Is Power Function safe?

Pros

Cons

Is Power Function Safe or a Scam?

Introduction

Power Function is a forex broker that has been making waves in the online trading community, particularly among those interested in foreign exchange and cryptocurrency trading. As more individuals seek to invest in these markets, the importance of choosing a reliable broker cannot be overstated. Unfortunately, the rise in popularity of online trading platforms has also led to an increase in scams and fraudulent activities. Therefore, it is crucial for traders to conduct thorough evaluations of brokers before committing their funds.

This article aims to provide a comprehensive analysis of Power Function, examining its regulatory status, company background, trading conditions, customer safety measures, and user experiences. The investigation is based on various online sources and reviews, ensuring an objective assessment of whether Power Function is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. A well-regulated broker is more likely to adhere to industry standards, ensuring the safety of client funds and fair trading practices. In the case of Power Function, it appears that the broker operates without proper regulatory oversight.

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation from reputable authorities such as the FCA, ASIC, or CySEC raises significant concerns about the broker's credibility. Furthermore, the lack of transparency regarding its operations and the absence of a physical address contribute to the perception that Power Function may not be a safe option for traders. Without a regulatory framework, clients may find it challenging to resolve disputes or recover funds in cases of fraud or mismanagement.

Company Background Investigation

Power Function's company history and ownership structure are essential in assessing its reliability. Unfortunately, the information available about the company's origins, development, and management team is sparse. This lack of transparency can be alarming for potential clients, as it makes it difficult to gauge the broker's legitimacy and operational practices.

Moreover, the absence of details regarding the management team's qualifications and experience raises further doubts about the broker's ability to provide a secure trading environment. A reputable broker typically discloses information about its leadership, demonstrating its commitment to transparency and accountability. In contrast, Power Function's limited information may indicate a lack of professionalism and reliability, suggesting that traders should exercise caution when considering this broker.

Trading Conditions Analysis

The trading conditions offered by a broker, including fees, spreads, and commissions, are crucial factors that can significantly impact a trader's profitability. In the case of Power Function, the broker claims to offer competitive trading conditions; however, the specifics remain unclear.

| Fee Type | Power Function | Industry Average |

|---|---|---|

| Spread on Major Pairs | Not disclosed | 1.0 - 2.0 pips |

| Commission Structure | Not specified | Varies |

| Overnight Interest Rates | Not provided | Varies |

The lack of clear information regarding fees and trading costs can be a red flag for traders. If a broker does not transparently disclose its fee structure, it may be attempting to hide unfavorable conditions that could erode a trader's profits. Additionally, any unusual or excessive fees could indicate potential scams, which is why it is essential for traders to understand the costs associated with their trading activities.

Client Funds Safety

Ensuring the safety of client funds is paramount for any trading platform. Power Function's measures regarding fund safety remain ambiguous. A reputable broker typically employs various security protocols, including segregated accounts, investor protection schemes, and negative balance protection.

However, the lack of detailed information about these safety measures raises concerns. Traders should be wary if a broker does not provide clear policies on how client funds are handled and protected. The absence of such measures could expose clients to significant risks, including loss of funds due to mismanagement or fraudulent activities.

Client Experience and Complaints

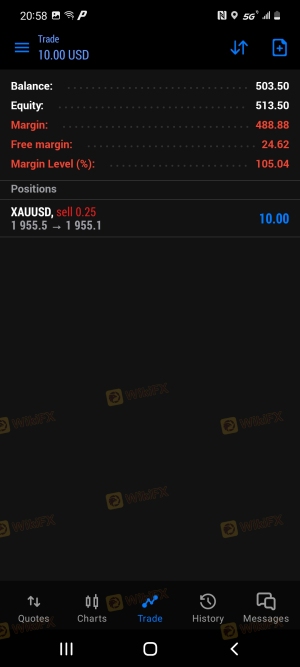

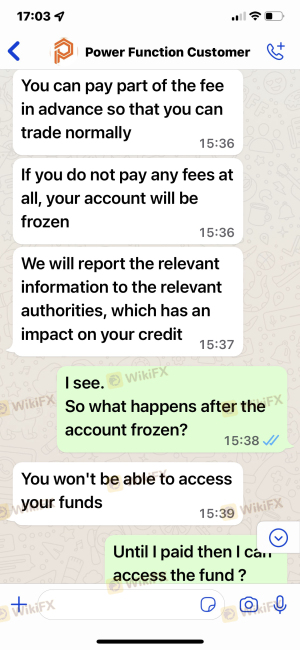

Analyzing customer feedback and experiences can provide valuable insights into a broker's reliability. Reports from users of Power Function indicate a mixed bag of experiences, with several complaints surfacing regarding withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | Medium | Slow to respond |

| Misleading Promotions | High | No resolution |

Common complaints include difficulties in processing withdrawals, which can be a significant warning sign for potential scams. If a broker makes it challenging for clients to access their funds, it may indicate that they are not operating in good faith. Additionally, the lack of timely responses from customer support can exacerbate user frustrations and diminish trust in the broker.

Platform and Execution

The trading platform's performance and execution quality are vital for a seamless trading experience. Power Function claims to offer a user-friendly trading platform; however, user reviews suggest that there may be issues with stability and execution speed. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

Moreover, any signs of platform manipulation or unfair practices should raise red flags. A trustworthy broker should provide a reliable platform that allows for efficient order execution without unnecessary hindrances.

Risk Assessment

Using Power Function involves a range of risks that potential clients should consider before engaging with the broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation |

| Fund Safety Risk | High | Lack of transparency |

| Customer Support Risk | Medium | Poor response times |

Traders should be aware of these risks and take appropriate measures to mitigate them. This could include setting strict budget limits, using risk management tools, and being cautious about the amount of capital allocated to trading with Power Function.

Conclusion and Recommendations

In conclusion, the investigation into Power Function raises significant concerns regarding its safety and legitimacy. The lack of regulatory oversight, transparency in company operations, and numerous customer complaints suggest that traders should approach this broker with caution.

While Power Function may offer appealing trading conditions, the potential risks associated with using an unregulated broker far outweigh the benefits. Therefore, it is advisable for traders to consider more reputable alternatives that are regulated by recognized authorities and have a proven track record of client satisfaction.

For those seeking safe trading environments, brokers regulated by the FCA, ASIC, or CySEC are recommended, as they provide the necessary oversight to protect client interests and ensure fair trading practices.

Is Power Function a scam, or is it legit?

The latest exposure and evaluation content of Power Function brokers.

Power Function Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Power Function latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.