Is OTOIA safe?

Business

License

Is Otoia A Scam?

Introduction

Otoia is a relatively new entrant in the forex trading market, positioning itself as a platform for retail traders seeking to engage in currency trading. In an industry where trust and reliability are paramount, it is crucial for traders to carefully evaluate the legitimacy of their chosen brokers. Fraudulent activities and scams are prevalent in the forex market, making it essential for traders to conduct thorough due diligence before investing their hard-earned money. This article will analyze Otoia's credibility by examining its regulatory status, company background, trading conditions, customer experience, and risk factors. The investigation is based on a review of multiple sources, including user testimonials, regulatory databases, and expert analyses.

Regulatory Status and Legitimacy

The regulatory environment is a critical factor in assessing the safety and reliability of any forex broker. Regulation ensures that brokers adhere to specific standards designed to protect investors. Unfortunately, Otoia appears to operate without any significant regulatory oversight. According to findings from various sources, Otoia lacks a valid license and has received numerous complaints related to withdrawal issues and customer service.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of a regulatory license raises significant red flags about Otoia's operations. Brokers regulated by reputable authorities are typically required to maintain a certain level of capital, segregate client funds, and provide transparent reporting. Otoia's lack of regulation suggests that it may not adhere to these essential practices, putting investors at risk. Furthermore, reports indicate that Otoia's website has been inaccessible since December 1, raising concerns about its operational status.

Company Background Investigation

Otoias company history is relatively obscure, with limited information available about its founding, ownership structure, or management team. Such opacity can be concerning for potential investors, as it often indicates a lack of accountability. A transparent company would typically provide detailed information about its founders and key personnel, including their experience and qualifications in the financial sector.

The absence of this information may suggest that Otoia is not committed to fostering trust and transparency with its clients. In an industry where credibility is crucial, this lack of disclosure can be a significant drawback. Additionally, without a well-defined corporate structure or a history of compliance, it is challenging to assess the company's commitment to ethical practices and customer service.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is vital. Otoia has been reported to have a complex and potentially exploitative fee structure. Traders have raised concerns about hidden fees, particularly relating to withdrawals, which have been described as difficult or impossible to execute. This lack of clarity around costs can be a significant deterrent for traders looking for a reliable platform.

| Fee Type | Otoia | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | High | Moderate |

| Commission Model | Opaque | Transparent |

| Overnight Interest Range | Unclear | Clear |

The high spreads and unclear commission structure suggest that Otoia may not be competitive compared to other regulated brokers. Furthermore, the lack of clear information regarding overnight interest rates raises additional concerns about transparency. Traders should be wary of brokers that do not provide straightforward information about their fee structures, as this can often lead to unexpected costs and diminished returns.

Customer Fund Safety

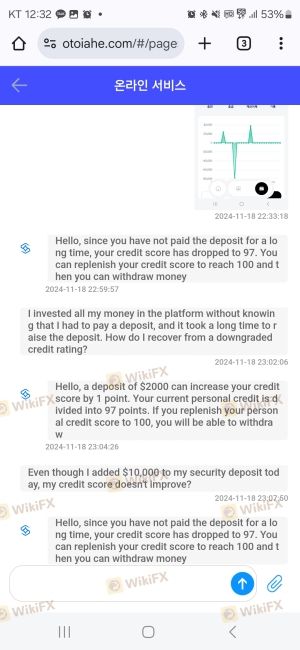

The safety of customer funds is a paramount concern for any trader. Otoia has been criticized for its lack of adequate safety measures. Reports suggest that customer funds may not be segregated, which is a standard practice among regulated brokers to protect client assets.

Furthermore, Otoia has not been reported to offer negative balance protection, which can leave traders vulnerable in volatile market conditions. The absence of investor protection mechanisms and the reported inability to withdraw funds raise significant concerns about the safety of funds held with Otoia.

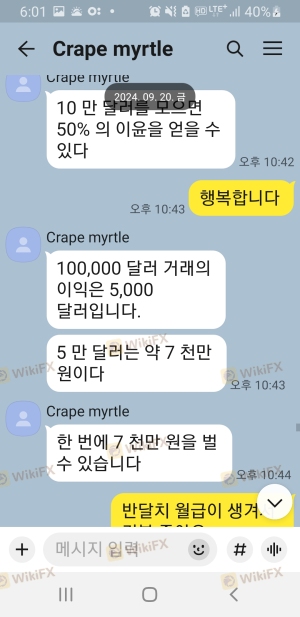

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Many users have reported negative experiences with Otoia, particularly concerning withdrawal issues and customer service responsiveness. The following table summarizes common complaint types associated with Otoia:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Transparency Concerns | High | Poor |

Numerous testimonials indicate that traders have faced significant challenges when attempting to withdraw their funds. Complaints often highlight a lack of communication from Otoia's support team and vague explanations regarding withdrawal policies. This pattern of complaints is alarming and suggests that Otoia may not prioritize customer satisfaction or transparency.

Platform and Trade Execution

The trading platform's performance is another critical factor for traders. Otoia's platform has received mixed reviews, with some users reporting issues related to stability and execution quality. Delays in order execution and instances of slippage have been noted, which can negatively impact trading outcomes.

Additionally, there are concerns about the potential for platform manipulation, as some users have reported discrepancies between market prices and execution prices. These issues can undermine trader confidence and raise questions about the overall integrity of the trading environment.

Risk Assessment

Using Otoia as a trading platform carries several risks. Below is a summary of key risk areas associated with trading through Otoia:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises significant concerns. |

| Fund Safety Risk | High | Lack of segregation and negative balance protection. |

| Customer Service Risk | Medium | Poor response to complaints and withdrawal issues. |

To mitigate these risks, traders should consider opening accounts with regulated brokers that provide clear information about their operations, fees, and customer protections. It is advisable to conduct thorough research and consider starting with a demo account to assess the platform's reliability before committing significant funds.

Conclusion and Recommendations

In conclusion, Otoia exhibits several concerning characteristics that suggest it may not be a safe or reliable trading platform. The lack of regulatory oversight, opaque fee structures, and numerous customer complaints raise significant red flags. Traders should exercise caution and consider alternative options that offer greater transparency and security.

For those seeking trustworthy forex brokers, consider alternatives such as OANDA or FXTM, which are well-regulated and have established reputations in the industry. These brokers provide transparent trading conditions and prioritize customer safety, making them more suitable choices for traders looking to navigate the forex market confidently.

Ultimately, the question of "Is Otoia safe?" leans heavily toward negative, and potential investors are advised to proceed with caution or seek more reputable alternatives.

Is OTOIA a scam, or is it legit?

The latest exposure and evaluation content of OTOIA brokers.

OTOIA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OTOIA latest industry rating score is 1.28, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.28 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.