Is Pro Lite Trade safe?

Business

License

Is Pro Lite Trade Safe or Scam?

Introduction

Pro Lite Trade is a forex broker that has emerged in the market, offering a variety of trading instruments, including forex pairs, commodities, and cryptocurrencies. As with any broker, it is crucial for traders to thoroughly evaluate the legitimacy and safety of their chosen platform before committing funds. The forex market is rife with potential risks, including scams, unregulated entities, and unreliable trading conditions. Therefore, this article aims to provide an objective analysis of Pro Lite Trade, examining its regulatory status, company background, trading conditions, and customer experiences to determine whether it is safe or a scam.

To gather information, this investigation utilized various online resources, including user reviews, regulatory databases, and expert analyses. The evaluation framework includes key areas such as regulation and legality, company background, trading conditions, customer fund security, customer experiences, platform performance, and overall risk assessment.

Regulation and Legality

The regulatory status of a broker is a critical factor in determining its legitimacy and safety. Pro Lite Trade claims to operate under various entities, including Prolite Trade Financial Services Limited in Cyprus and other offshore jurisdictions. However, our investigation revealed that Pro Lite Trade is unregulated, lacking oversight from reputable financial authorities. This absence of regulation raises significant concerns about the broker's credibility and the safety of investors' funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulatory oversight means that Pro Lite Trade is not subject to the stringent requirements that regulated brokers must adhere to, such as maintaining capital reserves, transparent operations, and investor protection measures. This unregulated status is a major red flag, indicating that traders should exercise extreme caution when considering whether Pro Lite Trade is safe for their investments.

Company Background Investigation

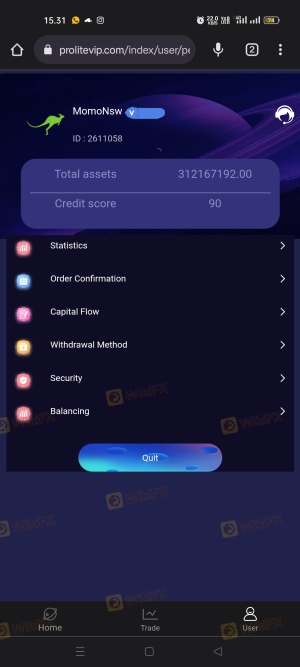

Pro Lite Trade was established in 2023, making it a relatively new player in the forex market. The company claims to be based in Canada, with an address listed in Edmonton. However, a deeper dive into its ownership structure and management team reveals a lack of transparency. There is limited information about the individuals behind the broker, which is concerning for potential investors. A transparent company should provide clear details about its founders and management, including their professional backgrounds and experience in the financial industry.

The absence of such information can lead to questions about the company's motives and operational integrity. Furthermore, the lack of a published registration certificate or verifiable documentation of its business operations raises additional concerns regarding whether Pro Lite Trade is safe for traders looking for a reliable broker.

Trading Conditions Analysis

Pro Lite Trade offers a range of trading conditions, including leverage up to 1:500 and a minimum deposit requirement of $200. However, the overall fee structure appears to be less favorable when compared to industry standards. Traders should be wary of any unusual fees that could affect their profitability.

| Fee Type | Pro Lite Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 5 pips | 1-2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | N/A | Varies |

The high spreads on major currency pairs are particularly concerning, as they can significantly impact trading costs. Additionally, the absence of a clear commission structure could suggest hidden fees or unfavorable trading conditions, which further complicates the question of is Pro Lite Trade safe for traders.

Customer Fund Security

The safety of customer funds is paramount in the forex trading industry. Pro Lite Trade's lack of regulation raises serious questions about its fund security measures. The broker does not provide clear information regarding fund segregation, investor protection, or negative balance protection policies.

In regulated environments, brokers are required to keep client funds in separate accounts and may offer compensation schemes in the event of insolvency. However, with Pro Lite Trade's unregulated status, there are no such assurances, leaving investors vulnerable to potential losses. Historical data on any past fund security issues is also absent, which adds to the uncertainty surrounding whether Pro Lite Trade is safe for investment.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of Pro Lite Trade reveal a pattern of complaints, particularly regarding withdrawal issues. Many users have reported difficulty in accessing their funds, with delays and unresponsive customer service being common themes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | High | Poor |

| Misleading Marketing Practices | Medium | Average |

For instance, one user reported that after multiple attempts to withdraw funds, they received vague responses from customer support, leading to frustration and distrust. Such complaints highlight significant risks associated with trading with Pro Lite Trade, further questioning is Pro Lite Trade safe for potential investors.

Platform and Trade Execution

The trading platform offered by Pro Lite Trade is based on VertexFX, which is accessible on various devices. However, user reviews indicate issues with platform stability and execution quality. Reports of slippage and rejected orders have surfaced, which are critical factors that can affect a trader's experience and profitability.

A broker's ability to execute trades efficiently is vital, as delays or errors can lead to substantial financial losses. The reported issues with Pro Lite Trade's platform performance raise concerns about its reliability, making it essential for traders to consider whether Pro Lite Trade is safe for their trading activities.

Risk Assessment

Using Pro Lite Trade comes with considerable risks, primarily due to its unregulated status and negative customer feedback. Below is a risk scorecard summarizing the key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated, no oversight |

| Financial Risk | High | Lack of fund security measures |

| Operational Risk | Medium | Platform issues and execution problems |

| Customer Service Risk | High | Poor response to complaints |

To mitigate these risks, traders are advised to conduct thorough research, consider using regulated brokers, and avoid investing large sums until they are confident in the broker's legitimacy.

Conclusion and Recommendations

In summary, the evidence indicates that Pro Lite Trade exhibits several concerning characteristics that point towards potential risks and a lack of reliability. The absence of regulation, poor customer feedback, and issues with trading conditions all contribute to the conclusion that Pro Lite Trade is not safe for traders.

For those considering investing in forex, it is recommended to opt for well-regulated brokers with a proven track record of transparency and customer support. Alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which can provide the necessary safeguards and peace of mind for traders.

In conclusion, potential investors should exercise extreme caution and consider the significant risks associated with Pro Lite Trade before proceeding.

Is Pro Lite Trade a scam, or is it legit?

The latest exposure and evaluation content of Pro Lite Trade brokers.

Pro Lite Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Pro Lite Trade latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.