Is SUN-H safe?

Pros

Cons

Is Sun H Safe or Scam?

Introduction

Sun H, a forex broker operating primarily in Australia, has garnered attention within the trading community. As traders navigate the complexities of the forex market, it becomes imperative to assess the credibility of brokers like Sun H. The potential for scams in the trading industry is significant, making due diligence essential. In this article, we will evaluate whether Sun H is a trustworthy broker or if it raises red flags for potential scams. Our investigation draws on various sources, including regulatory information, customer feedback, and industry analysis, to provide a comprehensive assessment of Sun H's safety.

Regulation and Legitimacy

The regulatory landscape is a critical factor in determining the safety of any forex broker. Sun H claims to operate under the regulatory oversight of the Australian Securities and Investments Commission (ASIC). However, there are concerns regarding its legitimacy, with reports suggesting that Sun H may be a "suspicious clone," indicating potential risks associated with its operations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Suspicious Clone |

The importance of regulation cannot be overstated. Brokers regulated by top-tier authorities like ASIC are subject to stringent compliance and operational standards, which help protect traders' funds and ensure fair trading practices. However, the existence of a suspicious clone raises questions about Sun H's adherence to these standards. The lack of a valid license number further compounds these concerns, suggesting that traders may be exposed to higher risks when dealing with this broker.

Company Background Investigation

Sun H & Co Pty Ltd, the company behind Sun H, presents itself as an established entity in the forex market. However, a closer look at its history and ownership structure reveals a more complex picture. The company appears to lack transparency regarding its operational history and management team. Information about the individuals behind the broker is scarce, which is often a red flag in the trading industry.

A transparent broker should provide clear information about its ownership and management, including the professional backgrounds of its executives. The absence of such details raises concerns about Sun H‘s credibility and commitment to ethical trading practices. Without a well-defined management structure, the broker may struggle with accountability, further complicating the safety of traders’ investments.

Trading Conditions Analysis

Understanding the trading conditions offered by Sun H is essential for evaluating its overall safety. Reports indicate that the broker has a complex fee structure, which may not be immediately apparent to new traders. Unusual fees can significantly impact trading profitability and raise concerns about the broker's transparency.

| Fee Type | Sun H | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | High | Moderate |

| Commission Model | Variable | Fixed |

| Overnight Interest Range | Unclear | Standard |

The high spreads on major currency pairs could deter traders from engaging in frequent trading, while the variable commission model adds another layer of complexity. Traders should be cautious of hidden fees that can erode their capital over time. Furthermore, the unclear overnight interest range suggests a lack of transparency, which could lead to unexpected costs for traders holding positions overnight.

Client Fund Security

The safety of client funds is paramount when evaluating a forex broker. Sun Hs measures for safeguarding client funds remain ambiguous. Reports indicate that the broker may not adequately segregate client funds from its operational capital, exposing traders to potential risks in the event of financial instability.

Traders should look for brokers that implement strict fund segregation policies, investor protection mechanisms, and negative balance protection. The absence of these measures could result in significant losses for traders, particularly in volatile market conditions. Historical issues related to fund security further underscore the need for caution when considering Sun H as a trading partner.

Customer Experience and Complaints

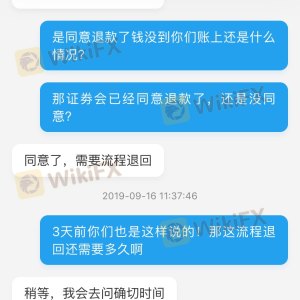

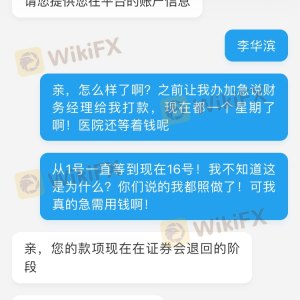

Customer feedback is a valuable resource for assessing a broker's reliability. Sun H has received mixed reviews, with many users expressing frustrations over withdrawal issues and slow customer support response times. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Slow or Unresponsive |

| Poor Customer Support | Medium | Inconsistent |

| Lack of Transparency | High | Minimal Communication |

One notable case involved a trader who reported being unable to withdraw funds for several weeks, leading to significant frustration. The company's slow response to inquiries exacerbated the situation, raising concerns about its commitment to customer service. Such patterns of complaints can indicate deeper systemic issues within the broker's operations.

Platform and Trade Execution

The trading platform's performance is a crucial aspect of the trading experience. Sun Hs platform has been described as user-friendly, but issues with order execution quality have been reported. Traders have experienced slippage and rejected orders, which can significantly affect trading outcomes.

A reliable broker should provide a stable and efficient trading environment, with minimal instances of slippage and high order fulfillment rates. Signs of potential platform manipulation, such as repeated slippage during high volatility, could indicate deeper issues within the broker's operations and raise further questions about its integrity.

Risk Assessment

Engaging with Sun H presents several risks that traders must consider. The following risk assessment summarizes key concerns:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of clear regulatory oversight |

| Financial Security Risk | High | Unclear fund segregation practices |

| Customer Service Risk | Medium | Mixed reviews on support responsiveness |

| Trading Conditions Risk | High | High spreads and unclear fee structures |

To mitigate these risks, traders are advised to conduct thorough research before committing funds. Engaging with regulated brokers that have a proven track record of transparency and customer service can help safeguard investments.

Conclusion and Recommendations

Based on the evidence gathered, it is clear that Sun H raises several concerns regarding its safety and reliability. The lack of clear regulatory oversight, transparency in operations, and a history of customer complaints suggests that traders should approach this broker with caution.

For traders seeking a safer trading environment, it is advisable to consider alternative brokers that are fully regulated and have established a reputation for transparency and customer service. Brokers regulated by top-tier authorities like ASIC or FCA are generally safer choices, as they adhere to strict compliance and operational standards.

In summary, while some traders may still choose to engage with Sun H, it is crucial to remain vigilant and informed about the potential risks involved.

Is SUN-H a scam, or is it legit?

The latest exposure and evaluation content of SUN-H brokers.

SUN-H Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SUN-H latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.