Milliva 2025 Review: Everything You Need to Know

Summary

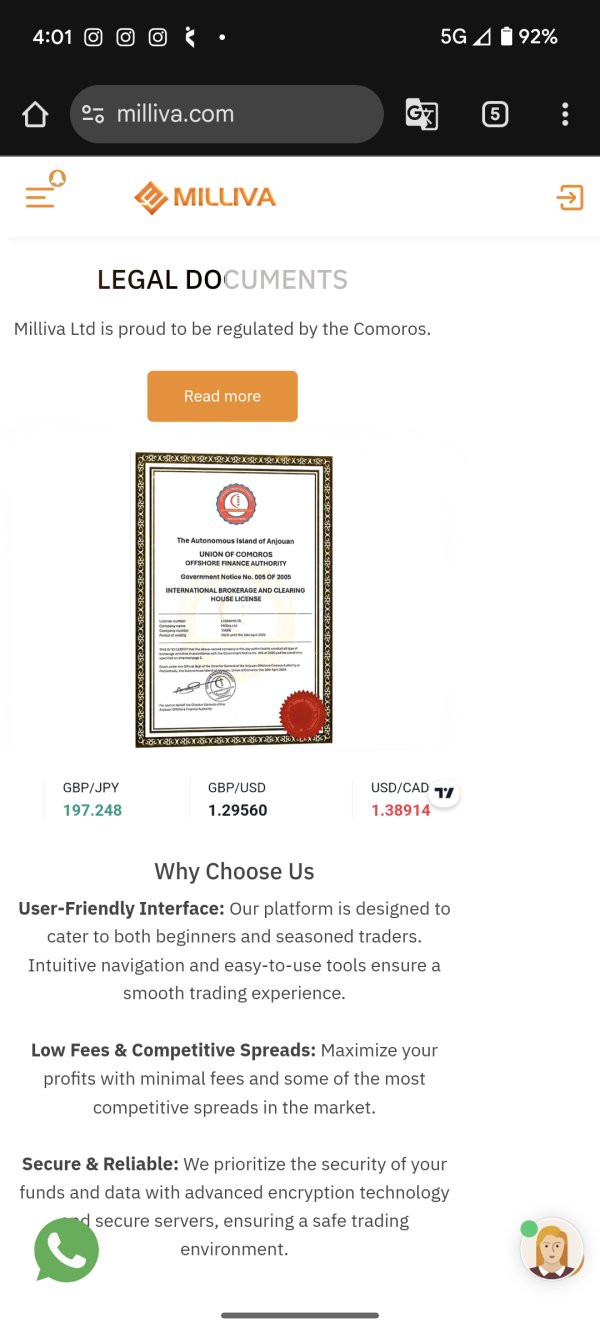

This comprehensive milliva review reveals major concerns about the broker's legitimacy and regulatory status. Milliva operates as an unlicensed forex and CFD broker, which raises serious questions about trader protection and fund security. Despite offering attractive features like leverage up to 1:400 and MetaTrader 5 platform support, the absence of proper regulatory oversight overshadows these benefits completely.

The broker targets both beginner and experienced traders with over 40 forex currency pairs and popular commodities like gold, silver, and oil. However, the extremely limited user feedback on platforms like Trustpilot, combined with warnings about potential fraudulent activity, suggests traders should exercise extreme caution. While Milliva provides mobile trading capabilities and multiple account types, the lack of transparent regulatory information and minimal customer testimonials create substantial red flags for potential clients seeking a reliable trading partner.

Important Notice

This review is based on publicly available information and limited user feedback as of December 2024. Milliva's regulatory status remains unclear across different jurisdictions, and the broker appears to operate without proper licensing in major financial centers. Traders should note that regulatory requirements vary significantly between regions, and what may be permissible in one jurisdiction could violate securities laws in another.

The evaluation presented here reflects information gathered from multiple sources, though comprehensive user experience data remains scarce. Potential clients are strongly advised to conduct independent research and verify all broker claims before committing funds. This assessment may not capture all aspects of client experiences, particularly given the limited volume of verified user reviews available.

Rating Framework

Broker Overview

Milliva positions itself as an online forex and CFD broker designed to serve both novice and experienced traders in the global financial markets. The company operates in the highly competitive retail trading space, offering access to foreign exchange markets and contracts for difference across various asset classes. However, fundamental questions about the broker's corporate structure, founding date, and regulatory compliance remain unanswered in available documentation.

The broker's business model centers on providing leveraged trading opportunities through the popular MetaTrader 5 platform, available on both desktop and mobile devices. Milliva's trading environment supports over 40 forex currency pairs alongside precious metals and energy commodities, targeting traders seeking diversified market exposure. Despite these offerings, the lack of clear regulatory oversight and transparent corporate information significantly undermines confidence in the broker's legitimacy and long-term viability for serious traders.

Regulatory Status: Milliva operates without verified licensing from major financial regulators, creating substantial legal and financial risks for traders. The broker's regulatory page lacks specific authorization numbers or supervisory body affiliations.

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and associated fees remains undisclosed in available materials, raising transparency concerns.

Minimum Deposit Requirements: The broker has not publicly disclosed minimum deposit thresholds for different account types, making it difficult for traders to plan their initial investment.

Promotions and Bonuses: No current promotional offers or bonus structures are detailed in accessible broker documentation.

Available Assets: Trading opportunities include over 40 forex currency pairs, precious metals like gold and silver, and energy commodities like oil, providing moderate diversification options.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs remains unavailable, hindering accurate cost-benefit analysis.

Leverage Options: Maximum leverage reaches 1:400, which may appeal to traders seeking higher market exposure but significantly increases risk potential.

Platform Options: MetaTrader 5 serves as the primary trading platform, accessible via PC and mobile devices, offering familiar functionality for experienced MT5 users.

This milliva review highlights the concerning lack of transparency across multiple operational aspects that serious traders typically require for informed decision-making.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

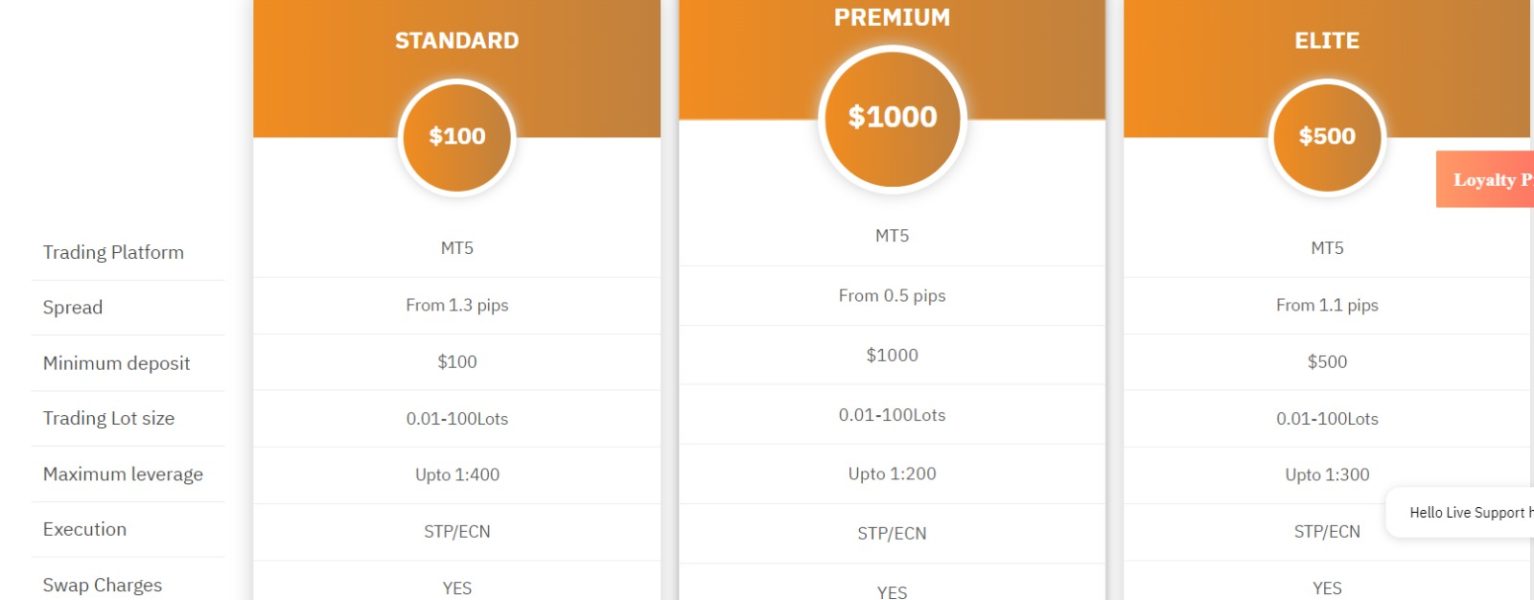

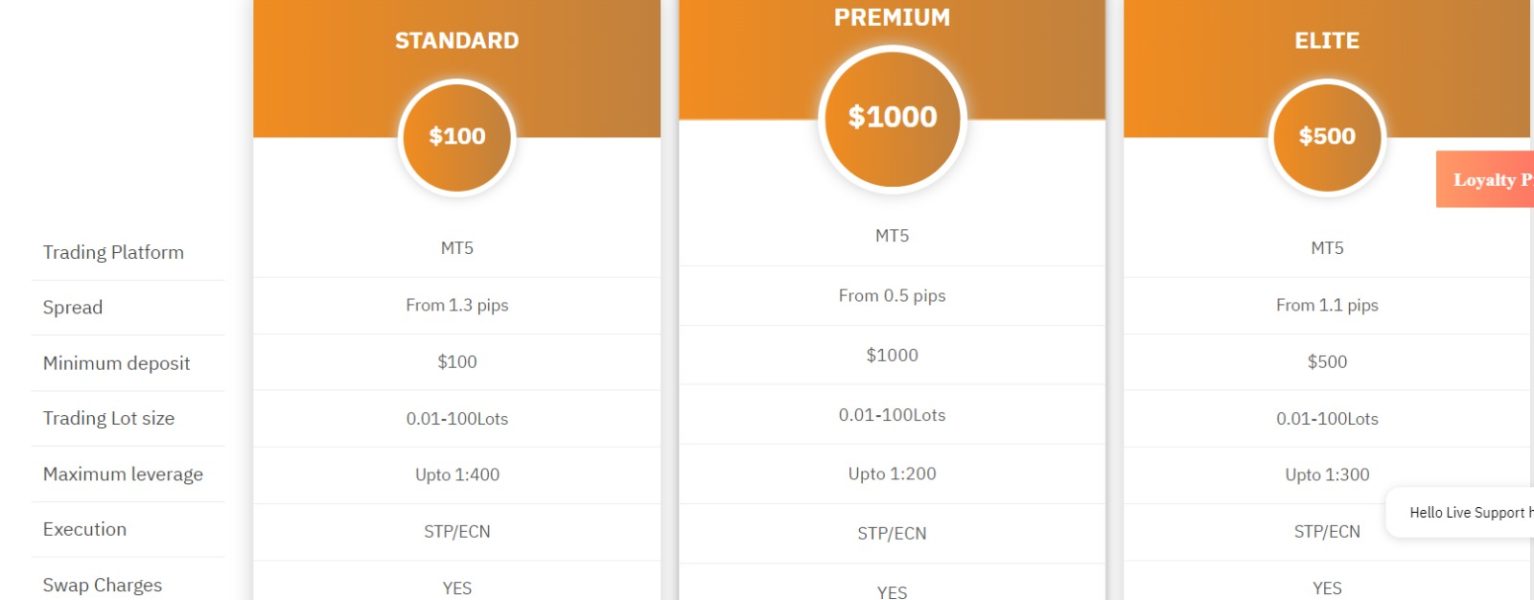

Milliva offers three distinct account types, though specific details about each tier's features, benefits, and requirements remain largely undisclosed. This lack of transparency makes it challenging for potential clients to understand which account structure best suits their trading needs and capital requirements. The absence of clear minimum deposit information further complicates the account selection process.

The broker's account opening procedures are not well-documented, leaving questions about verification requirements, processing times, and documentation needs. Without access to detailed terms and conditions, traders cannot adequately assess account-related fees, maintenance requirements, or potential restrictions. The lack of information about specialized account features, such as Islamic accounts for Muslim traders or professional account classifications, suggests limited accommodation for diverse client needs.

User feedback regarding account conditions remains virtually non-existent, making it impossible to verify the actual account opening experience or ongoing account management quality. This milliva review must note that the absence of transparent account information represents a significant weakness in the broker's service offering.

The broker's trading infrastructure centers around the MetaTrader 5 platform, which provides access to over 40 forex currency pairs along with popular commodities including gold, silver, and oil. MT5's robust charting capabilities, technical indicators, and automated trading support offer familiar functionality for traders experienced with this platform. However, the limited asset selection compared to major brokers may restrict diversification opportunities for sophisticated trading strategies.

Educational resources, market analysis tools, and research materials are notably absent from available information about Milliva's service offerings. The lack of economic calendars, daily market commentary, trading webinars, or educational content suggests minimal support for trader development and market awareness. This absence is particularly concerning for beginner traders who typically require substantial educational support.

Advanced trading tools such as copy trading, social trading features, or proprietary analysis software are not mentioned in available documentation. The platform appears to rely solely on standard MT5 functionality without additional value-added services that distinguish leading brokers in the competitive retail trading market.

Customer Service and Support Analysis (4/10)

Information about Milliva's customer support infrastructure remains conspicuously absent from available materials. The broker has not disclosed specific contact methods, support hours, or response time commitments, creating uncertainty about assistance availability when traders encounter issues. This lack of transparency about customer service capabilities represents a significant concern for traders who may require urgent support during market volatility.

The absence of multilingual support information suggests potential communication barriers for international clients. Without details about support channels such as live chat, phone support, or email ticketing systems, traders cannot assess the accessibility and convenience of customer assistance. Professional trading operations typically require reliable, responsive support, making this information gap particularly problematic.

User testimonials about customer service quality are not available, preventing verification of actual support experiences. The limited overall user feedback makes it impossible to assess response times, problem resolution effectiveness, or staff competency levels that would inform potential clients about service quality expectations.

Trading Experience Analysis (5/10)

Milliva's trading environment relies on the MetaTrader 5 platform, which provides mobile trading capabilities and familiar interface elements for experienced MT5 users. However, specific information about platform stability, execution speed, and order processing quality remains unavailable. Without user testimonials or performance data, traders cannot assess the reliability of trade execution during high-volatility periods or market opening hours.

The broker's order execution model, spread stability, and slippage characteristics are not documented in available materials. Professional traders typically require detailed information about execution quality, re-quote frequency, and liquidity provision to evaluate trading conditions. The absence of this technical information makes it difficult to assess whether the platform meets professional trading standards.

Mobile trading support extends the platform's accessibility, though specific app features, functionality, and performance metrics are not detailed. The lack of user feedback about mobile trading experiences prevents assessment of app stability, feature completeness, and overall usability across different devices and operating systems.

This milliva review must emphasize that the limited technical information available makes comprehensive trading experience evaluation extremely challenging.

Trust and Safety Analysis (2/10)

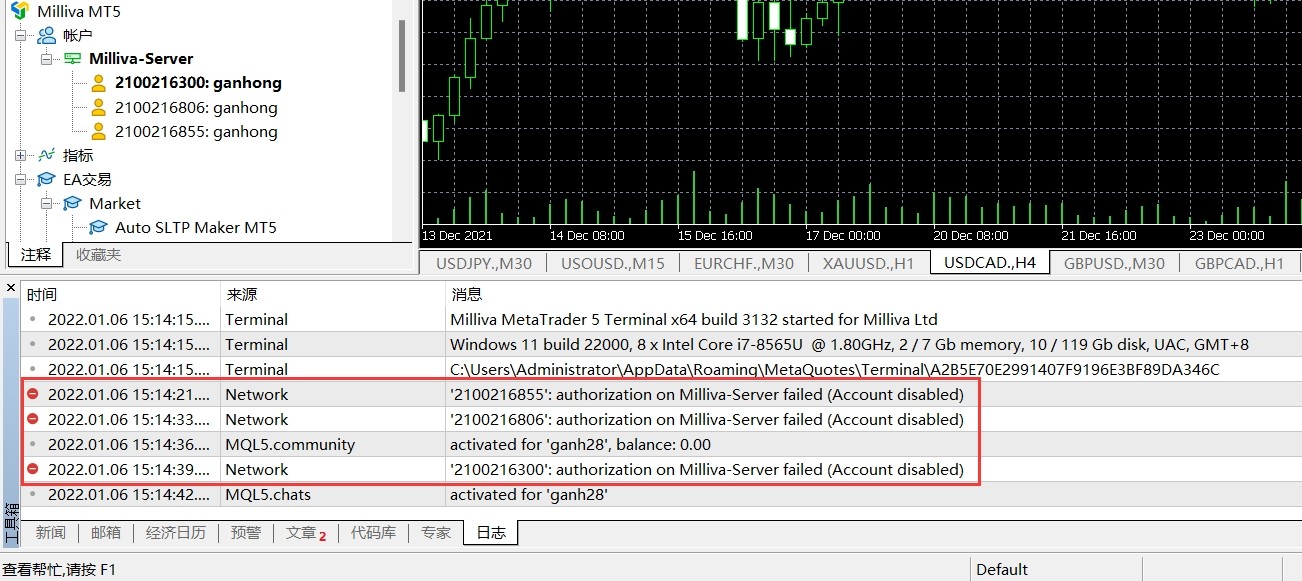

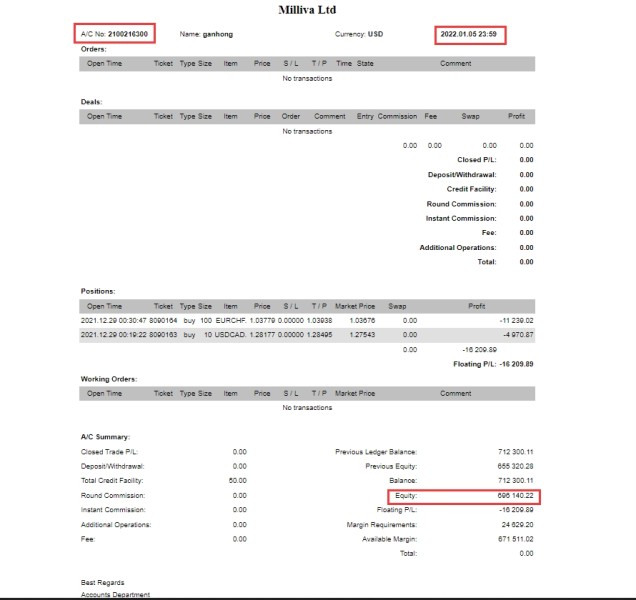

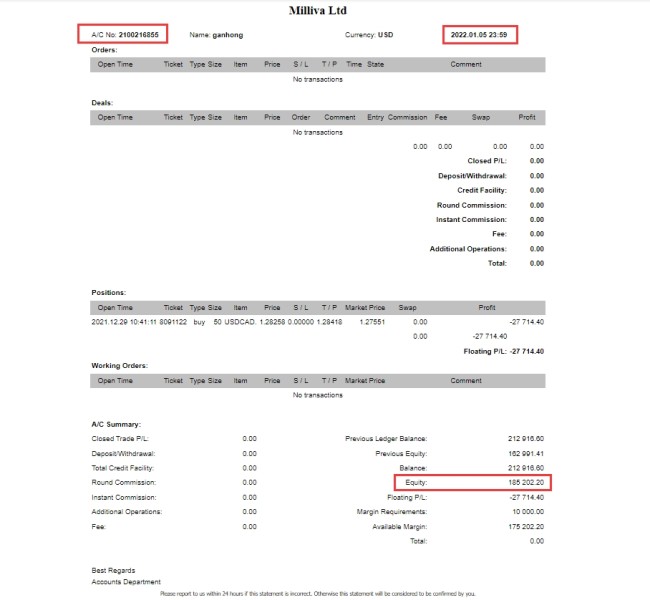

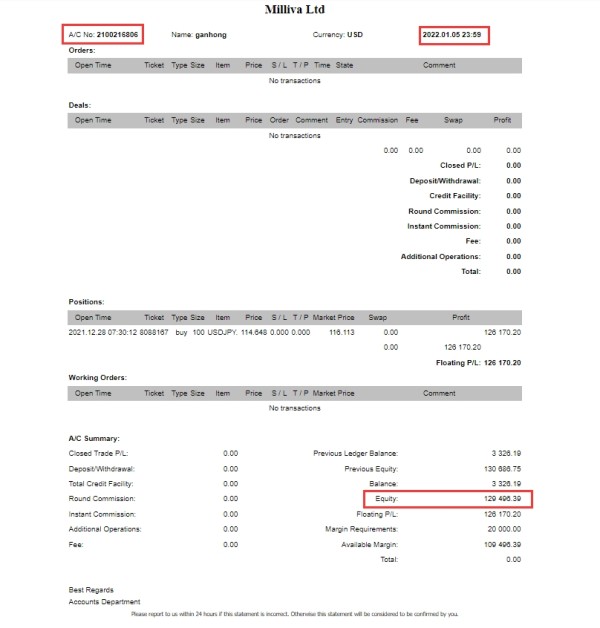

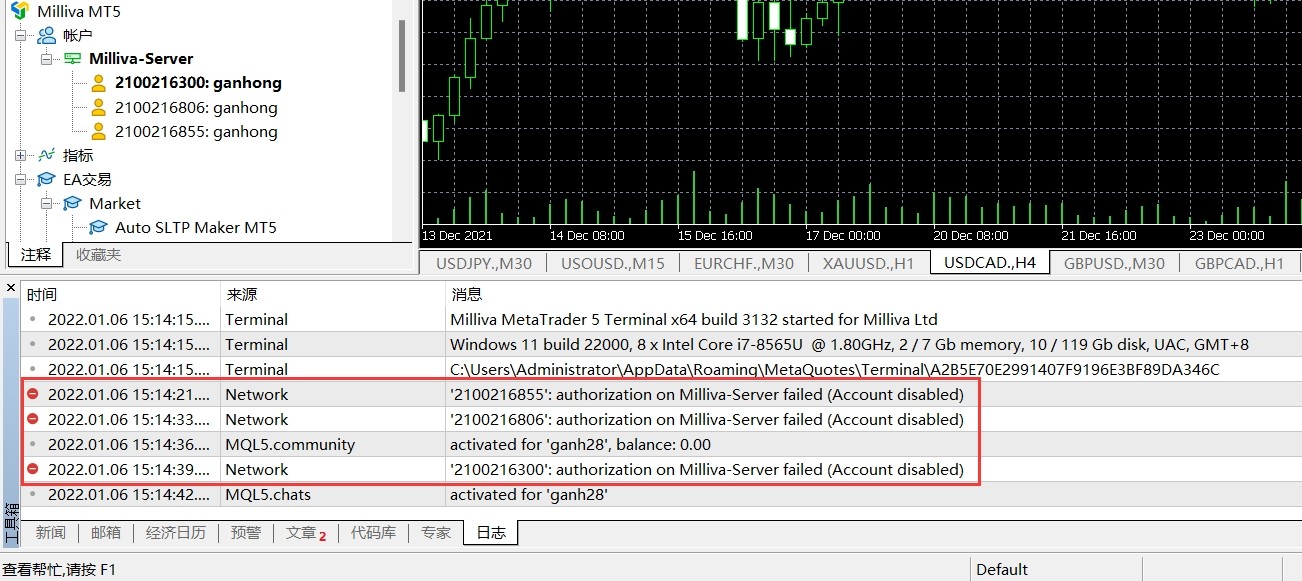

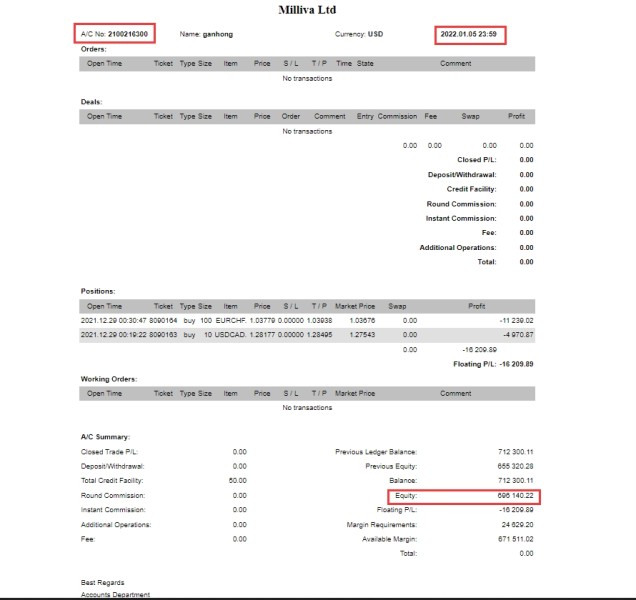

Milliva's most significant weakness lies in its regulatory status, operating without verified licensing from recognized financial authorities. This unlicensed operation creates substantial risks for trader funds, as clients lack regulatory protections typically provided by established financial supervisors. The absence of regulatory oversight means no independent monitoring of business practices, capital adequacy, or client fund segregation.

Fund security measures, including client money segregation, deposit insurance, and negative balance protection, are not detailed in available documentation. Without regulatory requirements mandating these protections, traders face elevated risks of capital loss beyond normal market exposure. The lack of transparency about corporate structure, ownership, and financial reporting further undermines confidence in the broker's stability.

Some sources have flagged potential concerns about the broker's legitimacy, with warnings about possible fraudulent activity. The combination of unlicensed operation, minimal user feedback, and fraud warnings creates a highly concerning risk profile that serious traders should carefully consider before depositing funds.

User Experience Analysis (4/10)

Overall user satisfaction data remains extremely limited, with minimal reviews available on major platforms like Trustpilot. This scarcity of user feedback prevents comprehensive assessment of client experiences across different aspects of the broker's services. The few available reviews do not provide sufficient insight into overall satisfaction levels, common issues, or service quality consistency.

Interface design and platform usability information is largely limited to standard MetaTrader 5 functionality, without details about any custom modifications or enhancements Milliva may have implemented. The registration and account verification processes are not well-documented, leaving questions about onboarding efficiency and user-friendliness for new clients.

Funding and withdrawal experiences, including processing times, fees, and available methods, lack user testimonials or detailed documentation. Without comprehensive user feedback, potential clients cannot assess the practical aspects of account management, fund operations, or ongoing service quality that significantly impact trading experience satisfaction.

Conclusion

This milliva review reveals a broker with significant regulatory and transparency concerns that overshadow its limited positive features. While Milliva offers high leverage up to 1:400 and MetaTrader 5 platform access, the absence of proper licensing and minimal user feedback create substantial risks for potential clients.

The broker may appeal to traders seeking high leverage opportunities, but the lack of regulatory protection makes it unsuitable for serious traders prioritizing fund security and professional service standards. The combination of unlicensed operation, limited transparency, and potential fraud warnings suggests extreme caution is warranted for anyone considering this broker.