CedarFX 2025 Review: Everything You Need to Know

Executive Summary

CedarFX is a new forex broker in the trading world. It offers zero commission trading services that attract traders who want to save money. This cedarfx review shows both good and bad points that potential clients should think about carefully before they open an account.

The broker has great features like high leverage up to 1:500 and access to over 170 assets across many markets. CedarFX makes itself special by mixing zero commission trading with helping the environment through tree planting projects. This appeals to traders who care about the planet and want sustainable investment choices.

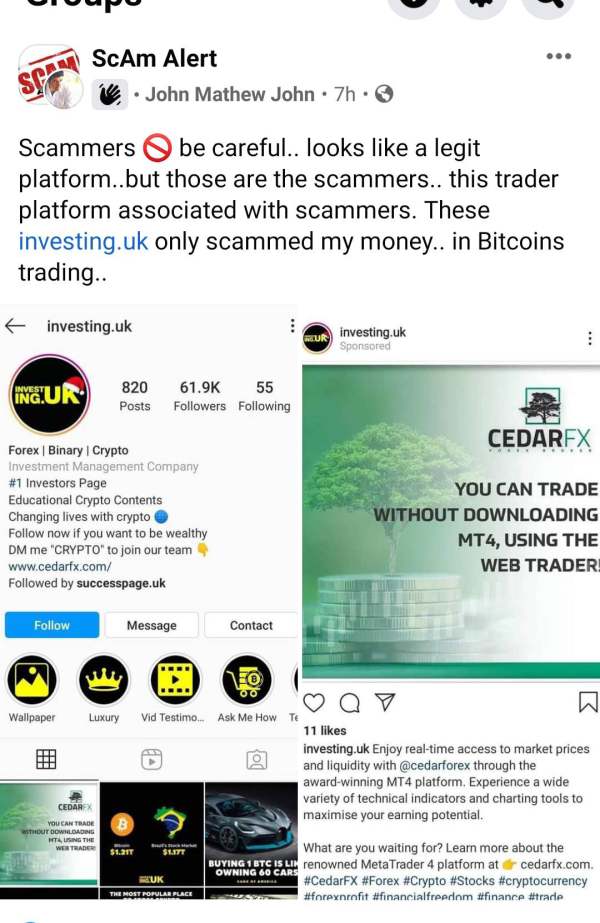

But user feedback shows big problems with how they handle accounts. Many people report that their accounts were closed suddenly on different review websites. These problems, plus the lack of clear information about regulation, make people unsure about whether this broker will be reliable long-term and protect clients properly.

The platform mainly targets traders who want low costs and many different assets to trade. It especially appeals to those who want to help the environment through their trading. While zero commission and high leverage provide clear benefits, the account closure problems and missing regulatory details mean traders should be very careful and do lots of research before choosing this broker.

Important Notice

Different countries have different trading rules, so CedarFX's services and legal compliance change a lot between regions. The information we have doesn't give full details about specific oversight in different areas. This makes it essential for potential clients to check their local regulatory status on their own.

This review uses information that anyone can find and feedback from users collected from many sources. The analysis here is just for information and should not be seen as personal investment advice. Traders should strongly consider doing their own research and think about their individual money situation before making any trading decisions.

Rating Framework

Broker Overview

CedarFX started in 2022 as a forex and CFD broker based in Saint Vincent and the Grenadines. The company has placed itself in the busy online trading market by focusing on zero commission trading services. It tries to be different from regular brokers who usually charge various fees and commissions on trades.

The broker's business plan includes an environmental angle that makes it stand out from regular trading platforms. CedarFX automatically joins reforestation projects, with the company saying that every dollar in commission saved can plant five trees through their partnership with Ecologi. This approach targets traders who care about the environment and want to match their trading activities with sustainability goals while they try to make money.

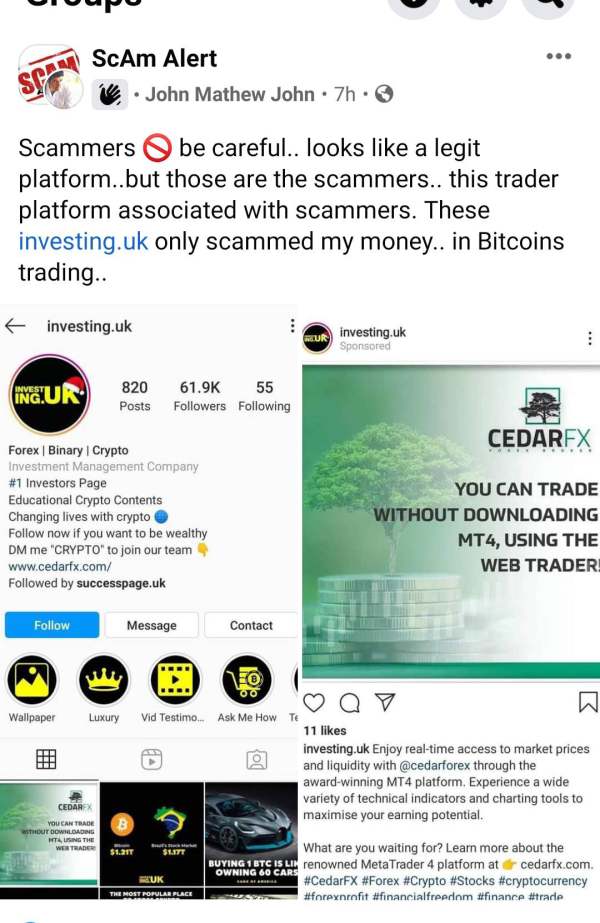

CedarFX works mainly through the MetaTrader 4 trading platform. It provides access to multiple asset types including foreign exchange pairs, cryptocurrencies, stocks, indices, commodities, and precious metals. The broker offers over 170 different trading instruments, giving clients lots of variety in their investment choices. According to available information, this cedarfx review shows that the company wants to serve both new and experienced traders through its wide asset selection and easy platform use.

The regulatory status and oversight of CedarFX stay unclear based on public information we can find. This represents a big consideration for potential clients who are checking if the broker is legitimate and has client protection measures.

Regulatory Oversight: Available information does not name specific regulatory authorities that watch over CedarFX operations. This raises important questions about client protection and fund security measures.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal options is not detailed in sources we can access. This requires direct contact with the broker for complete payment method details.

Minimum Deposit Requirements: The minimum deposit amount needed to open an account with CedarFX is not clearly stated in available documentation.

Promotional Offers: Current bonus programs and promotional incentives offered by CedarFX are not detailed in information sources we can easily find.

Tradeable Assets: The broker provides access to over 170 trading instruments across six major categories. These include foreign exchange currency pairs, cryptocurrency assets, individual stocks, market indices, various commodities, and precious metals including gold and silver.

Cost Structure: CedarFX advertises zero percent commission on trades with competitive spreads. However, specific spread ranges for different instruments are not detailed in available materials. This cedarfx review notes that the zero commission structure represents a main selling point for the broker.

Leverage Ratios: Maximum leverage available reaches 1:500. This provides significant amplification potential for trader positions across supported instruments.

Platform Options: Trading activities happen through the MetaTrader 4 platform. This offers familiar functionality for traders experienced with this industry-standard software.

Geographic Restrictions: Specific regional limitations and restricted territories are not clearly outlined in information sources we can access.

Customer Support Languages: The range of languages supported by CedarFX customer service is not specified in documentation we can access.

Detailed Rating Analysis

Account Conditions Analysis

CedarFX's account structure focuses on its zero commission trading model. This eliminates traditional per-trade fees that many brokers charge. This cedarfx review finds that while this approach provides clear cost advantages for active traders, the lack of detailed information about specific account types and their features creates uncertainty for potential clients.

The broker offers both standard Commission-Free Accounts and Eco Accounts. The latter emphasizes the environmental reforestation component. However, specific differences between these account types are not clearly detailed in available sources, including any varying terms, conditions, or minimum balance requirements.

The absence of published minimum deposit requirements makes it hard for potential clients to plan their initial investment. It also makes it difficult to compare CedarFX with other brokers in the market. This lack of transparency in basic account opening information represents a significant limitation for traders doing preliminary research.

User feedback shows concerning issues with account management. There are particularly reports of sudden account closures without clear explanations. These reports suggest potential problems with the broker's account maintenance policies and client relationship management practices.

Compared to other zero commission brokers in the market, CedarFX's offering appears competitive on the surface. But the limited transparency about account details and negative user experiences about account closures significantly impact the overall value proposition for potential clients.

The trading infrastructure at CedarFX relies mainly on the MetaTrader 4 platform. This provides a familiar and widely-used trading environment for forex and CFD traders. MT4 offers standard charting tools, technical indicators, and automated trading capabilities through Expert Advisors, giving traders access to essential analytical functionality.

With over 170 tradeable assets across multiple categories, CedarFX provides substantial diversity for portfolio construction and trading strategies. The inclusion of traditional forex pairs alongside cryptocurrencies, stocks, indices, and commodities allows traders to diversify their activities across different market sectors and risk profiles.

However, detailed information about additional research and analysis resources is notably absent from available documentation. Educational materials, market analysis reports, economic calendars, and trading tutorials are not clearly outlined. This may disadvantage newer traders who rely on broker-provided educational content for skill development.

The broker's support for automated trading through the MT4 platform provides opportunities for algorithmic trading strategies. Though specific details about any proprietary tools or enhanced automation features are not documented in accessible sources.

The environmental focus through the reforestation partnership represents a unique tool for traders interested in sustainable investing. Though the practical implementation and verification of these environmental contributions are not detailed in available materials.

Customer Service and Support Analysis

Customer service quality represents a significant area of concern based on available user feedback and limited information about support infrastructure. Reports from various review platforms show instances where traders experienced sudden account closures. This suggests potential issues with client relationship management and problem resolution processes.

The specific channels available for customer support are not clearly detailed in accessible information sources. These include phone, email, live chat, or other communication methods. This lack of transparency about support accessibility creates uncertainty for traders who may need assistance with technical issues, account problems, or trading questions.

Response time expectations and service level commitments are not documented in available materials. This makes it difficult for potential clients to understand what level of support they can expect when issues arise. The absence of published support hours and availability also limits traders' ability to plan for assistance needs.

Multiple language support capabilities are not specified in available documentation. This may present barriers for international traders who prefer to communicate in their native languages when dealing with account or technical issues.

The reported account closure issues suggest that when problems do arise, the resolution process may not meet standard industry expectations. This applies to client communication and problem-solving. These concerns significantly impact the overall assessment of customer service quality and reliability.

Trading Experience Analysis

The trading experience at CedarFX centers around the MetaTrader 4 platform. This provides a stable and familiar environment for forex and CFD trading activities. MT4's proven track record in the industry offers traders access to comprehensive charting tools, technical analysis capabilities, and automated trading functionality through Expert Advisors.

However, specific performance metrics about order execution quality are not available in accessible documentation. This includes data on slippage rates, requote frequency, and execution speeds. These technical performance indicators are crucial for traders, particularly those using scalping or high-frequency trading strategies where execution quality directly impacts profitability.

Platform stability and uptime statistics are not documented in available sources. This makes it difficult to assess reliability during volatile market conditions when consistent platform access becomes critical for risk management and position monitoring.

Mobile trading capabilities and the quality of mobile platform implementation are not detailed in accessible information. Though MT4 typically provides mobile app access across iOS and Android platforms. The specific features and functionality available through mobile trading with CedarFX remain unclear.

The trading environment's liquidity provision and spread stability during different market conditions are not documented. This creates uncertainty about trading costs beyond the advertised zero commission structure. Understanding spread behavior during news events and market volatility is essential for comprehensive cost analysis.

Trust and Security Analysis

The trust and security assessment of CedarFX reveals several significant concerns that potential clients should carefully consider. The absence of clear regulatory oversight information represents a fundamental issue for trader confidence and fund security. Regulatory supervision provides essential client protections and operational standards.

Without documented regulatory affiliations or licensing details, traders cannot verify the broker's compliance with established financial services standards. They also cannot confirm the existence of client fund protection measures such as segregated accounts or compensation schemes.

User feedback from various review platforms includes reports of sudden account closures without clear explanations. This suggests potential issues with the broker's client relationship management and transparency practices. These reports raise questions about the broker's approach to client communications and problem resolution.

The company's relatively recent establishment in 2022 means it lacks an extensive operational history. This would allow for comprehensive evaluation of its long-term stability and client service track record. New brokers inherently carry higher risk profiles until they establish proven operational records.

Third-party verification of the broker's environmental claims about reforestation projects is not readily available. This raises questions about the transparency and verifiability of these sustainability initiatives that form part of the broker's marketing approach.

The combination of unclear regulatory status, negative user feedback about account management, and limited operational history significantly impacts the overall trust assessment for this broker.

User Experience Analysis

User experience evaluation reveals mixed feedback with significant concerns about account management practices that impact overall client satisfaction. Reports from multiple users show experiences with unexpected account closures. This represents a serious disruption to trading activities and client relationships.

The account opening and verification process details are not clearly documented in available sources. This makes it difficult for potential clients to understand the requirements and timeline for beginning trading activities. Clear expectations about documentation requirements and approval processes are essential for user planning.

Interface design and platform usability rely mainly on the MetaTrader 4 environment. This provides familiar functionality for experienced traders but may present learning curves for newcomers to the platform. Specific customizations or enhancements made by CedarFX to the standard MT4 interface are not detailed.

Fund management experiences are not comprehensively documented in accessible sources. This includes deposit and withdrawal processes, timelines, and any associated fees or restrictions. User feedback about the efficiency and reliability of financial transactions is limited.

The primary user complaints center around account closure issues. This significantly impacts trader confidence and operational continuity. These reports suggest that the broker's client retention and relationship management practices may not meet industry standards for communication and problem resolution.

The target user profile appears to be traders prioritizing low costs and environmental sustainability. But the reported account management issues may deter users who value operational stability and transparent client relationships above cost considerations.

Conclusion

This cedarfx review presents a complex picture of a broker offering attractive features alongside significant concerns that require careful consideration. CedarFX's zero commission trading structure and high leverage ratios up to 1:500 provide clear advantages for cost-conscious traders. The environmental sustainability focus through reforestation projects offers a unique value proposition for socially responsible investors.

However, the reported account closure issues from multiple users create substantial concerns about operational reliability and client protection. These combine with the absence of clear regulatory oversight information. These factors significantly impact the broker's suitability for traders who prioritize security and transparent business practices.

CedarFX may be most appropriate for experienced traders who understand the risks associated with less regulated brokers. It suits those who prioritize low trading costs over comprehensive client protections. New traders or those seeking maximum security should likely consider more established brokers with clear regulatory oversight and proven track records of client service reliability.

The broker's main advantages include zero commission trading and environmental sustainability initiatives. Its primary disadvantages involve unclear regulatory status and concerning user feedback about account management practices.