Pemaxx 2025 Review: Everything You Need to Know

Executive Summary

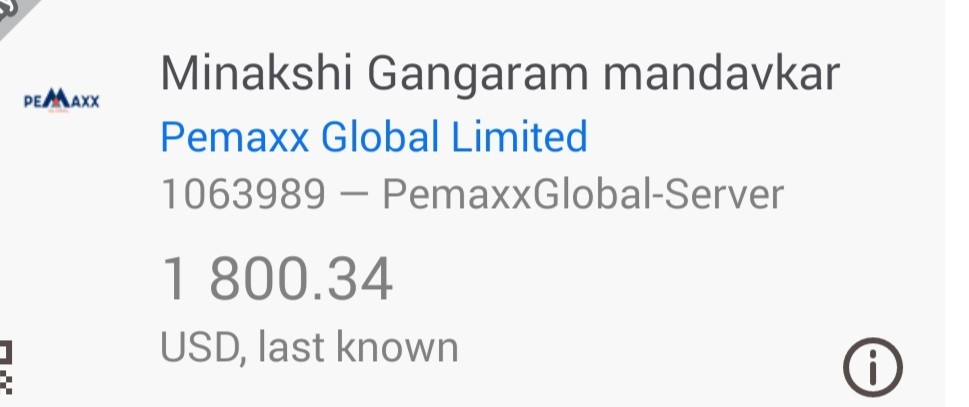

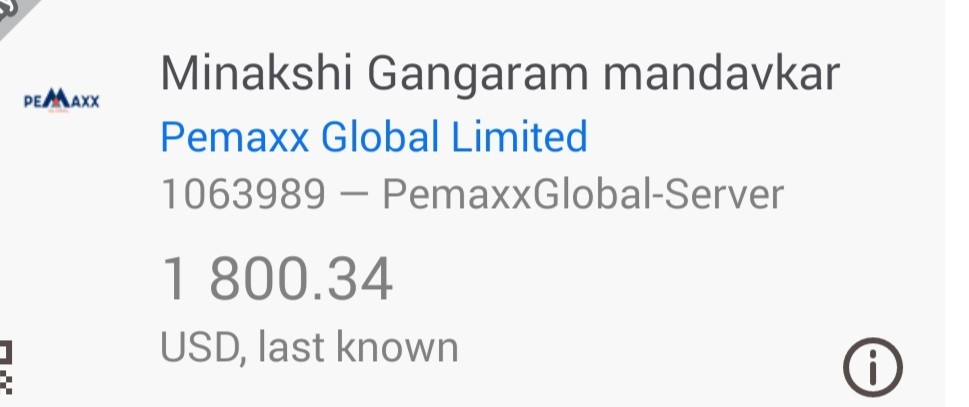

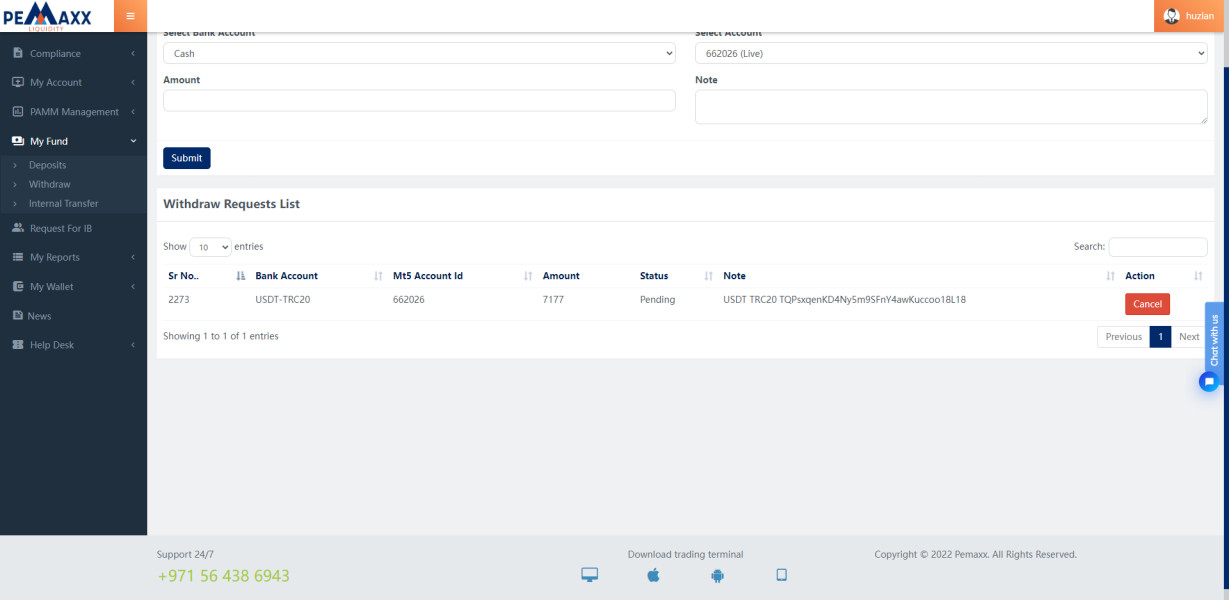

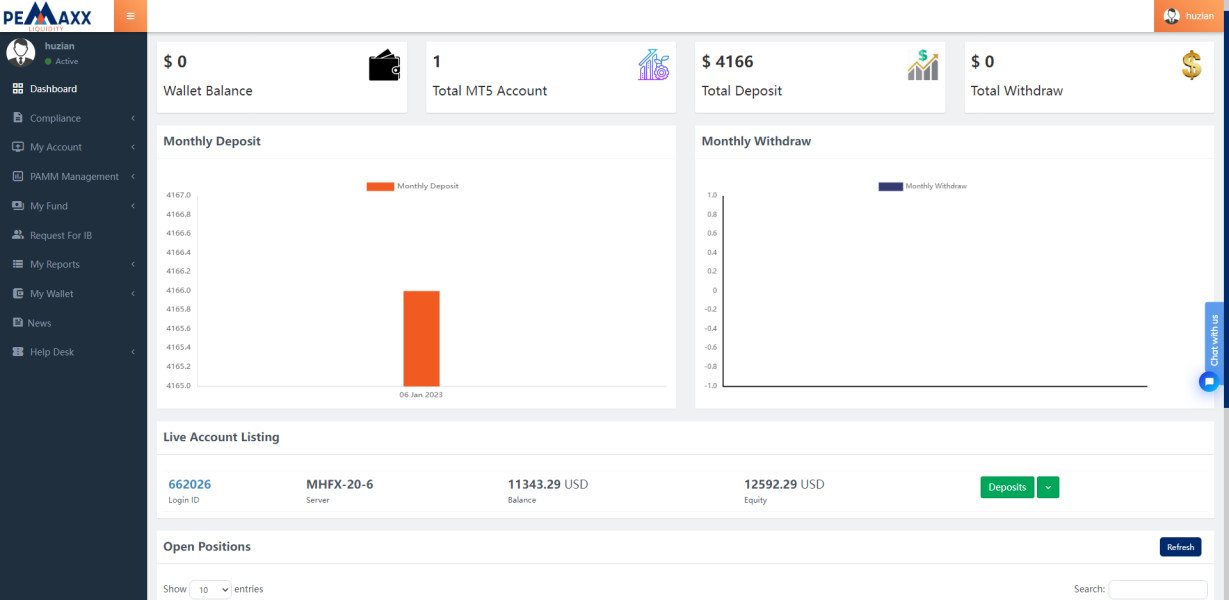

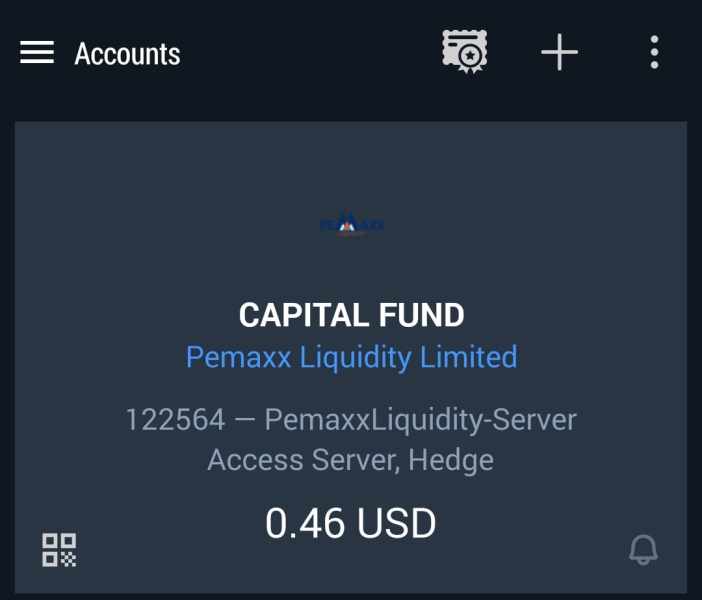

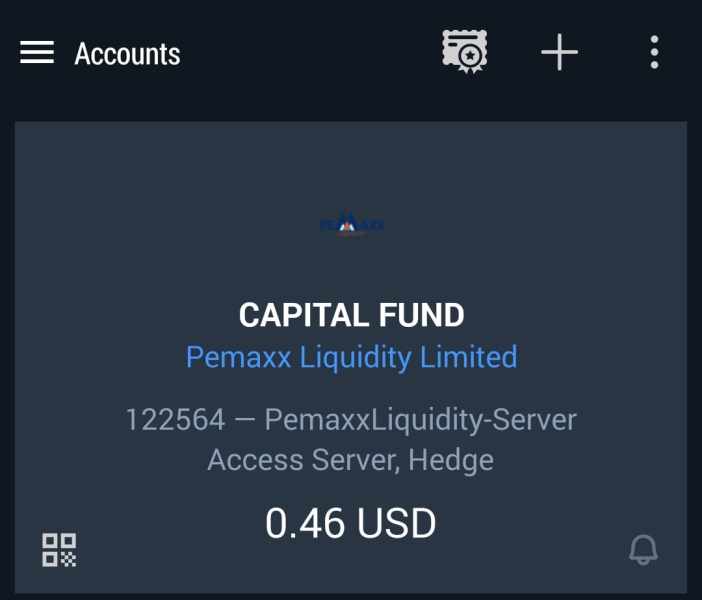

This pemaxx review shows major safety and trust issues that traders should think about carefully. Pemaxx started in 2023 and has its main office in Mauritius, where it runs as an online forex trading platform that gives access to currencies, commodities, cryptocurrencies, indices, and stocks through the MetaTrader 5 platform. The broker says you only need $10 to start trading, which sounds good for new traders. However, many sources show serious warning signs about how this company works.

User ratings show very poor results across the board. Some review sites give Pemaxx only 1 out of 5 stars, which is extremely bad. Many users have shared strong concerns about whether this broker is safe and real, with some reports pointing to possible scam behavior. Pemaxx says it follows rules set by the Mauritius Financial Services Commission (FSC), but important license details are not clear or proven. The company offers spreads starting from 0 pips on EUR/USD, which looks competitive. Still, the huge amount of negative feedback and safety worries make Pemaxx a very risky choice for traders who want reliable trading and safe money handling.

Important Notice

This review uses public information, user reviews, regulatory data, and market feedback from many sources as of 2025. Readers should know that Pemaxx works mainly under Mauritius rules, where oversight may be very different from major financial centers like the UK, US, or Australia. The regulatory system in Mauritius is usually seen as less strict than top-tier areas, which may affect trader protections and options when problems happen.

Our review method includes user stories, regulatory checks, platform analysis, and industry comparisons. Since there is conflicting information and serious safety claims about this broker, potential clients should strongly consider doing their own research and looking at other well-known brokers with proven records and strong regulatory oversight.

Rating Framework

Broker Overview

Pemaxx joined the online trading market in 2023. The company set itself up as a Mauritius-based forex and CFD broker that targets regular traders with low entry requirements. It works under the rules of the Mauritius Financial Services Commission, though specific license details are not clear in available papers. Pemaxx's business plan focuses on giving online trading access to many asset types including foreign exchange pairs, commodities, cryptocurrencies, stock indices, and individual stocks.

The broker's marketing focuses on easy access through its $10 minimum deposit rule. This might attract new traders and those with limited money to invest. However, this pemaxx review shows that the low entry cost may hide serious operational problems and safety concerns that have created lots of negative user feedback across many review sites.

Pemaxx uses the well-known MetaTrader 5 trading platform as its main trading tool. The platform offers access to forex pairs, precious metals, energy commodities, popular cryptocurrencies, major stock indices, and selected individual stocks. The broker advertises good spreads starting from 0 pips on major currency pairs like EUR/USD, though full fee structures and trading conditions are not properly explained. Despite these features that seem attractive, ongoing user complaints and safety claims have raised serious questions about the broker's operational honesty and long-term success in the competitive forex market.

Regulatory Jurisdiction: Pemaxx claims regulation under the Mauritius Financial Services Commission (FSC). However, specific license numbers and verification details are not clearly given in available materials, which raises concerns about regulatory transparency.

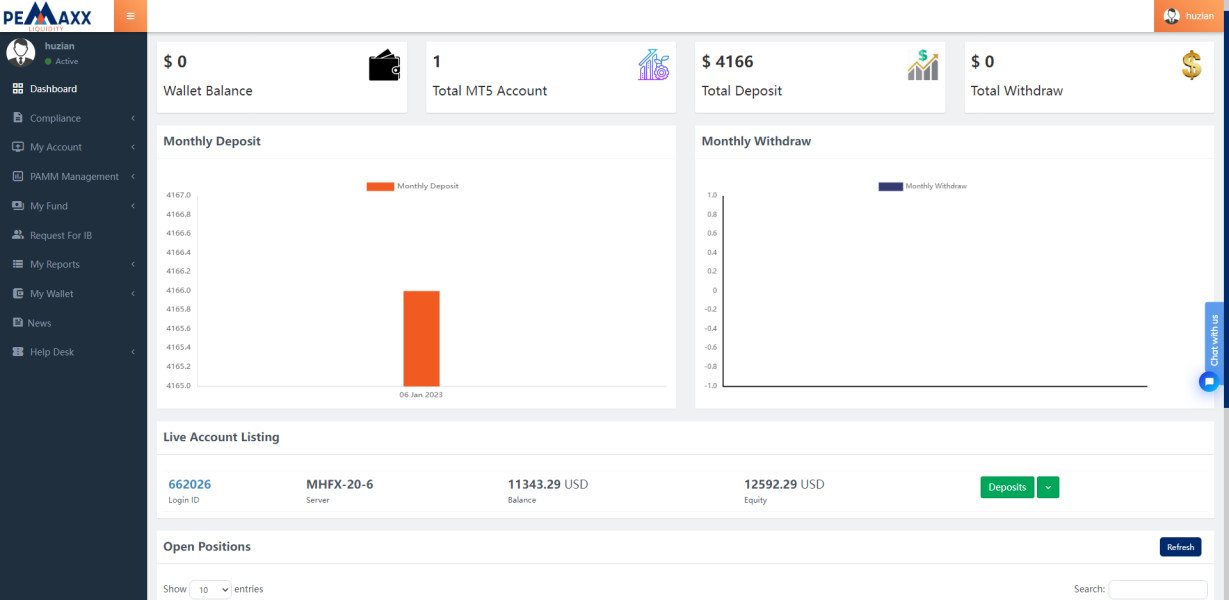

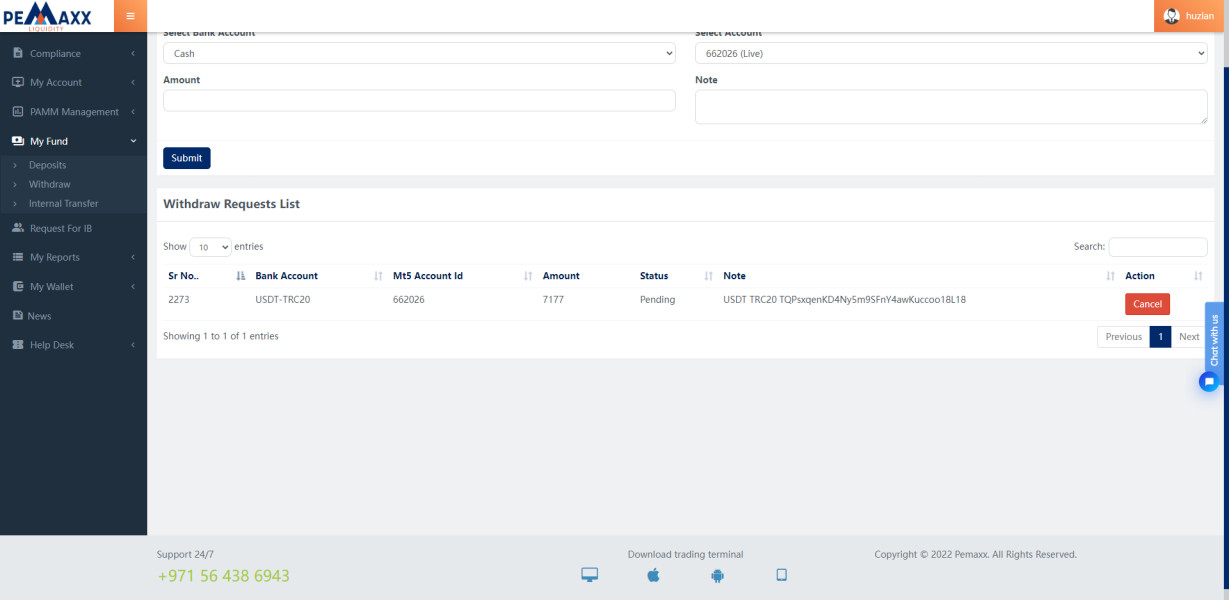

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not mentioned in available sources. This represents a major transparency gap for potential clients who want to understand fund transfer processes.

Minimum Deposit Requirements: The broker offers a very low minimum deposit of $10. This makes it accessible to traders with limited capital, though this low barrier may show targeting of inexperienced traders.

Bonus and Promotional Offers: Available sources do not mention specific bonus programs or promotional activities. This suggests either no such offerings exist or there is a lack of marketing transparency.

Available Trading Assets: Pemaxx provides access to multiple asset classes. These include major and minor forex pairs, precious metals and energy commodities, popular cryptocurrencies, global stock indices, and selected individual equity instruments.

Cost Structure and Fees: The broker advertises spreads starting from 0 pips on EUR/USD. However, full information about commission structures, overnight fees, and other trading costs remains undisclosed in available materials.

Leverage Ratios: Specific leverage information is not mentioned in available sources. This represents another major gap in trading condition transparency that potential clients should find concerning.

Trading Platform Options: Pemaxx offers the MetaTrader 5 platform. This provides standard charting tools, technical indicators, and automated trading capabilities, though additional proprietary tools are not mentioned.

Geographic Restrictions: Available sources do not specify regional restrictions or prohibited areas. However, traders should verify local regulatory compliance before engaging.

Customer Support Languages: Specific information about supported languages for customer service is not provided in available materials. This indicates potential communication limitations for international clients.

This pemaxx review highlights major information gaps that potential traders should address through direct broker contact before making deposit decisions.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

Pemaxx's account structure shows a mixed picture that fails to meet professional trading standards. The broker offers an attractive $10 minimum deposit that makes forex trading seem accessible to beginners and those with limited capital. However, this low barrier entry comes with major transparency issues that should concern potential traders.

Available sources do not provide clear information about different account types, their specific features, or tiered benefits. These details typically help distinguish professional brokers from questionable operators. The account opening process details remain undisclosed, which raises concerns about verification procedures, documentation requirements, and compliance with international anti-money laundering standards.

Professional traders usually need full account information including Islamic account availability, institutional account options, and clear fee structures. None of these are properly addressed in available Pemaxx materials, which creates uncertainty for serious traders. User feedback suggests that despite the low minimum deposit, actual trading conditions may not meet advertised standards, with some users reporting difficulties in account management and unclear terms of service.

The lack of detailed account specifications, combined with poor user satisfaction ratings, shows that while the entry threshold appears attractive, the overall account conditions fail to provide the transparency and reliability that serious traders require. This pemaxx review reveals that the seemingly attractive account conditions mask underlying problems that significantly impact the overall trading experience.

Pemaxx's trading tools and educational resources represent a major weakness in their service offering. The broker provides access to MetaTrader 5, which is an industry-standard platform with basic charting capabilities, technical indicators, and automated trading support. However, the availability of additional proprietary tools, market analysis resources, and educational materials remains unclear or absent from available documentation.

Professional forex brokers usually provide full market research, daily analysis reports, economic calendars, trading signals, and educational webinars. These resources support trader development and decision-making, but available sources suggest that Pemaxx lacks these essential tools. This limits traders to basic platform functionality without the analytical support necessary for informed trading decisions.

User feedback shows dissatisfaction with the overall tool quality and resource availability. This suggests that even the MetaTrader 5 implementation may not meet standard performance expectations, which is concerning for traders who rely on platform stability. The absence of mentioned research tools, educational content, or advanced analytical resources positions Pemaxx significantly behind established brokers who invest in comprehensive trader support systems.

For traders seeking professional-grade tools and educational support, this analysis reveals that Pemaxx falls short of industry standards. The broker offers minimal resources beyond basic platform access, which may not be sufficient for serious trading activities.

Customer Service and Support Analysis (Score: 2/10)

Customer service represents one of Pemaxx's most significant operational failures. User feedback consistently highlights poor support quality and inadequate response times, which are critical issues for any financial service provider. Available sources do not specify customer service channels, availability hours, or supported languages, which indicates a lack of comprehensive support infrastructure that professional traders require.

User reviews across multiple platforms consistently report negative experiences with Pemaxx customer service. These include slow response times, unhelpful representatives, and difficulty resolving account-related issues, all of which can seriously impact trading operations. The absence of clearly defined support channels such as live chat, dedicated phone lines, or comprehensive FAQ sections suggests inadequate investment in customer service infrastructure.

Professional forex brokers typically provide 24/5 multilingual support with multiple contact methods and dedicated account managers for larger accounts. Pemaxx appears to lack these standard features, which creates significant barriers for users who encounter technical issues, account problems, or trading-related questions that require immediate resolution. This is particularly problematic in forex trading, where market conditions can change rapidly and traders need quick support.

The consistently poor user ratings specifically mentioning customer service problems, combined with the lack of transparent support information, indicates that traders should expect minimal assistance when problems arise. This makes this broker unsuitable for those who value reliable customer support and professional service standards.

Trading Experience Analysis (Score: 3/10)

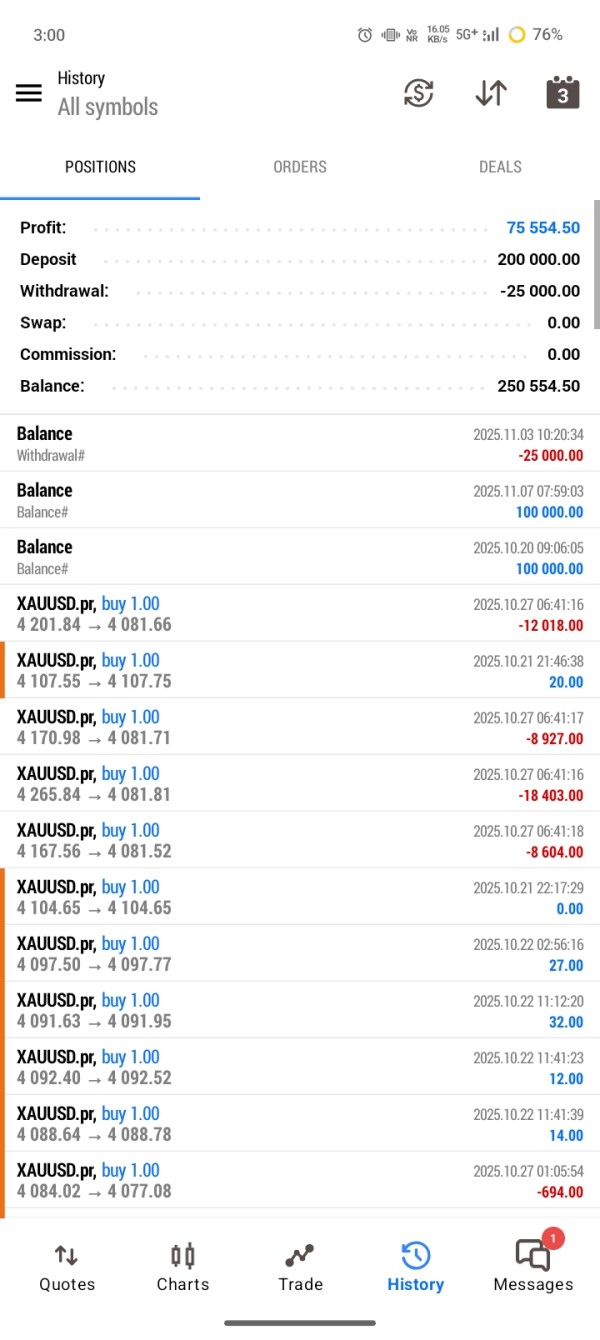

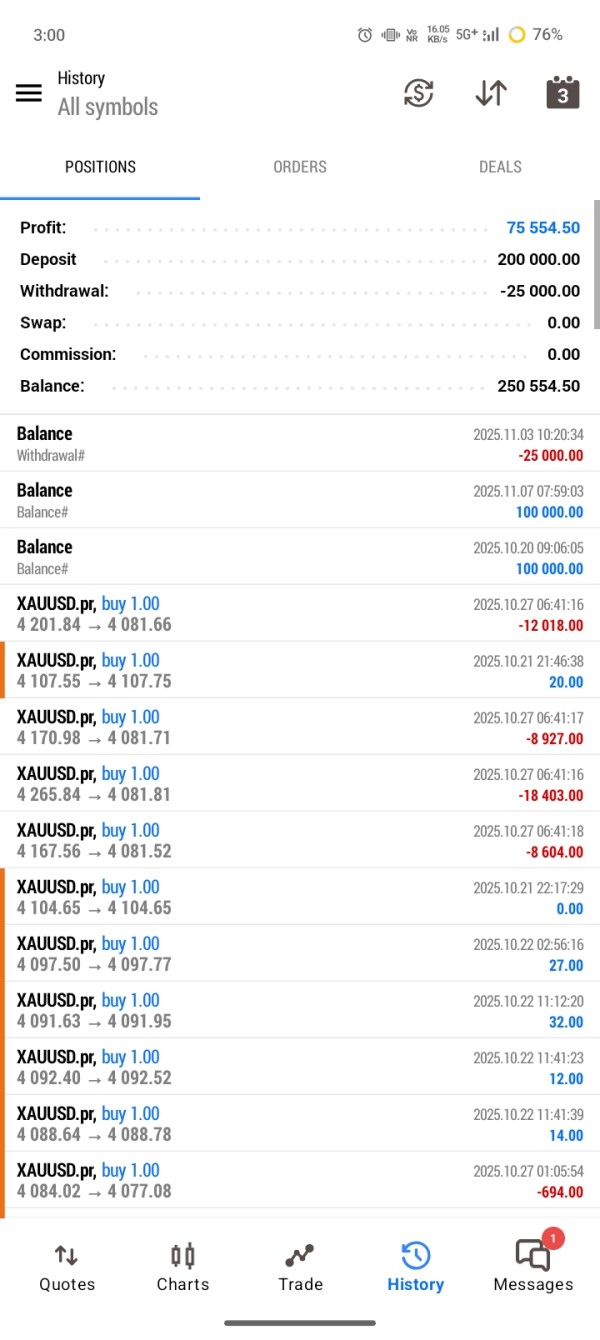

The trading experience with Pemaxx presents serious concerns that go beyond basic platform functionality. The broker offers MetaTrader 5 access and advertises competitive spreads starting from 0 pips on EUR/USD, which sounds attractive on paper. However, user feedback consistently reports problems with platform stability, order execution quality, and overall trading performance that significantly impact the actual trading experience.

Available sources suggest that users have experienced issues with platform reliability. However, specific technical performance data such as execution speeds, slippage rates, or server uptime statistics are not provided, which makes it difficult to assess true platform quality. The lack of transparent performance metrics, combined with negative user feedback, raises questions about the broker's technical infrastructure and commitment to providing professional trading conditions.

Mobile trading experience details are not mentioned in available sources. This is concerning given the importance of mobile access in modern forex trading, where traders need to monitor and manage positions on the go. Professional traders require reliable mobile platforms with full functionality, and the absence of mobile experience information suggests potential limitations in this critical area.

User reports indicate that despite advertised competitive spreads, the actual trading experience includes unexpected costs, execution problems, and platform issues. These problems significantly detract from the theoretical advantages and can impact trading profitability. The overall trading experience appears to fall well below industry standards, making Pemaxx unsuitable for serious traders who require reliable, professional-grade trading conditions.

This pemaxx review emphasizes that trading experience issues represent fundamental operational problems that potential clients should carefully consider.

Trust and Safety Analysis (Score: 1/10)

Trust and safety represent the most critical concerns in this Pemaxx evaluation. Multiple sources raise serious questions about the broker's legitimacy and operational integrity, which are fundamental issues for any financial service provider. While Pemaxx claims regulation under the Mauritius Financial Services Commission, the absence of clearly provided license numbers and verification details creates immediate transparency concerns that professional traders should find unacceptable.

User ratings across multiple review platforms consistently show extremely poor performance. Some sources rate Pemaxx as low as 1 out of 5 stars and include explicit scam allegations, which are serious red flags for any potential investor. These safety concerns are particularly troubling given the broker's recent 2023 establishment and lack of established operational history that would typically build market confidence over time.

The regulatory environment in Mauritius, while legitimate, offers less stringent oversight compared to tier-one financial centers like the UK's FCA or Australia's ASIC. This regulatory difference, combined with unclear licensing details and persistent safety allegations, creates a high-risk environment for trader funds and personal information security. Traders should be especially cautious when dealing with brokers in less regulated jurisdictions.

Fund safety measures, segregation policies, and investor protection schemes are not clearly documented in available materials. This suggests inadequate safeguards for client deposits, which is a major concern for anyone considering investing with this broker. Professional brokers typically provide detailed information about fund protection, insurance coverage, and regulatory compliance, none of which are adequately addressed by Pemaxx.

The combination of scam allegations, poor user ratings, regulatory transparency issues, and inadequate safety documentation makes Pemaxx unsuitable for traders who prioritize fund security and operational legitimacy.

User Experience Analysis (Score: 2/10)

User experience with Pemaxx demonstrates consistently poor performance across multiple evaluation criteria. User satisfaction ratings reach as low as 1 out of 5 stars on various review platforms, which indicates fundamental problems with the broker's service delivery. This extremely low satisfaction level shows issues with platform performance and overall client relationship management that extend beyond minor operational problems.

Interface design and platform usability information are not detailed in available sources. However, user feedback suggests that even basic functionality may not meet modern trading platform standards, which can frustrate traders and impact their ability to execute trades effectively. The registration and verification process details remain undisclosed, potentially indicating either overly complicated procedures or inadequate documentation that creates user frustration during account setup.

Fund operation experiences represent a particular area of user dissatisfaction. Reports suggest difficulties in deposit and withdrawal processes that are fundamental to broker operations and can significantly impact trader confidence. Professional traders require seamless, transparent fund management with clear processing times and minimal restrictions, areas where Pemaxx appears to fail consistently.

Common user complaints focus on safety concerns, poor customer service, platform reliability issues, and general dissatisfaction with the overall service quality. The pattern of negative feedback suggests systemic operational problems rather than isolated incidents, which indicates that user experience issues are likely to persist for new clients. This creates an environment where traders may face ongoing frustration and potential financial risks.

User demographics appear to include primarily novice traders attracted by the low minimum deposit. However, even this target market reports significant dissatisfaction, which suggests that the broker fails to meet even basic expectations. The consistently poor user experience ratings make Pemaxx unsuitable for traders seeking reliable, professional service quality regardless of their experience level.

Conclusion

This comprehensive pemaxx review reveals significant concerns that make the broker unsuitable for most traders. This is particularly true for those prioritizing safety, reliability, and professional service standards, which should be basic requirements for any financial service provider. While Pemaxx offers an attractive $10 minimum deposit and claims competitive spreads, these apparent advantages are overshadowed by serious safety allegations, extremely poor user ratings, and fundamental transparency issues that create unacceptable risks for trader funds and personal information.

The broker's 2023 establishment, unclear regulatory documentation, and persistent scam allegations combine to create a high-risk environment. This contradicts basic principles of safe forex trading and puts potential investors at significant risk. User satisfaction ratings consistently reaching 1 out of 5 stars across multiple platforms indicate systemic operational problems that extend beyond minor service issues to fundamental business practice concerns.

Traders seeking reliable forex brokers should prioritize established operators with clear regulatory oversight, transparent fee structures, comprehensive customer support, and positive user track records. Pemaxx fails to meet these basic requirements, making it unsuitable for both novice traders seeking safe learning environments and experienced traders requiring professional trading conditions. The significant safety concerns and poor user experiences documented in this analysis strongly suggest that potential clients should consider well-established alternatives with proven operational integrity and regulatory compliance.