ProFX 2025 Review: Everything You Need to Know

Executive Summary

ProFX presents itself as a young and developing forex broker with potential. However, it operates without clear regulatory oversight, which raises important concerns. This profx review reveals a broker that offers diverse trading opportunities through advanced platforms while raising concerns about transparency and regulatory compliance.

The broker provides access to over 65 currency pairs and 10 CFDs, supporting both MetaTrader 4 and MetaTrader 5 platforms with a focus on AI-driven precision trading. According to available information from ProFX Market sources, the company positions itself as a London-registered STP/ECN broker committed to delivering accurate trading through artificial intelligence-powered insights.

The platform caters to traders seeking diversified trading instruments and advanced platform capabilities. Though potential users should carefully consider the regulatory limitations before engaging with their services. The broker's offering includes foreign exchange, indices, cryptocurrencies, precious metals, CFDs, stocks, and futures, making it attractive for traders looking for variety in their trading portfolio.

However, the lack of comprehensive regulatory information and mixed user feedback suggests that traders should approach this broker with appropriate caution and due diligence.

Important Notice

Regional Entity Differences: ProFX operates without regulation from the FCA or other major regulatory bodies. This presents inherent risks for potential users that cannot be ignored. Traders should exercise caution when considering this broker and carefully evaluate their risk tolerance against the potential benefits offered.

Review Methodology: This evaluation is based on publicly available information and user feedback collected from various sources. Given the limited transparency from the broker itself, some aspects of this review rely on third-party reports and user experiences that may vary over time.

Rating Framework

Broker Overview

ProFX Market operates as a young London-registered STP/ECN broker. Though specific establishment dates remain unclear from available sources, the company has positioned itself as a technology-forward broker committed to providing precision trading through AI-powered insights. According to ProFX Market Review information, the broker's business model focuses on offering multiple trading products including forex, CFDs, precious metals, and other financial instruments to retail and potentially institutional clients.

The company's approach emphasizes technological advancement and market expertise. This suggests a modern take on forex brokerage services that appeals to tech-savvy traders. However, the lack of detailed company background information and regulatory transparency raises questions about the broker's operational history and corporate governance structure.

ProFX supports both MetaTrader 4 and MetaTrader 5 platforms, as confirmed by Profx Markets information. This provides traders with familiar and widely-accepted trading environments that most forex traders recognize. The broker covers multiple asset classes including forex, indices, cryptocurrencies, precious metals, CFDs, stocks, and futures, indicating a comprehensive approach to financial market access.

Notably, this profx review must highlight that ProFX operates without FCA or other major regulatory authority oversight. According to ProFX Market Review sources, this regulatory gap represents a significant consideration for potential users, particularly those prioritizing regulatory protection and compliance standards in their broker selection process.

Regulatory Status: ProFX operates without regulation from the FCA or other major regulatory institutions. This creates potential risks for users according to ProFX Market Review sources, as this lack of regulatory oversight means traders cannot rely on standard investor protection schemes.

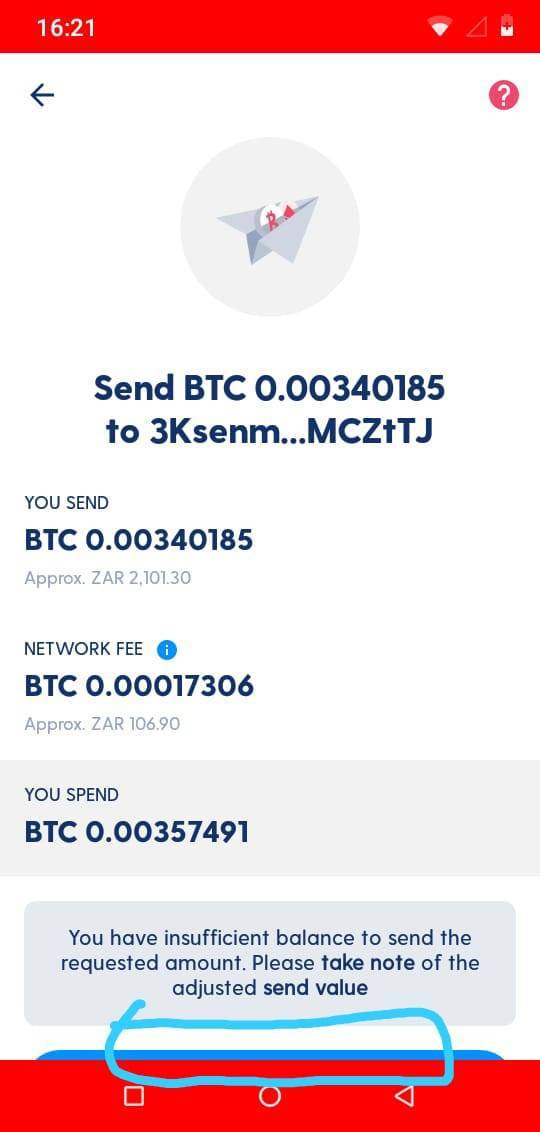

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available sources. This requires potential users to contact the broker directly for payment processing information, which may be inconvenient for traders seeking immediate clarity.

Minimum Deposit Requirements: Available sources do not specify minimum deposit amounts. This leaves crucial information unclear for prospective traders who need to plan their initial investment.

Bonus and Promotions: No specific information about promotional offers or bonus programs is mentioned in the available materials.

Tradable Assets: According to ProFX Market information, the broker provides access to over 65 currency pairs and 10 CFDs. The platform also supports trading in indices, cryptocurrencies, stocks, and futures, including precious metals like gold and silver.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not available in the source materials. This makes it difficult to assess the broker's competitiveness in terms of pricing, which is a crucial factor for most traders.

Leverage Ratios: Specific leverage information is not provided in the available sources. This requires direct inquiry with the broker for this important trading parameter that affects risk management.

Platform Options: Users can choose between MetaTrader 4 and MetaTrader 5 platforms according to Profx Markets information. This provides access to industry-standard trading environments that offer comprehensive functionality.

Regional Restrictions: Information about geographical limitations or restricted territories is not specified in available sources.

Customer Support Languages: The available materials do not detail which languages are supported by the customer service team.

This profx review emphasizes that many crucial details remain unclear. The lack of transparency highlights the need for improved communication from the broker regarding essential trading information.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions offered by ProFX remain largely unclear due to limited available information. Available sources do not provide specific details about account types, their distinctive features, or the requirements for each tier, which creates uncertainty for potential traders. This lack of transparency makes it difficult for potential traders to understand what they can expect from different account offerings.

Minimum deposit requirements are not specified in the available materials. This leaves prospective users without crucial information needed for financial planning and broker comparison, making it challenging to determine if the broker fits their budget. The absence of clear account opening procedures and requirements further complicates the evaluation process for potential clients.

Special account features, such as Islamic accounts for Sharia-compliant trading, are not mentioned in the source materials. This omission is particularly significant for traders who require specific religious compliance in their trading activities and cannot compromise on these requirements. The limited information available suggests that ProFX may not prioritize transparency in their account condition disclosure, which could be concerning for traders who value clear and upfront information about trading terms.

This profx review must note that without comprehensive account information, traders cannot make fully informed decisions about whether the broker's offerings align with their trading needs and financial capabilities.

ProFX demonstrates strength in platform provision by offering both MetaTrader 4 and MetaTrader 5. According to Profx Markets information, these platforms are industry standards that provide comprehensive trading tools, technical analysis capabilities, and automated trading support. The availability of both platforms allows traders to choose based on their experience level and specific trading requirements.

The broker provides access to multiple CFDs and forex pairs, with the platform supporting various asset classes including forex, indices, cryptocurrencies, precious metals, stocks, and futures. This diversity in trading instruments represents a significant strength for traders seeking portfolio diversification opportunities and multiple income streams. However, available sources do not detail specific research and analysis resources that the broker might provide.

Educational resources, market analysis, daily briefings, or economic calendars are not mentioned in the available information. This could limit the value proposition for traders who rely on broker-provided market insights to make informed trading decisions. Automated trading support through the MetaTrader platforms is implied but not explicitly detailed in terms of specific features or limitations.

The absence of information about proprietary trading tools or enhanced analytical resources suggests that ProFX relies primarily on the standard MT4 and MT5 functionalities rather than developing additional value-added services.

Customer Service and Support Analysis (6/10)

Customer service information for ProFX is notably limited in available sources. This makes it challenging to assess the quality and accessibility of their support services, which is concerning for traders who value reliable customer support. Specific customer service channels, such as live chat, phone support, or email ticketing systems, are not detailed in the available materials.

Response times and service quality metrics are not provided. This leaves potential users without insight into what they can expect from the broker's support team, particularly during critical trading situations when quick responses are essential. This lack of information is particularly concerning for traders who value responsive customer service, especially during critical trading situations.

Multi-language support capabilities are not specified, which could be a limitation for international traders who prefer to communicate in their native languages. Operating hours for customer service are also not detailed, making it unclear whether the broker provides round-the-clock support or operates within specific time zones that may not align with all traders' schedules. The absence of detailed customer service information suggests either limited support infrastructure or poor communication about available services.

Without user feedback specifically addressing customer service experiences, it's difficult to determine whether the broker provides adequate support for its clients' needs.

Trading Experience Analysis (7/10)

User feedback regarding trading experience appears generally positive according to available information. Though specific details are not extensively documented, which limits the depth of this assessment. The provision of both MT4 and MT5 platforms suggests that traders have access to robust and reliable trading environments with comprehensive functionality.

Platform stability and execution speed are not specifically addressed in available sources. This leaves questions about the broker's technical performance during various market conditions, which is crucial for successful trading outcomes. Information about slippage, requotes, or execution quality is not provided, making it difficult to assess the actual trading environment quality.

The availability of multiple asset classes through the MetaTrader platforms indicates a fairly complete trading experience in terms of instrument diversity. However, specific features such as one-click trading, advanced order types, or custom indicators are not detailed beyond standard MT4/MT5 capabilities, which may limit advanced trading strategies. Mobile trading experience is not specifically addressed in the available sources, though MT4 and MT5 platforms typically include mobile applications.

The lack of specific information about mobile app performance, features, or user experience represents a gap in the available assessment data. This profx review notes that while the fundamental trading infrastructure appears adequate, the lack of detailed performance data and user experience feedback makes it difficult to fully evaluate the quality of the trading environment.

Trust and Security Analysis (4/10)

The trust and security assessment for ProFX reveals significant concerns. These concerns primarily stem from the lack of regulatory oversight, which creates substantial risks for potential users. According to ProFX Market Review sources, the broker operates without regulation from the FCA or other major regulatory authorities, which eliminates standard investor protection measures and oversight mechanisms.

Fund security measures are not detailed in available sources. This leaves questions about client fund segregation, insurance coverage, or other protective measures that regulated brokers typically provide, creating uncertainty about fund safety. This absence of information is particularly concerning given the unregulated status of the broker.

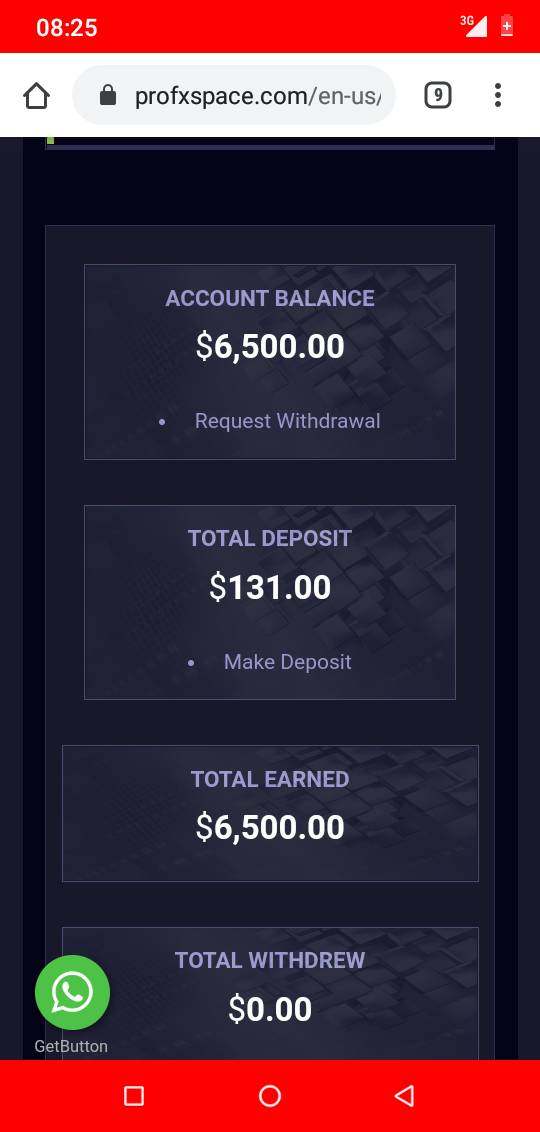

Company transparency is limited, with available sources not providing detailed information about financial reports, management team, or corporate governance structures. This lack of transparency makes it difficult for potential clients to assess the broker's financial stability and operational integrity, which are crucial factors in broker selection. Industry reputation presents mixed signals, with Profxgroups.com being identified as a typical scam according to review sources, though this may refer to a different entity or related website rather than the main ProFX operation.

This association nonetheless raises concerns about potential confusion or reputational risks that could affect traders. The absence of regulatory oversight means that standard dispute resolution mechanisms and compensation schemes are not available to traders, significantly increasing the risk profile for potential users.

User Experience Analysis (6/10)

Overall user satisfaction shows some positive indicators, with ProFX Romania receiving a 4.7 rating on Trustpilot according to available information. However, detailed user feedback and specific experience reports are not extensively documented in the source materials, limiting the comprehensiveness of this assessment. Interface design and usability information is not provided beyond the standard MT4 and MT5 platform offerings.

While these platforms are generally user-friendly, any broker-specific customizations or enhancements are not detailed in available sources. This makes it difficult to assess whether ProFX has added value beyond the standard platform experience. Registration and verification processes are not described in the available materials, leaving potential users without information about account opening convenience and requirements.

This lack of procedural transparency could create uncertainty for prospective clients who want to understand the onboarding process before committing. Fund operation experiences, including deposit and withdrawal convenience and speed, are not detailed in available sources, which is a significant information gap. This information gap is significant as payment processing experience often heavily influences overall user satisfaction and can make or break the relationship between trader and broker.

The broker appears suitable for traders seeking diversified trading tools and platform options. Though the limited feedback and transparency may not meet the expectations of users who prioritize comprehensive broker communication and support.

Conclusion

ProFX emerges as a developing forex broker offering diverse trading opportunities through established platforms. Though significant transparency and regulatory concerns limit its overall appeal, the broker does provide access to multiple trading instruments. The broker's strengths lie in providing access to multiple asset classes and industry-standard MetaTrader platforms, making it potentially suitable for traders seeking variety in their trading instruments.

However, the lack of regulatory oversight, limited transparency about trading conditions, and insufficient information about crucial operational aspects create substantial risks that potential users must carefully consider. The broker appears most appropriate for experienced traders who can navigate unregulated environments and conduct their own due diligence before making investment decisions. The main advantages include diverse asset selection and advanced platform access, while the primary disadvantages center on regulatory gaps and transparency limitations.

Prospective users should thoroughly evaluate their risk tolerance and regulatory requirements before engaging with this broker's services.