Is CapPlace safe?

Pros

Cons

Is CapPlace A Scam?

Introduction

CapPlace is a relatively new player in the forex market, positioning itself as a comprehensive trading platform that offers access to a variety of financial instruments, including forex, commodities, cryptocurrencies, and indices. Given the rapid expansion of the online trading landscape, it is crucial for traders to carefully evaluate the trustworthiness of brokers like CapPlace. The integrity of a trading platform can significantly impact a trader's financial success and security. This article aims to provide an objective analysis of CapPlace, examining its regulatory status, company background, trading conditions, customer experience, and overall safety. The evaluation is based on an extensive review of online sources, user feedback, and regulatory information.

Regulation and Legitimacy

Regulation is a critical aspect when assessing the credibility of a trading broker. A regulated broker is held to certain standards that ensure the protection of clients funds and offer recourse in case of disputes. CapPlace is regulated by the Mwali International Services Authority (MISA), which oversees its operations in the Comoros. However, it is essential to note that MISA is considered a lower-tier regulator compared to more established bodies like the FCA in the UK or ASIC in Australia.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| MISA | T2023294 | Comoros | Verified |

While CapPlace claims to adhere to high standards of operational integrity, the lack of oversight from a top-tier regulatory body raises concerns about the level of investor protection it can provide. Traders should be cautious, as brokers regulated in offshore jurisdictions may not offer the same level of safety as those under stricter regulations. Historical compliance issues or regulatory sanctions could further indicate potential risks associated with trading on this platform.

Company Background Investigation

CapPlace is operated by Robertson Finance Inc., a company registered in the Comoros. However, detailed information about the company's history and ownership structure is limited. The absence of transparency raises questions about the management teams qualifications and experience. A thorough background check on the management team is vital, as their expertise directly influences the broker's operations and client service.

The lack of public information regarding the company's leadership and its operational history suggests a potential red flag. Transparency in company operations and management is fundamental for building trust with clients. Without clear details on the company's financial stability and governance, potential traders may find it challenging to assess the broker's reliability.

Trading Conditions Analysis

CapPlace offers a variety of trading conditions, including multiple account types with varying features. The broker's fee structure is an essential consideration for traders, as it can significantly impact profitability. CapPlace charges a minimum deposit of $250 to open an account, which is relatively high compared to some competitors.

| Fee Type | CapPlace | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 0.2-0.5 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | Yes | Yes |

While CapPlace advertises competitive spreads starting at 0.1 pips, traders should be aware of the potential for higher spreads on less liquid instruments. Additionally, concerns have been raised about unclear fees associated with deposits and withdrawals, which could impact overall trading costs. Transparency in cost structures is crucial for traders to make informed decisions, and any hidden fees can lead to dissatisfaction and mistrust.

Customer Funds Safety

The safety of client funds is paramount in the trading industry. CapPlace has implemented several security measures, including the use of encryption technologies and secure payment methods. However, the broker's policies regarding fund segregation and investor protection are not explicitly detailed.

Traders should inquire whether client funds are held in segregated accounts, which would provide an additional layer of security in the event of the broker's insolvency. Additionally, the absence of negative balance protection could expose traders to significant risks during volatile market conditions. Historical instances of fund security issues or disputes can further inform potential users about the broker's reliability.

Customer Experience and Complaints

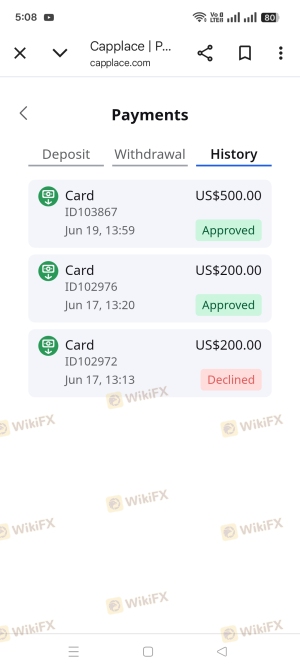

User feedback is a valuable source of information when evaluating a broker. CapPlace has received mixed reviews from clients, with some praising its user-friendly platform and diverse asset offerings. However, common complaints include withdrawal delays, high fees, and inadequate customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Inconsistent |

| Poor Customer Support | Medium | Slow Response |

| High Fees | Medium | Limited Clarity |

Several users have reported difficulties in accessing their funds, with some experiencing prolonged delays in withdrawals. Additionally, the quality of customer support has been criticized, with clients noting slow response times and unhelpful interactions. Such patterns of complaints can signal underlying issues with the broker's operations and should be carefully considered by potential traders.

Platform and Trade Execution

The performance and reliability of the trading platform are critical for successful trading. CapPlace offers a web-based platform and a mobile app designed to facilitate trading across various devices. While the interface is generally praised for its user-friendliness, there are concerns regarding the execution quality, including potential slippage and order rejections.

Traders should be aware of any signs of platform manipulation, which can undermine the integrity of the trading experience. A reliable platform should provide consistent execution and minimal slippage, particularly during volatile market conditions.

Risk Assessment

Engaging with CapPlace involves various risks that traders should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight from top-tier regulators. |

| Withdrawal Risk | High | Reports of delays and difficulties accessing funds. |

| Transparency Risk | Medium | Limited information about company operations and fees. |

| Execution Risk | Medium | Potential for slippage and order rejections. |

To mitigate these risks, traders are advised to conduct thorough research, start with a demo account if available, and maintain a disciplined trading strategy.

Conclusion and Recommendations

In conclusion, while CapPlace offers a range of trading instruments and an intuitive platform, several red flags warrant caution. The broker's regulatory status, lack of transparency, and mixed customer feedback raise concerns about its reliability.

For traders seeking a trustworthy broker, it may be prudent to consider alternatives with stronger regulatory oversight and proven track records. Brokers such as eToro and IG, known for their robust regulatory frameworks and positive user experiences, could be viable options for those prioritizing safety and transparency in their trading activities. Always conduct thorough due diligence before committing funds to any trading platform.

Is CapPlace a scam, or is it legit?

The latest exposure and evaluation content of CapPlace brokers.

CapPlace Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CapPlace latest industry rating score is 1.30, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.30 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.