Is PLOTIO safe?

Pros

Cons

Is Plotio Safe or Scam?

Introduction

Plotio is a forex broker that has emerged in the competitive landscape of online trading, offering a variety of financial instruments, including currency pairs, commodities, and indices. As the forex market continues to expand, traders must exercise caution when selecting a broker, as the risk of falling victim to scams or unreliable platforms is significant. This article aims to provide a comprehensive evaluation of Plotio, examining its regulatory status, company background, trading conditions, customer security, user experiences, platform performance, and overall risk profile. By leveraging multiple sources, including user reviews and regulatory data, we aim to answer the critical question: Is Plotio safe?

Regulation and Legitimacy

The regulatory framework within which a broker operates is paramount in determining its legitimacy. A well-regulated broker is more likely to adhere to industry standards and protect client funds. Plotio claims to be regulated by multiple authorities, including the Australian Securities and Investments Commission (ASIC) and the Securities Commission of the Bahamas (SCB). Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 528971 | Australia | Regulated |

| SCB | SIA-F212 | Bahamas | Offshore Regulated |

| CGSE | Type A1 | Hong Kong | Regulated |

While Plotio is regulated by ASIC, which is considered a reputable authority, its offshore regulation by the SCB raises concerns. Offshore regulations often lack the stringent oversight found in tier-1 jurisdictions, which can lead to increased risk for traders. Furthermore, the historical compliance of Plotio with these regulations remains unclear, necessitating a cautious approach when assessing whether Plotio is safe.

Company Background Investigation

Understanding the company behind a broker is crucial in evaluating its trustworthiness. Plotio was founded in 2019, positioning itself as a relatively new player in the market. The company is registered in Hong Kong, with its headquarters located at the Capital Union Building in Nassau, the Bahamas. The ownership structure and management team details are sparse, which can be a red flag for potential investors.

A transparent company typically discloses information about its key personnel, including their qualifications and experience in the financial industry. However, Plotio has not provided sufficient details about its management team, raising concerns about its operational transparency. The lack of information can lead to questions regarding the reliability of the broker and whether Plotio is safe for investors.

Trading Conditions Analysis

Evaluating the trading conditions offered by a broker is essential for understanding the overall cost of trading. Plotio provides access to various financial instruments, but the costs associated with trading can vary significantly. Below is a comparison of core trading costs:

| Fee Type | Plotio | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 - 1.1 pips | 0.3 - 0.6 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While Plotio offers competitive spreads, they can be higher than industry averages, particularly during volatile market conditions. Additionally, the absence of clear commission structures may lead to hidden fees that could impact overall profitability. Traders should be aware of potential costs when considering whether Plotio is safe for their trading activities.

Client Fund Security

The safety of client funds is a top priority for any trading platform. Plotio claims to implement several measures to protect client funds, including segregated accounts and negative balance protection. These practices are essential in ensuring that client funds are not mixed with the broker's operational funds, thus providing a layer of security.

However, the lack of a specific investor protection fund, such as those mandated by tier-1 regulators, is concerning. In the event of insolvency, clients may not have the same level of recourse as they would with a fully regulated broker. Additionally, historical issues regarding fund security have not been reported, but the offshore regulatory status raises questions about the overall safety of funds held with Plotio. Therefore, traders must consider these factors when assessing if Plotio is safe.

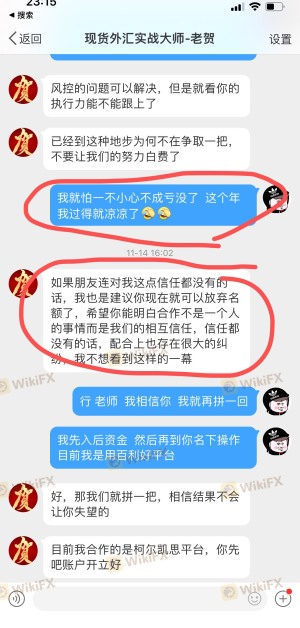

Customer Experience and Complaints

User feedback is a valuable resource for understanding the reliability of a broker. Plotio has received mixed reviews from clients, with some praising its trading platform and customer service, while others have reported significant issues. Common complaints include withdrawal delays, lack of transparency regarding fees, and difficulty in reaching customer support.

The following table summarizes the major complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Fee Transparency | Medium | Inadequate details |

| Customer Support | High | Delayed responses |

For instance, one user reported that their withdrawal request took over a week to process, which is unacceptable in the trading industry. Another user highlighted that the broker's customer support was unresponsive, raising concerns about the level of service provided. These experiences contribute to the growing skepticism about whether Plotio is safe for traders.

Platform and Trade Execution

The trading platform used by a broker can significantly impact the trading experience. Plotio offers the popular MetaTrader 5 (MT5) platform, known for its robust features and user-friendly interface. However, users have reported issues with order execution, including slippage and occasional rejections of orders during high volatility.

A reliable trading platform should provide consistent execution with minimal slippage. However, reports of slippage and rejected orders raise concerns about the platform's reliability. Traders should carefully consider these aspects before deciding to trade with Plotio, as these factors can influence whether Plotio is safe for their trading needs.

Risk Assessment

Every trading platform comes with inherent risks. Plotio's combination of offshore regulation, mixed user reviews, and concerns regarding fund security contribute to a moderate risk profile. Below is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited oversight |

| Fund Security Risk | Medium | Lack of investor protection mechanisms |

| Customer Service Risk | Medium | Reports of inadequate support and responsiveness |

To mitigate these risks, traders should conduct thorough research, consider starting with a demo account, and only invest funds they can afford to lose. Understanding these risks is crucial in determining whether Plotio is safe for individual trading strategies.

Conclusion and Recommendations

In conclusion, while Plotio presents itself as a legitimate broker with regulatory oversight, several factors warrant caution. The combination of offshore regulation, mixed user reviews, and concerns over customer support and fund security raises significant questions about the broker's reliability.

For traders considering whether Plotio is safe, it is advisable to proceed with caution. New traders or those with limited experience may want to explore more established brokers with a proven track record and strong regulatory backing. Some recommended alternatives include brokers regulated by tier-1 authorities, such as FCA or ASIC, which provide greater security and investor protection.

In summary, while Plotio may offer trading opportunities, prospective clients should weigh the risks carefully and consider their options before making any investment decisions.

Is PLOTIO a scam, or is it legit?

The latest exposure and evaluation content of PLOTIO brokers.

PLOTIO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PLOTIO latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.