Rockfort 2025 Review: Everything You Need to Know

Executive Summary

This Rockfort review shows a complete analysis of a forex broker that has major regulatory and safety problems. Rockfort Markets works as an unregulated broker, which puts it in a bad position compared to other forex trading companies. The broker offers some good features like the popular MT4 trading platform and access to over 50 forex currency pairs, but the lack of proper regulatory oversight creates big risks for traders who might want to use their services.

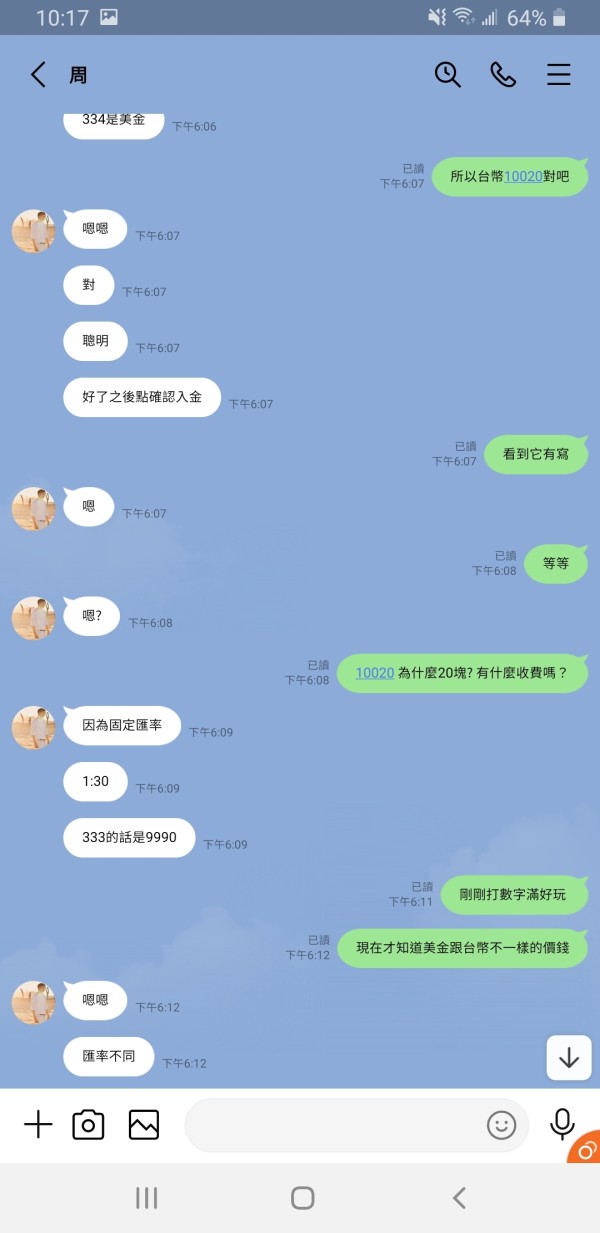

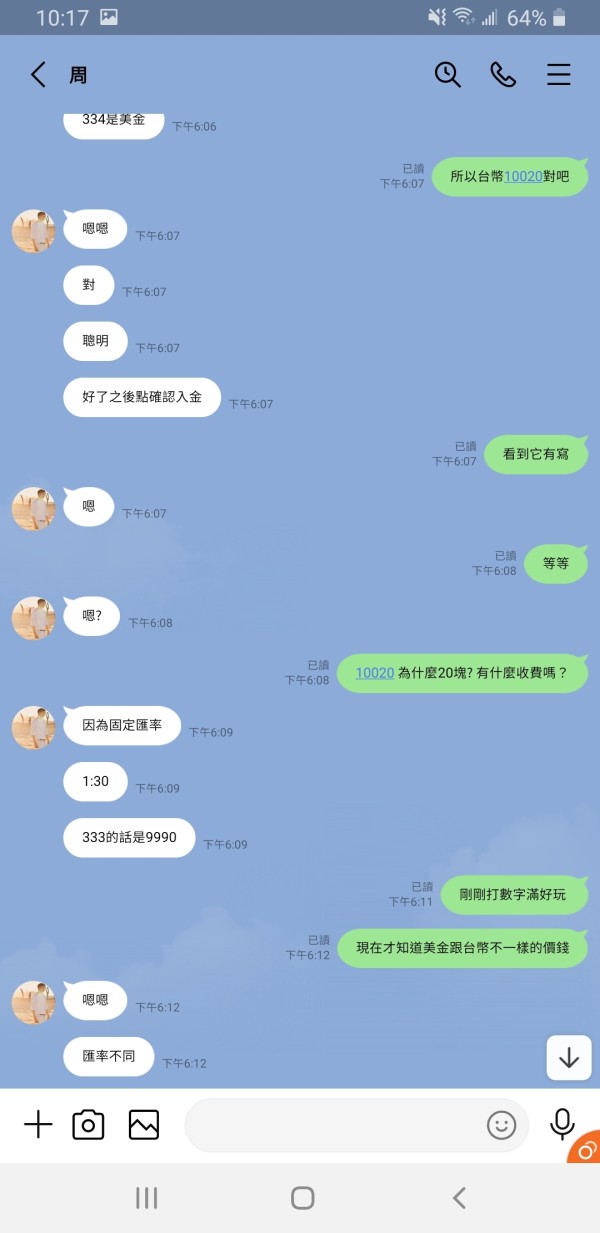

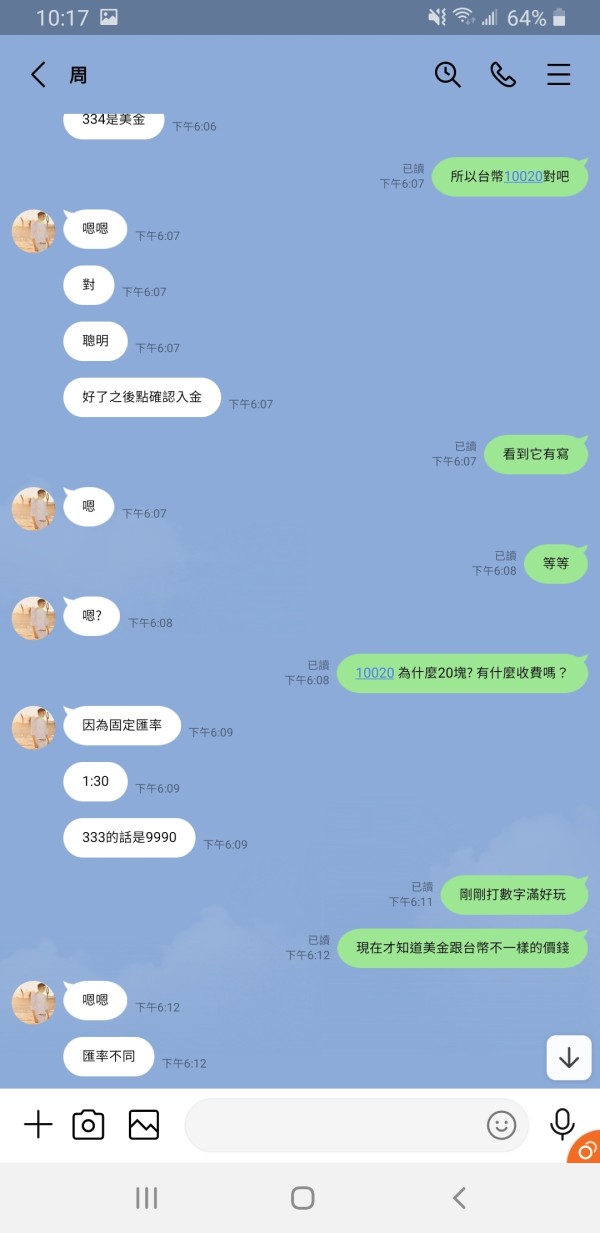

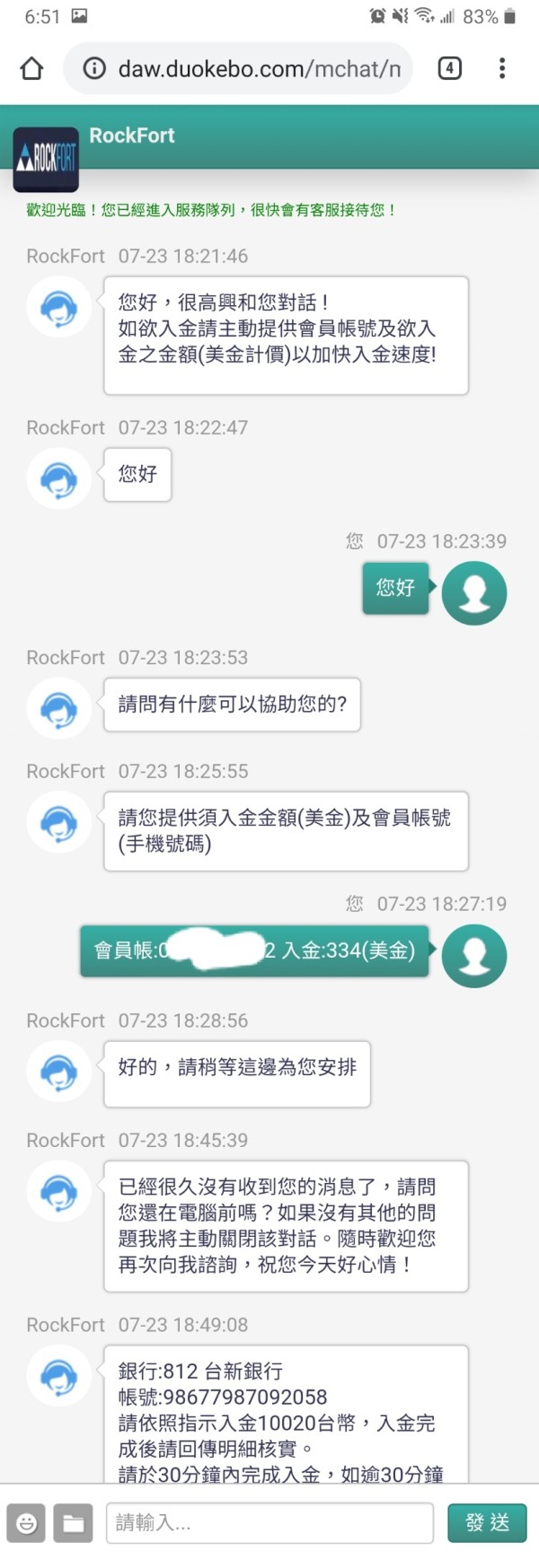

The broker mainly targets traders who want different forex trading options. It offers mobile forex trading platforms along with desktop solutions. However, the regulatory problems with Rockfort Markets are very serious and cannot be ignored. The Financial Markets Authority of New Zealand has cancelled Rockfort Markets' derivative issuer license because the company broke multiple license rules. This happened after the company lost an appeal in the High Court, where Justice Edwards supported the FMA's March 2023 decision to take away the broker's license. The court found that Rockfort had broken at least eight of its license conditions, including not following previous FMA Direction Orders and having poor systems for following advertising rules.

Important Notice

This evaluation shows major regional differences in Rockfort Markets' compliance status, especially regarding its operations in New Zealand. The broker's regulatory standing changes a lot across different areas, with the most concerning developments happening in New Zealand where the Financial Markets Authority has taken strong action against the company.

This review uses publicly available information from regulatory bodies, user feedback platforms, and industry reports. Since regulatory actions change often and the broker itself provides limited transparency, readers should check current information on their own before making any trading decisions.

Rating Framework

Broker Overview

Rockfort Markets works as a forex broker in an increasingly regulated financial services environment. Specific founding details remain unclear from available sources. The company has positioned itself as a provider of forex trading services, mainly focusing on currency pair trading through established platforms. However, regulatory authorities have looked closely at the broker's operational approach and business model, especially in New Zealand where it has faced major compliance challenges.

The broker's business model centers around forex trading services. It offers traders access to currency markets through digital platforms. According to available information, Rockfort Markets has tried to establish itself in the competitive forex brokerage space by providing access to popular trading platforms and a range of currency pairs. However, the company's approach to regulatory compliance has proven problematic, leading to serious consequences from financial authorities.

Regarding platform offerings, Rockfort Markets provides the widely-used MT4 trading platform alongside mobile forex trading solutions. The broker offers access to more than 50 forex currency pairs, positioning itself as a complete forex trading provider. The primary regulatory relationship was with New Zealand's Financial Markets Authority, though this relationship has been cut due to compliance failures. The FMA's cancellation of Rockfort's derivative issuer license represents a major regulatory action that affects the broker's credibility and operational legitimacy.

Regulatory Status: Rockfort Markets previously operated under New Zealand's Financial Markets Authority oversight but has lost this regulatory protection. The FMA cancelled the broker's derivative issuer license following multiple compliance violations and the company's failure to address regulatory concerns properly.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options is not detailed in available sources. This itself raises transparency concerns for potential traders seeking clear financial transaction procedures.

Minimum Deposit Requirements: The broker has not provided clear information about minimum deposit requirements in publicly available materials. This contributes to the overall lack of transparency that characterizes this broker.

Promotional Offers: Details about bonus promotions or special offers are not specified in available information. This suggests either the absence of such programs or poor communication about available benefits.

Trading Assets: The broker offers access to over 50 forex currency pairs. This provides traders with a reasonable selection of major, minor, and exotic currency combinations for trading opportunities.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not transparently provided in available sources. This lack of clear cost information makes it difficult for traders to assess the true cost of trading with this Rockfort review subject.

Leverage Options: Available materials do not specify the leverage ratios offered by the broker. This is crucial information for traders planning their risk management strategies.

Platform Selection: The broker primarily uses the MT4 trading platform. This platform is widely recognized and accepted in the forex trading community for its functionality and reliability.

Geographic Restrictions: Specific regional limitations are not detailed in available sources. However, regulatory actions in New Zealand may affect service availability in that area.

Customer Support Languages: Information about multilingual support options is not specified in available materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions offered by Rockfort Markets show major transparency issues that contribute to its low rating in this category. Available information does not specify different account types, their respective features, or the specific requirements for each tier. This lack of clarity makes it extremely difficult for potential traders to understand what they can expect when opening an account with the broker.

The absence of clear minimum deposit information represents a major concern for this Rockfort review. Most reputable brokers provide transparent information about account opening requirements, including minimum funding amounts for different account types. Without this basic information, traders cannot properly plan their initial investment or compare Rockfort's requirements with other market options.

Account opening procedures are not detailed in available sources. This raises questions about the broker's operational transparency. Professional forex brokers typically provide clear, step-by-step guidance about account opening, verification requirements, and timeline expectations. The lack of such information suggests either poor communication practices or poor operational procedures.

Special account features, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, are not mentioned in available materials. This absence of information about specialized account options limits the broker's appeal to diverse trading communities and suggests a limited service offering compared to more complete competitors.

Rockfort Markets receives a moderate rating for tools and resources primarily due to its provision of the MT4 trading platform. This platform is widely regarded as a professional-grade trading solution. The MT4 platform offers complete charting capabilities, technical analysis tools, and automated trading support through Expert Advisors, providing traders with essential functionality for forex market analysis and execution.

The broker's offering of over 50 forex currency pairs provides traders with reasonable diversification opportunities across major, minor, and exotic currency combinations. This selection allows for various trading strategies and enables traders to take advantage of different market conditions across global currency markets.

However, available information does not detail additional research and analysis resources that many traders expect from their brokers. Professional forex brokers typically provide market analysis, economic calendars, news feeds, and expert commentary to support trader decision-making. The absence of information about such resources suggests either limited offerings or poor communication about available tools.

Educational resources, which are crucial for trader development and platform familiarization, are not mentioned in available materials. Quality educational content including webinars, tutorials, and market education materials are standard offerings from reputable brokers, and their absence represents a major service gap.

Customer Service and Support Analysis (Score: 4/10)

Customer service evaluation for Rockfort Markets is limited by the lack of available information about support channels, response times, and service quality. The moderate-to-low rating reflects concerns about the broker's communication practices and the lack of transparent information about how traders can access support when needed.

Available sources do not specify the customer service channels offered, such as live chat, telephone support, email assistance, or help desk systems. Professional brokers typically provide multiple contact methods with clear availability hours and expected response times. The absence of such information creates uncertainty about support accessibility.

Response time commitments and service level agreements are not detailed in available materials. Traders need to understand how quickly they can expect responses to inquiries, especially for urgent trading-related issues or technical problems that may affect their market positions.

Multilingual support capabilities are not specified. This may limit the broker's accessibility to international traders who prefer support in their native languages. Quality customer service often includes support in multiple languages to serve diverse trading communities effectively.

The regulatory issues surrounding Rockfort Markets may also impact customer service quality. Regulatory compliance problems often relate to broader operational challenges that can affect support services and customer communication.

Trading Experience Analysis (Score: 5/10)

The trading experience with Rockfort Markets receives a middle-ground rating primarily based on the provision of the MT4 platform. This platform offers reliable functionality for forex trading. MT4 is widely recognized for its stability, complete charting capabilities, and support for automated trading strategies through Expert Advisors.

Platform stability and execution speed information is not detailed in available user feedback. This makes it difficult to assess the technical performance that traders can expect. Reliable order execution and minimal slippage are crucial factors for trading success, especially in volatile forex markets where timing is essential.

The Rockfort review of trading functionality suggests that while the MT4 platform provides standard features expected by forex traders, additional platform options or proprietary trading tools are not mentioned in available sources. Many competitive brokers offer multiple platform choices or enhanced trading interfaces to accommodate different trader preferences.

Mobile trading experience details are limited, though mobile forex trading platforms are mentioned as available. The quality and functionality of mobile trading applications significantly impact trader convenience and the ability to manage positions while away from desktop computers.

Overall trading environment assessment is complicated by the regulatory concerns surrounding the broker. These issues may affect trader confidence and the overall trading experience regardless of platform technical capabilities.

Trust and Safety Analysis (Score: 1/10)

Trust and safety represent the most concerning aspects of Rockfort Markets, earning the lowest possible rating due to severe regulatory issues and the lack of current regulatory protection. The Financial Markets Authority of New Zealand has taken decisive action against the broker, cancelling its derivative issuer license following multiple material violations of license obligations.

Regulatory compliance failures are well-documented. Justice Edwards of the High Court upheld the FMA's decision to cancel Rockfort's license. The court found that the broker had breached at least eight of its license conditions, including failure to comply with previous FMA Direction Orders and poor systems for ensuring compliance with advertising regulations.

Client fund protection measures are not detailed in available information. This is especially concerning given the broker's unregulated status. Reputable brokers typically provide clear information about segregated client accounts, investor compensation schemes, and fund protection measures that safeguard trader deposits.

Company transparency is severely lacking, with limited public information about the broker's financial status, operational procedures, or corporate governance. The absence of regular financial reporting and transparent communication about business operations raises major concerns about the company's reliability and accountability.

The regulatory penalties and license cancellation represent serious red flags. Potential traders must consider these carefully when evaluating the safety of their investments with this broker.

User Experience Analysis (Score: 3/10)

User experience evaluation for Rockfort Markets is challenged by limited available feedback and the overshadowing concerns about regulatory compliance. The low rating reflects both the lack of complete user testimonials and the major trust issues that affect overall user satisfaction.

Interface design and usability information is primarily limited to the MT4 platform, which generally provides a professional trading interface. However, the broker's website and account management systems are not detailed in available user feedback, making it difficult to assess the complete user journey from registration through ongoing account management.

Registration and verification processes are not described in available sources. This creates uncertainty about the user onboarding experience. Professional brokers typically provide clear, efficient account opening procedures with reasonable verification requirements and transparent timelines.

Fund management experience, including deposit and withdrawal procedures, lacks detailed user feedback in available sources. The ease and reliability of financial transactions significantly impact overall user satisfaction and confidence in the broker's services.

The broker appears to target traders seeking diversified forex trading options. However, the regulatory issues and transparency concerns may not align with the expectations of traders who prioritize safety and regulatory protection in their broker selection criteria.

Conclusion

This complete Rockfort review reveals major concerns that outweigh the broker's limited positive features. While Rockfort Markets offers access to the popular MT4 platform and over 50 forex currency pairs, the severe regulatory issues and lack of transparency create substantial risks that cannot be overlooked.

The broker is not recommended for traders who prioritize regulatory protection and transparent business practices. The cancellation of its New Zealand regulatory license following multiple compliance violations represents a serious red flag that potential traders must carefully consider.

The main advantages include MT4 platform access and a reasonable selection of forex trading assets. However, the disadvantages significantly outweigh these benefits, including unregulated status, regulatory penalties, lack of transparency in costs and procedures, and insufficient information about client protection measures. Traders seeking reliable, regulated forex trading services should consider alternative brokers with stronger regulatory standing and transparent operational practices.