PEMAXX GLOBAL foreign exchange brokers specializing in providing foreign exchange trading services, the company's official website https://crm.pemaxx.com/register, about the company's legal and temporary regulatory information, the company's address 20 Edith Cavell Street, Level 6 Ken Lee Building, Port Louis 11302,Mauritius.

PEMAXX GLOBAL Forex Broker

Basic Information

Mauritius

MauritiusCompany profile

Pros

Cons

Pemaxx Forex Broker - Complete Information Guide

1. Broker Overview

Pemaxx, officially known as Pemaxx Liquidity Limited, was established between 2 to 5 years ago. The company is headquartered at 20 Edith Cavell Street, Level 6, Ken Lee Building, Port Louis 11302, Mauritius, with an additional office located in Dubai. This broker operates as a private entity, offering a range of financial services primarily targeting retail clients in the forex market.

The company has positioned itself as an online trading platform providing access to various financial markets, including forex, futures, stocks, indices, cryptocurrencies, and commodities. Despite its claims, the broker has faced scrutiny regarding its legitimacy and operational practices. The development of the company has been marked by its establishment in an offshore jurisdiction, which raises questions about regulatory compliance and investor protection.

Pemaxx operates under a retail forex license issued in Mauritius, but the specifics of its operational history remain vague. The company claims to provide a full MetaTrader 5 license, indicating its intention to cater to a diverse trading clientele. However, its lack of transparency regarding its operational milestones and regulatory standing has led to concerns among potential investors.

2. Regulatory and Compliance Information

Pemaxx claims to be regulated by the Financial Services Commission (FSC) of Mauritius, with a license number purportedly listed as C24209694. However, investigations reveal that this license does not appear in the official register of the FSC, leading to significant doubts about the broker's regulatory status.

The regulatory environment in Mauritius is known to be lenient, with brokers only required to maintain a minimum capital of €25,000 to €250,000 depending on the license type. In comparison, stricter jurisdictions such as the European Union require a minimum capital of €730,000. This discrepancy suggests that while Pemaxx may hold a license, it does not offer the same level of investor protection as brokers regulated in more stringent environments.

Customer funds are not segregated, and there is no participation in an investor compensation scheme, which further amplifies the risk for clients. Furthermore, Pemaxx's compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations has not been adequately documented, raising concerns about the broker's commitment to safeguarding client interests.

3. Trading Products and Services

Pemaxx offers a diverse range of trading instruments, including over 40 currency pairs for forex trading, covering major, minor, and exotic pairs. The broker also provides access to Contracts for Difference (CFDs) across various categories:

- Indices: Trade on baskets of top shares.

- Commodities: Including metals like gold and silver, as well as energy products like crude oil.

- Stocks: Access to over 65 shares from prominent markets including the UK, US, and Europe, featuring well-known companies like Amazon and Facebook.

- Cryptocurrencies: Trading options for popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

The frequency of product updates and the addition of new trading instruments is not specified, which may limit traders looking for a dynamic trading environment. Pemaxx primarily focuses on retail trading services, while institutional client services and white-label solutions are not clearly outlined in their offerings.

4. Trading Platform and Technology

Pemaxx promotes the MetaTrader 5 (MT5) platform as its primary trading software, which is widely regarded as a leading platform in the trading industry. However, there is no clear information regarding the availability of the platform for download or registration, indicating potential operational issues.

The broker does not provide details about a proprietary trading platform, nor does it mention the existence of a web-based trading platform. There is also no mention of mobile applications for iOS or Android, which are essential for traders seeking flexibility in their trading activities.

Pemaxx's execution model is not explicitly stated, leaving uncertainty about whether they operate on an ECN, STP, or Market Making basis. The server location is reportedly in the United Kingdom, but technical infrastructure specifics are not provided, which could impact the trading experience.

The broker does not clarify if they support API access for automated trading, which is a common feature among reputable brokers. This lack of information may deter algorithmic traders looking for robust trading solutions.

5. Account Types and Trading Conditions

Pemaxx offers several account types, including Standard, Diamond, and Platinum accounts. However, the specific conditions for each account type, such as minimum deposit requirements, spreads, and commissions, are not clearly outlined.

- Standard Account: Minimum deposit and spreads are not disclosed.

- Diamond Account: Similar lack of transparency regarding conditions.

- Platinum Account: Claims to offer the best trading conditions but lacks detailed information.

The leverage offered by Pemaxx is up to 1:500, which is significantly higher than the limits set by many regulatory authorities, such as 1:30 in Europe. This high leverage can amplify both potential profits and losses, posing substantial risks, especially for inexperienced traders.

The minimum trading lot size is 0.01, allowing for micro-trading, while overnight fees or swap rates are not disclosed, leaving traders uncertain about potential costs associated with holding positions overnight.

6. Funds Management

Pemaxx claims to support various deposit methods, including bank transfers, credit cards, and electronic wallets such as Neteller, Skrill, and Perfect Money. However, the minimum deposit requirements for different account types are not specified, which could lead to confusion for potential clients.

The processing time for deposits is not clearly defined, and there are no fees mentioned for deposits. However, the withdrawal methods and any associated limitations are also not detailed, raising concerns about the transparency of their financial operations.

Withdrawal processing times and fee structures remain undisclosed, which is a significant red flag for potential investors. This lack of clarity can lead to complications when clients attempt to access their funds, especially if they encounter issues with their accounts.

7. Customer Support and Educational Resources

Pemaxx offers multiple customer support channels, including telephone, email, and possibly live chat, although the effectiveness of these channels remains unverified. The support team can be reached at +971 56 438 6943 or via email at support@pemaxx.com.

The service hours and time zone coverage are not specified, which could affect clients in different regions. There is no indication of multilingual support, which can be a limitation for non-English speaking clients.

Educational resources such as webinars, tutorials, or eBooks are not mentioned, which may hinder the development of novice traders who rely on structured learning. Additionally, market analysis services, including daily updates or research reports, are not provided, limiting the support available for informed trading decisions.

8. Regional Coverage and Restrictions

Pemaxx appears to primarily serve clients from Mauritius and Dubai, but the specific regions where they accept clients are not clearly defined. The broker's operational status in various jurisdictions remains ambiguous, especially given its unregulated status.

The broker does not explicitly state the countries or regions from which they do not accept clients, which could lead to potential legal issues for traders in restricted areas. Furthermore, there are no special restrictions mentioned that could impact trading activities based on geographical location.

In conclusion, potential investors should approach Pemaxx with caution, considering the numerous red flags associated with its operational practices, regulatory compliance, and overall transparency. The lack of clear information and the unregulated nature of the broker pose significant risks for traders looking to engage with this platform. It is crucial for investors to conduct thorough research and consider alternative, well-regulated brokers for their trading needs.

PEMAXX GLOBAL Similar Brokers

Latest Reviews

yogi6234

United Arab Emirates

MT5-1063989. Arohi a sales agent gave a $50 account to trade and said you can withdraw the profits if you acheive trading 10 statndard lots. As per the requirement lots have been completed and equity is now at $1800. Now there are giving false statements and not giving withdrawals. Also they have disabled the access so unable to login as well. When asked they all are talking in rude language. Scammers

Exposure

2025-03-15

liao7038

Hong Kong

Some time ago, I opened an account transaction on Pemaxx and made a profit of 7,000 US dollars. However, I applied for a withdrawal after making a profit, but the account was not credited in 5 days. Moreover, the account was deleted after logging in to the trading software. Isn’t this a trick of the fraud platform? Run away with $10,000? I want to expose this bad platform, expose their person in charge, and let investors open their eyes and see this platform clearly

Exposure

2023-01-18

Mangesh Chavan

India

Great Broker and best service

Positive

2025-11-12

Vinayak6131

India

I am working with Pemaxx from last 5 years. It has the best support team. Withdrawal and deposit are very smooth.

Positive

2025-01-30

Kiran Patil

India

I am Investor in Pemaxx , I have deposited 2000$ and made 7000$+ . Best Forex Broker ,Deposits and withdrawals are easy and fast. And it has a great support team!

Positive

2024-12-03

PEMAXX GLOBAL

News

Exposure Pemaxx Review: Fund Scams & No Withdrawals, Say Traders

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

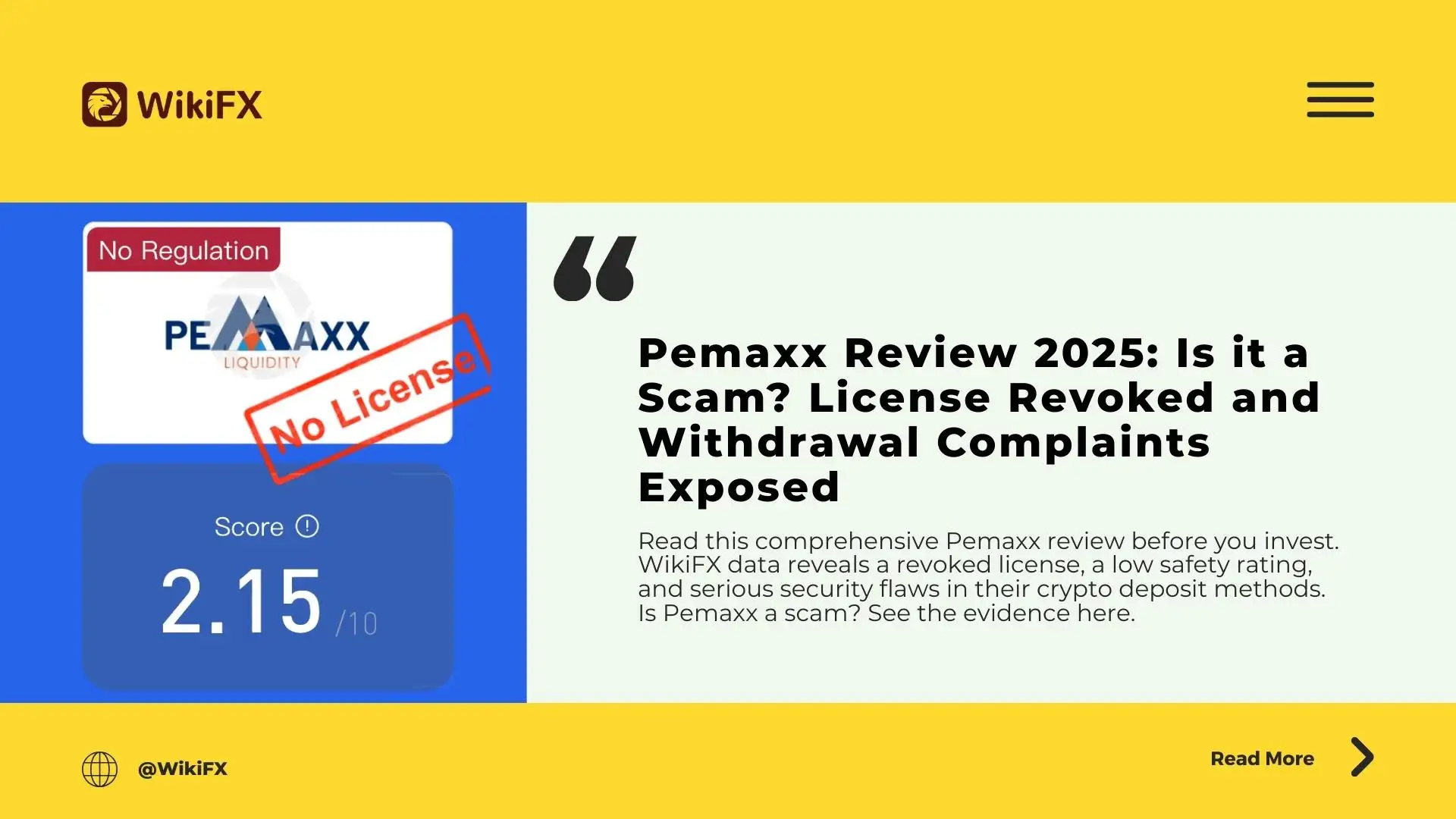

Exposure Pemaxx Review 2025: Is it a Scam? License Revoked and Withdrawal Complaints Exposed

Read this comprehensive Pemaxx review before you invest. WikiFX data reveals a revoked license, a low safety rating, and serious security flaws in their crypto deposit methods. Is Pemaxx a scam? See the evidence here.

News WikiFX Broker Assessment Series| Pemaxx: Legit or Scam?

Registered in the United Kingdom, Pemaxx presents itself as an online trading platform providing a large financial market including Forex, Futures, Stocks, Indices, Crypto, and Commodities, with the leverage up to 1:500.

FX2820909357

United Arab Emirates

Someone is playing with my account when I make profits

Exposure

2025-03-24