Is Profx safe?

Business

License

Is ProfX Safe or a Scam?

Introduction

ProfX is a forex broker that has garnered attention in the trading community for its claims of offering a diverse range of trading instruments and competitive trading conditions. Operating primarily online, ProfX positions itself as a platform for both novice and experienced traders looking to engage in forex trading and other financial markets. However, the forex market is fraught with risks, and traders must exercise due diligence when selecting a broker. Given the prevalence of scams in the industry, it is essential for traders to carefully evaluate the legitimacy and safety of any trading platform before committing their funds. This article investigates the safety of ProfX by examining its regulatory status, company background, trading conditions, client safety measures, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. A regulated broker is subject to oversight by financial authorities, which helps ensure compliance with industry standards and protects clients' funds. ProfX claims to operate under the jurisdiction of the United Kingdom, but it is crucial to verify its regulatory status with recognized authorities.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | United Kingdom | Not Regulated |

Upon investigation, it becomes evident that ProfX is not regulated by the Financial Conduct Authority (FCA) or any other reputable regulatory body. The absence of regulation raises significant concerns regarding the broker's legitimacy and the safety of client funds. Unregulated brokers often lack the necessary oversight to ensure fair trading practices and may engage in unethical behavior, such as delaying withdrawals or misappropriating client funds. The importance of regulation cannot be overstated; it serves as a safeguard for traders, providing a layer of protection against potential fraud. Therefore, the lack of regulatory oversight for ProfX is a strong indicator that it may not be a safe trading option.

Company Background Investigation

Understanding the company behind a trading platform is vital in assessing its reliability. ProfX's history, ownership structure, and management team play a significant role in its overall credibility. ProfX was established in 2018, but details about its ownership and the backgrounds of its management team are unclear. This lack of transparency raises concerns about the company's commitment to ethical practices and customer service.

A thorough background check reveals that ProfX operates from Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment. This offshore status often attracts brokers that seek to avoid stringent regulations, which can lead to a higher risk of scams. Moreover, the absence of comprehensive information regarding the management team and their professional experience further compounds the uncertainty surrounding ProfX. Without a transparent ownership structure and experienced leadership, it is difficult to trust the broker's intentions and operational integrity.

Trading Conditions Analysis

The trading conditions offered by a broker significantly impact the trading experience. ProfX claims to provide competitive spreads and a variety of account types, but it is essential to scrutinize these claims for any hidden fees or unfavorable conditions.

| Fee Type | ProfX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 2 pips | 1 pip |

| Commission Model | Commission-free | Varies |

| Overnight Interest Range | Not specified | Typically 0.5% |

ProfX's spreads start from 2 pips, which is considerably higher than the industry average of 1 pip. This discrepancy could indicate that traders may incur higher costs when trading with ProfX. Additionally, the commission model is not clearly defined, which raises concerns about transparency. The lack of clarity surrounding overnight interest rates is also troubling, as it can lead to unexpected costs for traders holding positions overnight. Overall, the trading conditions at ProfX may not be as favorable as advertised, suggesting that traders should exercise caution.

Client Funds Security

The safety of client funds is paramount when evaluating a broker. ProfX's approach to fund security is critical in determining whether it is a safe trading platform. A reputable broker typically employs measures such as segregated accounts, investor protection schemes, and negative balance protection to safeguard client funds. However, ProfX lacks transparency regarding these vital safety measures.

The absence of information on fund segregation raises red flags, as it suggests that client funds may not be kept separate from the company's operational funds. This can lead to potential misuse of funds and increased risk for traders. Furthermore, without investor protection schemes in place, clients may find themselves without recourse in the event of financial difficulties faced by the broker. There have been no publicly reported incidents of fund security breaches at ProfX, but the lack of clear policies and protections creates a precarious situation for potential investors.

Customer Experience and Complaints

Customer feedback is an essential aspect of assessing a broker's reliability. Reviews and testimonials can provide insights into the experiences of other traders and highlight potential issues. A review of customer feedback regarding ProfX reveals a mixed bag of experiences, with several users reporting difficulties in withdrawing funds and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Unresolved queries |

Common complaints include delays in processing withdrawal requests and a lack of responsiveness from customer support. Many users have expressed frustration over the difficulty in reaching the support team, which raises concerns about the company's commitment to customer service. For instance, one trader reported waiting weeks for a withdrawal to be processed, only to receive vague responses from the support team. Such experiences indicate that ProfX may not prioritize client satisfaction, further contributing to the perception that it may not be a safe choice for trading.

Platform and Execution

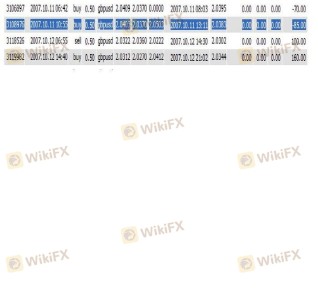

The trading platform provided by a broker is crucial for a seamless trading experience. ProfX claims to offer the widely used MetaTrader 4 platform, which is known for its user-friendly interface and robust features. However, it is important to evaluate the platform's performance, stability, and execution quality.

Reports from users indicate that while the platform itself is functional, there have been instances of slippage and delayed order execution. Traders have expressed concerns about the speed at which trades are executed, particularly during volatile market conditions. Such delays can lead to missed opportunities and financial losses, raising questions about the reliability of ProfX's trading platform. Additionally, any signs of platform manipulation or unfair practices could further compromise the safety of trading with ProfX.

Risk Assessment

Engaging with any trading platform carries inherent risks, and it is essential to assess these risks comprehensively. The overall risk profile of ProfX suggests that it may not be a safe trading option for most investors.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk |

| Fund Security Risk | High | Lack of transparency in fund management |

| Customer Service Risk | Medium | Complaints about withdrawal issues |

| Platform Execution Risk | Medium | Reports of slippage and delays |

Given these risks, it is advisable for traders to approach ProfX with caution. Potential investors should consider utilizing risk mitigation strategies, such as setting strict trading limits and ensuring they do not invest more than they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that ProfX may not be a safe trading option for investors. The lack of regulatory oversight, transparency in fund management, and poor customer service raise significant concerns about the broker's legitimacy. Additionally, the unfavorable trading conditions and mixed customer feedback further contribute to the perception that ProfX may be operating in a manner that is not in the best interest of its clients.

For traders seeking a reliable and safe trading experience, it is recommended to consider alternative brokers that are regulated by reputable authorities and offer transparent trading conditions. Brokers such as IG, OANDA, and Forex.com have established track records of reliability, client protection, and positive customer experiences. Ultimately, exercising caution and conducting thorough research is essential to ensure a safe and successful trading journey.

Is Profx a scam, or is it legit?

The latest exposure and evaluation content of Profx brokers.

Profx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Profx latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.