OTOIA 2025 Review: Everything You Need to Know

Executive Summary

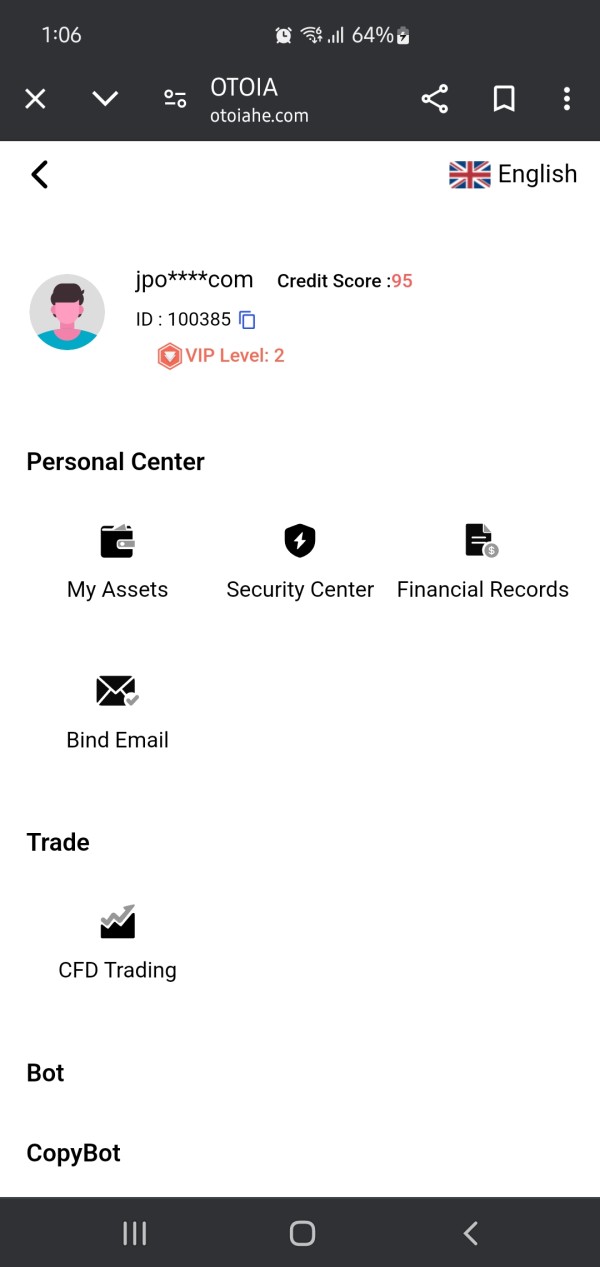

This comprehensive otoia review examines a relatively new player in the forex brokerage landscape. OTOIA has generated considerable discussion regarding its legitimacy and credibility among traders and industry experts. OTOIA was established in May 2017 and is headquartered in Maryland, United States. The company positions itself as a forex broker serving both novice traders looking to enter the foreign exchange market and experienced traders seeking new trading opportunities.

However, our analysis reveals significant concerns about the broker's regulatory status and overall transparency. According to WikiFX and other industry monitoring platforms, OTOIA's legitimacy remains questionable. Limited verifiable information exists about its regulatory compliance and operational framework, which raises red flags for potential clients. The broker's relatively short operational history, combined with a lack of clear regulatory oversight, raises important questions for potential clients.

Despite marketing itself to a broad range of traders, the available evidence suggests concerning gaps in transparency. OTOIA may not meet the standard regulatory requirements expected of legitimate forex brokers, according to multiple industry sources. This otoia review aims to provide traders with essential information to make informed decisions. Traders need to determine whether this broker aligns with their trading needs and risk tolerance before committing funds.

Important Notice

This review is based on publicly available information and user feedback collected from various forex industry monitoring platforms. The sources include WikiFX and WikiBit, which are well-known broker evaluation services. Due to the limited regulatory information available about OTOIA, potential compliance risks may vary significantly across different jurisdictions. Traders should be particularly cautious when considering brokers that lack clear regulatory oversight from established financial authorities.

The evaluation methodology employed in this analysis relies on publicly accessible data, user testimonials, and industry reports. No direct testing or on-site investigation was conducted by our review team. Given the concerns raised about OTOIA's legitimacy by multiple industry sources, prospective clients are strongly advised to conduct additional due diligence. Traders should verify all information independently before engaging with this broker or depositing any funds.

Rating Framework

*Note: Due to limited verifiable information about OTOIA's services and operations, comprehensive scoring cannot be provided at this time.

Broker Overview

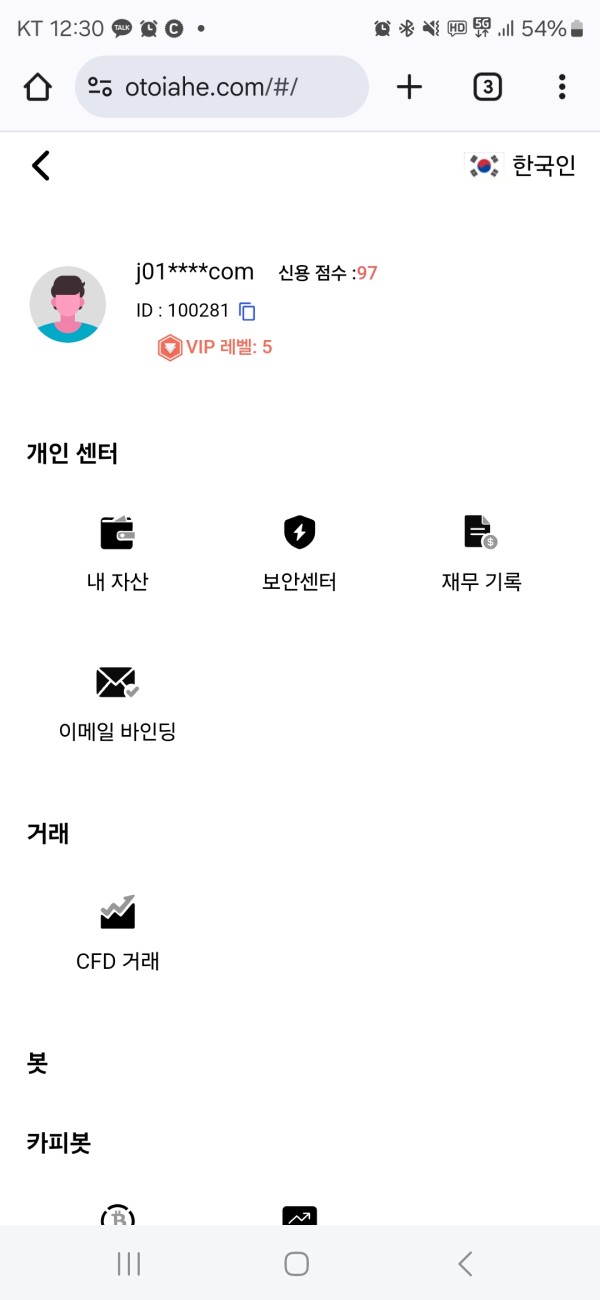

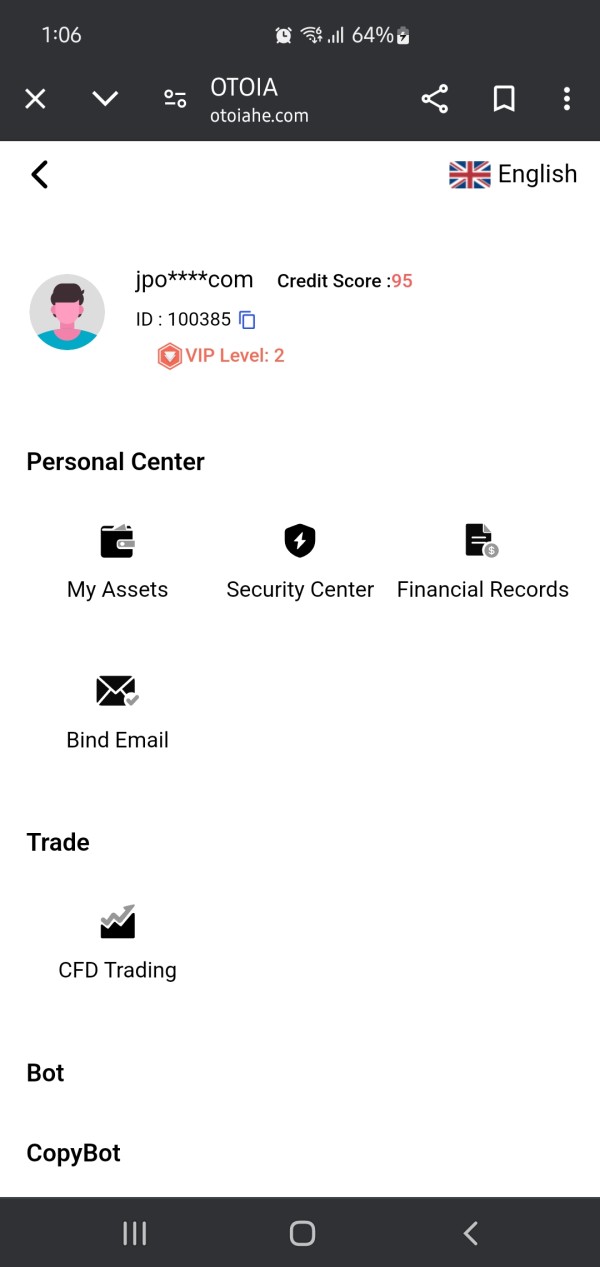

OTOIA entered the forex brokerage market in May 2017. The company established its operations from Maryland, United States, according to available company information. According to available company information, the broker aims to provide forex trading services to a diverse clientele ranging from beginners to experienced traders. However, the company's background information remains notably sparse, with limited details available about its founding team, corporate structure, or business development history.

The broker presents itself as offering access to foreign exchange markets. Specific details about its business model, operational framework, and service delivery mechanisms are not clearly documented in available public materials. This lack of transparency has contributed to ongoing discussions within the forex community about the broker's legitimacy and operational capacity. Many traders and industry experts have raised questions about the company's ability to provide reliable services.

Industry monitoring platforms, including WikiFX, have raised questions about OTOIA's regulatory compliance and overall credibility. The specific trading platform types, asset coverage, and regulatory oversight that typically characterize established forex brokers remain unclear in OTOIA's case. This otoia review emphasizes the importance of this information gap. Regulatory compliance and platform reliability are fundamental considerations for forex traders when selecting a broker.

Regulatory Oversight: The source materials do not provide specific information about OTOIA's regulatory status or compliance with financial authorities. This represents a significant concern for potential clients seeking regulated trading environments that offer legal protections.

Deposit and Withdrawal Methods: Specific information about payment processing, supported currencies, and transaction methods is not detailed in the available source materials. This makes it difficult to assess the broker's financial infrastructure and reliability for handling client funds.

Minimum Deposit Requirements: The source materials do not specify minimum account funding requirements. This is typically fundamental information provided by legitimate forex brokers to help traders understand entry barriers.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not mentioned in the available information. This suggests either limited marketing activities or lack of such programs entirely.

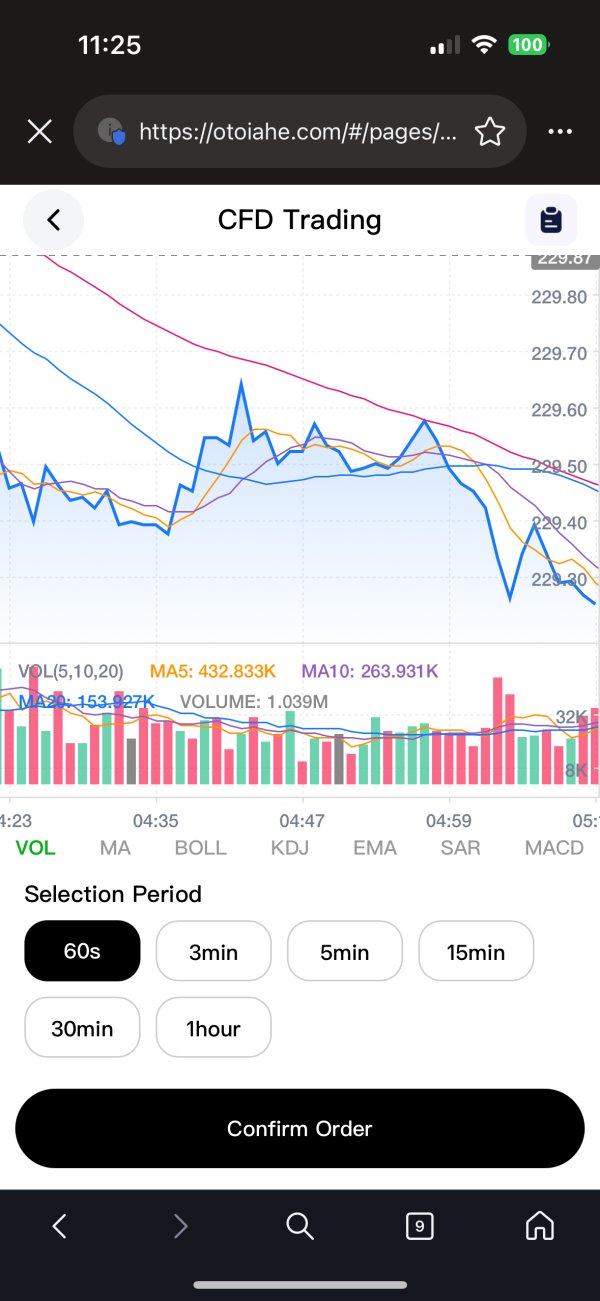

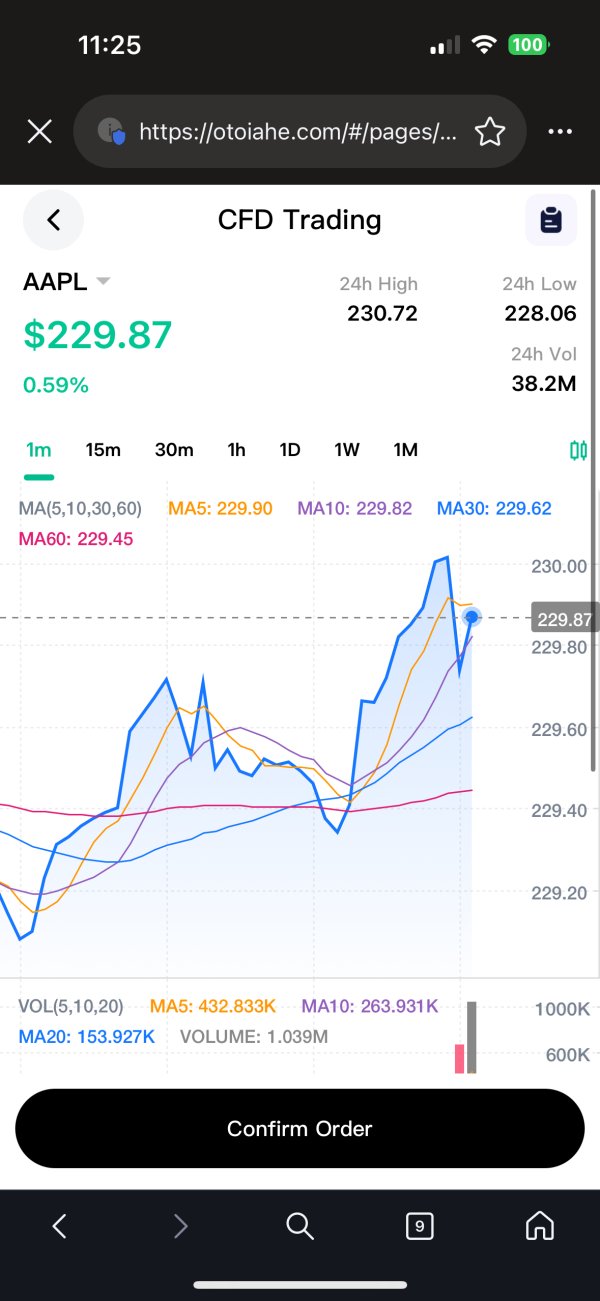

Trading Assets: The range of currency pairs, commodities, indices, or other financial instruments available for trading through OTOIA is not specified. This information gap makes it impossible to assess whether the broker offers sufficient trading opportunities.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other trading costs remains unspecified in available documentation. Traders cannot evaluate the competitiveness of OTOIA's pricing without this essential information.

Leverage Options: The source materials do not provide information about maximum leverage ratios or margin requirements offered by the broker. This limits traders' ability to assess risk management options and trading flexibility.

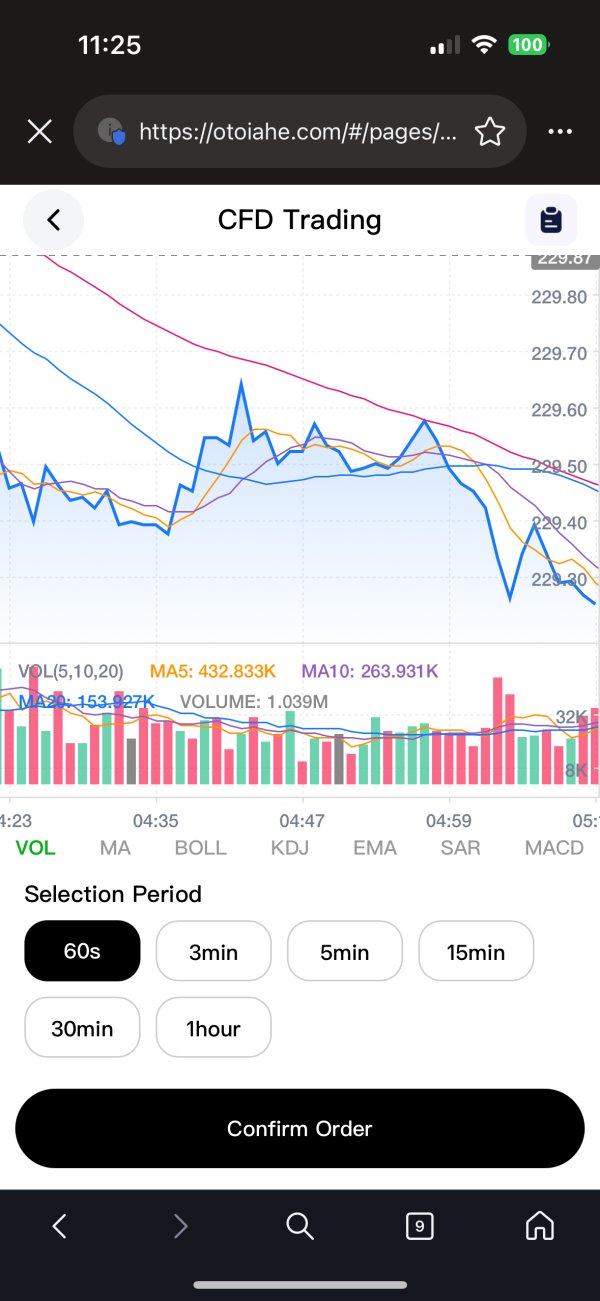

Platform Selection: Specific trading platforms, whether proprietary or third-party solutions like MetaTrader, are not identified in the available information. Platform quality directly impacts trading success and user experience.

Geographic Restrictions: Information about restricted countries or regional limitations is not available in the source materials. This creates uncertainty for international traders about service availability.

Customer Support Languages: The languages supported by customer service teams are not specified in available documentation. This otoia review highlights these information gaps as significant concerns for potential clients seeking comprehensive broker evaluation.

Account Conditions Analysis

The evaluation of OTOIA's account conditions faces substantial limitations due to the lack of detailed information in available source materials. Typically, forex brokers provide comprehensive details about their account types. These details range from basic retail accounts to professional and institutional offerings with varying features and benefits. However, OTOIA's account structure, minimum deposit requirements, and account-specific features remain unspecified in all available documentation.

Industry standards suggest that legitimate forex brokers typically offer multiple account tiers with varying benefits. These benefits include reduced spreads, enhanced leverage, or premium support services that cater to different trader needs. The absence of clear account condition information makes it impossible to assess how OTOIA's offerings compare to industry benchmarks. Traders cannot determine whether the broker provides competitive advantages to different trader segments.

Furthermore, essential account features such as Islamic account availability, demo account access, or account verification procedures are not documented. These features are standard offerings among reputable brokers and are crucial for many traders. This lack of transparency regarding fundamental account conditions represents a significant concern for potential clients. Traders require specific account features to align with their trading strategies or religious requirements.

The absence of detailed account condition information in this otoia review reflects broader transparency concerns about the broker's operational framework. It also raises questions about the broker's commitment to providing comprehensive service information to potential clients.

Assessment of OTOIA's trading tools and educational resources cannot be completed based on available source materials. Established forex brokers typically provide comprehensive suites of analytical tools. These tools include technical indicators, charting packages, economic calendars, and market analysis resources that help traders make informed decisions. However, specific information about OTOIA's tool offerings remains unavailable in all documentation reviewed.

Educational resources represent another critical component of broker evaluation, particularly for novice traders seeking to develop their skills. Industry-leading brokers commonly offer webinars, trading guides, video tutorials, and market commentary to support client development. The absence of information about OTOIA's educational initiatives makes it impossible to assess their commitment to trader education. This gap is particularly concerning for beginners who rely on broker-provided educational content.

Automated trading support, including expert advisor compatibility and algorithmic trading infrastructure, is increasingly important for modern forex traders. Many successful traders rely on automated systems to execute their strategies efficiently and consistently. However, details about OTOIA's automation capabilities and third-party integration options are not specified in available documentation. This limits assessment of the broker's suitability for traders who use automated trading systems.

Research and analysis resources, such as daily market reports, fundamental analysis, and economic research, are standard offerings among reputable brokers. These resources help traders stay informed about market developments and make better trading decisions. The lack of information about OTOIA's research capabilities raises questions about their ability to provide comprehensive trading support. Clients seeking informed market insights may find this broker inadequate for their needs.

Customer Service and Support Analysis

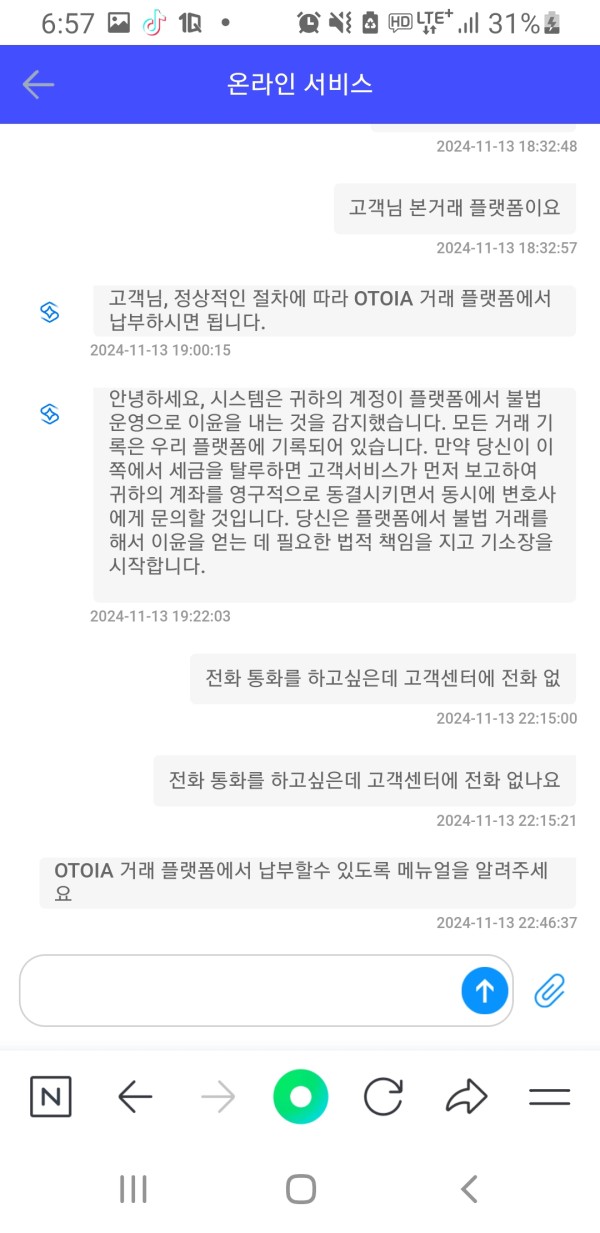

Evaluation of OTOIA's customer service framework cannot be comprehensively assessed due to limited information in available source materials. Professional forex brokers typically maintain multiple communication channels to serve their clients effectively. These channels include live chat, telephone support, email assistance, and comprehensive FAQ sections to address client inquiries and technical issues promptly.

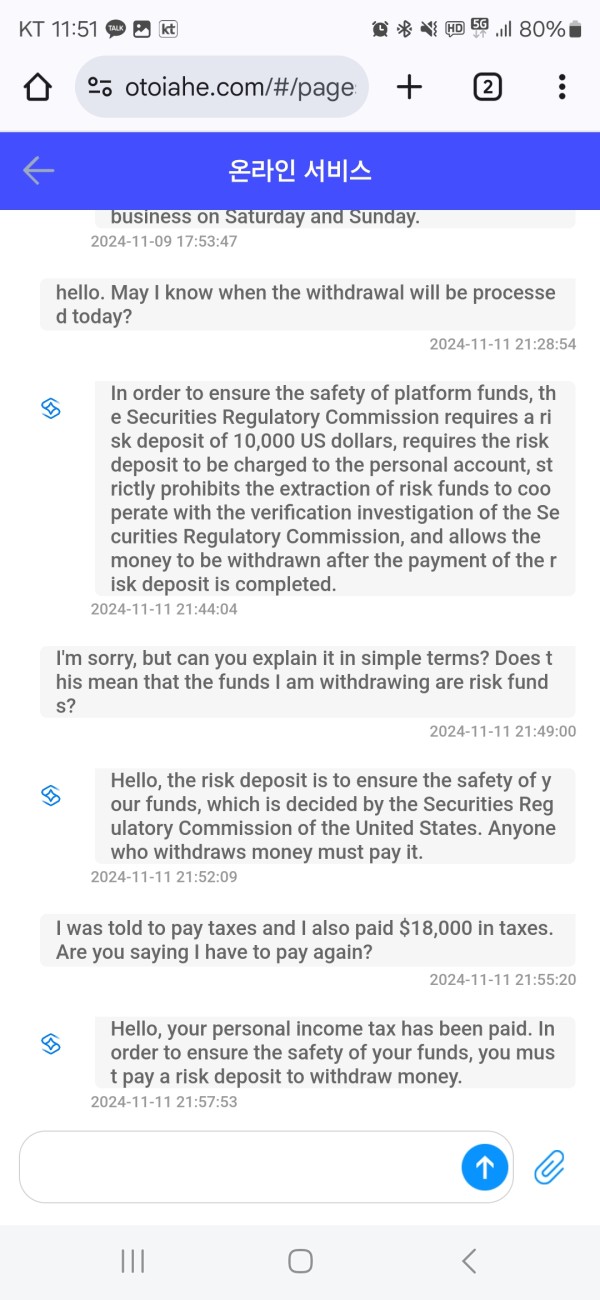

Response time standards, service quality metrics, and customer satisfaction indicators are crucial elements in assessing broker support capabilities. These metrics help traders understand what level of service they can expect when issues arise. However, specific information about OTOIA's customer service performance, availability hours, and support team expertise is not documented. This makes it impossible to evaluate the quality and reliability of their customer support operations.

Multilingual support capabilities are increasingly important for international forex brokers serving diverse client bases from around the world. Many traders prefer to communicate in their native language when dealing with complex financial matters or urgent issues. The absence of information about OTOIA's language support options limits assessment of their ability to serve traders effectively. This is particularly concerning for non-English speaking traders who may need assistance.

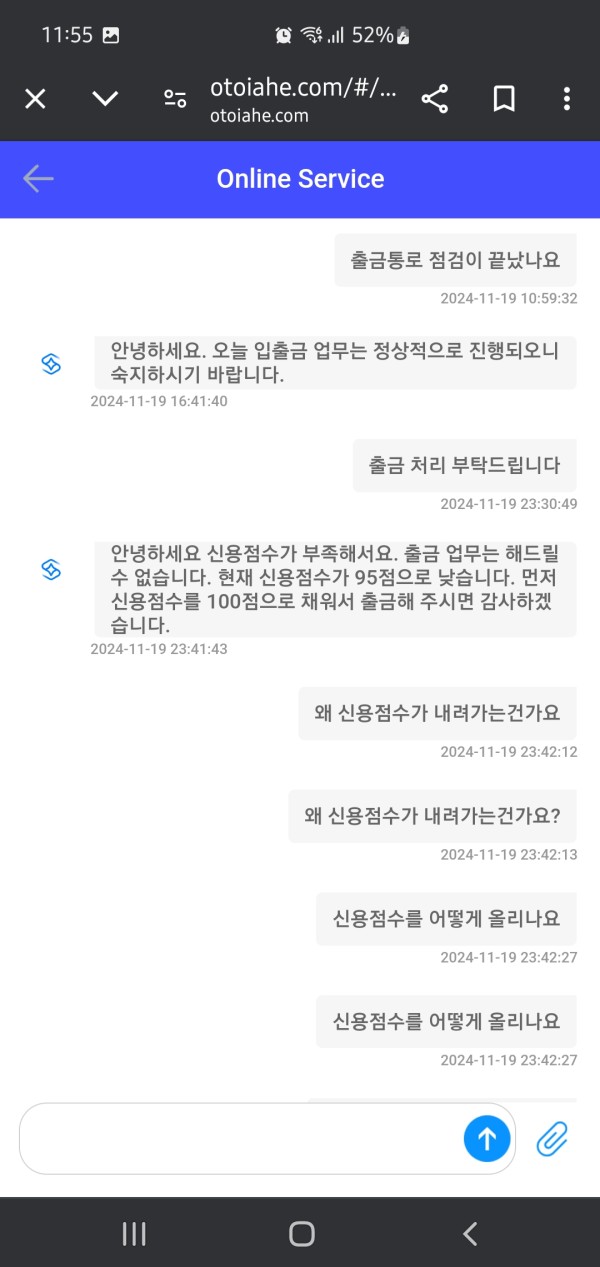

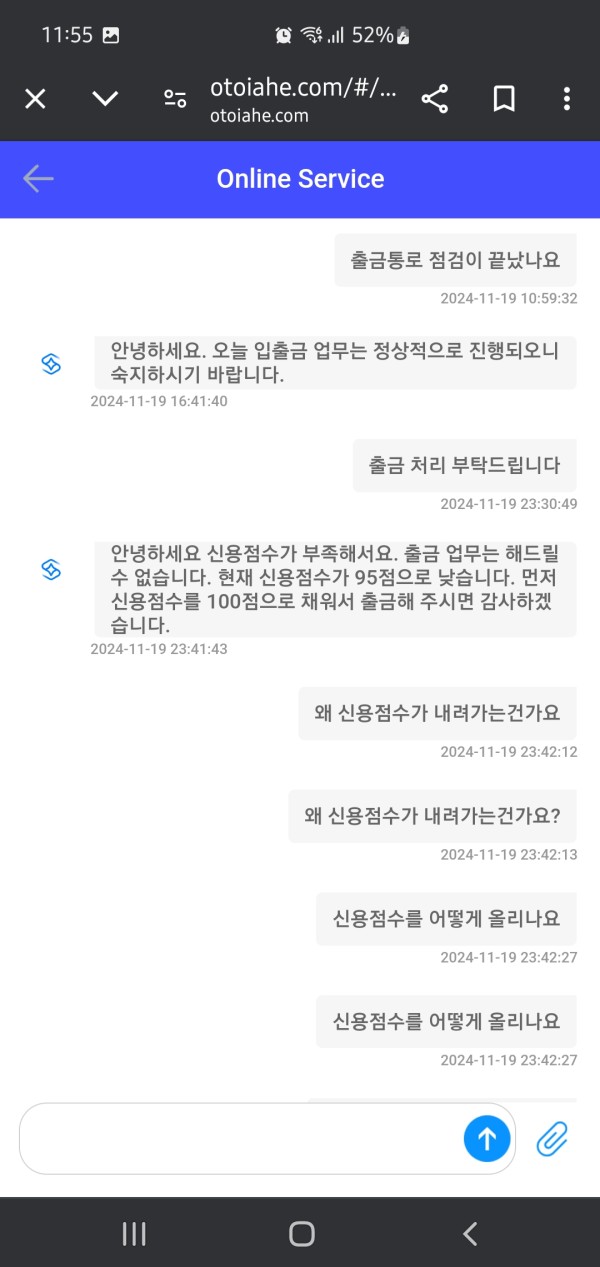

Problem resolution procedures, escalation processes, and customer complaint handling mechanisms represent essential components of professional broker operations. These procedures ensure that client issues are addressed fairly and efficiently when problems occur. The lack of documented customer service protocols raises concerns about OTOIA's ability to address client issues effectively. It also questions their ability to maintain satisfactory service standards throughout the trading relationship.

Trading Experience Analysis

Assessment of OTOIA's trading experience quality faces significant limitations due to insufficient information about platform performance and execution capabilities. Modern forex trading requires stable, fast-executing platforms with comprehensive functionality to support various trading strategies. Traders need reliable technology to execute their strategies effectively in fast-moving markets. However, specific performance metrics, uptime statistics, and execution quality data for OTOIA's trading infrastructure are not available.

Platform stability and execution speed are fundamental requirements for successful forex trading, particularly during high-volatility market periods when prices change rapidly. Poor execution can result in significant losses even with good trading strategies, making this a critical evaluation factor. However, specific performance metrics, uptime statistics, and execution quality data for OTOIA's trading infrastructure are not available in source materials. This makes objective assessment impossible and creates uncertainty for potential clients.

Order execution quality, including slip rates, requote frequency, and fill rates, represents critical performance indicators for forex brokers. These metrics directly impact trading profitability and strategy effectiveness across different market conditions. The absence of verifiable execution data prevents comprehensive evaluation of OTOIA's trading environment quality. Traders cannot assess the broker's suitability for different trading strategies without this essential information.

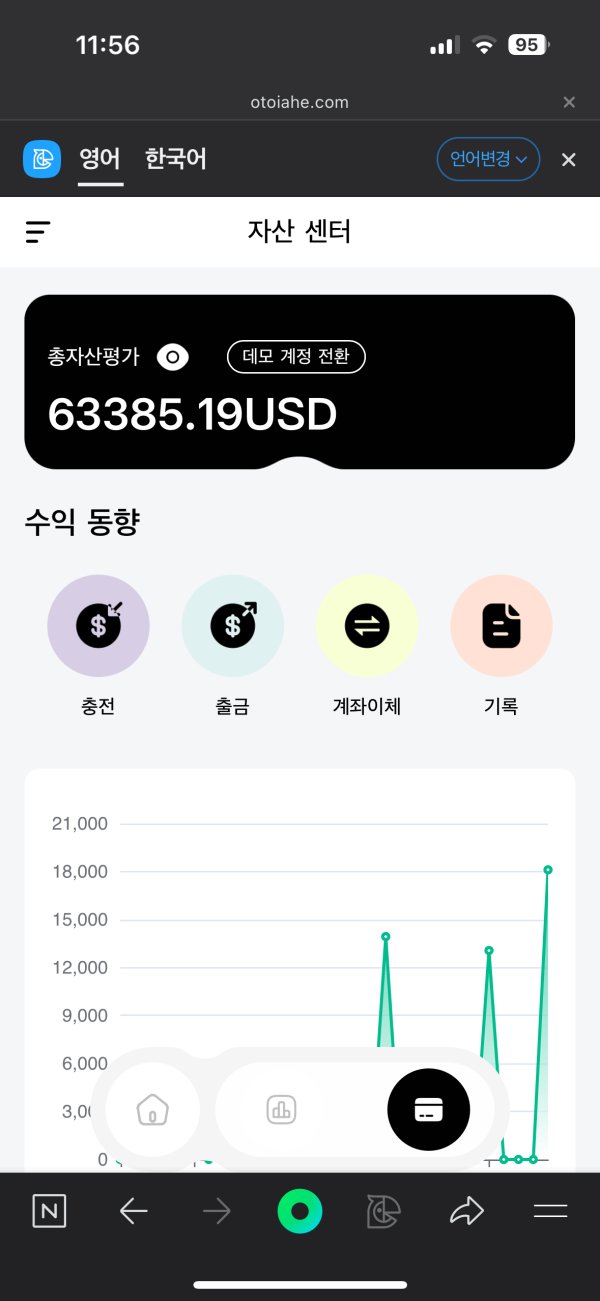

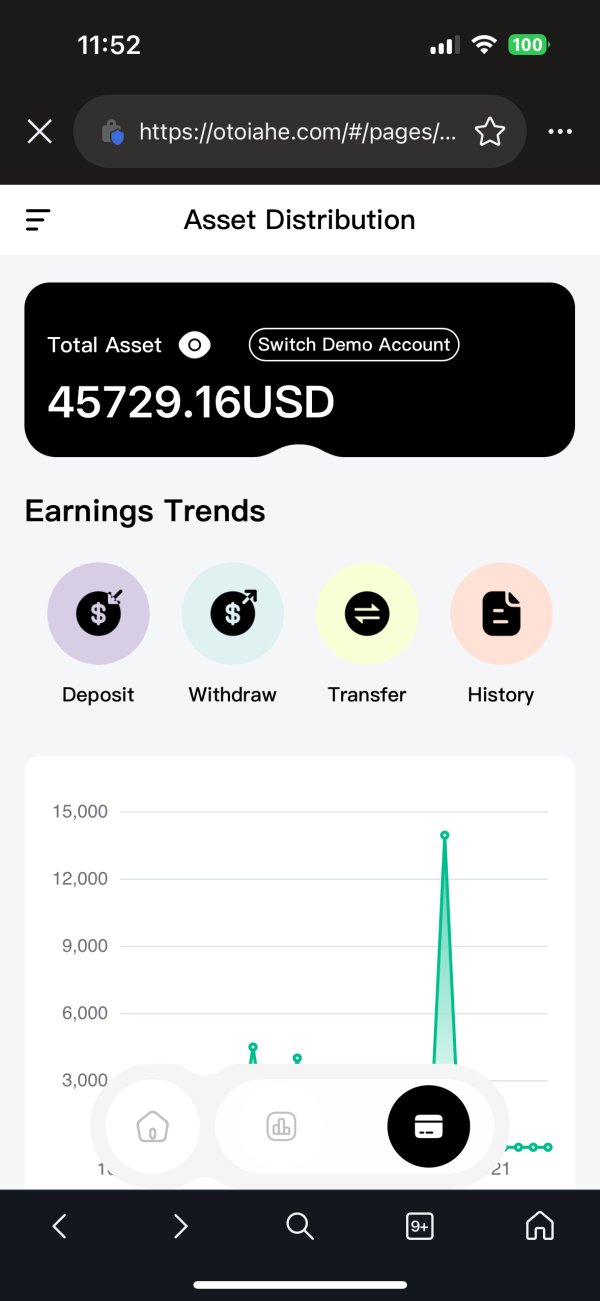

Mobile trading capabilities have become essential for modern forex traders who require access to markets and account management functions. Many traders need to monitor positions and execute trades while away from desktop computers. However, information about OTOIA's mobile platform availability, functionality, and performance is not specified in available documentation. This otoia review emphasizes that the lack of verifiable trading experience data represents a significant concern. Potential clients seeking reliable trading environments with proven performance records should be cautious.

Trust and Reliability Analysis

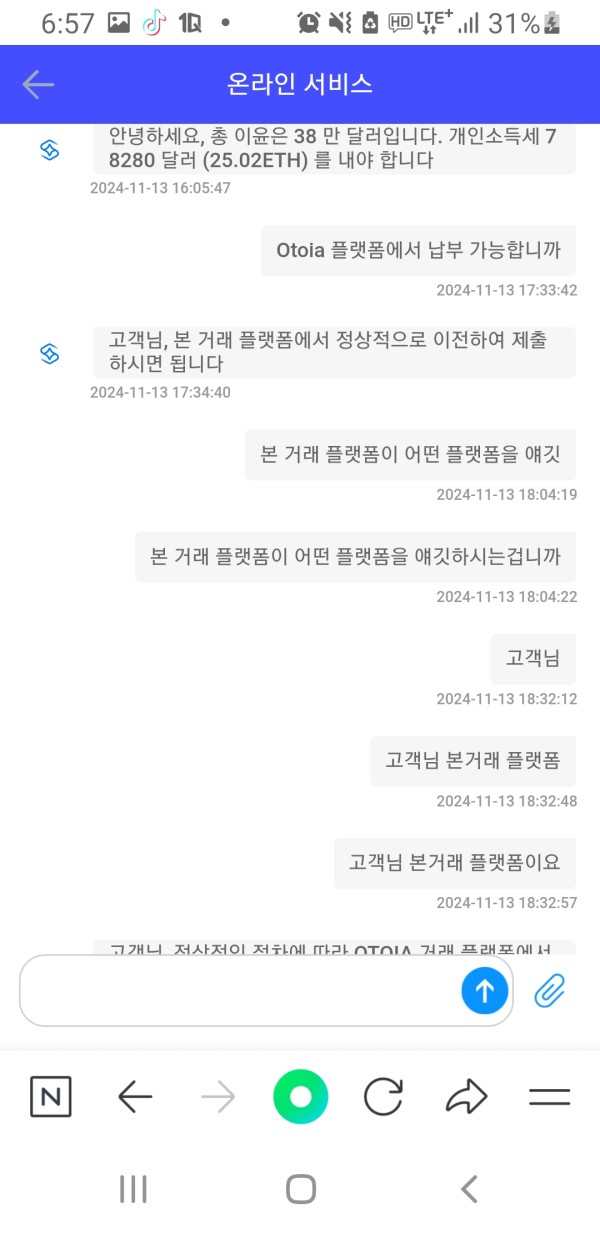

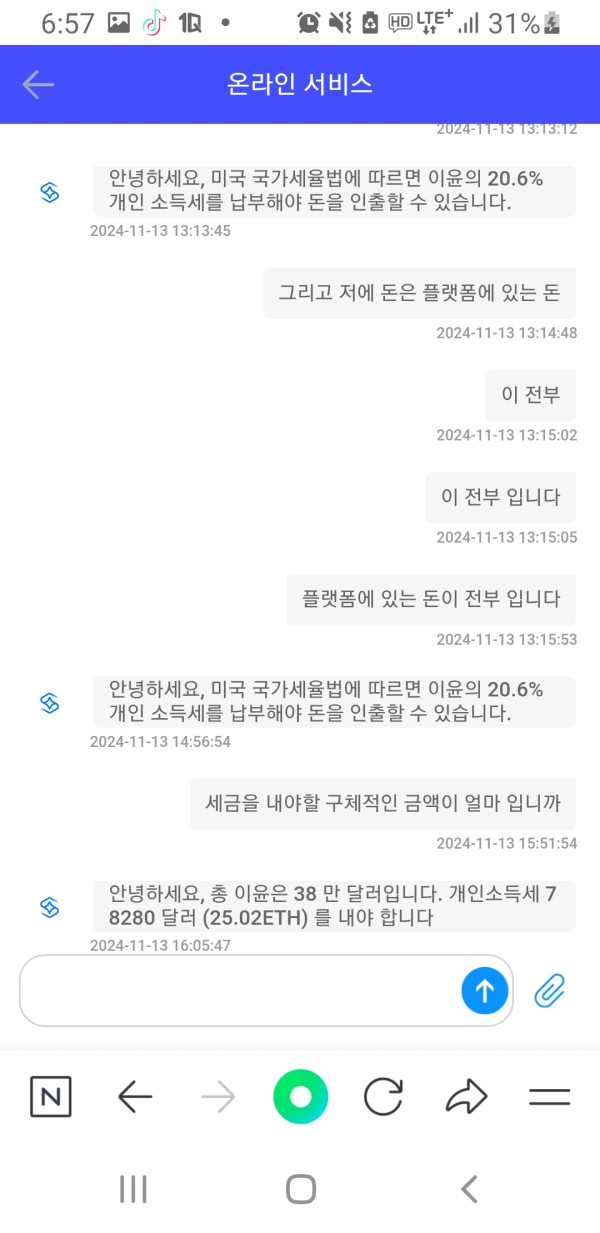

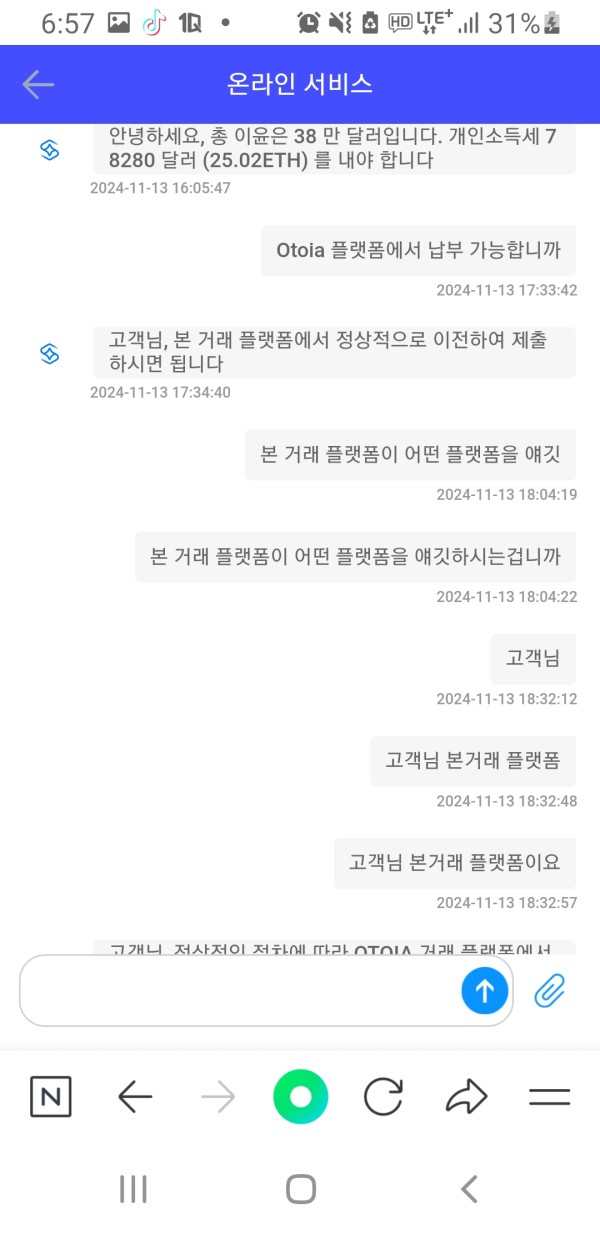

Trust assessment for OTOIA faces substantial challenges due to limited regulatory information and transparency concerns identified by industry monitoring platforms. WikiFX and other broker evaluation services have raised questions about the broker's legitimacy. This represents a fundamental concern for potential clients seeking secure trading environments with proper oversight and legal protections.

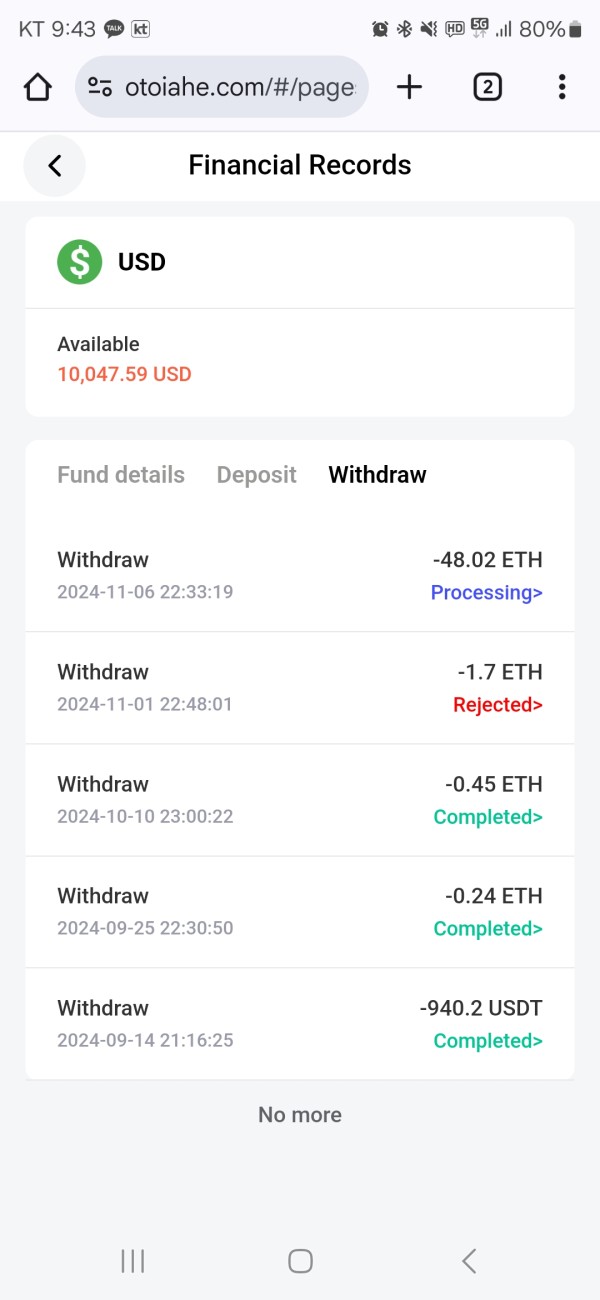

Regulatory compliance represents the cornerstone of broker trustworthiness, providing legal protections and operational oversight that safeguard client interests. Regulated brokers must follow strict rules about fund handling, operational standards, and client protection measures. However, specific regulatory licenses, compliance certifications, and oversight relationships are not clearly documented for OTOIA. This creates significant uncertainty about legal protections available to clients and recourse options if problems arise.

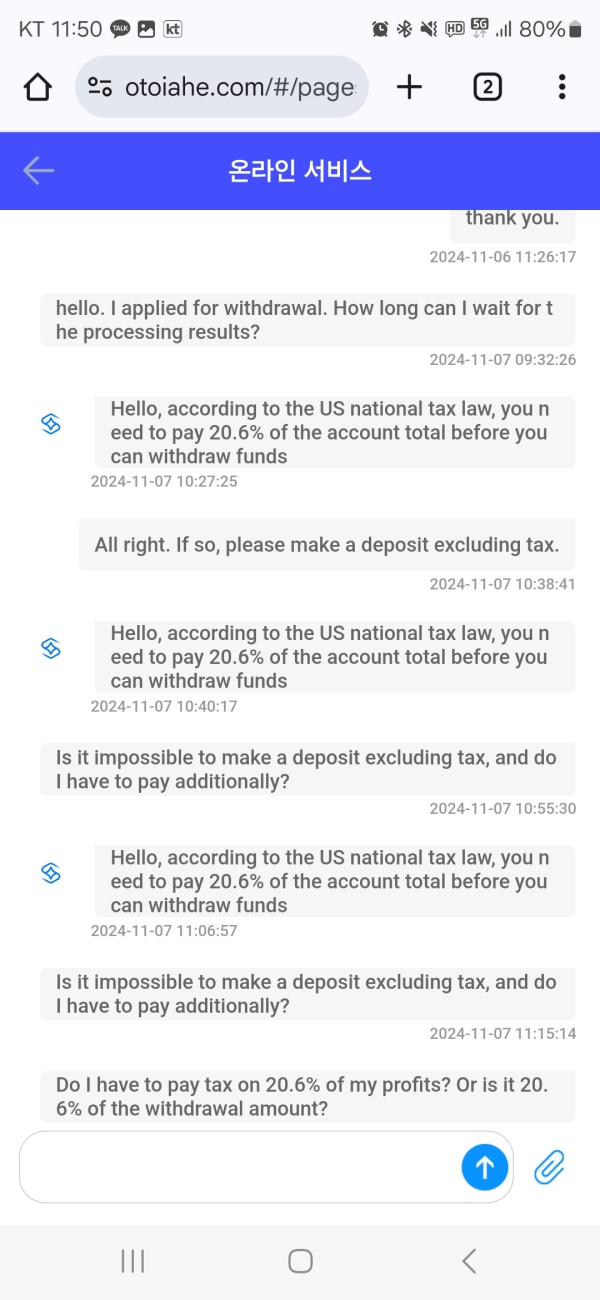

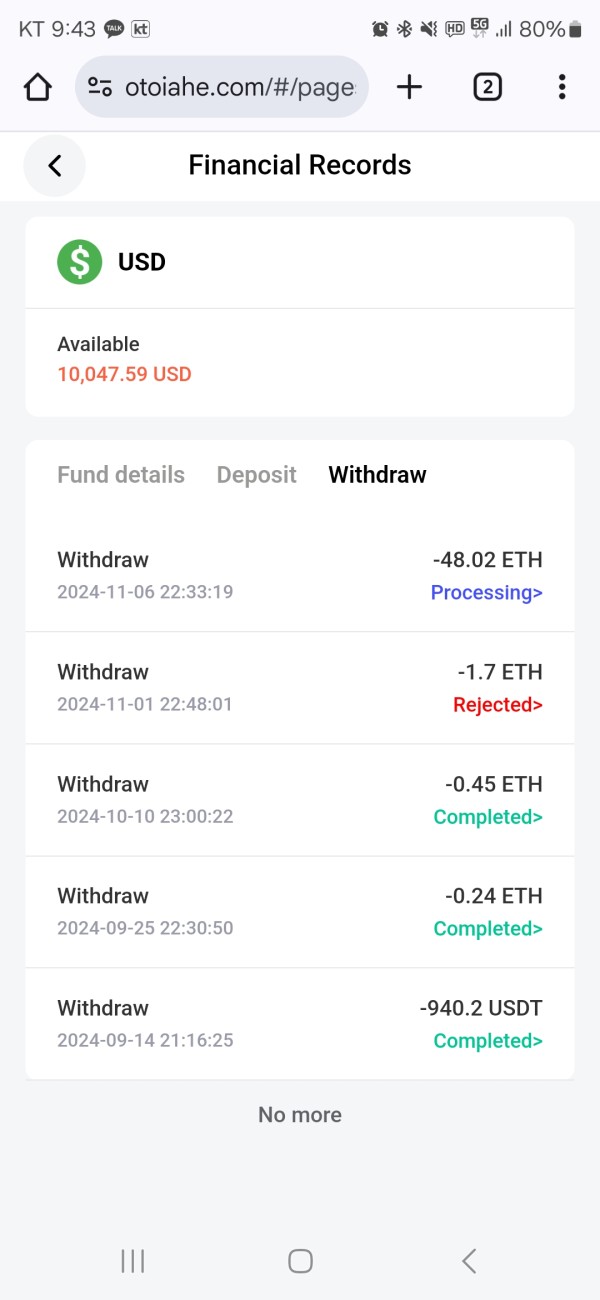

Fund security measures, including client money segregation, insurance coverage, and deposit protection schemes, are essential trust indicators for forex brokers. These protections ensure that client funds are safe even if the broker faces financial difficulties. The absence of clear information about OTOIA's fund protection mechanisms raises concerns about client asset security. It also questions recovery procedures in adverse scenarios where the broker might face operational or financial problems.

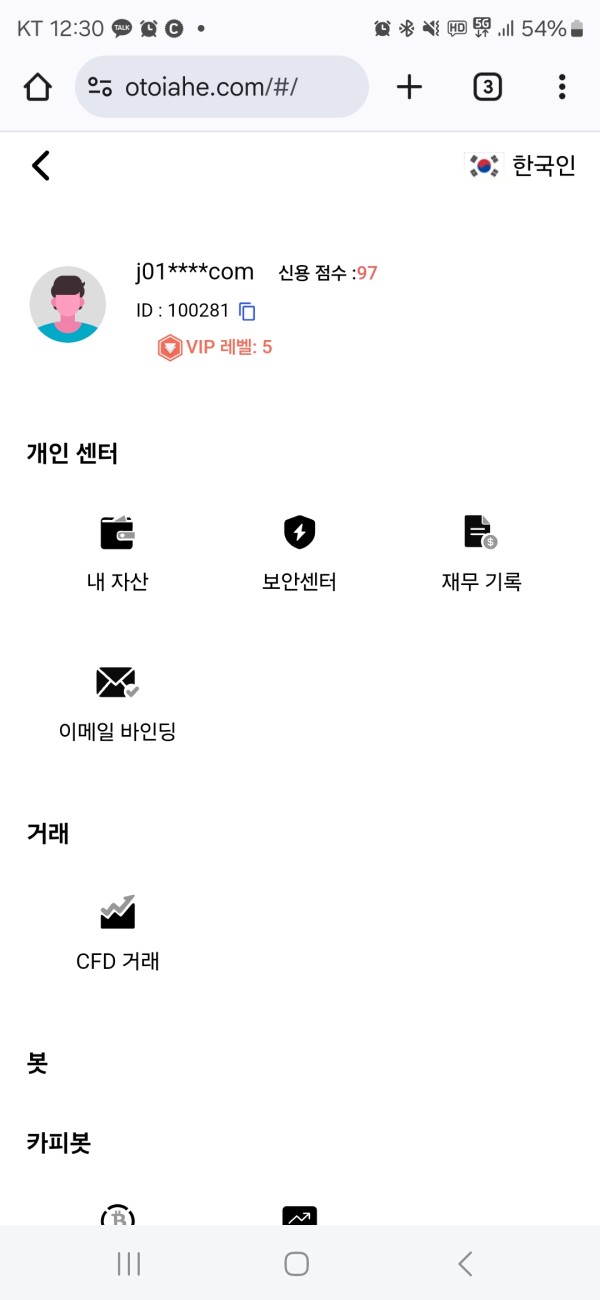

Company transparency, including financial reporting, ownership disclosure, and operational accountability, contributes significantly to broker trustworthiness. Transparent brokers provide clear information about their operations, leadership, and financial stability to build client confidence. The limited publicly available information about OTOIA's corporate structure and operational transparency suggests potential concerns. This raises questions about accountability and adherence to professional standards expected in the financial services industry.

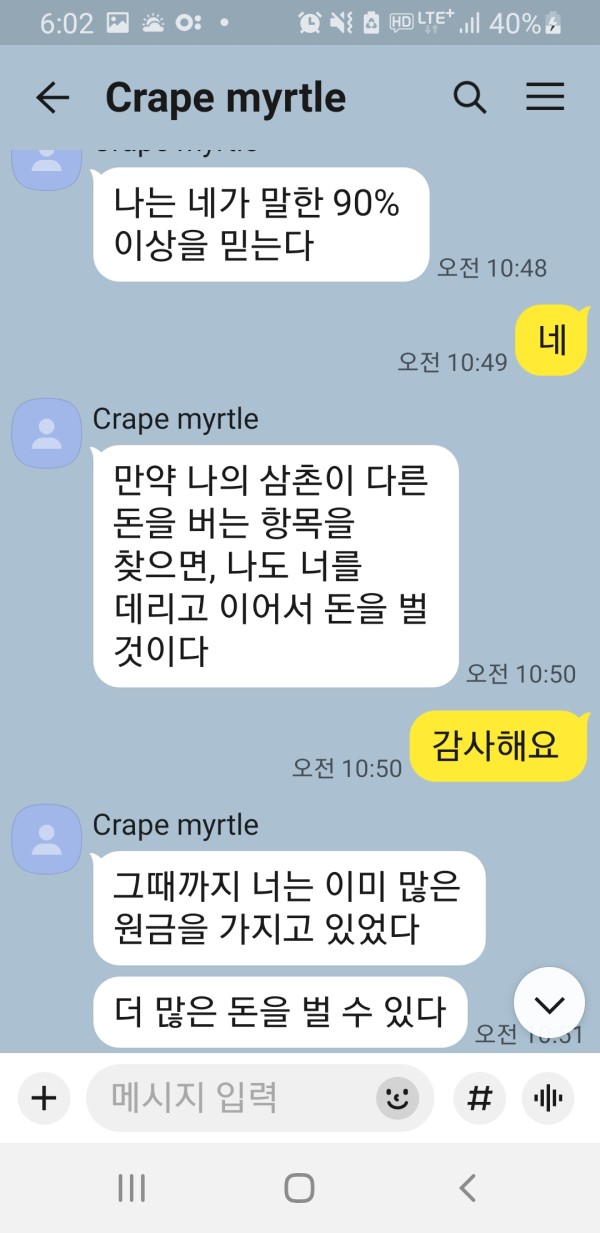

Industry reputation and third-party evaluations provide additional trust indicators for broker assessment that help traders make informed decisions. The questioning of OTOIA's legitimacy by multiple industry monitoring platforms represents a significant concern. Potential clients should carefully consider this feedback when evaluating this broker option against more established alternatives.

User Experience Analysis

Comprehensive user experience evaluation for OTOIA cannot be completed due to limited user feedback and operational information available in source materials. User satisfaction typically encompasses platform usability, service quality, problem resolution effectiveness, and overall trading environment satisfaction. These factors directly impact trader success and long-term satisfaction with their chosen broker.

Interface design and platform usability significantly impact trader productivity and satisfaction levels across different skill levels and trading styles. Well-designed platforms help traders execute strategies efficiently while poorly designed interfaces can hinder performance and cause frustration. However, specific information about OTOIA's platform design philosophy, user interface quality, and navigation efficiency is not available. This prevents objective usability assessment and makes it difficult for traders to evaluate platform suitability.

Registration and account verification processes represent initial user experience touchpoints that significantly influence client satisfaction and first impressions. Smooth onboarding processes help traders start trading quickly while complicated procedures can create frustration and delays. The absence of detailed information about OTOIA's onboarding procedures, documentation requirements, and verification timelines limits assessment. Traders cannot evaluate the efficiency and user-friendliness of initial user experience quality.

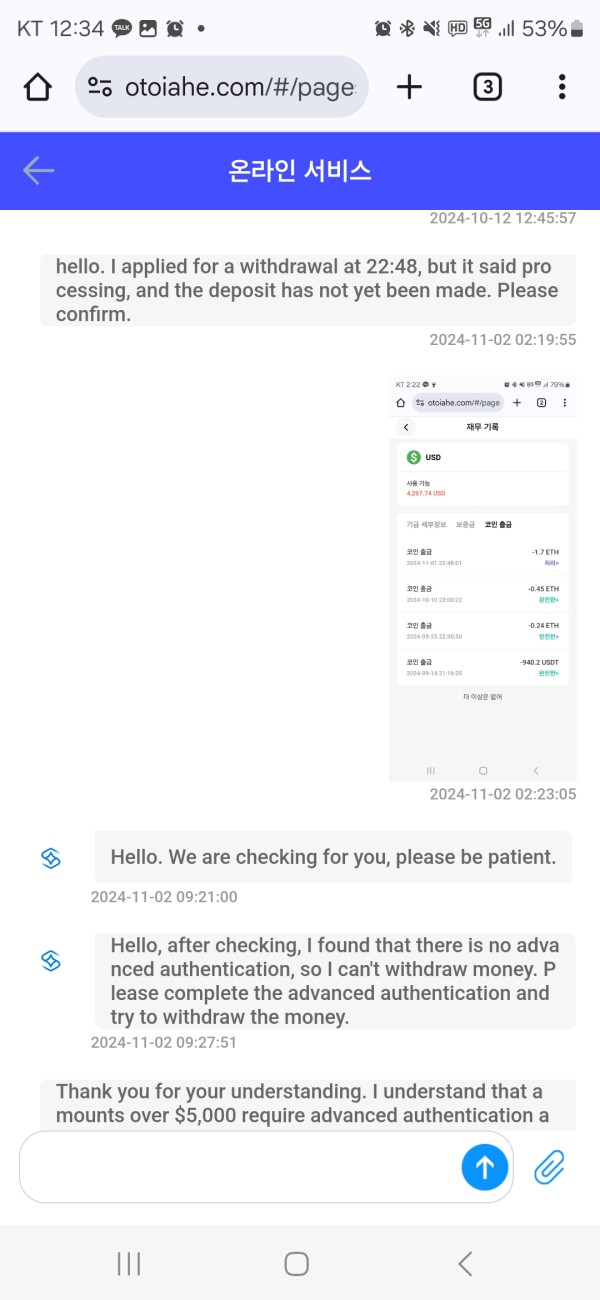

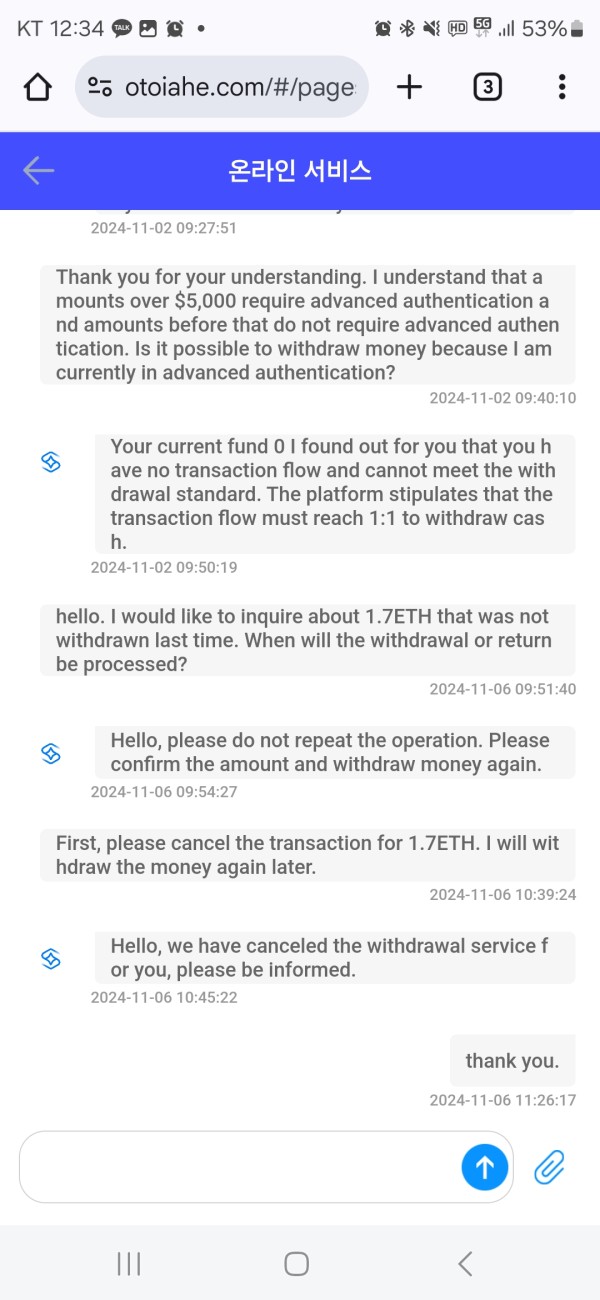

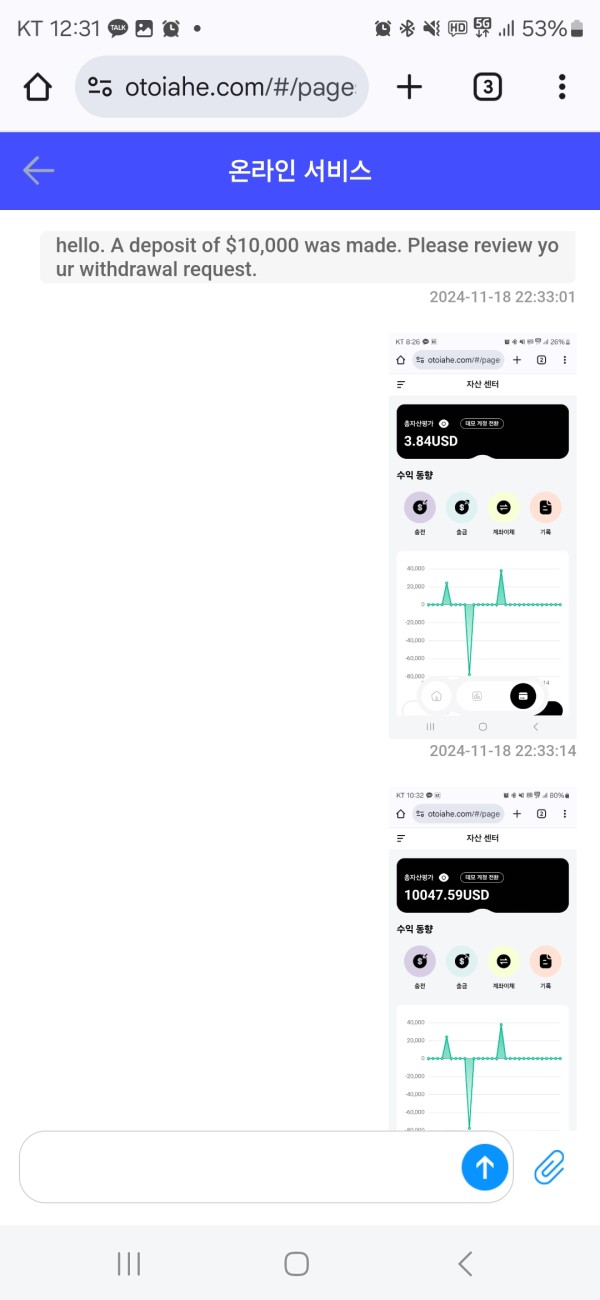

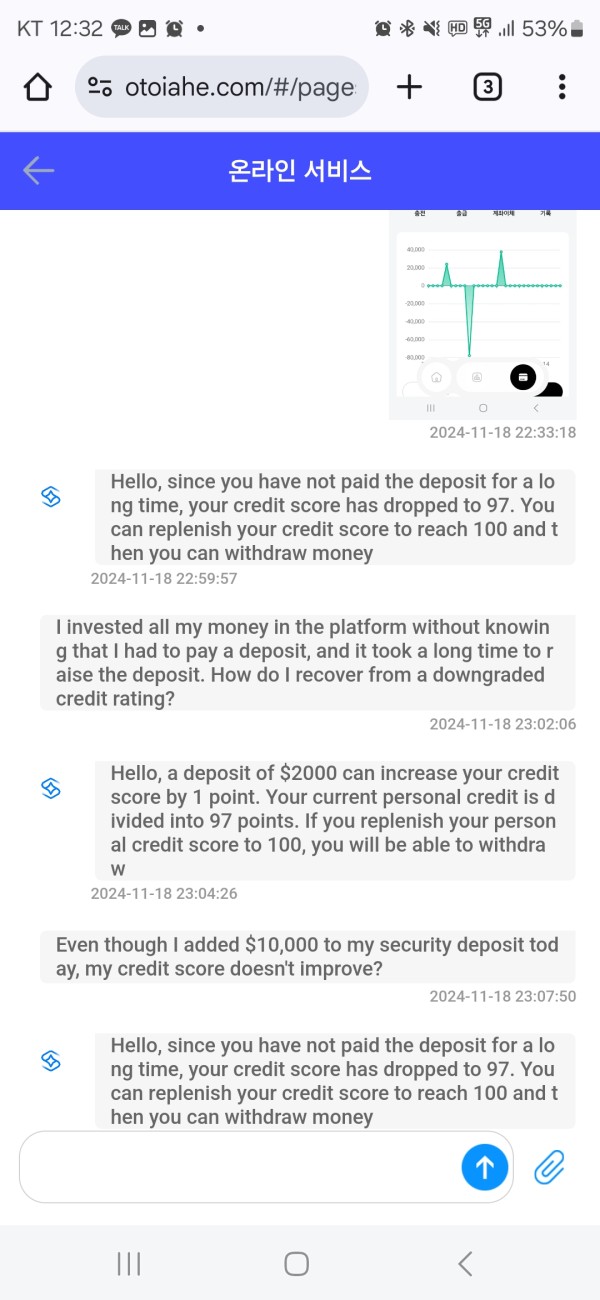

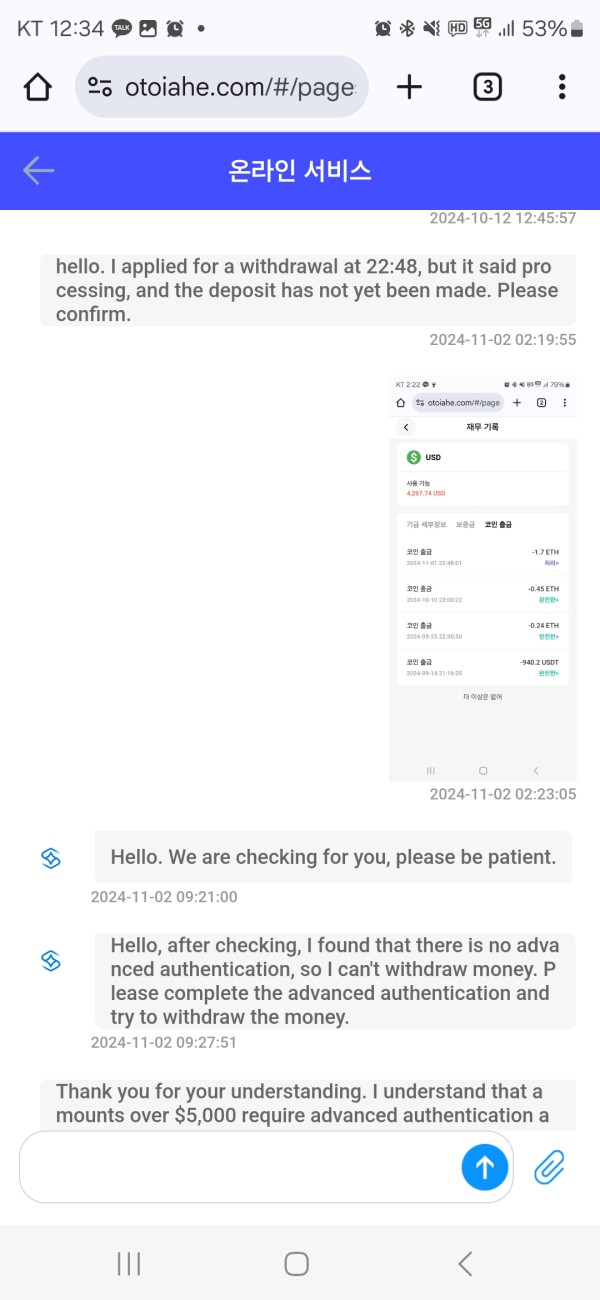

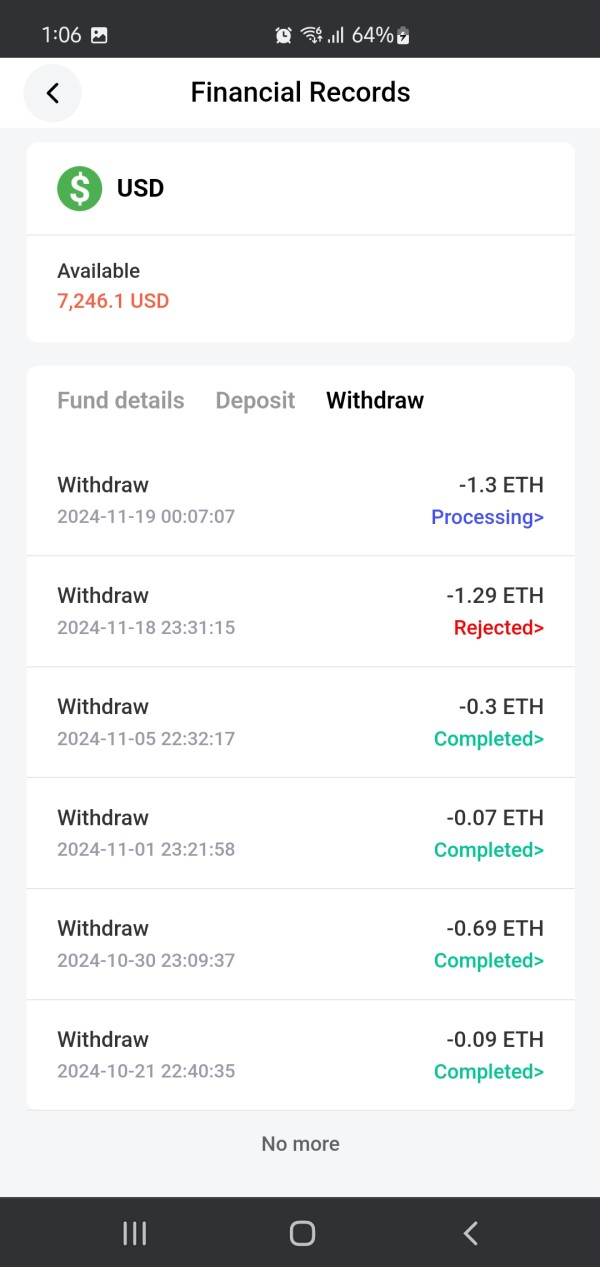

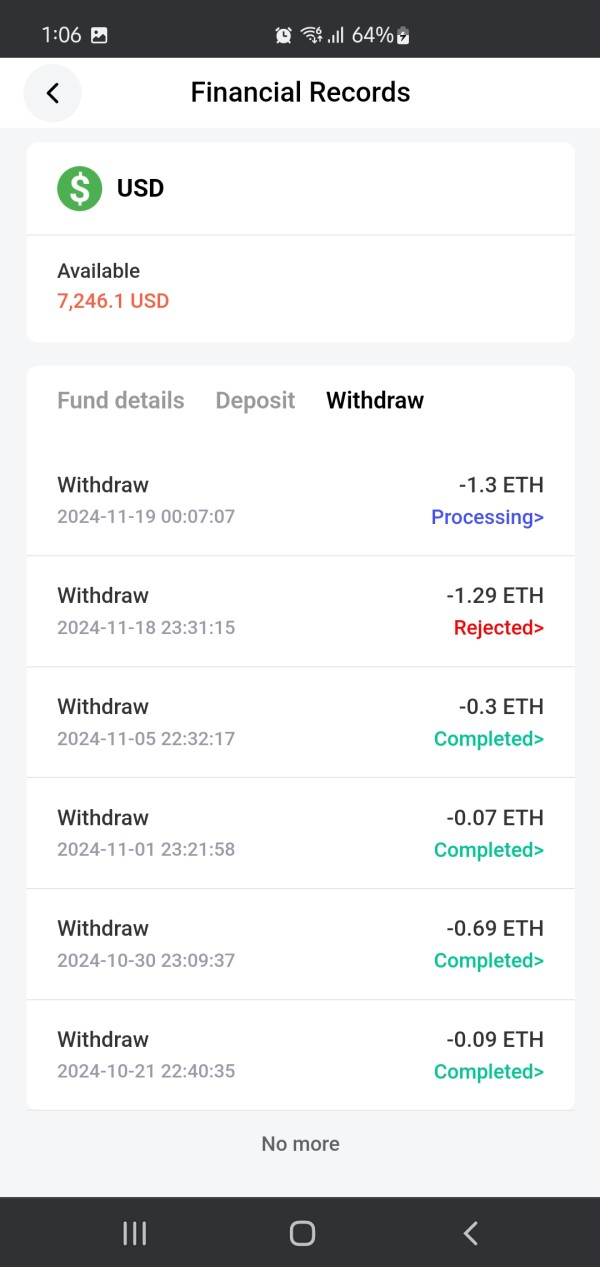

Funding and withdrawal experience, including transaction processing times, fee structures, and procedure complexity, directly impacts ongoing user satisfaction. Efficient financial transactions are essential for maintaining trader confidence and operational flexibility throughout the trading relationship. However, specific operational details about OTOIA's financial transaction processes are not documented in available materials. This creates uncertainty about the practical aspects of working with this broker.

Common user complaints and satisfaction trends provide valuable insights into broker performance from client perspectives and real-world experiences. These insights help potential clients understand typical challenges and benefits associated with specific brokers. The limited availability of verified user feedback about OTOIA makes it difficult to assess typical user experiences. It also makes it challenging to identify potential service issues that might affect client satisfaction.

Conclusion

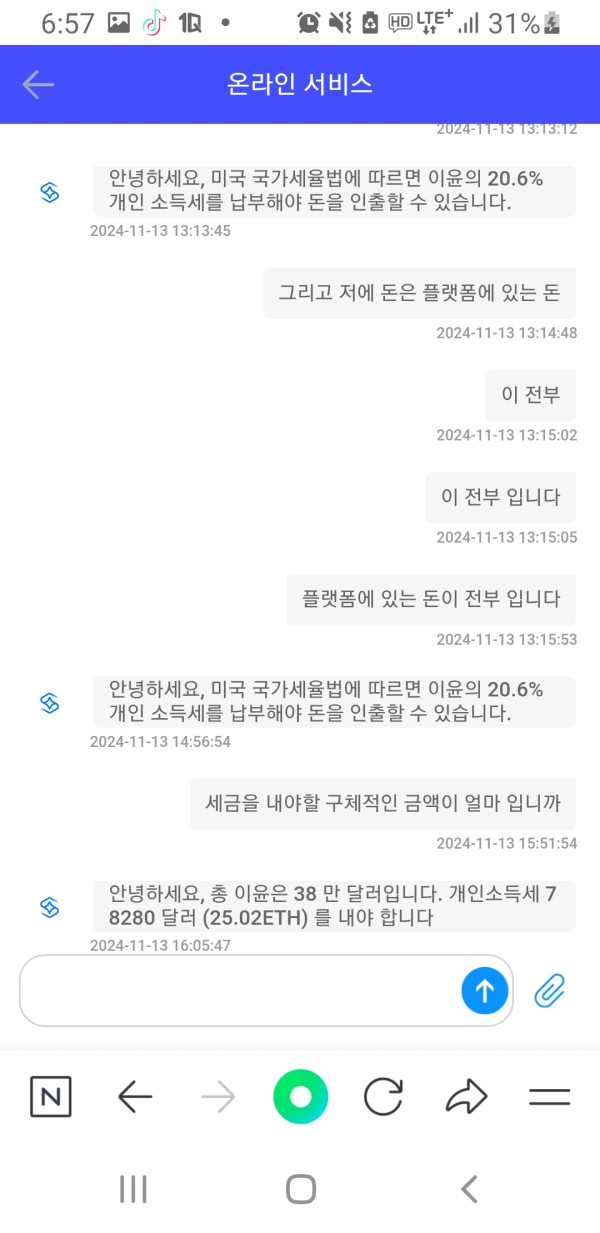

This comprehensive otoia review reveals significant concerns about OTOIA's legitimacy and operational transparency that potential clients should carefully consider. The broker's relatively recent establishment in 2017, combined with limited regulatory information and questioning by industry monitoring platforms, suggests substantial risks. These risks may be particularly problematic for traders who prioritize security and regulatory protection in their broker selection process.

While OTOIA may appeal to beginners seeking entry into forex markets, the lack of verifiable regulatory compliance poses serious concerns. The absence of operational transparency and comprehensive service information represents significant red flags that experienced traders typically avoid. The absence of detailed account conditions, trading tools, and customer service information further compounds concerns. These gaps raise questions about the broker's professional standards and operational capability to serve clients effectively.

The primary disadvantages identified include questionable regulatory status, limited operational transparency, and insufficient verifiable information about core services. These factors create an environment of uncertainty that most professional traders prefer to avoid. These factors suggest that traders, particularly those prioritizing security and regulatory protection, should exercise extreme caution. Potential clients should consider more established brokers with clear regulatory oversight when making their forex broker choice.