Is Optium Group safe?

Business

License

Is Optium Group A Scam?

Introduction

Optium Group is an online forex broker that has emerged in the trading landscape, offering a range of financial instruments, including forex, stocks, commodities, indices, and cryptocurrencies. However, the rapid proliferation of online trading platforms has raised significant concerns about their legitimacy and the safety of traders' investments. It is imperative for traders to conduct thorough assessments of forex brokers to ensure their safety and reliability, particularly in light of the numerous scams that have plagued the industry. This article aims to provide an in-depth analysis of Optium Group, evaluating its regulatory status, company background, trading conditions, and customer experiences to determine whether it is a safe trading option or a potential scam.

The investigation is based on a comprehensive review of available information, including regulatory data, customer feedback, and expert analyses. By employing a structured evaluation framework, this article seeks to present a balanced view of Optium Group's operations, focusing on key indicators of trustworthiness and potential risks.

Regulation and Legitimacy

One of the foremost considerations when evaluating any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to established standards of conduct and financial integrity. Unfortunately, Optium Group is reported to lack valid regulation, which poses a significant risk to potential investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a regulatory license indicates that Optium Group is not subject to oversight by any recognized financial authority. This lack of regulation raises serious concerns about the broker's legitimacy and the safety of client funds. Furthermore, claims regarding a license from the United States NFA (National Futures Association) have been deemed suspicious, with indications that it may be a clone or fraudulent license. Such regulatory deficiencies are critical red flags for any prospective trader.

The quality of regulation directly impacts the level of investor protection available. Regulated brokers are typically required to maintain segregated accounts for client funds, ensuring that traders' money is protected even in the event of the broker's financial difficulties. In contrast, unregulated brokers like Optium Group may not have such safeguards in place, leaving traders vulnerable to potential losses. Given these factors, the lack of regulation is a significant indicator that traders should exercise caution when considering whether Optium Group is safe to trade with.

Company Background Investigation

Optium Group claims to have its operations based in the United Kingdom, but further investigation reveals a lack of transparency regarding its ownership structure and management team. The company appears to have been established recently, with reports indicating it was founded only a couple of years ago. This relatively short history, coupled with the absence of verifiable information about its ownership and management, raises questions about the broker's credibility and operational integrity.

The management team's background is also a crucial element in assessing the broker's trustworthiness. A well-experienced and reputable management team can significantly enhance a broker's reliability. However, there is scant information available about the individuals behind Optium Group, which further complicates the assessment of its legitimacy. The lack of clear information regarding the management and ownership structure can be seen as a significant transparency issue, suggesting that traders should be wary of engaging with this broker.

Moreover, the absence of readily available corporate information and the lack of a physical presence in the claimed jurisdiction can be indicative of potential fraudulent practices. Legitimate brokers typically provide detailed disclosures about their operations, including their registration details and management team. In contrast, Optium Group's opacity raises concerns about its operational practices and overall reliability.

Trading Conditions Analysis

When evaluating a broker's trading conditions, it is essential to consider the overall cost structure, including spreads, commissions, and other fees. Optium Group offers various trading accounts with different features, but the overall fee structure has raised concerns among traders.

| Fee Type | Optium Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | Varies (0.1 - 1.0 pips) |

| Commission Model | Varies | Typically lower |

| Overnight Interest Range | Not disclosed | Standard rates apply |

Optium Group claims to offer spreads starting from 0.0 pips, which may appear attractive at first glance. However, the lack of transparency regarding commission structures and other potential fees raises questions about the overall cost of trading with this broker. Traders have reported experiencing hidden fees and unfavorable withdrawal conditions, which can significantly impact profitability.

Moreover, the absence of clear information regarding overnight interest rates and other trading costs can lead to unexpected expenses for traders. In a competitive market where many brokers disclose their fee structures transparently, Optium Group's lack of clarity is concerning. Traders should carefully consider these factors when evaluating whether Optium Group is safe to trade with, as unexpected costs can erode potential profits.

Customer Fund Safety

The safety of customer funds is paramount in the forex trading industry. Regulated brokers are typically required to implement strict measures to protect client funds, including segregating client accounts and providing investor protection mechanisms. However, Optium Group's unregulated status raises significant concerns regarding the safety of customer funds.

The absence of a regulatory framework means that there are no guarantees in place to protect traders' investments. This lack of investor protection is a critical risk factor, as traders may find it challenging to recover their funds in the event of a dispute or broker insolvency. Additionally, Optium Group has not provided clear information regarding its policies on negative balance protection, further exacerbating concerns about the safety of client funds.

Historically, unregulated brokers have been known to engage in questionable practices, including the potential misappropriation of client funds. Without the oversight of a regulatory authority, traders are left with little recourse if they encounter issues with fund withdrawals or account management. Given these factors, it is essential for traders to assess the risks associated with using Optium Group, especially regarding the safety of their funds.

Customer Experience and Complaints

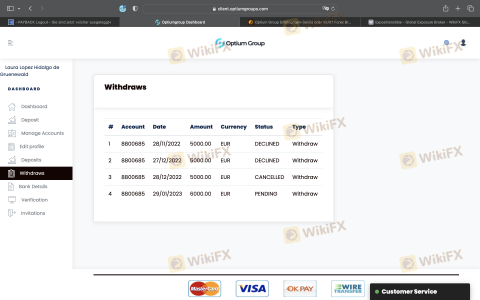

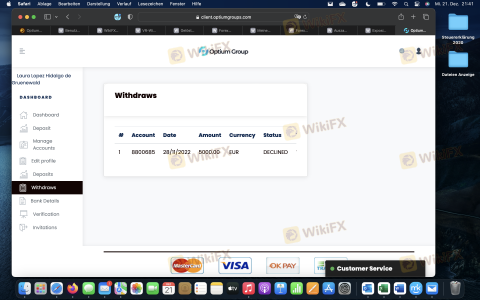

Customer feedback is a valuable indicator of a broker's reliability and service quality. In the case of Optium Group, numerous reviews and testimonials suggest a concerning pattern of customer dissatisfaction. Many traders have reported positive experiences during the initial deposit phase, but complaints arise when it comes to fund withdrawals.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Transparency | Medium | Inconsistent |

| Customer Support Issues | High | Unresponsive |

Common complaints include significant delays in processing withdrawal requests, a lack of transparency regarding fees, and unresponsive customer support. In many cases, traders have reported that their accounts were blocked after they attempted to withdraw funds, raising serious concerns about the broker's operational practices.

For instance, one trader recounted a frustrating experience where they requested a withdrawal, only to be met with repeated delays and requests for additional documentation. Such experiences are indicative of potential scam practices, where brokers may employ tactics to retain client funds. These patterns of behavior underscore the importance of assessing whether Optium Group is safe to trade with, as the risk of encountering similar issues is significant.

Platform and Trade Execution

The performance and reliability of a broker's trading platform are critical factors influencing the overall trading experience. Optium Group offers a proprietary trading platform, but reports from users indicate that it may not meet industry standards. Traders have expressed concerns about the platform's stability, order execution quality, and potential issues with slippage.

In addition, the absence of well-known trading platforms like MetaTrader 4 or 5 raises questions about the broker's commitment to providing a robust trading environment. Traders often prefer established platforms that offer advanced features and reliable execution. The lack of such options with Optium Group could limit traders' ability to effectively manage their trades and optimize their strategies.

Furthermore, reports of execution issues, such as rejected orders and unexpected slippage, can significantly impact a trader's profitability. These concerns highlight the necessity for thorough evaluation when determining whether Optium Group is safe to trade with, as a subpar trading platform can lead to adverse trading experiences.

Risk Assessment

Given the various factors discussed, the overall risk associated with trading with Optium Group is considerable. The lack of regulation, transparency issues, and negative customer feedback all contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Financial Risk | High | Potential loss of funds without recourse |

| Operational Risk | Medium | Platform performance and execution issues |

| Customer Service Risk | High | Poor responsiveness and support quality |

To mitigate these risks, traders are advised to conduct thorough due diligence, consider alternative regulated brokers, and avoid depositing significant amounts until they have verified the broker's legitimacy. Seeking out brokers with established reputations and regulatory oversight can significantly reduce the likelihood of encountering issues.

Conclusion and Recommendations

In conclusion, the evidence suggests that Optium Group exhibits several concerning characteristics that warrant caution. The lack of regulation, transparency issues, and negative customer feedback raise significant red flags about the broker's legitimacy and operational practices. As such, traders should carefully consider whether Optium Group is safe to trade with.

For those seeking to engage in forex trading, it is advisable to explore alternative brokers that are regulated by reputable authorities and have a proven track record of reliability and customer satisfaction. Some recommended alternatives include brokers that offer robust regulatory oversight, transparent fee structures, and reliable customer support. By prioritizing safety and reliability, traders can better protect their investments and enhance their trading experiences.

Is Optium Group a scam, or is it legit?

The latest exposure and evaluation content of Optium Group brokers.

Optium Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Optium Group latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.