Is Hayes Johnston safe?

Business

License

Is Hayes Johnston Safe or Scam?

Introduction

Hayes Johnston is a forex broker that has positioned itself in the trading market with claims of providing a wide range of trading options and competitive conditions. However, in an industry where the risk of scams is prevalent, it is crucial for traders to conduct thorough evaluations of their brokers before committing their funds. This article aims to analyze whether Hayes Johnston is a safe trading platform or if it raises red flags that suggest it could be a scam. Our investigation is based on a review of regulatory compliance, company history, trading conditions, customer experiences, and overall risk assessments.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most important factors to consider when assessing its legitimacy. A well-regulated broker typically adheres to strict guidelines that protect traders' interests. Unfortunately, Hayes Johnston does not appear to have robust regulatory backing.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Canada | Not Verified |

The absence of valid regulatory information raises concerns about the safety of funds and the overall trustworthiness of Hayes Johnston. The broker has been flagged for having a regulatory index of 0.00, indicating a lack of oversight. This means that traders engaging with Hayes Johnston may be exposed to higher risks, as they lack the protections afforded by regulatory bodies. Furthermore, the company has a business index of 6.98, which is also low, suggesting that its operational practices may not meet industry standards. Given these factors, it is essential for prospective clients to question: is Hayes Johnston safe?

Company Background Investigation

Hayes Johnston Pty Ltd was established approximately 5 to 10 years ago and claims to operate out of Canada. However, the lack of transparency regarding its ownership structure and management team raises further questions about its credibility.

The companys website provides limited information about its history, which is concerning for potential clients seeking transparency. A thorough background check on the management team also reveals no notable experience in the forex industry, which could indicate a lack of expertise in managing a trading platform. Transparency and information disclosure are critical components of a trustworthy broker, and Hayes Johnston falls short in this regard. This lack of information can lead to skepticism about whether Hayes Johnston is safe for traders.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is crucial. Hayes Johnston presents a complicated fee structure that can be confusing for traders.

| Fee Type | Hayes Johnston | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2-4 pips | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Hayes Johnston are significantly higher than the industry average, which could eat into traders' profits. Additionally, the company does not provide clear information on commissions or overnight interest rates, which further complicates the cost structure. Such opacity may indicate that traders could face unexpected fees, leading to a less favorable trading experience. With these trading conditions, the question remains: is Hayes Johnston safe for traders looking for competitive pricing?

Customer Funds Safety

The safety of customer funds is paramount in the forex trading industry. Hayes Johnstons website does not clearly outline its policies on fund security, which raises alarms for potential clients.

The absence of information on fund segregation, investor protection schemes, or negative balance protection indicates a lack of robust safety measures in place. Without these protections, traders may find themselves vulnerable to losses that exceed their initial investments. Historical issues surrounding fund security and disputes have not been disclosed, further adding to the uncertainty. Therefore, it is essential to assess whether Hayes Johnston is safe in terms of safeguarding customer funds.

Customer Experience and Complaints

Analyzing customer feedback is a vital aspect of evaluating a broker's reliability. Reviews of Hayes Johnston reveal a mix of experiences, with several clients expressing dissatisfaction regarding customer service and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Support | Medium | Average |

| High Fees | Medium | Limited |

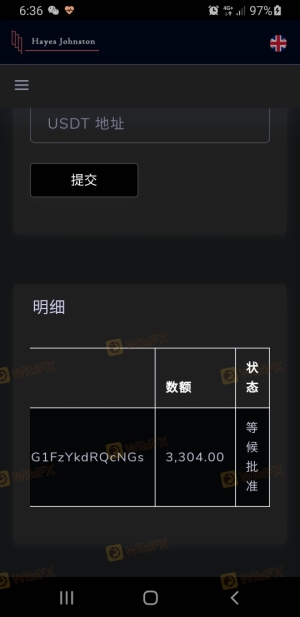

Common complaints include withdrawal delays, which can be a significant red flag for potential scams. Additionally, customers have reported a lack of responsive support, indicating that traders may struggle to resolve issues efficiently. One case involved a trader who faced a prolonged delay in receiving their funds, leading to frustration and a loss of trust in the platform. Given these complaints, it raises the question: is Hayes Johnston safe for traders who value timely support and access to their funds?

Platform and Trade Execution

The trading platform's performance is another critical factor in evaluating a broker. Hayes Johnston offers a trading platform that has been described as functional but lacking in advanced features.

Users have reported issues with order execution, including slippage and occasional rejections of trades, which can be detrimental to trading strategies. The absence of evidence suggesting platform manipulation is a positive aspect, yet the overall experience remains subpar compared to industry standards. Traders seeking a reliable platform may be left wondering if Hayes Johnston is safe for their trading activities given these execution issues.

Risk Assessment

Using Hayes Johnston poses several risks that potential traders should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation raises concerns. |

| Financial Risk | Medium | High spreads and unclear fees. |

| Operational Risk | Medium | Customer service issues reported. |

Considering these risks, traders should approach Hayes Johnston with caution. It is advisable to mitigate these risks by conducting further research and considering alternative brokers that provide more transparency and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Hayes Johnston raises several red flags that could indicate it is not a safe trading option. The lack of regulatory oversight, unclear trading conditions, and negative customer experiences point towards a potentially risky trading environment. For traders seeking a reliable and safe platform, it may be prudent to explore other options with established regulatory frameworks and positive user feedback.

If you are considering trading with Hayes Johnston, it is essential to weigh the risks carefully and seek out alternative brokers that offer better security and transparency. Ultimately, the question remains: is Hayes Johnston safe? The current evidence suggests that it may be wise to proceed with caution and consider more reputable alternatives in the forex market.

Is Hayes Johnston a scam, or is it legit?

The latest exposure and evaluation content of Hayes Johnston brokers.

Hayes Johnston Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Hayes Johnston latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.