Is FXASI safe?

Business

License

Is FXASI Safe or Scam?

Introduction

FXASI is an online forex broker that positions itself within the competitive landscape of the foreign exchange market. With the rise of retail trading, many brokers like FXASI have emerged, promising lucrative trading opportunities. However, the influx of brokers has also led to an increase in scams and fraudulent activities, making it essential for traders to exercise caution when selecting a broker. In this article, we will investigate whether FXASI is a safe trading platform or potentially a scam. Our investigation is based on a thorough analysis of regulatory compliance, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict standards that protect client funds and promote fair trading practices. Unfortunately, FXASI does not hold any licenses from recognized regulatory bodies, which raises significant concerns about its legitimacy. The absence of regulation is a red flag, as unregulated brokers often lack accountability and may engage in unscrupulous practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of oversight means that FXASI operates without the stringent checks and balances that regulated brokers must comply with. This absence of regulation increases the risk for traders, as they have no recourse if issues arise, such as withdrawal problems or fraudulent activities. Furthermore, the absence of a track record of compliance makes it difficult to assess the broker's operational integrity and reliability.

Company Background Investigation

FXASI's history and ownership structure are critical in evaluating its credibility. Unfortunately, there is limited publicly available information regarding the company's founding, development, and ownership. This lack of transparency can be concerning for potential clients, as it makes it difficult to ascertain the legitimacy of the broker. A reputable broker typically provides detailed information about its management team, including their backgrounds and professional experiences.

In the case of FXASI, the management teams credentials are not readily available, which may indicate a lack of transparency. A reliable broker should openly disclose information about its management and operational practices. The absence of such information can lead to skepticism regarding the broker's intentions and reliability. Without a clear understanding of who runs the company, traders may feel uneasy about trusting FXASI with their funds.

Trading Conditions Analysis

Evaluating the trading conditions offered by FXASI is essential for understanding the overall cost of trading with this broker. While the platform may advertise competitive spreads and low fees, it is crucial to dissect the actual costs involved. FXASI's fee structure appears to be opaque, with no clear information regarding spreads, commissions, or overnight interest rates. Lack of transparency in fee structures can lead to unexpected costs, making it difficult for traders to accurately assess their potential profitability.

| Fee Type | FXASI | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 1% - 3% |

In addition to unclear fees, traders should be cautious of any unusual or hidden charges that may arise during their trading experience. Such practices are often indicative of less reputable brokers. If FXASI does not provide a clear and comprehensive breakdown of its trading costs, it may pose a risk to traders who are unaware of the potential financial implications of their trades.

Client Funds Security

The safety of client funds is paramount when evaluating a forex broker. FXASI's lack of regulatory oversight raises serious concerns regarding the security of client deposits. A reputable broker should implement stringent measures to protect client funds, including segregated accounts and investor protection schemes. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, providing an additional layer of security in the event of financial difficulties.

Furthermore, effective investor protection policies, such as negative balance protection, can safeguard clients from losing more than their initial investment. Unfortunately, FXASI does not provide clear information regarding its security measures, which places clients at a higher risk. Historical issues surrounding fund safety, such as complaints about withdrawal difficulties, further exacerbate concerns about the broker's reliability.

Customer Experience and Complaints

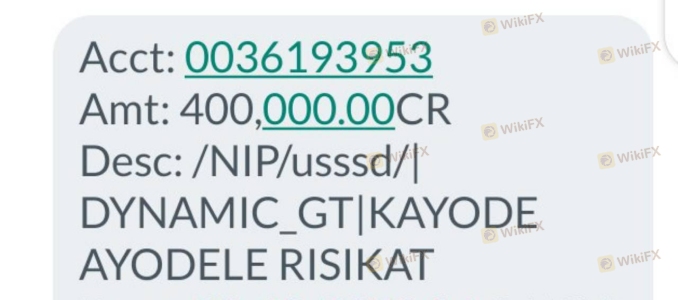

Analyzing customer feedback is crucial in determining the overall reputation of FXASI. A common theme in user reviews is the difficulty in withdrawing funds, which is a significant red flag for any broker. Traders have reported challenges in accessing their funds, often leading to frustration and distrust. The quality of the broker's customer support is also a critical factor; effective communication can mitigate many issues that arise during the trading process.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Moderate |

| Customer Support Delays | High | Poor |

Several users have shared their experiences, indicating that FXASI's response to complaints is often inadequate. For instance, one user reported a prolonged delay in processing a withdrawal request, leading to increased anxiety and distrust. Another user highlighted the lack of transparency in communication, making it difficult to resolve issues effectively. Such patterns of complaints can significantly impact the overall trustworthiness of FXASI.

Platform and Execution

The trading platform's performance and order execution quality are vital components of the trading experience. FXASI claims to offer a user-friendly trading environment; however, without a thorough evaluation, it is challenging to ascertain the platform's reliability. Issues such as slippage, order rejections, and platform manipulation can severely impact a trader's experience and profitability.

Traders should be wary of any signs of platform manipulation, as this can indicate a lack of integrity on the part of the broker. If FXASI fails to provide a stable and efficient trading environment, it may be a cause for concern for potential clients.

Risk Assessment

Utilizing FXASI presents various risks that traders should consider before committing their funds. The lack of regulation, transparency, and customer feedback all contribute to a higher risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | Opaque fee structure and withdrawal issues. |

| Operational Risk | Medium | Potential platform manipulation and execution issues. |

To mitigate these risks, traders should conduct thorough research, consider starting with a minimal deposit, and explore alternative brokers with better regulatory standings and customer reviews.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that FXASI raises several red flags that warrant caution. The absence of regulation, unclear trading conditions, and negative customer experiences indicate that FXASI may not be a safe trading option for most investors. Traders should be particularly wary of the potential for withdrawal issues and the lack of transparency surrounding fees.

For those seeking reliable trading options, it is advisable to consider brokers that are regulated by reputable authorities and have a proven track record of positive customer experiences. Some alternatives include brokers such as IG, OANDA, and Forex.com, which are well-regarded in the industry and offer robust regulatory protections. Ultimately, thorough due diligence is essential for ensuring a safe trading environment.

Is FXASI a scam, or is it legit?

The latest exposure and evaluation content of FXASI brokers.

FXASI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXASI latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.