Power Function 2025 Review: Everything You Need to Know

Executive Summary

This power function review covers a unique entity in the financial services space. Mathematical concepts meet trading applications here. Power Function appears to be more of a mathematical concept and programming tool rather than a traditional forex broker, based on available materials. The information focuses mainly on Power Function's mathematical definition and its applications in C++ programming. This suggests potential value in technical analysis and algorithmic trading environments.

The entity shows promise for traders with mathematical and programming backgrounds. It particularly appeals to those interested in developing algorithmic trading strategies. However, the lack of detailed regulatory information, trading conditions, and traditional broker services makes it difficult to provide a comprehensive evaluation as a conventional forex broker. Our assessment remains neutral due to insufficient information about core brokerage services, regulatory compliance, and actual trading offerings.

The primary appeal appears to be for users who understand mathematical functions and their applications in financial markets. This especially applies to those seeking to implement power function calculations in their trading algorithms or technical analysis frameworks.

Important Notice

Users across different regions may face varying legal and safety risks when engaging with Power Function services due to the absence of clear regulatory information in available materials. The regulatory landscape for mathematical tools and their application in trading can differ significantly between jurisdictions. Traders should conduct thorough due diligence before implementation.

This evaluation is based on available information summaries and does not include comprehensive user feedback or third-party assessments. The review focuses on publicly available information about Power Function's mathematical applications and potential trading utility rather than traditional broker evaluation metrics.

Rating Framework

Broker Overview

Power Function presents an unconventional profile in the financial services sector. Available information focuses primarily on its mathematical foundations rather than traditional brokerage operations. The entity appears to be rooted in mathematical concepts, specifically the power function formula and its applications in programming environments, particularly C++ implementations. This mathematical foundation suggests potential applications in quantitative trading and algorithmic strategy development.

The available materials do not provide specific information about establishment dates, traditional company background, or standard business models typically associated with forex brokers. Instead, the focus remains on the mathematical definition and computational applications of power functions. This indicates a more specialized approach to financial market participation.

Trading platform types, asset categories, and regulatory oversight details are not specified in the available documentation. This power function review must therefore approach the evaluation from the perspective of a mathematical tool with potential trading applications rather than a conventional brokerage service. The absence of traditional broker characteristics suggests users should approach this entity with different expectations compared to standard forex brokers.

Regulatory Regions: Specific regulatory information is not detailed in available materials. This creates uncertainty about jurisdictional oversight and compliance frameworks that typically govern financial service providers.

Deposit and Withdrawal Methods: Available documentation does not specify traditional banking methods, payment processors, or funding mechanisms typically associated with broker services.

Minimum Deposit Requirements: Specific deposit requirements are not mentioned in the available information. This suggests either non-traditional account structures or incomplete service documentation.

Bonus and Promotions: No promotional offers or bonus structures are referenced in the available materials. This indicates either absence of such programs or limited marketing information.

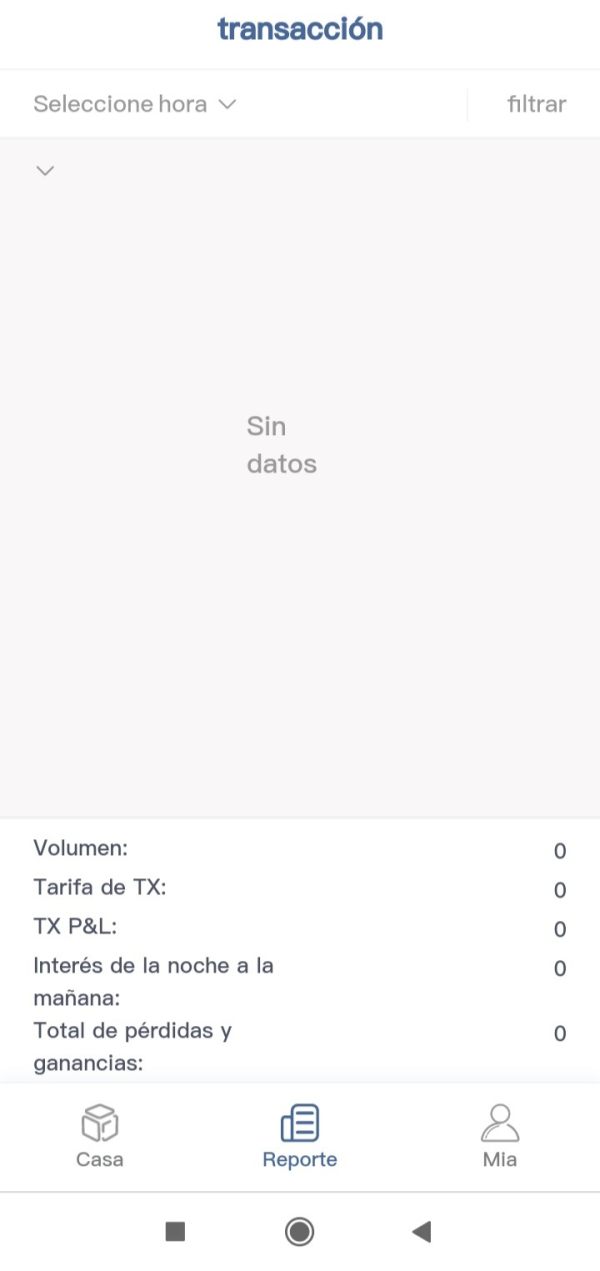

Tradeable Assets: The range of financial instruments available for trading is not specified in current documentation. This makes it difficult to assess market access and trading opportunities.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not available in the current materials. This prevents comprehensive cost analysis.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in available documentation.

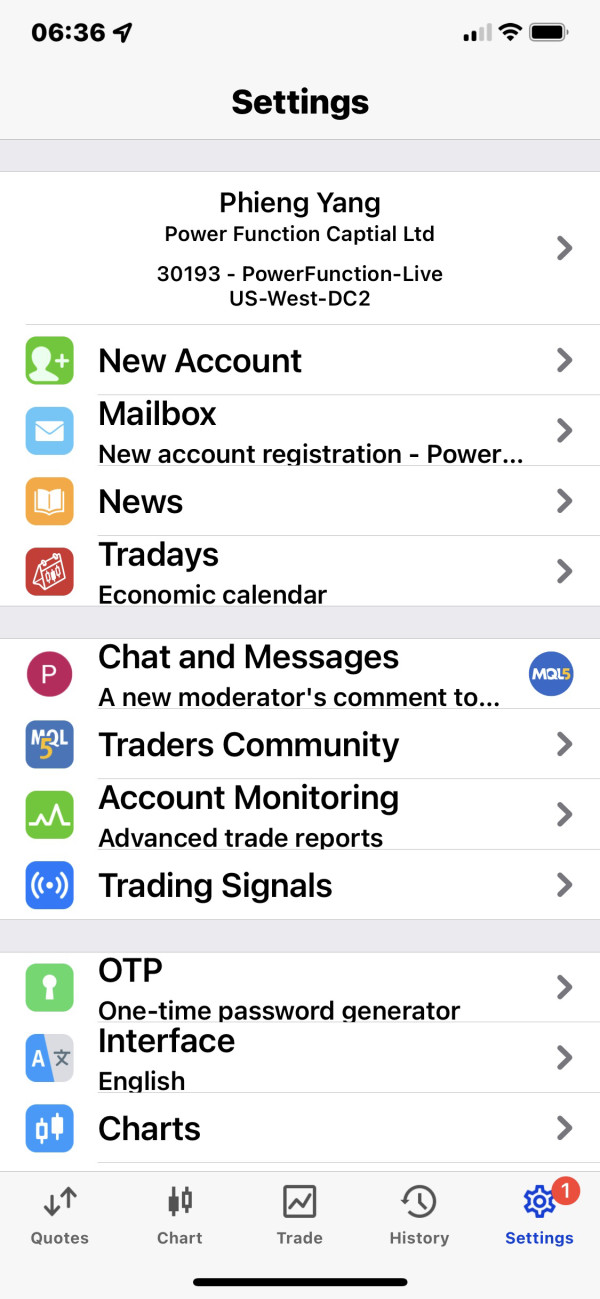

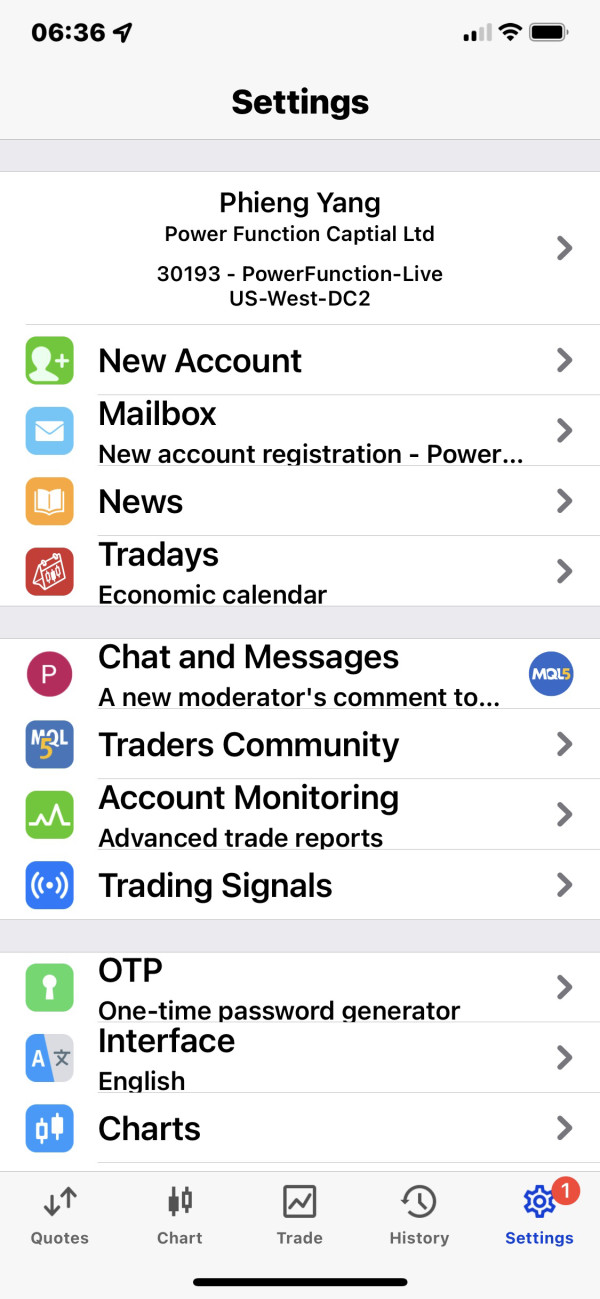

Platform Options: Specific trading platform availability, including MetaTrader support or proprietary solutions, is not detailed in current materials.

This power function review reveals significant information gaps in traditional broker evaluation categories. This suggests either a non-traditional service model or incomplete public documentation.

Account Conditions Analysis

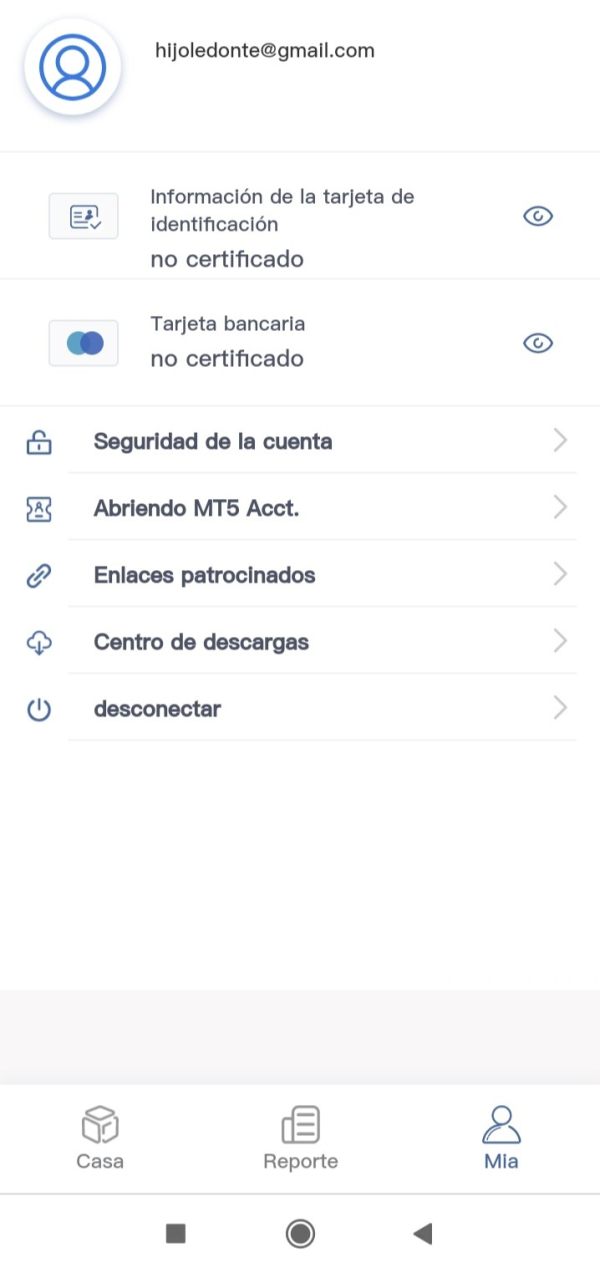

The evaluation of account conditions for Power Function presents significant challenges due to the absence of detailed account information in available materials. Traditional account types, such as standard, premium, or professional accounts, are not specified or described in the documentation reviewed. This creates uncertainty for potential users seeking to understand account structures, minimum balance requirements, and associated benefits or limitations.

Account opening procedures, verification requirements, and documentation processes are not outlined in available materials. The lack of information about Islamic accounts, demo account availability, or specialized account features makes it difficult to assess accommodation for diverse trading needs and religious requirements.

Without specific details about account management features, funding requirements, or maintenance conditions, this power function review cannot provide definitive guidance on account suitability for different trader profiles. The mathematical focus of available information suggests that traditional account structures may not apply, or comprehensive account details have not been made publicly available.

Users considering Power Function should seek additional clarification about account conditions directly from the service provider. Standard broker evaluation criteria cannot be adequately assessed based on current information availability.

The analysis of trading tools and resources available through Power Function is limited by the mathematical nature of available documentation. While the materials reference power function calculations and C++ programming applications, specific trading tools, market analysis resources, and educational materials are not detailed in current information sources.

Research capabilities, market analysis tools, and technical indicators that traders typically expect from brokerage services are not specified in available documentation. The mathematical foundation suggests potential for algorithmic trading support, but specific automated trading platforms, expert advisor compatibility, or strategy development resources are not clearly outlined.

Educational resources, webinars, market commentary, and training materials that support trader development are not referenced in current materials. This absence of educational content may limit the service's appeal to traders seeking comprehensive learning and development support.

The focus on mathematical concepts and programming applications indicates potential value for quantitatively-oriented traders. However, the lack of traditional trading tools and resources creates gaps in service offerings compared to conventional forex brokers. Users with technical backgrounds may find value in the mathematical applications, while those seeking comprehensive trading support may need to look elsewhere.

Customer Service and Support Analysis

Customer service evaluation for Power Function faces significant limitations due to the absence of support information in available materials. Traditional customer service channels such as live chat, phone support, email assistance, and help desk availability are not specified or described in current documentation.

Response time expectations, service quality standards, and problem resolution procedures are not outlined in available information. The lack of customer service details creates uncertainty about support availability during trading hours, technical assistance, and account management help.

Multi-language support capabilities, regional service teams, and time zone coverage are not addressed in current materials. This absence of service information may particularly concern international users who require support in their native languages or during specific regional trading hours.

Without customer service details, user feedback about support quality, or documented service level agreements, this evaluation cannot assess the adequacy of customer support offerings. Potential users should directly inquire about support availability and service standards before engaging with Power Function services.

Trading Experience Analysis

The assessment of trading experience with Power Function is constrained by the limited information available about actual trading functionality and user feedback. Platform stability, execution speed, and order processing quality are not addressed in current documentation. This makes it impossible to evaluate core trading performance metrics.

User interface design, platform functionality, and trading tool integration are not described in available materials. The mathematical focus suggests potential applications in algorithmic trading environments, but specific platform features, charting capabilities, and order management systems are not detailed.

Mobile trading experience, cross-platform compatibility, and accessibility features are not specified in current information sources. This creates uncertainty about trading flexibility and platform access across different devices and operating systems.

Without concrete trading experience data, user testimonials about platform performance, or technical specifications about execution quality, this power function review cannot provide definitive conclusions about trading experience quality. The mathematical foundation may appeal to technical traders, but practical trading implementation details require further clarification.

Trust and Regulation Analysis

Trust assessment for Power Function faces significant challenges due to the complete absence of regulatory information in available materials. Traditional regulatory oversight from bodies such as FCA, CySEC, ASIC, or other financial authorities is not mentioned or verified in current documentation.

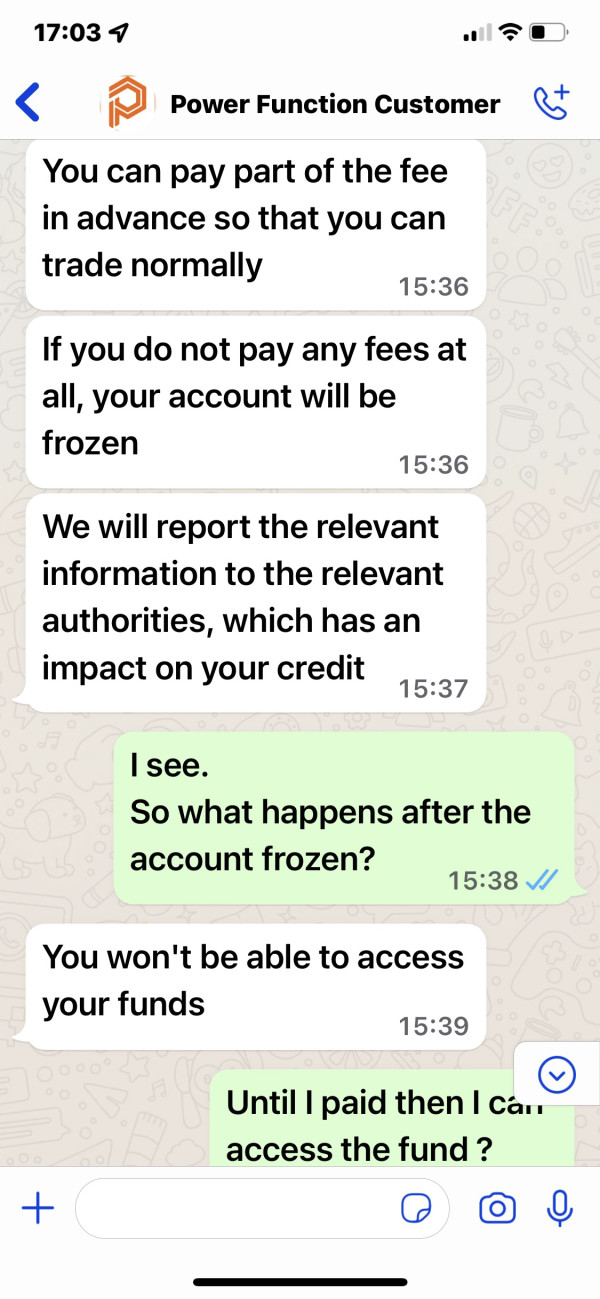

Fund safety measures, segregated account policies, investor protection schemes, and deposit insurance coverage are not specified in available information. This lack of regulatory transparency significantly impacts the trust assessment and raises concerns about fund security and regulatory compliance.

Company transparency regarding ownership, financial statements, regulatory filings, and corporate governance is not addressed in current materials. The absence of regulatory licensing information, compliance certifications, and oversight details creates substantial uncertainty about operational legitimacy.

Industry reputation, regulatory history, and any negative incidents or enforcement actions are not documented in available information. Without regulatory verification, third-party oversight, or compliance documentation, the trust rating remains low. This reflects the significant information gaps in this critical evaluation area.

User Experience Analysis

User experience evaluation for Power Function is severely limited by the absence of user feedback and experience data in available materials. Overall user satisfaction metrics, platform usability ratings, and community feedback are not available for assessment in current documentation.

Interface design quality, navigation efficiency, and ease of use for different skill levels are not described in available information. The mathematical focus may appeal to technically sophisticated users, but broader user experience considerations are not addressed in current materials.

Registration procedures, account verification processes, and onboarding experiences are not detailed in available documentation. This creates uncertainty about user journey quality and potential friction points in service adoption.

Common user complaints, frequently reported issues, and resolution experiences are not documented in available information. Without user testimonials, satisfaction surveys, or community feedback, this evaluation cannot assess real-world user experience quality or identify areas for improvement.

Conclusion

This power function review reveals an entity that differs significantly from traditional forex brokers. Available information focuses primarily on mathematical concepts and programming applications rather than conventional brokerage services. The overall assessment remains neutral due to substantial information gaps in critical evaluation areas including regulation, trading conditions, and user experience.

Power Function appears most suitable for users with strong mathematical and programming backgrounds. It particularly appeals to those interested in algorithmic trading development and quantitative analysis applications. The mathematical foundation may provide value for technical traders seeking to implement power function calculations in their trading strategies.

The primary advantages lie in the potential mathematical applications and programming utility. However, significant disadvantages include the lack of regulatory information, absence of traditional broker services, and limited transparency about operational details. Potential users should conduct thorough due diligence and seek additional clarification before engagement.