Is SUNAC safe?

Pros

Cons

Is Sunac Safe or a Scam?

Introduction

In the ever-evolving world of forex trading, the choice of a broker can significantly impact a trader's success. Sunac, a relatively new player in the forex market, has garnered attention for its services. However, the question remains: Is Sunac safe? For traders, it's crucial to conduct thorough evaluations of any broker before committing funds. This article aims to provide an objective analysis of Sunac, assessing its regulatory standing, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a review of multiple online sources and user feedback, following a structured framework that addresses key aspects of broker reliability.

Regulation and Legitimacy

One of the most critical factors in determining whether a broker is trustworthy is its regulatory status. Regulation serves as a safety net for traders, ensuring that brokers adhere to specific standards and practices. Unfortunately, Sunac currently operates without any valid regulatory oversight, which raises significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulatory oversight means that there is no government or financial authority monitoring Sunac's operations, which could expose traders to higher risks. Regulatory bodies typically enforce rules that protect investors, including requirements for transparency, financial reporting, and client fund protection. With no oversight, traders have little recourse in case of disputes or issues with fund withdrawals, which is a common concern with unregulated brokers.

Furthermore, historical compliance issues and a lack of transparency in the broker's operations contribute to the growing skepticism about its reliability. Is Sunac safe? Given its unregulated status, potential clients should exercise extreme caution and consider the risks involved before engaging with this broker.

Company Background Investigation

Sunac, formally known as Sunac Finance Limited, was allegedly incorporated in April 2021 in Hong Kong. Despite its relatively short history, the company has not established a strong reputation within the trading community. The ownership structure remains opaque, with limited information available about the individuals behind the company. This lack of transparency raises red flags regarding the broker's credibility.

The management team's background and professional experience are also crucial indicators of a company's reliability. Unfortunately, details about Sunac's management team are scarce, making it difficult to assess their qualifications and expertise in the financial sector. A broker's management should ideally possess a wealth of experience and a proven track record in forex trading and financial services to inspire confidence among clients.

Moreover, the broker's transparency and level of information disclosure are concerning. The inaccessibility of its official website further complicates the ability to gather relevant information. This opacity can lead to mistrust among potential clients, making it challenging for them to ascertain whether Sunac is safe for trading.

Trading Conditions Analysis

When evaluating a broker, understanding the overall cost structure is essential. Sunac offers various trading services, but the details regarding its fees and commissions are not readily available. This lack of clarity can be detrimental to traders who need to understand the costs involved in their trading activities.

| Fee Type | Sunac | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | 0.5%-2% |

The absence of specific information on spreads, commissions, and overnight fees makes it difficult to compare Sunac's trading conditions with industry standards. Traders should be wary of hidden fees that could erode their profits, especially in an unregulated environment where transparency is lacking.

Additionally, any unusual or problematic fee policies could indicate potential risks. Traders are advised to seek brokers with clear and competitive fee structures, as this can greatly influence their trading performance. Given the current lack of information regarding Sunac's trading costs, potential clients should carefully consider whether Sunac is safe for their trading needs.

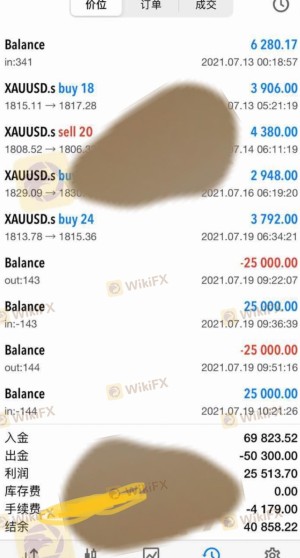

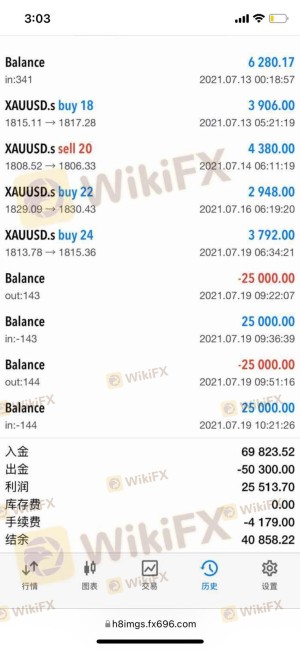

Customer Funds Security

The safety of customer funds is paramount when choosing a broker. Regulated brokers are typically required to implement strict measures to protect client funds, including segregating client accounts and providing investor protection schemes. However, Sunac's lack of regulation raises significant concerns regarding the security of client funds.

Without regulatory oversight, there is no assurance that client funds are held in segregated accounts, which means that the broker could potentially misuse these funds. Furthermore, there is no information available regarding any investor protection or negative balance protection policies. This absence of safety measures increases the risk for traders, as they could potentially lose more than their initial investment.

Additionally, historical issues surrounding fund security and withdrawal problems associated with Sunac further highlight the risks involved. Traders should be particularly cautious when dealing with unregulated brokers like Sunac, as the potential for financial loss is significantly higher. Therefore, it is crucial to ask the question: Is Sunac safe? The evidence suggests that it may not be.

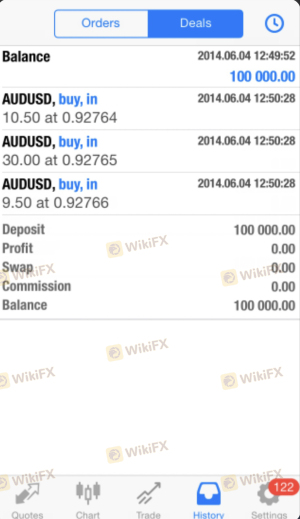

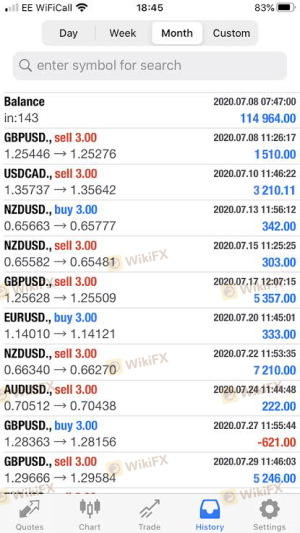

Customer Experience and Complaints

Analyzing customer feedback is vital in assessing a broker's reliability. Reviews and experiences shared by users can provide insights into the company's responsiveness and the quality of its services. Unfortunately, Sunac has received numerous complaints regarding withdrawal issues and unresponsive customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

| Misleading Information | High | Poor |

Common complaints include difficulties in withdrawing funds and a lack of communication from the support team. Many users have reported being unable to access their funds, which is a significant red flag for any broker. The severity of these issues indicates a pattern of poor customer service and operational inefficiencies.

For instance, one user reported waiting weeks for a withdrawal request to be processed, only to receive vague responses from customer support. Such experiences raise concerns about the broker's commitment to its clients and its overall operational integrity. Given these factors, it is reasonable to question whether Sunac is safe for traders who prioritize reliable and responsive customer service.

Platform and Execution

A broker's trading platform is a critical component of the trading experience. It should be stable, user-friendly, and capable of executing trades efficiently. Unfortunately, there is limited information available regarding Sunac's platform performance and execution quality.

Traders need to be aware of potential issues such as slippage and order rejections, which can significantly impact their trading outcomes. If a broker's platform demonstrates poor execution quality, it can lead to increased trading costs and missed opportunities.

Without transparent information regarding execution metrics, it is challenging to determine whether Sunac's platform meets industry standards. Traders should be cautious when engaging with a broker that lacks a proven track record in this area, prompting further scrutiny of whether Sunac is safe for their trading activities.

Risk Assessment

Engaging with any broker involves inherent risks, and it is essential to evaluate these risks comprehensively. Sunac's unregulated status, lack of transparency, and history of customer complaints contribute to a heightened risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Potential misuse of client funds |

| Customer Service Risk | Medium | Poor responsiveness to complaints |

Given these risks, it is crucial for traders to implement risk mitigation strategies. This may include starting with a small investment, thoroughly researching the broker, and considering more established alternatives. The high-risk nature of trading with Sunac suggests that potential clients should exercise extreme caution before proceeding.

Conclusion and Recommendations

In conclusion, the evidence suggests that Sunac may not be a safe trading option for forex traders. Its lack of regulation, transparency issues, and numerous customer complaints raise significant concerns about its reliability and operational integrity. Traders should be particularly wary of the risks associated with unregulated brokers and consider seeking alternatives that offer more robust regulatory protections.

For those looking for safer trading options, it is advisable to consider well-regulated brokers with a proven track record in the industry. Brokers that are overseen by top-tier regulatory bodies can provide a greater level of security and peace of mind for traders. Ultimately, the key takeaway is to prioritize safety and transparency when choosing a forex broker, as these factors are crucial for a successful trading experience.

Is SUNAC a scam, or is it legit?

The latest exposure and evaluation content of SUNAC brokers.

SUNAC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SUNAC latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.