Is Milliva safe?

Pros

Cons

Is Milliva Safe or a Scam?

Introduction

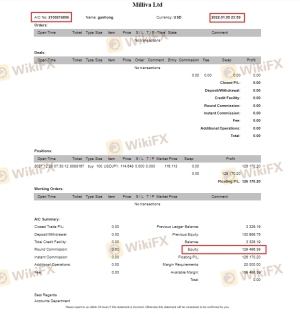

Milliva is a forex broker that claims to provide a robust trading platform for both novice and experienced traders. It markets itself as an award-winning broker with a user-friendly interface and competitive trading conditions. However, the forex market is rife with scams and unregulated entities, making it crucial for traders to conduct thorough due diligence before investing their funds. In this article, we will objectively analyze whether Milliva is a trustworthy broker or if it raises red flags that could indicate fraudulent activity. Our investigation will be based on extensive research, including regulatory status, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

One of the most critical factors to assess when evaluating a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices that protect client funds. Milliva claims to be regulated by the Financial Services Authority of St. Vincent and the Grenadines; however, multiple sources indicate that this claim is unsubstantiated.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | 26892 BC 2022 | St. Vincent & the Grenadines | Not Verified |

The lack of a credible regulatory framework raises serious concerns regarding the safety of funds deposited with Milliva. The Financial Conduct Authority (FCA) in the UK has also issued warnings against Milliva, stating that it operates without proper authorization. This absence of regulation not only puts traders at risk but also suggests that Milliva may not have a legitimate operational framework to protect clients' interests.

Company Background Investigation

Milliva's operational history is shrouded in ambiguity. The broker claims to have been established in 2021, but various reviews suggest that it lacks a transparent ownership structure and management team. The absence of verifiable information regarding its founders and executives further complicates the assessment of its credibility.

Moreover, the company does not provide adequate information about its physical address or corporate structure, which is a common tactic used by fraudulent brokers to evade accountability. Transparency is essential in the financial industry, and Milliva's reluctance to disclose pertinent information raises questions about its legitimacy.

Trading Conditions Analysis

When evaluating the trading conditions offered by Milliva, several aspects warrant attention. The broker advertises a minimum deposit of $100, which is relatively standard in the industry. However, the leverage offered is as high as 1:500, a practice that is often associated with higher risk, especially for inexperienced traders.

| Fee Type | Milliva | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1-2 pips | 1-1.5 pips |

| Commission Model | None (claims) | $5-$10 per lot |

| Overnight Interest Range | Not disclosed | Varies by broker |

The trading costs associated with Milliva appear to be on the higher side, particularly concerning spreads that can reach up to 2 pips. Such fees can significantly impact a trader's profitability, especially for those engaging in high-frequency trading. Additionally, the lack of clarity regarding commission structures and overnight interest rates raises further concerns.

Customer Funds Security

The security of customer funds is paramount when evaluating a forex broker. Milliva does not provide sufficient details about its measures for fund protection. There is no indication that client funds are held in segregated accounts, which is a standard practice among reputable brokers to ensure that client funds are not misused.

Moreover, the absence of investor protection schemes, such as those provided by regulatory bodies like the FCA or ASIC, leaves traders vulnerable to losing their funds in the event of the broker's insolvency. The lack of transparency regarding these security measures further exacerbates the concerns surrounding whether Milliva is safe.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of Milliva indicate a pattern of complaints regarding withdrawal delays and difficulties in accessing funds. Many users report that the broker employs tactics to stall withdrawal requests, which is a common red flag for scam brokers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Misleading Marketing Claims | Medium | Inconsistent |

For instance, one user reported that their withdrawal request took over three months to process, leading to frustration and loss of trust in the broker. Such experiences suggest that Milliva may prioritize acquiring new clients over maintaining existing ones, which raises further concerns about its operational integrity.

Platform and Trade Execution

Milliva offers the widely-used MetaTrader 5 (MT5) platform, which is known for its advanced trading capabilities. However, the quality of trade execution is equally important. Reports suggest that users have faced issues with slippage and order rejections, which can significantly impact trading performance.

The absence of clear information regarding execution speed and reliability raises suspicions about whether Milliva engages in practices that could manipulate trades. Traders should be cautious when choosing a broker, especially one that may not provide a transparent trading environment.

Risk Assessment

Considering the various factors discussed, the overall risk associated with trading through Milliva is high. The lack of regulation, transparency, and consistent customer complaints indicate potential pitfalls for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operates without adequate oversight |

| Financial Risk | High | Potential loss of funds due to mismanagement |

| Withdrawal Risk | High | Reports of delayed or blocked withdrawals |

To mitigate these risks, traders should consider using regulated brokers with a proven track record and transparent operational practices. Conducting thorough research and reading user reviews can also help in making informed decisions.

Conclusion and Recommendations

In summary, the evidence suggests that Milliva is not a safe broker and raises several red flags that indicate potential fraudulent activity. The lack of regulation, transparency issues, and consistent customer complaints point to a high-risk trading environment.

For traders seeking reliable options, it is advisable to consider well-regulated brokers that offer robust investor protection mechanisms. Examples of such brokers include those regulated by the FCA, ASIC, or other reputable financial authorities. By prioritizing safety and transparency, traders can significantly reduce their risk exposure in the forex market.

Is Milliva a scam, or is it legit?

The latest exposure and evaluation content of Milliva brokers.

Milliva Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Milliva latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.