Regarding the legitimacy of Huanying forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is Huanying safe?

Pros

Cons

Is Huanying markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

Clone FirmLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

TradeMaster Securities (Hong Kong) Limited

Effective Date:

2016-08-18Email Address of Licensed Institution:

cs@tjzsec.comSharing Status:

No SharingWebsite of Licensed Institution:

www.tjzsec.comExpiration Time:

--Address of Licensed Institution:

香港中環德輔道中55號協成行中心21樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Huanying Safe or Scam?

Introduction

Huanying International, a financial services provider based in Hong Kong, has positioned itself as a notable player in the forex market since its establishment. With a wide array of financial products and services, including forex trading, stocks, and asset management, it aims to cater to diverse investor needs. However, the forex market is notorious for its complexities and potential pitfalls, making it essential for traders to carefully evaluate the brokers they choose. This article investigates the safety and legitimacy of Huanying, employing a comprehensive assessment framework that includes regulatory compliance, company background, trading conditions, customer experience, and risk evaluation.

Regulatory and Legitimacy

Understanding a broker's regulatory status is crucial for assessing its safety. Huanying claims to operate under the jurisdiction of the Hong Kong Securities and Futures Commission (SFC). However, there are serious concerns regarding its legitimacy, as various reports label it as a "clone firm," suggesting it may not be operating under proper licensing.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | N/A | Hong Kong | Clone firm status |

The significance of regulatory oversight cannot be overstated. A legitimate broker should be registered with recognized financial authorities, which provide a safety net for traders. The SFC is known for its stringent regulations, but the classification of Huanying as a clone firm raises red flags about its compliance history. Traders should be particularly cautious, as the lack of clear regulatory validation can signal potential risks.

Company Background Investigation

Founded in 2016, Huanying International has undergone several transformations, including a name change to "Trademaster Securities (Hong Kong) Limited." This raises questions about its stability and ownership structure. The management teams background is also crucial in assessing the broker's reliability. Reports indicate that the company has faced numerous complaints related to fund withdrawals and account access issues, which could be indicative of poor management practices and a lack of transparency.

Moreover, the information available about the company's operations and ownership is limited, which diminishes the trustworthiness of Huanying. A transparent broker should provide clear details regarding its ownership, management, and operational history, which Huanying seems to lack.

Trading Conditions Analysis

Huanying offers a variety of financial instruments, including forex pairs, stocks, and ETFs. However, its fee structure warrants scrutiny. While the broker advertises competitive spreads, user experiences indicate hidden fees and commissions that could erode profitability.

| Fee Type | Huanying | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | 0.03% (min. 3 HKD) | 0.1% - 0.5% |

| Overnight Interest Range | High | Low to Medium |

The analysis of Huanying's trading conditions reveals potential discrepancies between advertised and actual costs. Traders should remain vigilant regarding any unusual fee policies, as they can significantly impact trading outcomes. Transparency in fee structures is essential for traders to make informed decisions.

Client Fund Security

The safety of client funds is a paramount concern for any trader. Huanying claims to segregate client funds from its operational funds, holding them in accounts with top-tier banks. However, the lack of regulatory oversight raises questions about the effectiveness of these measures.

The absence of negative balance protection further complicates the safety of funds, as traders could find themselves liable for losses exceeding their deposits. Historical complaints about fund withdrawal issues further exacerbate concerns regarding the broker's commitment to safeguarding client assets.

Customer Experience and Complaints

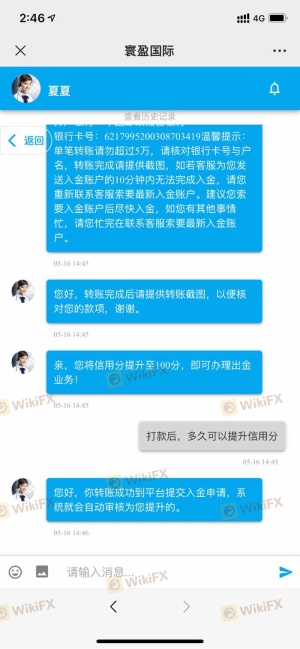

Customer feedback is a vital indicator of a broker's reliability. Unfortunately, Huanying has garnered numerous complaints, particularly regarding withdrawal difficulties and account access issues. Many users report that their accounts were arbitrarily suspended, leading to an inability to retrieve funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Access Problems | High | Poor |

Two notable cases illustrate the issues faced by traders. In one instance, a trader reported being unable to access their account after a successful initial trading period, leading to significant financial distress. In another case, users were asked to pay additional fees to withdraw their funds, raising suspicions of fraudulent activities.

Platform and Execution

The trading platform offered by Huanying is another critical factor in assessing its safety. While the broker provides an online trading platform, users have reported issues with execution quality, including slippage and order rejections. Such problems can adversely affect trading performance, particularly in volatile market conditions.

Traders should be wary of any signs of platform manipulation, as this could indicate a lack of integrity on the broker's part. A reliable broker should offer a stable and efficient trading environment, ensuring that orders are executed promptly and accurately.

Risk Assessment

Using Huanying presents several risks that traders must consider. The combination of regulatory concerns, customer complaints, and execution issues contributes to an overall high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Clone firm status raises concerns. |

| Fund Security | High | Withdrawal issues and lack of protection. |

| Customer Service | High | Poor response to complaints and issues. |

To mitigate these risks, traders should conduct thorough due diligence, consider starting with a small investment, and be prepared to withdraw funds promptly if issues arise.

Conclusion and Recommendations

In conclusion, the evidence suggests that Huanying may not be a safe broker for forex trading. The classification as a clone firm, coupled with numerous customer complaints and regulatory concerns, indicates a lack of reliability. Traders should exercise caution when dealing with this broker and consider alternative options that are well-regulated and have a proven track record of customer satisfaction.

For those seeking safer trading environments, brokers with established reputations and robust regulatory oversight, such as OANDA or IG, may offer more security and reliability. Always prioritize due diligence and ensure that your chosen broker aligns with your trading needs and risk tolerance.

Is Huanying a scam, or is it legit?

The latest exposure and evaluation content of Huanying brokers.

Huanying Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Huanying latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.