Is GTS safe?

Pros

Cons

Is GTS A Scam?

Introduction

GTS, a forex broker that has emerged in the competitive online trading landscape, claims to offer a variety of trading options and advanced platforms. However, in an industry rife with scams and unregulated entities, traders must exercise caution when evaluating the legitimacy and safety of brokers like GTS. This article will investigate GTS's regulatory status, company background, trading conditions, customer experiences, and overall risk assessment to determine whether GTS is a safe trading option or a potential scam. Our investigation is based on a thorough review of various sources, including regulatory databases and customer feedback, to provide a comprehensive analysis of GTS's credibility.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in assessing its legitimacy. GTS claims to operate under several regulatory frameworks; however, a closer examination reveals significant discrepancies. GTS has previously held licenses from the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC). Unfortunately, both licenses have been revoked, raising serious concerns about GTS's compliance and operational integrity. The lack of valid regulatory oversight implies that traders may not have adequate protections in place should disputes arise.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 784199 | United Kingdom | Revoked |

| ASIC | 486229 | Australia | Suspicious Clone |

The revocation of these licenses indicates that GTS has failed to meet the required standards of regulatory compliance. The presence of multiple complaints against GTS, totaling over 141 in recent months, suggests a pattern of concerning behavior that traders should be wary of. Therefore, assessing whether GTS is safe based on its regulatory history highlights a troubling trend of non-compliance, making it a risky choice for potential investors.

Company Background Investigation

GTS was established in 2015 and claims to provide forex trading services primarily in the United Kingdom and Australia. However, the company‘s background is shrouded in ambiguity, with limited information available regarding its ownership structure and management team. The management team’s experience and qualifications are vital in assessing a brokers credibility, but GTS has not provided adequate transparency about its leadership, raising questions about the expertise behind its operations.

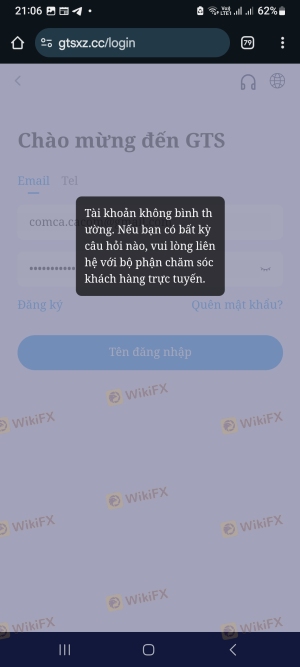

Moreover, GTS's official website has been reported as frequently inaccessible, which is a red flag indicating potential operational issues or a lack of commitment to customer service. Transparency is crucial in the financial services industry, and GTS‘s opacity regarding its operational practices and trading conditions can lead to misunderstandings and mistrust among potential clients. Therefore, when evaluating whether GTS is safe, it is essential to consider the company’s lack of transparency and its implications for potential investors.

Trading Conditions Analysis

Understanding the trading conditions offered by GTS is essential for evaluating its overall value proposition. The broker claims to provide competitive spreads and various trading instruments; however, the specifics remain unclear. The lack of transparency regarding fees and charges is concerning, as many users have reported hidden fees and unexpected charges when attempting to withdraw funds. This is a common tactic employed by scam brokers to limit access to clients capital.

| Fee Type | GTS | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 0.1 - 1.5 pips |

| Commission Model | Not Transparent | Varies by broker |

| Overnight Interest Range | Not Specified | 0.5 - 2.5 % |

The absence of a clear commission structure and vague descriptions of trading costs indicate a potential for exploitation. Traders must be cautious and consider the implications of these trading conditions before proceeding with GTS. The lack of essential information about accounts, leverage, spreads, and commissions further raises the question: Is GTS safe for trading?

Customer Funds Security

The security of customer funds is paramount when evaluating any broker. GTS claims to prioritize the safety of its clients' funds; however, upon investigation, the reality appears less reassuring. GTS does not provide clear information about fund segregation, investor protection schemes, or negative balance protection policies. This lack of clarity raises significant concerns about the safety of client deposits, especially considering the broker's revoked regulatory licenses.

Historical complaints regarding withdrawal issues further highlight the risks associated with trading with GTS. The absence of a robust framework for safeguarding client funds suggests that traders could be at risk of losing their investments without any recourse. Thus, when assessing whether GTS is safe, it is evident that the broker's inadequate security measures pose a significant risk to potential clients.

Customer Experience and Complaints

Customer feedback is a vital component of understanding a broker's reliability. GTS has been subject to numerous complaints, particularly concerning withdrawal issues and customer service responsiveness. Many users have reported frustrations with their inability to withdraw funds, with some waiting months for their requests to be processed. The companys response to these complaints has been deemed inadequate, with many customers feeling ignored or dismissed.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Inadequate |

For instance, an Australian investor reported not receiving their withdrawal request after three months, while another from Hong Kong claimed to have been defrauded, unable to access their funds since 2020. These accounts reinforce the notion that potential clients should carefully consider whether GTS is safe before investing their money.

Platform and Trade Execution

The trading platform offered by GTS is another critical area of evaluation. While the broker claims to provide access to popular trading platforms like MetaTrader 4 and 5, users have reported difficulties in accessing these tools. The platform's performance, stability, and execution quality are essential for a successful trading experience. However, reports of slippage and rejected orders have raised alarms about the platform's reliability.

Additionally, the lack of transparency regarding execution conditions further complicates the assessment of whether GTS is safe for traders seeking a dependable trading environment. Without reliable access to the platform and consistent execution quality, traders may find themselves at a disadvantage.

Risk Assessment

Engaging with GTS presents several inherent risks that potential clients should be aware of. The overall risk associated with trading with GTS is significant, as outlined below:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Revoked licenses indicate potential fraud. |

| Fund Security | High | Lack of transparency regarding fund safety. |

| Customer Service | Medium | Poor response to complaints and issues. |

Given these factors, traders are advised to exercise caution and consider alternative options that offer better regulatory oversight and customer support. If you are contemplating trading with GTS, it is crucial to weigh these risks carefully.

Conclusion and Recommendations

In conclusion, the investigation into GTS reveals numerous red flags that suggest it may not be a safe trading option. The broker's revoked regulatory licenses, lack of transparency regarding trading conditions, and numerous customer complaints raise serious concerns about its legitimacy. Therefore, traders should be cautious and consider whether GTS is safe before making any financial commitments.

For those seeking reliable and regulated alternatives, it is advisable to explore brokers with established reputations and transparent practices. Companies like FXTM, OctaFX, and FP Markets offer better regulatory protection and customer support, making them safer choices for forex trading. Ultimately, the decision to engage with GTS should be made with careful consideration of the significant risks involved.

Is GTS a scam, or is it legit?

The latest exposure and evaluation content of GTS brokers.

GTS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GTS latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.