality and any potential issues with the trading platform is essential for anyone considering Rockfort as their trading partner.

Risk Assessment

Using Rockfort presents various risks that traders must be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns |

| Financial Risk | Medium | Higher spreads can eat into profits |

| Operational Risk | Medium | Complaints about withdrawal delays |

Traders are advised to exercise caution when engaging with Rockfort. It is crucial to conduct thorough research and consider alternative brokers that offer more transparency and regulatory oversight.

Conclusion and Recommendations

In summary, while Rockfort presents itself as a legitimate forex broker, various red flags indicate that it may not be entirely safe for traders. The lack of comprehensive regulatory oversight, transparency issues, and a concerning history of customer complaints suggest that potential investors should approach with caution.

For traders seeking a more secure environment, it is advisable to consider well-established and regulated alternatives such as brokers under the Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC). Ultimately, ensuring that your trading partner is trustworthy is essential for a positive trading experience.

In conclusion, is Rockfort safe? Based on the available evidence, many factors suggest that it may be prudent to look elsewhere for your trading needs.

Is ROCKFORT a scam, or is it legit?

The latest exposure and evaluation content of ROCKFORT brokers.

ROCKFORT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ROCKFORT latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.