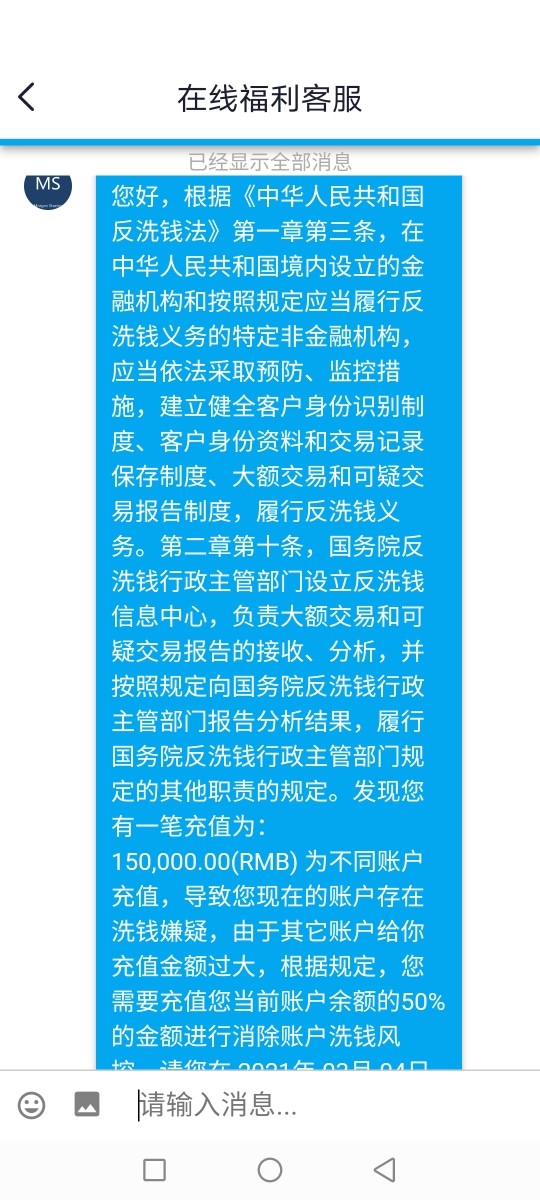

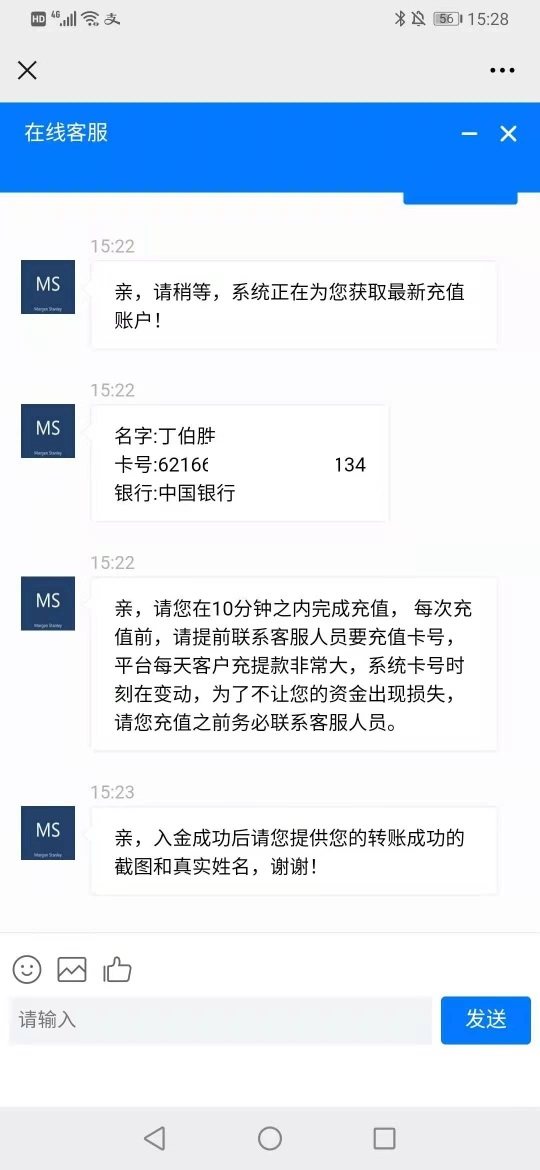

Morgan Stanley's reputation is supported by its long-standing history in financial services; however, scrutiny has arisen over its regulatory adherence. The firm's record reveals discrepancies with various regulatory bodies, including significant alerts regarding its supervisory methods.

- Check SEC Records: Confirm the firm's disciplinary history.

- Consult FINRA's BrokerCheck: Investigate any regulatory actions against individual brokers.

- Read Customer Reviews: Gauge user experiences to identify advice on avoiding potential issues.

Overall user sentiment about fund safety is mixed. Concerns over poor communication and regulatory missteps underscore the importance of thorough verification prior to any client engagement.

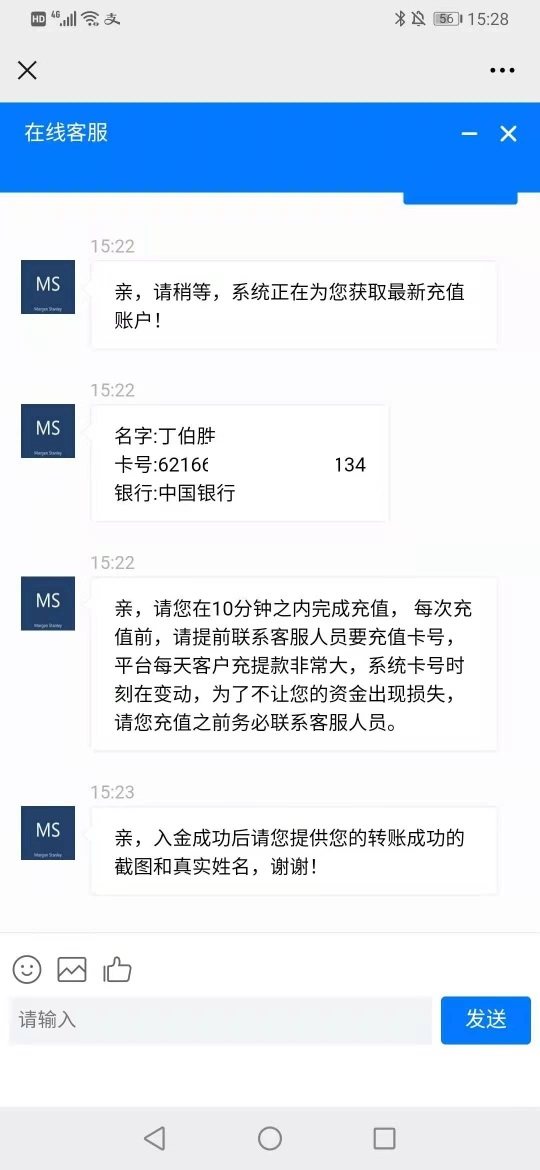

Trading Costs Analysis

The double-edged sword effect.

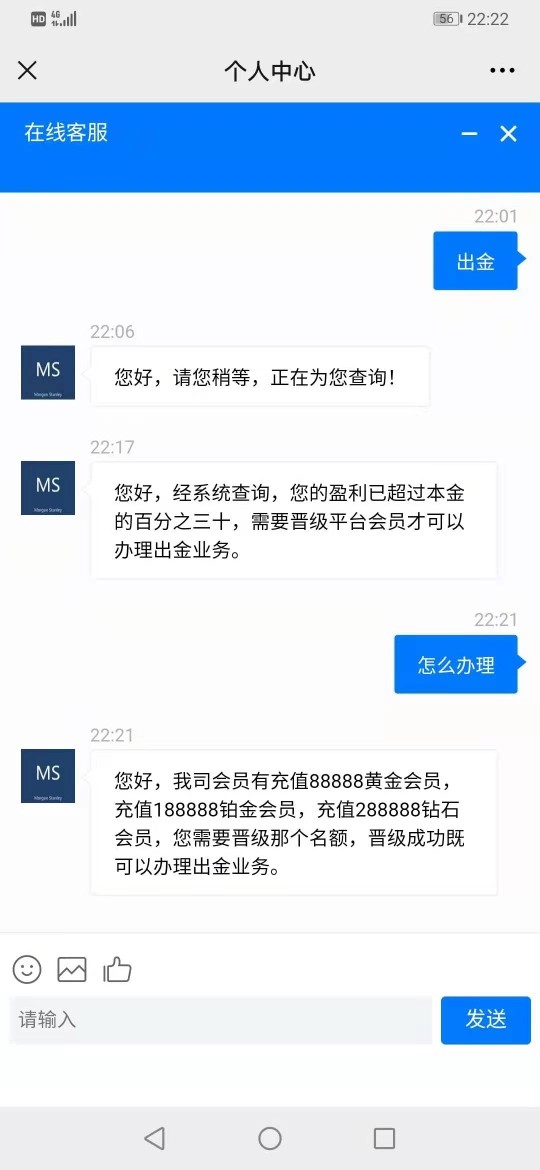

Several positive aspects surround Morgan Stanley's trading cost structure. Their commission cuts allow for competitive pricing compared to other firms; however, the underlying costs are clouded by a host of potential hidden fees.

"Inconsistent customer service and unnecessary charges diminish the overall experience." – User complaint from BBB reviews.

Additionally, clients have echoed sentiments about their accounts being subject to low-balance fees without clear communication about changes to account requirements. Thus, it is crucial for potential customers to read carefully about costs and fees.

Cost Structure Summary:

While Morgan Stanley offers attractive commissions, clients should be attuned to other financial obligations that can add up, significantly impacting net earnings.

Professional depth vs. beginner-friendliness.

Morgan Stanley's trading platforms are robust, featuring advanced tools that support various trading strategies effective for both seasoned traders and newer clients.

The E*TRADE platform, part of Morgan Stanley's services, has been rated highly for user experience and research capabilities, according to Kiplinger's 2022 review. It has achieved recognition not just for mobile functionality but also for the breadth of available financial resources.

Quality of Tools and Resources:

Users can gain insights from extensive market research and various trading calculators, bolstered by Morgan Stanley's institutional knowledge.

In sum, while the platforms are among the industry leaders, first-time users may need additional support to leverage all features efficiently.

User Experience Analysis

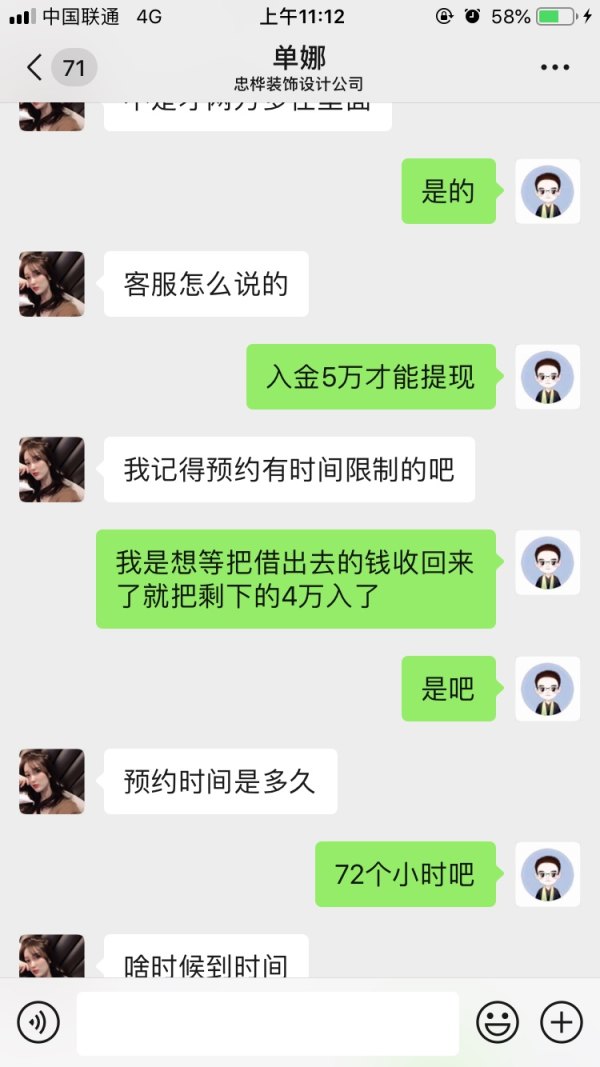

Navigating client relationships.

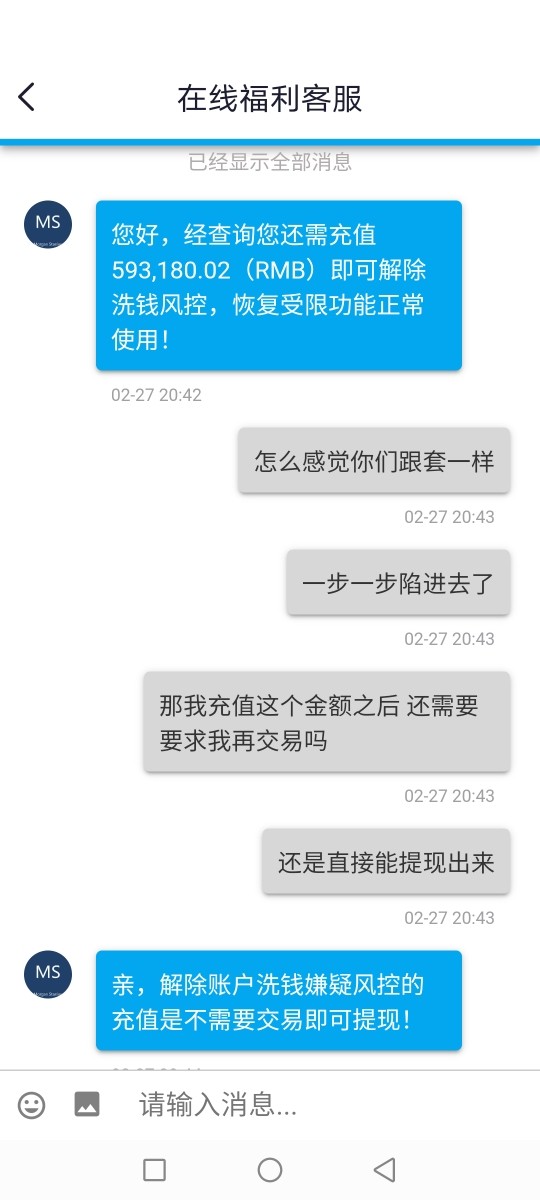

The user experience with Morgan Stanley reveals a stark contrast between technical capabilities and the overall customer service quality. Reviews frequently indicate significant dissatisfaction regarding the responsiveness of client advisors.

In testimonials, numerous clients reported extended waiting times for support and difficulty accessing needed information. This widespread concern paints a more complex picture of user satisfaction than their advanced tool offerings might suggest.

The review on customer sentiment showcases a clear call for improvement in service delivery alongside their advanced technological solutions.

Customer Support Analysis

A critical component of investment.

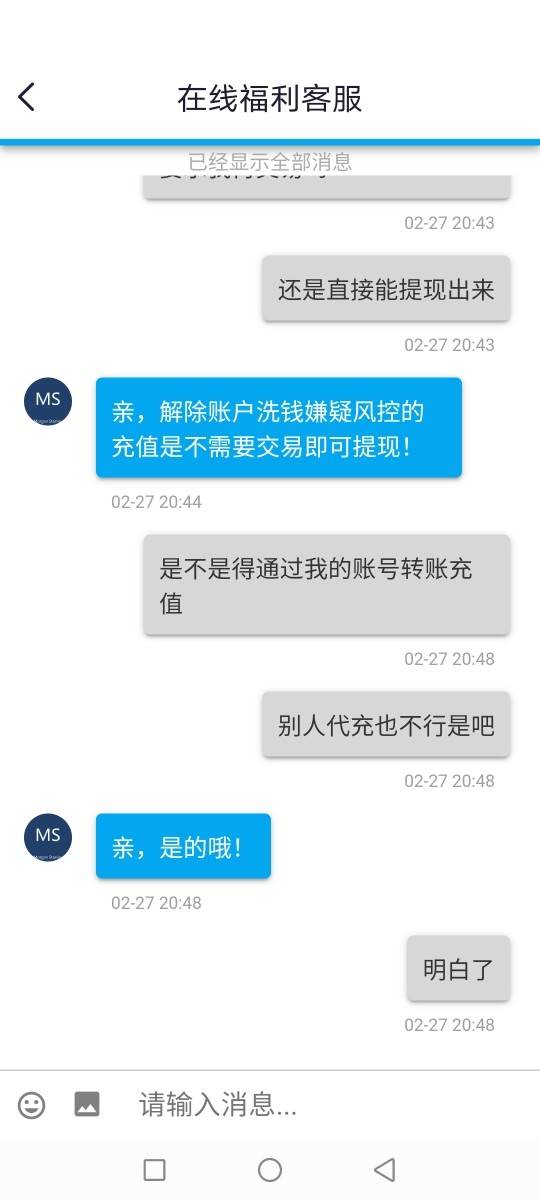

Feedback concerning customer support has been noticeably negative, with users expressing frustration over lengthy wait times and inefficient service during critical account transactions.

"Trying to contact customer service has been a nightmare. The lack of proper support isn't acceptable," lamented a user, reflecting the general consensus from customer complaints on platforms like BBB.

This lack of effective communication may hinder the overall client experience and can exacerbate the effects of the various fees and conditions tied to an investment account.

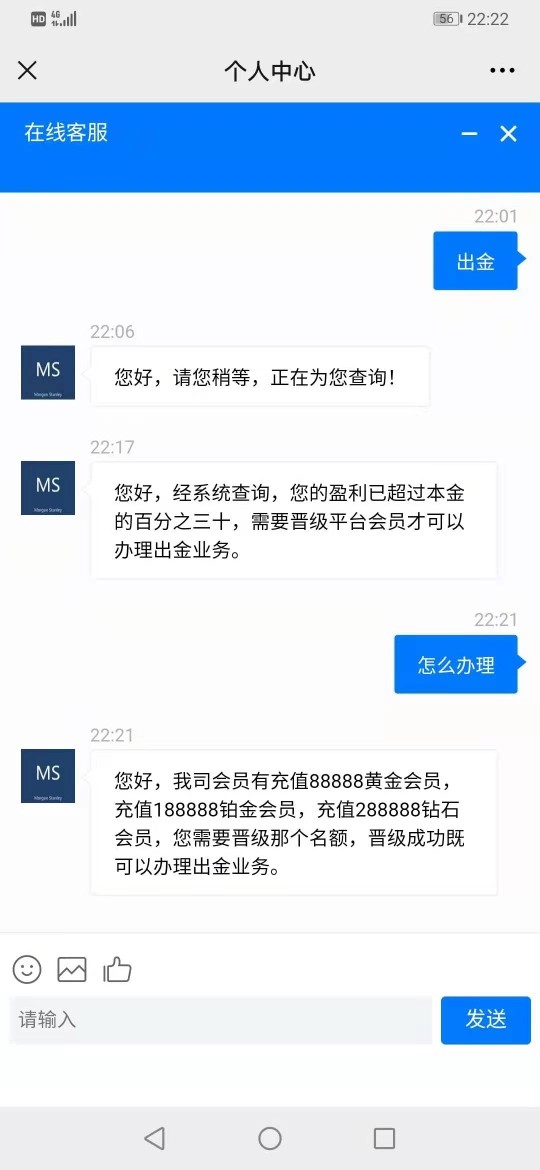

Account Conditions Analysis

Assessing account stability.

Morgan Stanley's account conditions reveal complexity often marked by minimum balance requirements that some customers may find challenging to meet. Such conditions can lead to additional fees, impacting overall account profitability.

Customers have raised specific complaints regarding their experiences with varying account types and associated fees, clarifying the need for prospective clients to understand the terms of their investing relationship clearly.

A transparent dialogue regarding account conditions should be prioritized by the firm to foster better client relationships and satisfaction.

Quality Control

In presenting this review, consideration has been given to potential information conflicts and gaps. Addressing conflicting information is crucial, especially when it pertains to client experiences and regulatory incidents surrounding Morgan Stanley. Both positive and negative user experiences were incorporated to maintain balance and objectivity in this review.

Conclusion

While Morgan Stanley has an esteemed position in the financial services industry, prospective clients must navigate substantial risks related to fees and service quality. Proper diligence, including exploring customer feedback and reviewing regulatory standing, is essential for anyone considering engagement with this heavyweight in the investment world. The 2025 outlook for Morgan Stanley showcases opportunities amid persistent challenges, requiring careful navigation of the complexities involved in investment management.