Is PEMAXX GLOBAL safe?

Pros

Cons

Is Pemaxx A Scam?

Introduction

Pemaxx is an online forex broker that positions itself as a player in the global trading market, offering a wide range of trading instruments including forex, cryptocurrencies, commodities, and indices. Given the rapid growth of the online trading industry, many brokers have emerged, making it essential for traders to exercise caution when selecting a broker. The potential for scams and fraudulent activities is significant, which necessitates thorough research and due diligence before committing funds.

This article aims to provide a comprehensive evaluation of Pemaxx, analyzing its regulatory status, company background, trading conditions, customer experiences, and overall safety. The investigation is based on a review of multiple sources, including regulatory databases, customer feedback, and industry assessments, to determine whether Pemaxx is a legitimate broker or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy and reliability. A regulated broker is subject to oversight by financial authorities, which helps ensure the safety of client funds and adherence to ethical trading practices. In the case of Pemaxx, the broker claims to be registered in Mauritius, but further investigation reveals significant discrepancies regarding its regulatory status.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Mauritius FSC | C24209694 | Mauritius | Not Found |

Despite claiming to have a license, no record of Pemaxx can be found in the Mauritius Financial Services Commission (FSC) database. This raises serious concerns about the broker's credibility and suggests that it may be operating without proper licensing. The FSC is known for its relatively lenient regulatory framework, which does not guarantee the same level of investor protection as stricter regulatory bodies like the FCA or ASIC.

The absence of valid regulation means that traders using Pemaxx are exposed to high risks, including the potential loss of funds without any legal recourse. Many reviews and assessments from reputable sources have flagged Pemaxx as an unregulated broker, emphasizing that trading with such entities is inherently risky and often leads to financial loss.

Company Background Investigation

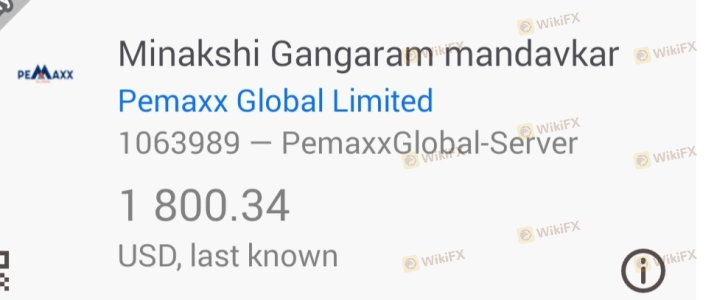

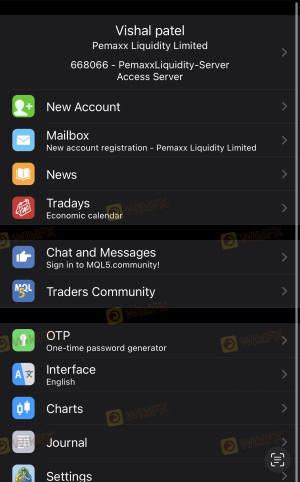

Pemaxx is operated by Pemaxx Liquidity Limited, which is registered in Mauritius. However, the companys history and ownership structure remain vague, with limited information available about its management team and operational practices. The lack of transparency is a significant red flag, as reputable brokers typically provide detailed information about their background, including the experience of their management team and their business model.

Many reviews indicate that Pemaxx has been operational for only a few years, raising questions about its stability and reliability as a trading platform. A broker's history is crucial in assessing its trustworthiness; established brokers with a long track record are generally considered safer options. In contrast, newer brokers may lack the necessary infrastructure and experience to manage client funds effectively.

The information disclosure level on Pemaxx's website is inadequate. Potential clients are often left without clear insights into the companys policies, terms of service, or any legal documentation. This opacity can lead to misunderstandings about the broker's operations and could potentially mask fraudulent practices.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. Pemaxx claims to provide competitive trading conditions, including high leverage and various account types. However, the lack of clarity regarding fees and spreads raises suspicions.

| Fee Type | Pemaxx | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 0.1 pips | 1.0 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not disclosed | Typically between 0.5% - 3% |

While Pemaxx advertises spreads starting from 0.1 pips, the absence of specific information regarding commissions and overnight interest rates makes it challenging to assess the true cost of trading. Many traders have reported hidden fees and unfavorable trading conditions with unregulated brokers, which can significantly erode potential profits.

Moreover, the promise of high leverage (up to 1:500) is common among unregulated brokers. While high leverage can amplify profits, it also increases the risk of substantial losses, particularly for inexperienced traders. Regulatory bodies in many jurisdictions limit leverage to protect retail investors, indicating that Pemaxx's offering is not aligned with industry standards.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker. Regulated brokers are typically required to maintain client funds in segregated accounts, ensuring that these funds are protected in the event of insolvency. However, Pemaxx's status as an unregulated broker raises significant concerns regarding the safety of client funds.

There is no evidence that Pemaxx employs robust measures to safeguard client funds. The absence of investor protection schemes and the lack of segregation of client funds make it highly susceptible to mismanagement or fraudulent activities. Furthermore, the absence of negative balance protection means that traders could potentially lose more than their initial investment, a risk not present with regulated brokers.

Historically, many unregulated brokers have faced allegations of mishandling client funds, leading to significant losses for traders. This highlights the importance of choosing a broker with a strong regulatory framework and a proven track record in fund management.

Customer Experience and Complaints

Customer feedback is a vital component of assessing a broker's reliability. Reviews for Pemaxx reveal a concerning trend of negative experiences, particularly regarding withdrawal issues and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Blocking | High | Poor |

Many users have reported difficulties in withdrawing funds, with some claiming that their accounts were blocked after they attempted to withdraw profits. These complaints are alarming, as they indicate potential fraudulent practices where brokers may restrict access to funds to prevent withdrawals.

Typical cases include traders who reported making profits but faced significant delays or outright refusals when requesting withdrawals. Such experiences reflect a lack of accountability and customer support, which are critical for maintaining trust in a trading platform.

Platform and Trade Execution

The performance and reliability of the trading platform are crucial for a positive trading experience. Pemaxx claims to offer the popular MetaTrader 5 platform, known for its advanced features and user-friendly interface. However, many users have reported issues with platform accessibility and execution quality.

The lack of transparency regarding order execution quality, slippage, and rejection rates raises concerns about the overall reliability of the trading platform. Traders have noted instances of delayed order executions and unresponsive customer support, which can be detrimental in fast-moving markets.

Moreover, the absence of a demo account option prevents potential clients from testing the platform before committing real funds, further complicating the decision-making process.

Risk Assessment

Engaging with Pemaxx presents several risks that potential traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | Potential loss of funds with no recourse. |

| Operational Risk | Medium | Issues with platform stability and execution. |

| Customer Service Risk | High | Poor response to customer complaints. |

To mitigate these risks, traders should consider using regulated brokers with robust security measures and transparent policies. Conducting thorough research and reading reviews can also help identify red flags before investing.

Conclusion and Recommendations

In conclusion, the evidence suggests that Pemaxx exhibits several characteristics typical of scam brokers. The absence of valid regulation, a lack of transparency, and numerous customer complaints raise significant concerns about its legitimacy.

Traders are strongly advised to exercise caution and consider alternative options that offer regulatory oversight and a proven track record of reliability. For those seeking to engage in forex trading, reputable brokers such as IG, OANDA, or Forex.com provide safer environments with strong regulatory frameworks and positive customer reviews.

Ultimately, the risks associated with trading with Pemaxx outweigh any potential benefits, making it a broker that traders should avoid.

Is PEMAXX GLOBAL a scam, or is it legit?

The latest exposure and evaluation content of PEMAXX GLOBAL brokers.

PEMAXX GLOBAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PEMAXX GLOBAL latest industry rating score is 2.16, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.16 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.