Is PROFXFUND safe?

Business

License

Is ProfxFund A Scam?

Introduction

In the ever-evolving world of forex trading, choosing a reliable broker is crucial for success. ProfxFund positions itself as an attractive option for traders seeking high returns. However, the importance of due diligence cannot be overstated, as the forex market is fraught with unregulated entities and potential scams. This article aims to provide a comprehensive analysis of ProfxFund, evaluating its legitimacy and safety for potential investors. Our investigation draws on various online sources, reviews, and regulatory databases to assess the broker's credibility, regulatory status, and overall trading conditions.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors for traders. A regulated broker is subject to strict oversight, which helps ensure the safety of client funds and fair trading practices. Unfortunately, ProfxFund does not appear to be regulated by any recognized financial authority. The lack of regulation raises significant concerns about the broker's legitimacy and reliability.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that ProfxFund is not held to any standards of accountability, exposing traders to potential risks. Furthermore, the broker's website does not provide any information regarding its compliance history or regulatory affiliations, which is a red flag for potential clients. Engaging with an unregulated broker like ProfxFund increases the risk of encountering unethical practices, including fund mismanagement and withdrawal issues.

Company Background Investigation

Understanding the company behind a trading platform is essential for assessing its reliability. ProfxFund claims to be based in China, but there is a lack of verifiable information regarding its ownership and operational history. The company does not provide a clear outline of its management team, which makes it difficult to evaluate their qualifications and experience.

The opacity surrounding ProfxFund raises concerns about its transparency and commitment to ethical trading practices. Without a well-defined company structure and experienced management, traders may find themselves in a precarious situation if issues arise. The absence of information about the company's history and its operational practices further complicates the assessment of its trustworthiness.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience. ProfxFund claims to offer competitive trading conditions, but the lack of transparency about its fee structure is concerning. Traders should be wary of any broker that does not clearly disclose its trading costs.

| Fee Type | ProfxFund | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Variable |

| Overnight Interest Range | N/A | 0.5%-1.5% |

The absence of specific information regarding spreads and commissions suggests that ProfxFund may employ hidden fees or unfavorable trading conditions. Traders should be cautious of brokers that do not provide clear and accessible information about their fees, as this can lead to unexpected costs that erode potential profits.

Client Funds Security

Client fund security is a paramount concern for any trader. ProfxFund does not provide information about its security measures, such as fund segregation or investor protection mechanisms. The lack of a clear policy on negative balance protection further exacerbates concerns about the safety of client funds.

Without proper safeguards in place, traders risk losing their investments in the event of the broker's insolvency or fraudulent practices. Historical issues related to fund security and client disputes have been reported by users of unregulated brokers, making it imperative for potential clients to consider these risks before investing with ProfxFund.

Customer Experience and Complaints

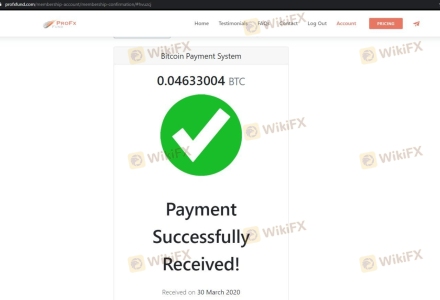

Customer feedback can provide valuable insights into a broker's reliability. Reviews of ProfxFund reveal a mix of experiences, with many users reporting difficulties related to account verification and withdrawal processes. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Verification | Medium | Slow |

| Customer Support | High | Unresponsive |

Several users have claimed that their withdrawal requests were delayed or denied without adequate explanation. The lack of responsive customer service further compounds these issues, leaving traders feeling frustrated and vulnerable. Such complaints highlight the potential risks associated with trading through ProfxFund and raise questions about the broker's commitment to customer support.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. ProfxFund reportedly offers access to popular trading software, but reviews suggest that users have encountered issues with platform stability and order execution quality. Traders have expressed concerns about slippage and rejected orders, which can significantly impact trading performance.

Inconsistent platform performance can lead to missed opportunities and increased trading costs, making it essential for traders to assess the reliability of the platform before committing funds. Any signs of platform manipulation or irregularities should be taken seriously, as they can indicate deeper issues within the broker's operations.

Risk Assessment

Trading with ProfxFund presents several risks that potential clients should consider. The unregulated status of the broker, combined with the lack of transparency and customer complaints, indicates a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of protection measures |

| Customer Service Risk | Medium | Poor responsiveness |

To mitigate these risks, traders should conduct thorough research and consider using regulated brokers that offer clear information about their trading conditions and fund security measures. Diversifying investments and limiting exposure to high-risk brokers can also help protect traders from potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that ProfxFund operates in a high-risk environment that lacks regulatory oversight and transparency. The absence of a solid regulatory framework, combined with numerous customer complaints and questionable trading conditions, raises significant concerns about the broker's legitimacy.

Traders should exercise extreme caution when considering ProfxFund as a trading partner. For those looking for safer alternatives, we recommend exploring brokers that are regulated by reputable authorities and offer transparent trading conditions. By prioritizing safety and due diligence, traders can protect their investments and foster a more secure trading experience.

In summary, Is ProfxFund safe? The overwhelming evidence suggests it is not, making it essential for traders to seek out more reliable and regulated options in the forex market.

Is PROFXFUND a scam, or is it legit?

The latest exposure and evaluation content of PROFXFUND brokers.

PROFXFUND Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PROFXFUND latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.