Regarding the legitimacy of Morgan Stanley forex brokers, it provides FCA, CYSEC, NFA and WikiBit, (also has a graphic survey regarding security).

Is Morgan Stanley safe?

Pros

Cons

Is Morgan Stanley markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Morgan Stanley & Co. International Plc

Effective Date:

2001-12-01Email Address of Licensed Institution:

complaintsms@morganstanley.comSharing Status:

No SharingWebsite of Licensed Institution:

www.morganstanley.comExpiration Time:

--Address of Licensed Institution:

25 Cabot Square London E14 4QA UNITED KINGDOMPhone Number of Licensed Institution:

+4402074258000Licensed Institution Certified Documents:

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

Clone FirmLicense Type:

Market Making License (MM)

Licensed Entity:

Trading Point of Financial Instruments Ltd

Effective Date:

2010-08-05Email Address of Licensed Institution:

compliance@trading-point.comSharing Status:

No SharingWebsite of Licensed Institution:

www.trading-point.com, www.xm.com, www.pipaffiliates.comExpiration Time:

--Address of Licensed Institution:

12, Richard and Verengaria Street, Araouzos Castle Court, 3rd Floor, 3042, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 029 900Licensed Institution Certified Documents:

NFA Derivatives Trading License (EP)

National Futures Association

National Futures Association

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

MORGAN STANLEY & CO INTERNATIONAL PLC

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

25 Cabot Square Canary Wharf London United KingdomPhone Number of Licensed Institution:

+44(0) 20 7425 8000Licensed Institution Certified Documents:

Is Morgan Stanley Safe or Scam?

Introduction

Morgan Stanley, a globally recognized financial services firm, has established itself as a key player in the foreign exchange (Forex) market. Founded in 1935, the company has grown to offer a wide range of financial services, including investment banking, wealth management, and asset management. Given its prominence, traders and investors often seek to understand the legitimacy and safety of engaging with such a large institution. Assessing the credibility of Forex brokers is crucial, as the industry can be rife with scams and unregulated entities that may jeopardize traders' investments. This article aims to provide a thorough evaluation of whether Morgan Stanley is safe for traders or if there are underlying risks that warrant caution. The analysis will utilize various sources, focusing on regulatory compliance, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

Morgan Stanley operates under stringent regulatory oversight, which is a critical factor in determining its legitimacy. The firm is registered with various regulatory bodies, ensuring that it adheres to industry standards and practices designed to protect investors. Below is a summary table of Morgan Stanley's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Exchange Commission (SEC) | 801-26847 | United States | Verified |

| Financial Industry Regulatory Authority (FINRA) | 105922 | United States | Verified |

| Financial Conduct Authority (FCA) | 100329 | United Kingdom | Verified |

The regulatory landscape in which Morgan Stanley operates is robust. The SEC and FINRA impose strict compliance requirements on registered firms, which include regular audits, financial disclosures, and adherence to fiduciary standards. Morgan Stanley's designation as a "systemically important financial institution" by the Financial Stability Board underscores its significance in the global financial system, further reinforcing its credibility. Historical compliance records indicate that while the firm has faced regulatory scrutiny in the past, it has taken corrective measures to address these issues, which reflects a commitment to maintaining high operational standards. Therefore, based on regulatory oversight and compliance history, Morgan Stanley is safe for investors.

Company Background Investigation

Morgan Stanley has a storied history that dates back to its founding in 1935, established in response to the Glass-Steagall Act, which mandated the separation of commercial and investment banking. Over the decades, the company has evolved significantly, expanding its services and global reach. Today, Morgan Stanley operates in over 42 countries, employing nearly 80,000 individuals. The ownership structure is predominantly institutional, with major shareholders including Mitsubishi UFJ Financial Group and various asset management firms.

The management team at Morgan Stanley is comprised of seasoned professionals with extensive experience in finance and investment. This expertise is crucial for navigating the complexities of the financial services industry. The firm's transparency in operations and commitment to regular disclosures have fostered trust among its clients. Morgan Stanley's investor relations section provides detailed financial reports, allowing stakeholders to assess the company's performance and stability. Overall, the company's long-standing presence and professional management contribute to the conclusion that Morgan Stanley is safe for investors seeking reliable financial services.

Trading Conditions Analysis

When evaluating whether Morgan Stanley is safe, understanding the trading conditions it offers is essential. The firm's fee structure is competitive, but it is important to analyze the costs associated with trading. Below is a comparison of core trading costs:

| Fee Type | Morgan Stanley | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.2 pips | 1.5 pips |

| Commission Model | $0 on stocks | $5 on average |

| Overnight Interest Range | 2.5% | 3.0% |

Morgan Stanley's spreads for major currency pairs are generally lower than the industry average, which can be advantageous for traders looking to minimize costs. The commission structure is also favorable, particularly for stock trading, where Morgan Stanley does not charge commissions, aligning it with the growing trend of commission-free trading in the industry. However, it is important to note that some clients have reported unexpected fees related to account maintenance and inactivity, which could be a concern for infrequent traders. Overall, while the trading conditions are largely favorable, potential clients should be aware of the fee structure to ensure that Morgan Stanley is safe for their trading needs.

Customer Funds Security

The safety of customer funds is a paramount concern for any Forex trader. Morgan Stanley employs several measures to ensure the security of client deposits. Client funds are held in segregated accounts, which means they are kept separate from the firm's operational funds. This practice is essential in safeguarding clients' money in the event of financial difficulties faced by the firm.

Additionally, Morgan Stanley is a member of the Securities Investor Protection Corporation (SIPC), which provides limited protection for customers in the event of a brokerage firm failure. SIPC insurance covers up to $500,000 in securities and cash, including a $250,000 limit for cash claims. Furthermore, Morgan Stanley has implemented negative balance protection policies, which prevent clients from losing more than their initial investment in volatile market conditions.

Despite these robust security measures, there have been instances in the past where clients have raised concerns about the handling of their funds. However, the firm has generally responded effectively to such issues, reinforcing its commitment to customer security. Therefore, it can be concluded that Morgan Stanley is safe in terms of customer funds security.

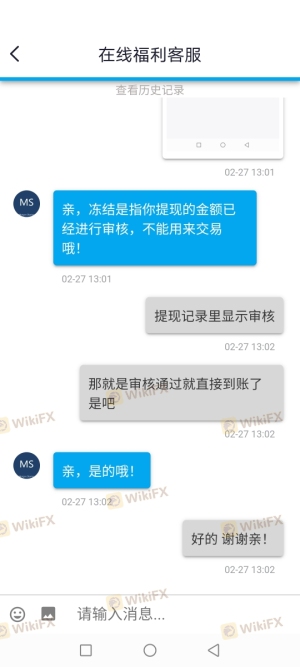

Customer Experience and Complaints

Customer feedback is an essential aspect of assessing the overall safety and reliability of a Forex broker. Morgan Stanley has garnered mixed reviews, with many clients praising its comprehensive services and professional advisors. However, some common complaints have emerged, particularly regarding customer service and response times. Below is a summary of the primary complaint types and their severity ratings:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Customer Service Delays | Moderate | Improved |

| High Fees on Inactivity | Low | Addressed |

| Account Closure Issues | High | Ongoing Review |

One notable case involved a client who faced significant delays in account closure, leading to frustration and financial losses. While Morgan Stanley has made efforts to address these issues, the recurring nature of such complaints raises questions about the consistency of its customer service. Nevertheless, the majority of clients report satisfactory experiences, indicating that while there are areas for improvement, Morgan Stanley is safe for most traders.

Platform and Execution Quality

The trading platform offered by Morgan Stanley is robust, featuring advanced tools for analysis and execution. The platform's performance is generally stable, with users reporting minimal downtime. However, some traders have experienced issues with slippage and order rejections during high-volatility periods. These factors can significantly impact trading outcomes, particularly for those employing high-frequency trading strategies.

The quality of order execution is another critical area of concern. While Morgan Stanley's execution speeds are generally competitive, there have been reports of delays during peak trading hours. Traders should evaluate their trading style and consider whether these execution issues could affect their strategies. Overall, while the platform offers a comprehensive suite of tools, potential users should be aware of the execution quality to determine if Morgan Stanley is safe for their trading activities.

Risk Assessment

Engaging with any Forex broker comes with inherent risks. When evaluating Morgan Stanley, several key risk areas must be considered. Below is a risk assessment summary:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | Low | Strong oversight from SEC and FINRA |

| Customer Service Reliability | Medium | Mixed reviews, with some service delays |

| Market Volatility Impact | High | Potential for losses in volatile conditions |

To mitigate these risks, traders should conduct thorough research, maintain open communication with their advisors, and implement sound risk management strategies. Diversifying investments and setting stop-loss orders can also help protect against sudden market shifts. In conclusion, while there are risks associated with using Morgan Stanley, they are manageable with proper precautions.

Conclusion and Recommendations

In summary, after a comprehensive analysis of Morgan Stanley, it is evident that the firm is a legitimate and reputable player in the Forex market. Regulatory oversight, a solid company background, and strong customer fund security measures contribute to the conclusion that Morgan Stanley is safe for investors. However, potential users should be aware of the mixed customer experiences and consider their trading style when evaluating the platform.

For traders seeking reliable alternatives, firms such as Charles Schwab, TD Ameritrade, and Interactive Brokers offer competitive services and may be worth exploring. Ultimately, the decision to engage with Morgan Stanley should be based on individual trading needs and risk tolerance.

Is Morgan Stanley a scam, or is it legit?

The latest exposure and evaluation content of Morgan Stanley brokers.

Morgan Stanley Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Morgan Stanley latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.