Is RediMax safe?

Pros

Cons

Is Redimax Safe or a Scam?

Introduction

Redimax is an international forex trading platform that claims to provide a comprehensive suite of trading services, including forex, commodities, and indices. Positioned as a broker catering to both retail and institutional clients, Redimax aims to attract traders with promises of high leverage and low fees. However, in the volatile world of forex trading, it is crucial for traders to conduct thorough due diligence before engaging with any broker. The potential for scams and unregulated operations is prevalent, making it essential for traders to evaluate the credibility and safety of their chosen platform. This article employs a detailed investigative approach, utilizing various sources and criteria to assess whether Redimax is a safe trading option or a potential scam.

Regulation and Legitimacy

One of the primary factors in determining the safety of a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that the broker adheres to established financial standards and practices. In the case of Redimax, the broker claims to be regulated by the Dubai Financial Services Authority (DFSA). However, this assertion has been met with skepticism.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| DFSA | N/A | United Arab Emirates | False Claims |

Upon investigation, it was revealed that the license number provided by Redimax does not correspond to the broker but rather to a different entity entirely. The DFSA has issued warnings indicating that Redimax is not authorized to operate within its jurisdiction. The absence of a legitimate regulatory framework raises significant concerns regarding the safety of traders' funds. Without oversight from a recognized authority, traders face heightened risks, including the potential for fraud and mismanagement of funds.

Company Background Investigation

Redimax operates under the guise of being a reputable brokerage; however, its company history and ownership structure remain opaque. There is a lack of publicly available information regarding the company's establishment, management team, and operational history. This anonymity is a red flag, as it suggests that the broker may be attempting to conceal its true identity and intentions.

The management team behind Redimax has not been disclosed, which further complicates the assessment of the broker's credibility. A transparent broker typically provides information about its leadership, including professional backgrounds and industry experience. In contrast, Redimax's lack of transparency raises questions about its legitimacy and operational integrity. Traders should be cautious when dealing with brokers that do not openly share information about their corporate structure and management.

Trading Conditions Analysis

When evaluating whether Redimax is safe, it is essential to examine its trading conditions, including fees and commissions. A broker's fee structure can significantly impact a trader's profitability. Redimax claims to offer competitive trading costs; however, specific details regarding spreads, commissions, and overnight fees are either vague or missing.

| Fee Type | Redimax | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 0.5 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 2% - 5% |

The lack of clarity surrounding trading costs is concerning. Traders may encounter unexpected fees or unfavorable conditions that could erode their capital. Moreover, the absence of a detailed fee schedule suggests that Redimax may not operate with the same level of transparency as more reputable brokers.

Customer Fund Safety

The safety of customer funds is paramount when assessing whether Redimax is safe. A reliable broker should implement robust measures to protect clients' investments, including segregated accounts and negative balance protection. However, Redimax does not appear to provide these essential safeguards.

Funds deposited with Redimax may not be kept in segregated accounts, which means that the broker could potentially use client funds for its operational expenses. Additionally, the lack of negative balance protection means that traders could incur losses exceeding their initial investments. These factors contribute to a heightened risk profile for anyone considering trading with Redimax.

Customer Experience and Complaints

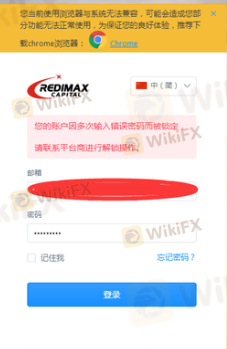

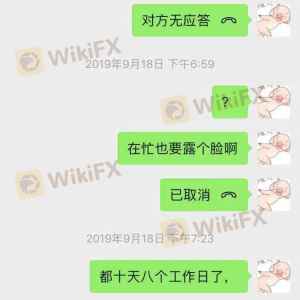

Customer feedback is an invaluable resource for gauging the reliability of a broker. In the case of Redimax, user reviews and complaints reveal a troubling pattern. Many traders have reported difficulties in withdrawing funds, with some alleging that their requests were ignored or delayed indefinitely.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Average |

| Misleading Information | High | Poor |

Common complaints include the inability to access funds, unresponsive customer service, and misleading claims about regulatory status. These issues highlight a significant risk for traders, as they may find themselves unable to retrieve their investments once deposited with Redimax.

Platform and Trade Execution

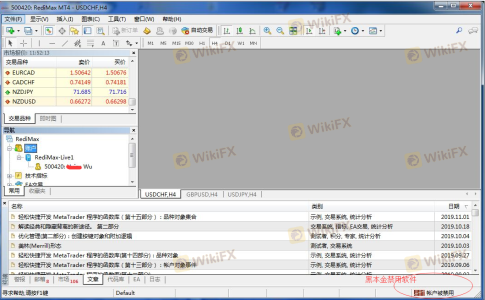

The performance of a trading platform is crucial for a trader's success. Redimax claims to offer access to the widely used MetaTrader 4 platform, which is known for its reliability and user-friendly interface. However, reports indicate that users have experienced technical issues, including website malfunctions that prevent account creation and trading.

The quality of order execution is another critical factor. Traders have raised concerns about slippage and order rejections, which can adversely affect trading outcomes. Any signs of platform manipulation or irregularities in trade execution further exacerbate the concerns surrounding Redimax's legitimacy.

Risk Assessment

Evaluating the overall risk associated with trading with Redimax is essential for potential clients. Given the broker's lack of regulation, transparency, and history of customer complaints, the risks are considerable.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No legitimate regulatory oversight |

| Fund Safety Risk | High | Lack of segregated accounts |

| Withdrawal Risk | High | History of withdrawal issues |

| Transparency Risk | Medium | Opaque ownership and management |

Traders should approach Redimax with extreme caution. To mitigate risks, it is advisable to seek out regulated brokers with established reputations and transparent operations.

Conclusion and Recommendations

In conclusion, the evidence suggests that Redimax is not a safe trading option. The combination of false regulatory claims, lack of transparency, and numerous customer complaints raises significant red flags. Traders should be wary of engaging with this broker, as the potential for loss is high.

For those seeking reliable alternatives, it is recommended to consider well-regulated brokers with a proven track record of customer satisfaction and safety. Options include brokers regulated by reputable authorities such as the FCA (UK) or ASIC (Australia), which provide better assurances for fund security and operational integrity.

Ultimately, when assessing whether Redimax is safe, it is clear that the risks outweigh any potential benefits, making it prudent for traders to avoid this platform altogether.

Is RediMax a scam, or is it legit?

The latest exposure and evaluation content of RediMax brokers.

RediMax Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RediMax latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.