Ikon 2025 Review: Everything You Need to Know

Ikon Finance has been a notable player in the forex brokerage scene since its establishment in 2010. The broker is regulated by the UK's Financial Conduct Authority (FCA), which is known for its strict regulatory standards. This review synthesizes user experiences and expert opinions to provide a comprehensive overview of Ikon Finance, highlighting its strengths and weaknesses.

Note: It's essential to recognize that Ikon Finance operates under various entities across different regions, which may affect the services and regulations applicable to clients. Therefore, prospective traders are encouraged to verify the specific entity they are dealing with for fairness and accuracy.

Ratings Overview

We rate brokers based on a combination of user feedback, expert analysis, and factual data from multiple sources.

Broker Overview

Founded in 2010, Ikon Finance is headquartered in London, UK. The broker provides access to various financial markets, including forex and CFDs, through platforms like MetaTrader 4 (MT4) and its proprietary Prodigy platform. Ikon Finance is regulated by the FCA, which ensures a level of security for traders, including the segregation of client funds and participation in the Financial Services Compensation Scheme (FSCS).

Detailed Review

Regulatory Areas

Ikon Finance is primarily regulated in the UK by the FCA, which imposes strict guidelines to protect traders. However, the broker's operations might vary depending on the specific entity clients engage with, as indicated in several reviews.

Deposit/Withdrawal Currencies

The broker accepts deposits and withdrawals in several currencies, including USD, GBP, and EUR. Notably, Ikon Finance does not charge additional fees for deposits or withdrawals, which is a positive aspect for traders.

Minimum Deposit

The minimum deposit required to open an account with Ikon Finance starts at $200, which is considered competitive compared to other brokers in the industry. Some accounts, like the Ikon Pro account, require a higher minimum deposit of $1,500.

Ikon Finance offers various promotions, including a loyalty program with a $100 no-deposit bonus for new clients outside the EU. Other promotions include a 30% power bonus and cash rebates for high-volume trading, which can be appealing for active traders.

Tradable Asset Classes

The broker provides access to a range of tradable assets, including forex pairs, commodities, and indices. However, specific details about available instruments are not extensively mentioned on their website, which could be a drawback for traders seeking comprehensive information.

Costs (Spreads, Fees, Commissions)

Spreads at Ikon Finance vary by account type, starting at 0.3 pips for the Ikon Pro account and averaging around 1.3 pips for other accounts. The broker does not charge commissions on most accounts, but the Pro account does incur a commission fee.

Leverage

Ikon Finance offers a maximum leverage of 1:30 for major currency pairs, adhering to FCA regulations. This level of leverage is considered standard among regulated brokers, balancing potential gains with risk management.

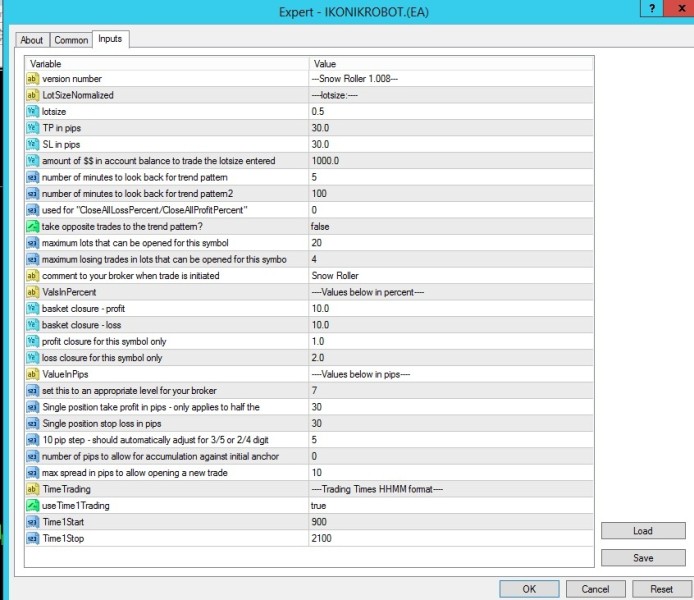

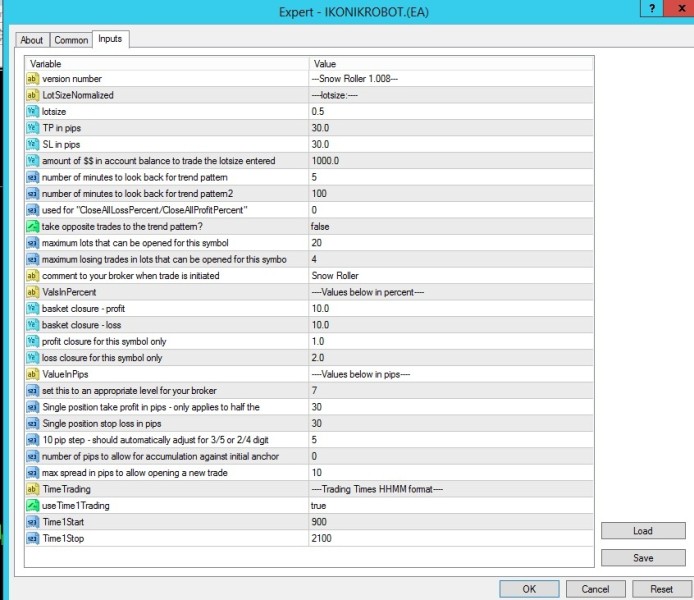

Clients can trade using the popular MT4 platform, known for its robust features and user-friendly interface. The proprietary Prodigy platform also offers advanced trading tools, although some users have noted it lacks the sophistication of MT4.

Restricted Regions

Ikon Finance operates globally but does not accept clients from the United States, Japan, and several other countries due to regulatory restrictions. This limitation may affect potential traders looking to open accounts from these regions.

Available Customer Support Languages

The customer support team at Ikon Finance primarily communicates in English, which may be a limitation for non-English speaking clients. The absence of live chat support has also been noted as a drawback in customer service.

Repeated Rating Overview

Detailed Breakdown

Account Conditions

The various account types offered by Ikon Finance cater to different trading styles. The minimum deposit requirements are reasonable, but higher-tier accounts require significant capital. This flexibility allows traders to choose an account that aligns with their trading strategy.

While Ikon Finance provides access to advanced trading platforms, the educational resources available are limited. Users have expressed a desire for more comprehensive training materials and market analysis tools.

Customer Service

Customer service has received mixed reviews, with some users reporting slow response times and limited support options. The lack of live chat and phone support can hinder effective communication for traders needing immediate assistance.

Trading Experience

The trading experience on Ikon Finance's platforms is generally positive, with users appreciating the fast execution speeds. However, some have noted that the proprietary platform could be improved in terms of user interface and functionality.

Trustworthiness

Ikon Finance's regulation by the FCA adds a layer of trustworthiness, reassuring clients about the safety of their funds. However, the lack of extensive awards or recognitions may raise questions about its standing in the competitive brokerage landscape.

User Experience

Overall, user experiences with Ikon Finance have been mostly favorable, but there are areas for improvement, particularly in customer support and educational resources. The broker's focus on technology and trading tools is a plus, but it needs to address the gaps in user support.

The promotional offerings at Ikon Finance are attractive, particularly for new clients. However, traders should be aware of the terms and conditions associated with these bonuses to avoid any misunderstandings.

In conclusion, the Ikon review for 2025 highlights a broker that offers a balanced trading environment with regulatory backing and a variety of account options. While it has its strengths, particularly in trading technology, areas such as customer support and educational resources require attention for a more holistic trading experience.