Is MBA Trading safe?

Pros

Cons

Is MBA Trading Safe or a Scam?

Introduction

MBA Trading is a forex trading and investment company that claims to offer a range of services, including forex training and investment opportunities. Based in Nigeria, it has garnered attention for its promises of high returns, which can attract both novice and seasoned traders. However, the forex market is notorious for its risks, making it crucial for traders to evaluate the legitimacy of brokers before engaging with them. This article aims to assess whether MBA Trading is a safe option or a potential scam by examining its regulatory status, company background, trading conditions, customer safety measures, and user experiences. The investigation is based on a thorough review of online resources, including user reviews and expert analyses.

Regulation and Legitimacy

The regulatory status of a forex broker is vital for ensuring the safety of customer funds and the integrity of trading practices. Unfortunately, MBA Trading operates without any valid regulatory oversight, which is a significant red flag. Below is a summary of its regulatory status:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not regulated |

The absence of regulation means that MBA Trading is not subject to the oversight of any financial authority, which raises concerns about its legitimacy. Legitimate brokers are typically regulated by recognized entities that enforce standards for transparency, client fund protection, and fair trading practices. The lack of such oversight for MBA Trading indicates that traders could be exposed to higher risks, including potential fraud. Furthermore, the company's claims of being regulated by various bodies have been found to be misleading, further amplifying concerns about its credibility.

Company Background Investigation

MBA Trading and Capital Investment Limited was established in Nigeria and has made claims of having offices in the United Kingdom and the United Arab Emirates. However, a deeper investigation reveals that there is little verifiable information about its operational history or ownership structure. The company's website is currently inactive, which raises further doubts about its transparency and reliability.

The management team's qualifications and experience are also unclear, as there is no publicly available information detailing their backgrounds. In a legitimate business environment, transparency regarding management is essential for building trust with clients. The lack of information about the people running MBA Trading adds to the overall uncertainty surrounding the company.

Additionally, the company's claims of providing educational resources and investment opportunities are not backed by verifiable results or testimonials, which is another cause for concern. Given these factors, it is essential for potential clients to approach MBA Trading with caution.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions and fee structures is crucial. MBA Trading has set a high minimum deposit requirement of $1,000, which is significantly above the industry average. This high barrier to entry raises questions about the company's intentions and whether it is designed to attract serious investors or simply to collect funds from clients.

The following table summarizes the core trading costs associated with MBA Trading:

| Fee Type | MBA Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The promised returns of 2.5% to 15% per month are also highly unrealistic in the context of financial markets. Such consistent high returns without verifiable proof or audited trading results may indicate potential fraudulent activities. This combination of high fees and unrealistic return promises is a common characteristic of scams, leading to further skepticism about whether MBA Trading is safe.

Customer Funds Safety

The safety of customer funds is a top priority for any trader. Unfortunately, MBA Trading does not provide adequate information regarding its fund safety measures. There is no clear indication of whether client funds are kept in segregated accounts, which is a standard practice among regulated brokers to protect client investments.

Additionally, there are no investor protection mechanisms in place, such as negative balance protection. This means that traders could potentially lose more than their initial investment, which is a significant risk. Historical data on MBA Trading's operations indicate that there have been allegations of it running a Ponzi scheme, which further complicates the issue of fund safety. Given these factors, it is clear that potential clients should be extremely cautious when considering engaging with MBA Trading.

Customer Experience and Complaints

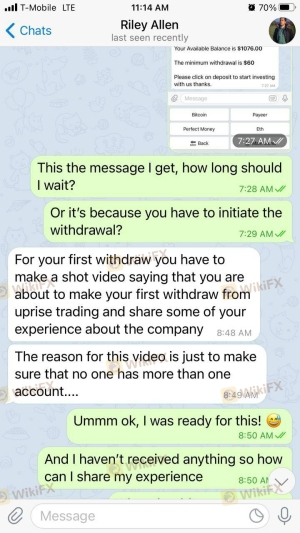

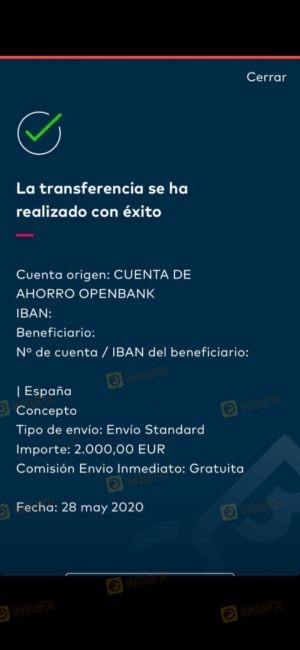

User feedback is a valuable indicator of a broker's reliability and service quality. Unfortunately, MBA Trading has received numerous complaints regarding its operations. Common complaints include issues with withdrawal processes, lack of communication, and unfulfilled promises of returns.

The following table illustrates the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Communication Gaps | Medium | Poor |

| Unrealistic Return Claims | High | Poor |

Many users have reported difficulties in withdrawing their funds, which is a significant concern for any investor. In some cases, users claim they were unable to access their money after making deposits, which raises serious questions about the company's trustworthiness. Such complaints suggest that MBA Trading may not be a safe option for traders looking to invest their funds.

Platform and Trade Execution

The trading platform offered by MBA Trading is a critical aspect of its service. However, reviews indicate that users have experienced issues with platform stability, order execution quality, and slippage. A reliable trading platform should provide seamless execution and minimal slippage, but reports suggest that MBA Trading may not meet these standards.

There are also indications of potential platform manipulation, with some users alleging that their trades were not executed as intended. Such practices are highly unethical and can lead to significant financial losses for traders. Given these concerns, it is essential for potential clients to weigh the risks before engaging with MBA Trading.

Risk Assessment

Engaging with MBA Trading presents several risks that potential clients should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Safety Risk | High | Lack of fund protection measures. |

| Trading Condition Risk | High | High fees and unrealistic return promises. |

| Customer Service Risk | Medium | Poor response to complaints. |

To mitigate these risks, potential clients should conduct thorough research and consider using regulated brokers that offer transparency and security. It is advisable to only invest money that one can afford to lose and to remain vigilant about the signs of potential scams.

Conclusion and Recommendations

In conclusion, MBA Trading raises significant red flags that suggest it may not be a safe option for traders. The lack of regulatory oversight, high minimum deposit requirements, unrealistic return promises, and numerous customer complaints indicate that potential clients should exercise extreme caution. While there is no definitive proof that MBA Trading is a scam, the identified risks and concerns make it a questionable entity in the forex market.

For traders seeking reliable investment opportunities, it is recommended to consider regulated brokers that prioritize transparency and customer protection. Some reputable alternatives include brokers with established regulatory frameworks and positive user feedback. In light of the findings, it is clear that traders need to be very careful when contemplating engaging with MBA Trading, as the risks far outweigh the potential rewards.

Is MBA Trading a scam, or is it legit?

The latest exposure and evaluation content of MBA Trading brokers.

MBA Trading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MBA Trading latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.