Is LZTD safe?

Business

License

Is LZTD Safe or Scam?

Introduction

LZTD, a forex brokerage operating under the name Le Izan Capital Limited, has made its mark in the foreign exchange market by offering a range of trading services. However, as with any financial service provider, it is crucial for traders to conduct thorough due diligence before investing their hard-earned money. Given the prevalence of scams in the forex industry, evaluating the legitimacy and safety of brokers like LZTD becomes essential. This article aims to provide a comprehensive analysis of LZTD's regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on various online reviews, regulatory databases, and user feedback, ensuring a balanced and objective evaluation.

Regulation and Legitimacy

The regulatory status of a forex broker is a fundamental aspect that determines its credibility and safety. A regulated broker is subject to strict oversight, which helps protect traders' interests. In the case of LZTD, the broker claims to operate under a regulatory framework; however, significant concerns have been raised about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | British Virgin Islands | Not Verified |

LZTD is registered in the British Virgin Islands, a jurisdiction known for its lenient regulatory environment. It lacks a valid license from any major financial authority, such as the FCA, ASIC, or CySEC. This absence of regulation raises red flags about the broker's operational practices and the safety of clients' funds. The lack of a credible regulatory framework means that traders may not have access to the protections typically afforded by regulated brokers, such as compensation schemes and clear dispute resolution processes.

Company Background Investigation

LZTD operates under the name Le Izan Capital Limited and claims to have been established in the British Virgin Islands. However, the company's transparency regarding its ownership structure and management team is limited. There is little verifiable information about the individuals behind LZTD, which further complicates the assessment of its legitimacy.

The lack of transparency in a company's operations can be a significant warning sign for potential investors. A credible brokerage should provide clear information about its leadership, including their qualifications and experience in the financial industry. Unfortunately, LZTD does not meet these expectations, leaving potential clients in the dark about who is managing their investments. The absence of a comprehensive disclosure policy raises concerns about the company's commitment to ethical practices and investor protection.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is vital for assessing the overall cost of trading. LZTD offers various trading services, but the specifics of its fee structure and trading conditions require careful scrutiny.

| Fee Type | LZTD | Industry Average |

|---|---|---|

| Spread for Major Pairs | Not Specified | 1.0 - 2.0 pips |

| Commission Model | Not Specified | Varies by Broker |

| Overnight Interest Range | Not Specified | Varies by Broker |

The absence of clear information on trading costs can lead to unexpected expenses for traders. LZTD's failure to disclose its spread, commission structure, and overnight interest rates raises concerns about hidden fees that could significantly affect profitability. Traders should be cautious when dealing with brokers that do not transparently outline their fee structure, as this may indicate an attempt to obscure unfavorable trading conditions.

Customer Funds Security

The security of customer funds is a paramount concern for any trader. LZTD's measures for safeguarding client funds are critical to understanding whether it is a safe broker. A reputable brokerage typically employs various security measures, such as segregating client funds from operational funds, providing negative balance protection, and offering insurance against insolvency.

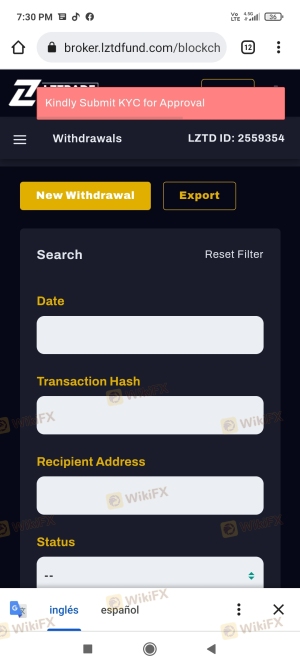

However, LZTD has not provided sufficient information regarding its fund security protocols. The lack of clarity surrounding the segregation of client funds and the absence of investor protection measures suggest that traders may be at risk of losing their investments without recourse. Historical issues related to fund security and disputes with clients further exacerbate concerns about LZTD's credibility.

Customer Experience and Complaints

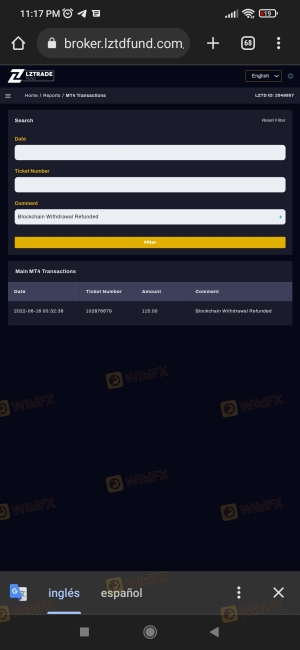

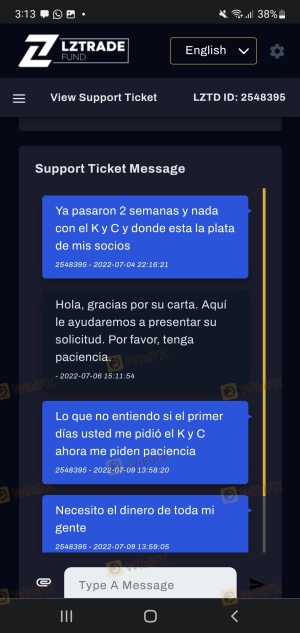

Analyzing customer feedback is essential for understanding the overall experience of traders with a broker. Reviews of LZTD reveal a pattern of dissatisfaction among users, with many reporting difficulties in withdrawing funds and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Misleading Information | High | Poor |

Common complaints include claims that the broker employs aggressive tactics to solicit additional investments while making it challenging to withdraw funds. This pattern of behavior is often associated with fraudulent brokers, raising significant concerns about LZTD's operational integrity. The lack of effective communication from the company in response to these complaints further diminishes trust in the broker.

Platform and Execution

The trading platform is a crucial component of the trading experience, affecting order execution quality and overall user satisfaction. LZTD offers the widely-used MetaTrader 4 (MT4) platform, which is known for its robustness and versatility. However, user experiences with LZTD's execution quality have been mixed.

Traders have reported issues with slippage, delayed order execution, and instances of rejected orders. Such experiences can severely impact trading performance and profitability. Furthermore, any signs of potential platform manipulation should be taken seriously, as they may indicate deeper issues with the broker's operational practices.

Risk Assessment

Engaging with LZTD carries inherent risks that potential traders should consider. The absence of regulation, coupled with a lack of transparency and numerous customer complaints, creates a high-risk environment for investors.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | Potential for fund loss without recourse |

| Operational Risk | Medium | Issues with withdrawal and execution |

Traders should approach LZTD with caution, as the risks associated with this broker may outweigh potential rewards. It is advisable to consider alternative brokers with established regulatory frameworks and positive user feedback to mitigate these risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that LZTD exhibits several characteristics commonly associated with fraudulent brokers. The lack of regulation, limited transparency, and numerous customer complaints indicate that potential traders should exercise extreme caution.

For traders seeking a safe environment to invest, it is advisable to consider regulated brokers with proven track records and robust customer support. Alternatives such as brokers regulated by the FCA, ASIC, or CySEC may provide a more secure trading experience. In light of the findings, it is clear that LZTD is not a safe broker, and potential investors should be wary of engaging with this platform.

Is LZTD a scam, or is it legit?

The latest exposure and evaluation content of LZTD brokers.

LZTD Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LZTD latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.