Pro Lite Trade 2025 Review: Everything You Need to Know

Executive Summary

Pro Lite Trade is a new forex broker. This broker has caused major problems in the trading community because many users complain about serious issues. This pro lite trade review shows a worrying pattern of user complaints and questions about whether the broker is real. The broker claims to offer low spreads and free trading. However, most user feedback shows serious warning signs about how the platform works.

The broker uses the VertexFX trading platform. It claims to offer forex, commodities, indices, and cryptocurrencies, but many traders report problems with withdrawals and question whether the broker follows regulations. Many review platforms say Pro Lite Trade might be fake. Several users describe their experiences as dealing with "cyber criminals."

The platform targets retail investors who want low-cost trading. The many negative reviews and scam claims suggest that potential clients should be very careful. This review looks at all available evidence to give traders a complete assessment of Pro Lite Trade's services and reliability.

Important Notice

Pro Lite Trade claims registration in Canada. However, many independent review platforms and user stories have raised serious questions about whether the broker is legitimate and how it operates. Potential investors should know that regulatory status claims may not reflect actual compliance or consumer protection standards.

This review analyzes publicly available information, user reviews from multiple platforms, and third-party assessments. Given the serious nature of allegations against this broker, readers should conduct additional research before considering any financial commitment. The evidence suggests extreme caution is necessary.

Rating Framework

Broker Overview

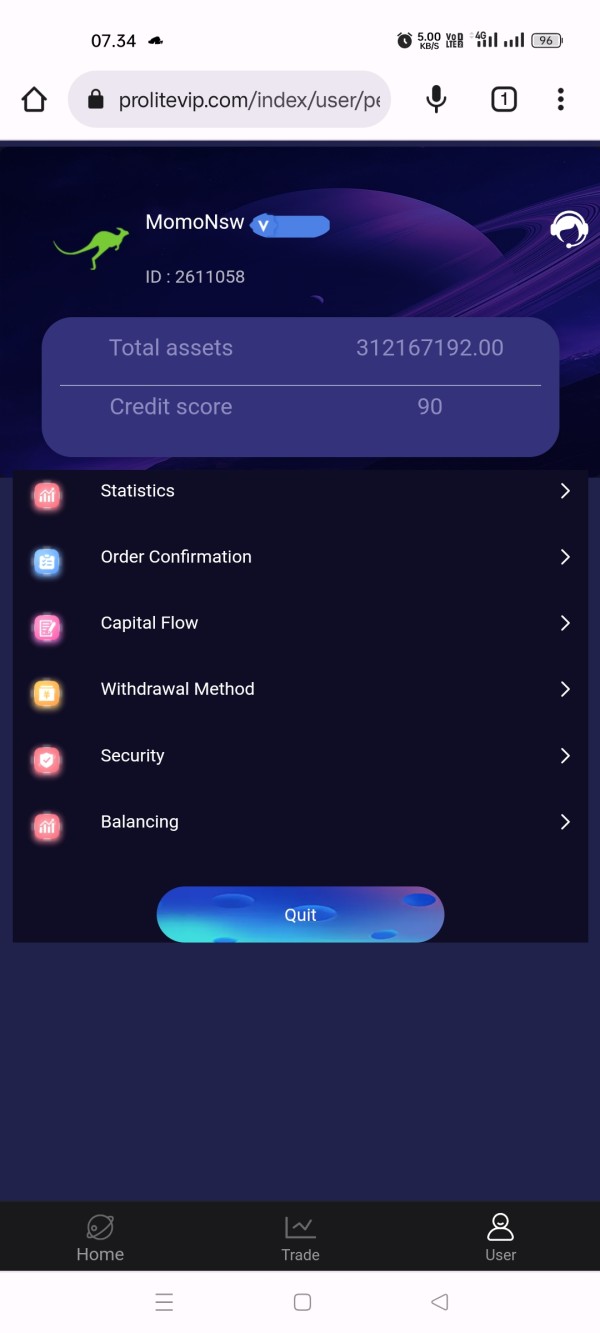

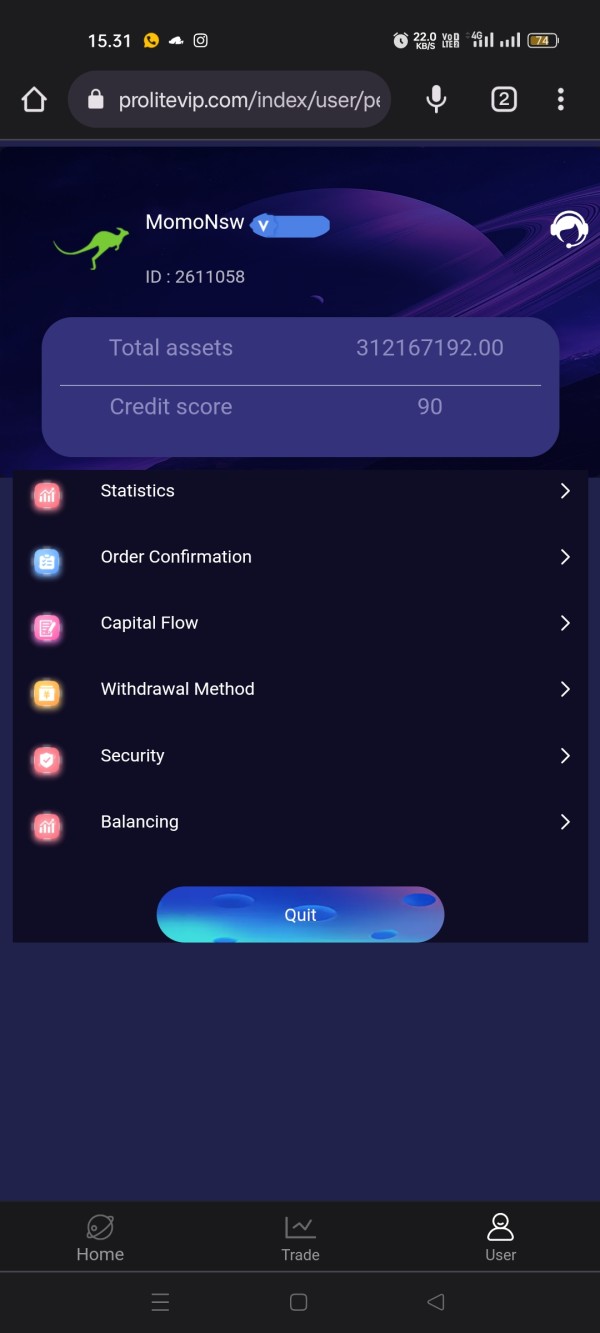

Pro Lite Trade presents itself as a forex and CFD broker. The company targets traders who want competitive trading conditions, and it claims to have started in 2023, though checking this timeline has proven difficult because of limited transparent corporate information. The broker's business model focuses on attracting clients with promises of low spreads and commission-free trading.

However, this pro lite trade review has found major concerns about the platform's actual operations versus its marketing claims. User reports consistently describe experiences that go against the broker's promotional materials. Many traders claim the platform uses fraudulent practices.

Pro Lite Trade uses the VertexFX trading platform. This platform supports both desktop and mobile trading, and the broker claims to offer access to various financial instruments including forex currency pairs, commodities, precious metals, energy products, and cryptocurrency CFDs. Despite these offerings, the overwhelming negative feedback from actual users suggests serious operational problems that potential clients should carefully consider before using this platform.

Regulatory Status: Pro Lite Trade's regulatory situation remains unclear and disputed. While the broker may claim Canadian registration, independent verification of legitimate regulatory oversight has not been confirmed through standard regulatory databases.

Deposit and Withdrawal Methods: Specific information about funding methods has not been detailed in available sources. This lack of information raises concerns about transparency.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available documentation. This indicates poor disclosure practices.

Promotional Offers: No verified bonus or promotional structures have been documented in this pro lite trade review.

Trading Assets: The broker claims to offer over 35 forex currency pairs, along with commodities including gold and oil. However, the actual availability and trading conditions for these instruments remain unverified.

Cost Structure: While Pro Lite Trade advertises low spreads and commission-free trading, specific spread ranges and fee structures are not transparently disclosed.

Leverage Ratios: Leverage information is not clearly specified in available materials.

Platform Options: The broker uses VertexFX platform for both desktop and mobile trading. User feedback on platform performance is limited.

Geographic Restrictions: Information about service availability by region has not been clearly documented.

Customer Support Languages: Specific language support details are not available in reviewed materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

Pro Lite Trade's account conditions receive an extremely poor rating. The broker lacks transparency and has concerning user feedback, and it fails to provide clear information about account types, minimum deposit requirements, or specific trading terms. This pro lite trade review found no evidence of different account tiers or specialized features that would benefit traders.

User reports consistently show that the attractive trading conditions advertised by Pro Lite Trade do not work in practice. Many traders report discovering hidden fees and unfavorable execution after funding their accounts. The absence of detailed account documentation and terms of service transparency significantly hurts confidence in the broker's offerings.

The lack of Islamic account options, educational account features, or other standard industry accommodations suggests a basic and potentially inadequate service structure. Combined with numerous user complaints about account access issues and unexpected restrictions, the overall account conditions appear substandard compared to legitimate brokers in the market.

The tools and resources provided by Pro Lite Trade receive a poor rating. This is due to limited verified information and negative user experiences, and while the broker claims to offer the VertexFX platform with multiple asset classes, actual user feedback suggests the trading environment lacks essential features and reliability. Available information indicates minimal research and analysis resources.

There is no evidence of comprehensive market analysis, economic calendars, or educational materials that traders typically expect from legitimate brokers. The absence of detailed platform features and trading tools documentation raises questions about the depth of services actually provided.

User feedback suggests that automated trading support and advanced charting capabilities may be limited or non-functional. The lack of third-party tool integration and limited customization options further reduce the platform's value for serious traders seeking professional-grade trading resources.

Customer Service and Support Analysis (Score: 1/10)

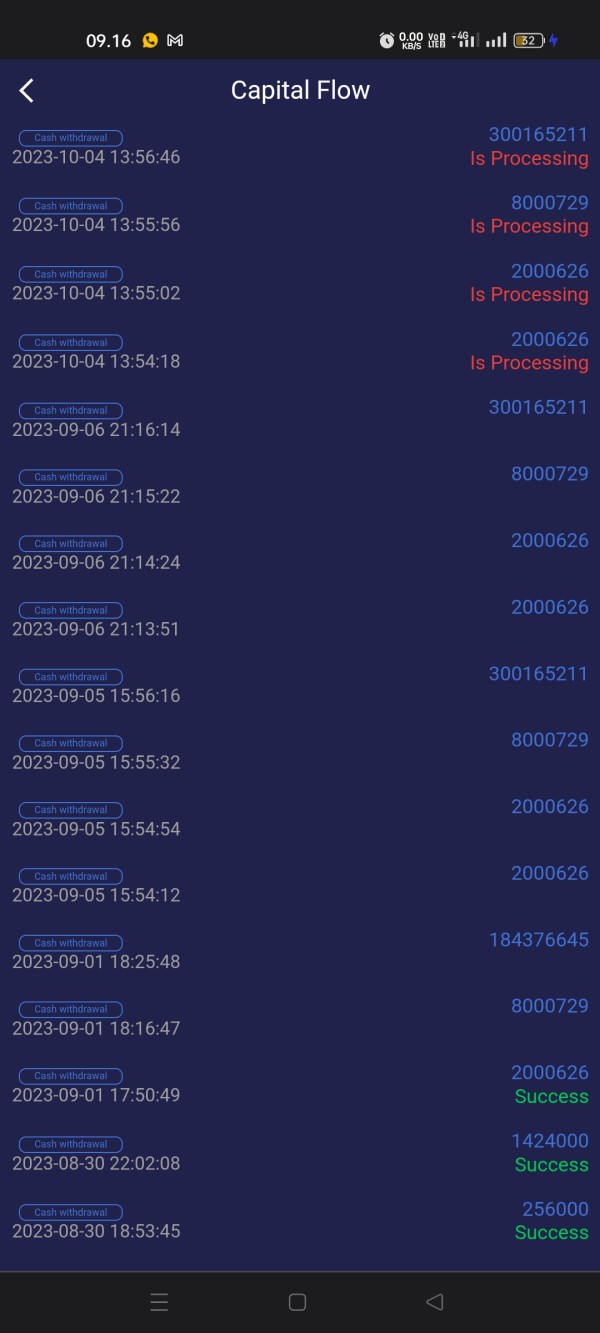

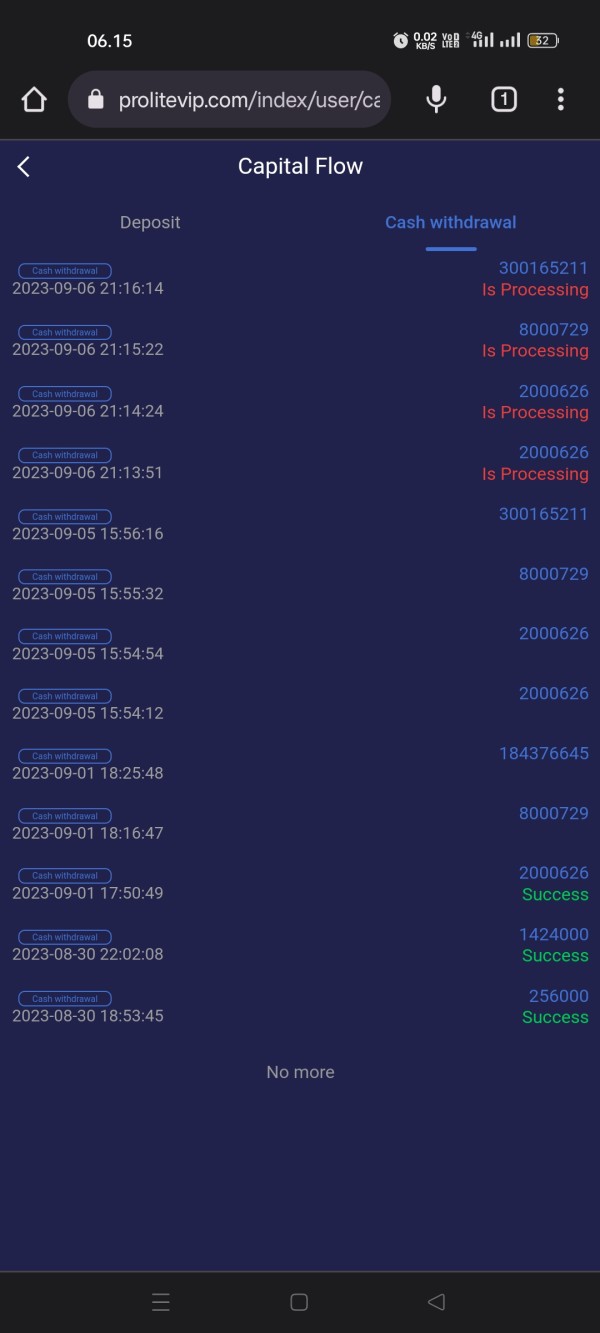

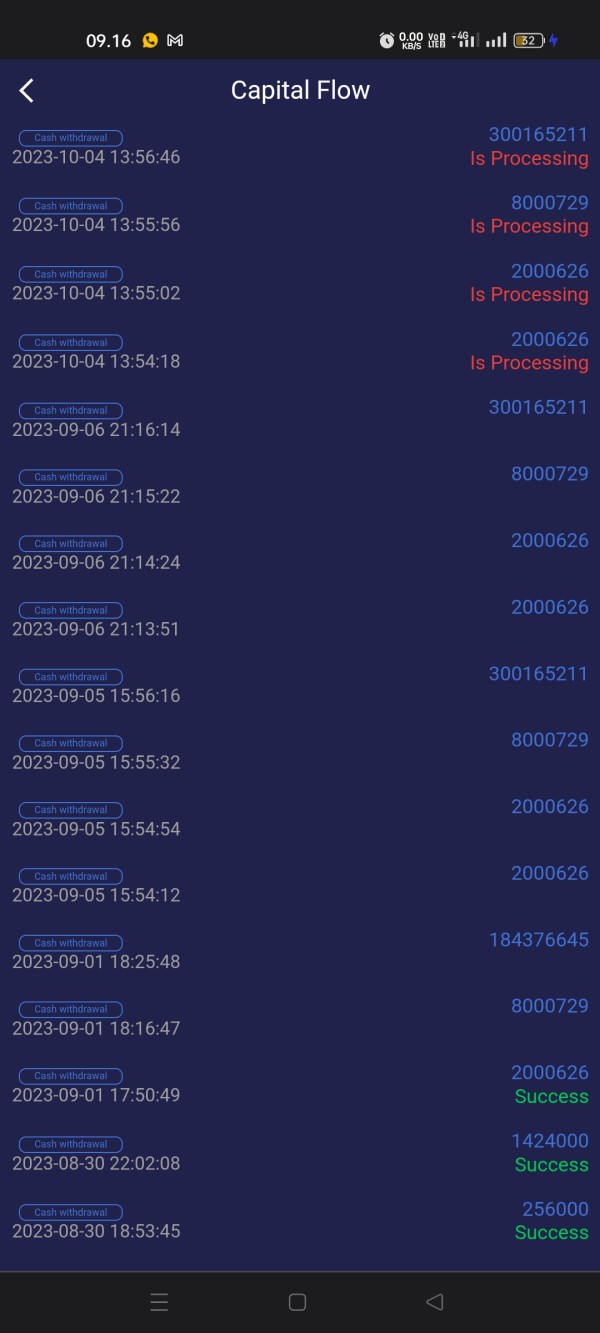

Customer service represents Pro Lite Trade's most significant weakness. It earns the lowest possible rating, and user reviews consistently describe poor responsiveness, unprofessional interactions, and inability to resolve basic account issues. Multiple traders report complete communication breakdowns when attempting to address withdrawal requests or account problems.

The broker appears to lack adequate customer support infrastructure. Users report long response times and unhelpful responses when support is eventually provided, and many reviews indicate that customer service representatives seem unwilling or unable to address legitimate trader concerns, particularly regarding fund withdrawals. The absence of multiple communication channels and limited support hours further compound service quality issues.

User testimonials frequently describe feeling abandoned by customer support. This is especially true when attempting to recover invested funds or resolve account access problems.

Trading Experience Analysis (Score: 2/10)

The trading experience with Pro Lite Trade receives a very poor rating based on user feedback and platform limitations. This pro lite trade review found numerous complaints about order execution quality, platform stability issues, and unexpected trading restrictions that significantly impact the user experience.

Users report frequent platform disconnections, delayed order processing, and price manipulation concerns that undermine trading effectiveness. The VertexFX platform, while potentially functional, appears to suffer from poor implementation or server-side issues that create frustrating trading conditions for users.

Many traders describe experiencing slippage, requotes, and other execution problems that suggest inadequate liquidity or poor broker practices. The absence of competitive execution speeds and reliable platform performance makes Pro Lite Trade unsuitable for traders requiring professional-grade trading conditions.

Trustworthiness Analysis (Score: 1/10)

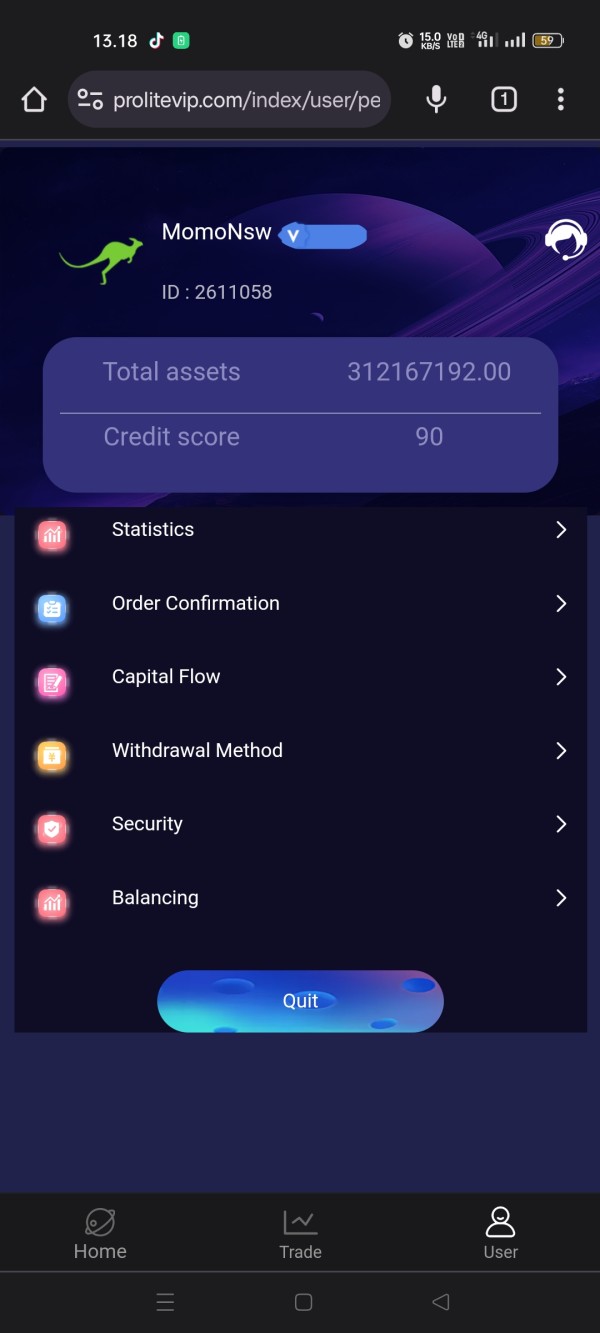

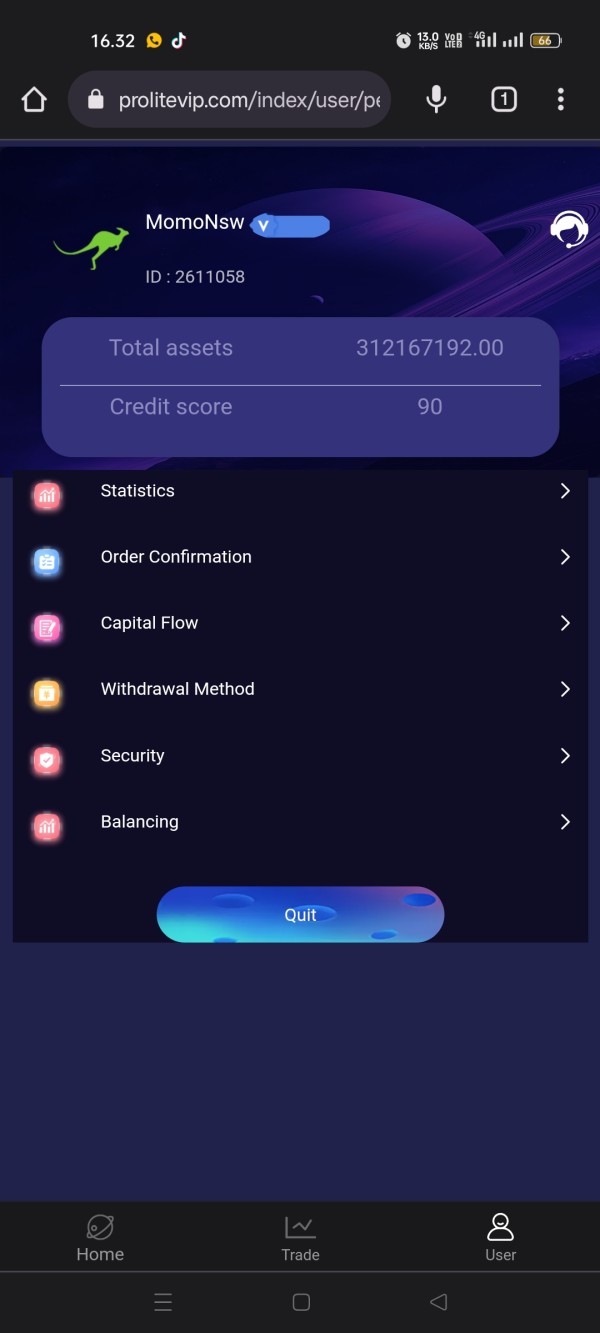

Trustworthiness represents the most critical concern with Pro Lite Trade. It earns the minimum rating due to widespread allegations of fraudulent practices, and multiple review platforms contain user reports describing the broker as operating like "cyber criminals," with numerous allegations of fund theft and withdrawal denial. The broker's regulatory claims cannot be independently verified through standard regulatory databases.

This raises serious questions about legitimate oversight and consumer protection. The absence of transparent corporate information, verified licensing, and clear regulatory compliance creates an extremely high-risk environment for potential clients.

Third-party review platforms consistently rate Pro Lite Trade negatively. Many explicitly warn users about potential scam operations, and the pattern of user complaints, combined with lack of verifiable regulatory status, creates a trust profile that suggests extreme caution is warranted for any potential engagement with this broker.

User Experience Analysis (Score: 2/10)

Overall user experience with Pro Lite Trade is overwhelmingly negative based on available feedback and review analysis. Users consistently report dissatisfaction with platform functionality, customer service interactions, and overall broker reliability that creates a poor trading environment.

The registration and account verification process appears problematic. Users report difficulties accessing their accounts and unclear onboarding procedures, and interface design and platform usability receive criticism for poor implementation and limited functionality compared to industry standards. User feedback indicates that the broker attracts clients with appealing marketing but fails to deliver on promised services.

This creates frustration and financial losses for many traders. The predominance of negative reviews and scam allegations suggests that user satisfaction is extremely low across all aspects of the broker's services.

Conclusion

This comprehensive pro lite trade review reveals a broker with serious operational and trustworthiness concerns. These issues make it unsuitable for most traders, and the overwhelming pattern of negative user feedback, combined with questionable regulatory status and poor service delivery, creates a high-risk environment that potential clients should avoid. While Pro Lite Trade may appeal to traders seeking low-cost trading options, the evidence suggests that the broker's actual practices do not align with its marketing promises.

The combination of poor customer service, platform issues, and widespread fraud allegations makes this broker inappropriate for serious trading activities. Traders seeking reliable forex and CFD services would be better served by choosing established brokers with verified regulatory status, transparent operations, and positive user feedback.

The risks associated with Pro Lite Trade appear to far outweigh any potential benefits from their advertised trading conditions.