BotBro 2025 Review: Everything You Need to Know

Executive Summary

This detailed botbro review looks at a trading platform that has gotten lots of attention in automated trading. BotBro says it's an AI-powered trading robot that helps users make passive income through automated forex trading, but our research shows major concerns about whether the platform is real and safe.

The platform has some nice features like zero commission trading and a low minimum deposit of just $100. BotBro also gives users mobile trading options, which could appeal to people who want automated trading on their phones. But these good points are hidden by serious warning signs that users need to think about carefully.

BotBro goes after people who want automated trading and passive income opportunities. The platform says it uses smart computer programs to help traders at all skill levels. But many sources report fraud claims and bad user experiences, so people should be very careful. The platform connects to scam networks and gets poor trust scores from review sites, making it wrong for most traders, especially beginners who want reliable automated trading.

Important Notice

Regional Entity Differences: Our research shows that BotBro doesn't have proper oversight from regulators, which creates big risks for users everywhere. The lack of clear regulatory information makes us seriously worried about whether the platform is real and if it protects users.

Review Methodology: This review uses detailed analysis of user feedback, market information, and reports from multiple review platforms including TradingGuides, FraudRecoveryExperts, and other industry sources. Since there's limited official paperwork and regulatory filings, this assessment relies heavily on user experiences and third-party investigations.

Rating Framework

Broker Overview

BotBro appeared as an online trading platform that claims to use artificial intelligence and smart computer programs to provide automated trading services. TradingGuides says the platform presents itself as a way to make passive income through forex trading. But the company's background stays mostly hidden, with little transparency about when it started, who owns it, or its business history.

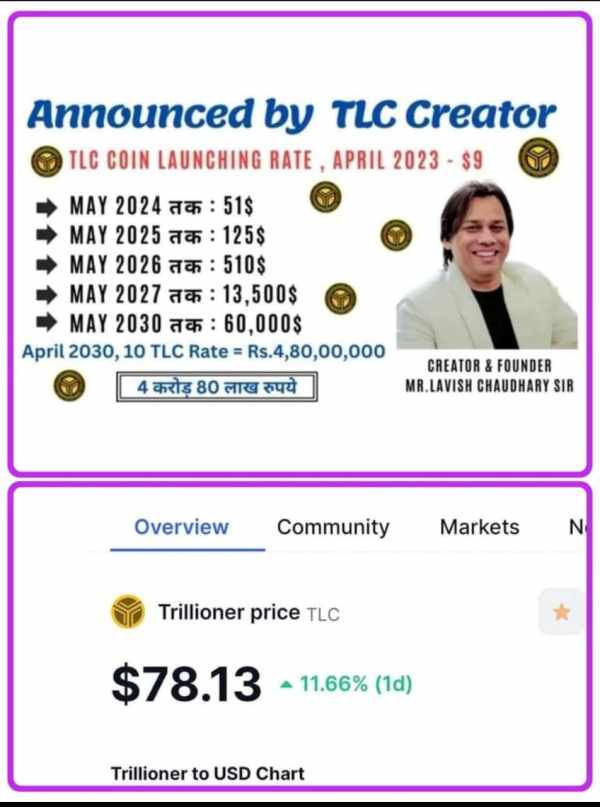

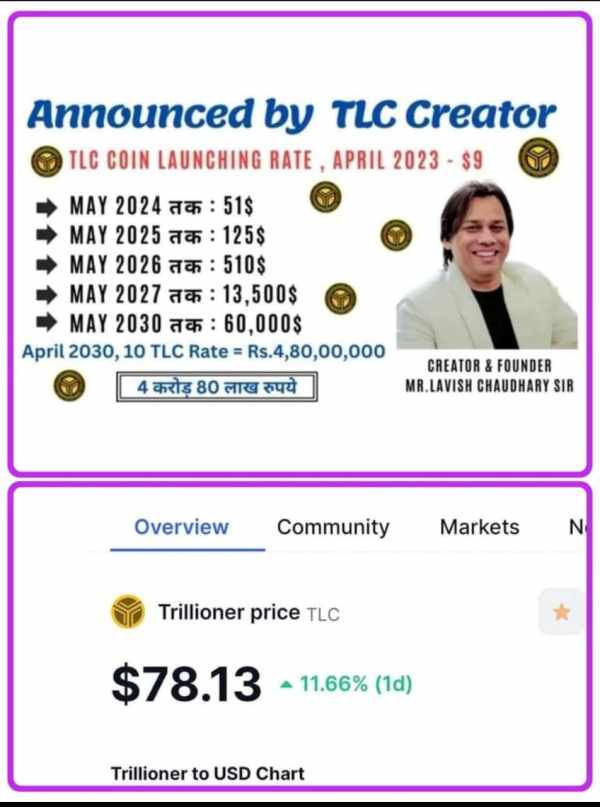

The platform has gotten attention mainly through aggressive marketing that promises high returns and easy passive income. FraudRecoveryExperts reports that BotBro connects to questionable business practices and faces claims of being part of a bigger scam network. The lack of clear company information and regulatory compliance immediately raises red flags about whether the platform is legitimate.

BotBro's business model focuses on automated trading services, specifically targeting forex markets. The platform claims to use advanced computer programs to make trades for users, requiring very little input from the trader. However, this botbro review must stress that such claims are common among fake platforms, and the absence of verifiable performance data or regulatory oversight makes these promises highly suspect.

The platform works without clear regulatory permission from recognized financial authorities, which is a major concern for potential users. This lack of regulatory oversight means users have limited options in case of disputes and no guarantee of fund protection or fair trading practices.

Regulatory Status: Our investigation finds no evidence of proper regulatory permission from recognized financial authorities. This absence of regulatory oversight represents a major risk factor for potential users.

Deposit and Withdrawal Methods: Specific information about payment methods remains unclear in available documentation. The lack of transparent information about funding options is concerning for potential users.

Minimum Deposit Requirement: TradingGuides says BotBro requires a minimum deposit of $100, which seems accessible but may be designed to attract unsuspecting users. The low entry point could be a trap rather than a genuine benefit.

Bonuses and Promotions: Available sources do not provide specific information about promotional offers, though such platforms often use attractive bonuses to lure victims. Many fake platforms use bonuses as bait to get users to deposit money.

Tradable Assets: The platform focuses primarily on forex trading, though the specific range of available currency pairs and other instruments remains unclear in official documentation. This lack of clarity makes it hard for users to know what they can actually trade.

Cost Structure: While TradingGuides reports zero commission trading, this botbro review notes that hidden fees and unfavorable trading conditions are common tactics used by fraudulent platforms to generate revenue. What seems free often costs users money in other ways.

Leverage Ratios: Specific leverage information is not detailed in available sources, raising concerns about risk management and transparency. Users need this information to understand their potential risks and rewards.

Platform Options: The platform offers mobile trading capabilities, though detailed information about desktop platforms or advanced trading tools remains limited. The lack of comprehensive platform options suggests a basic or incomplete service offering.

Geographic Restrictions: Available documentation does not specify regional limitations or availability. This uncertainty makes it unclear where users can legally access the platform.

Customer Support Languages: Specific language support information is not provided in available sources. Users may face communication barriers when seeking help or support.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions offered by BotBro present a mixed picture that ultimately favors caution over optimism. While the platform advertises a relatively low minimum deposit of $100, making it seemingly accessible to a broad range of users, the lack of detailed information about account types and features raises significant concerns.

BotBro does not provide comprehensive information about different account tiers, special features, or account-specific benefits according to available sources. This lack of transparency is particularly troubling in the context of legitimate trading platforms, which typically offer detailed breakdowns of account conditions, fees, and features. The absence of information about Islamic accounts, VIP tiers, or professional account options suggests either a very limited service offering or deliberate hiding of terms.

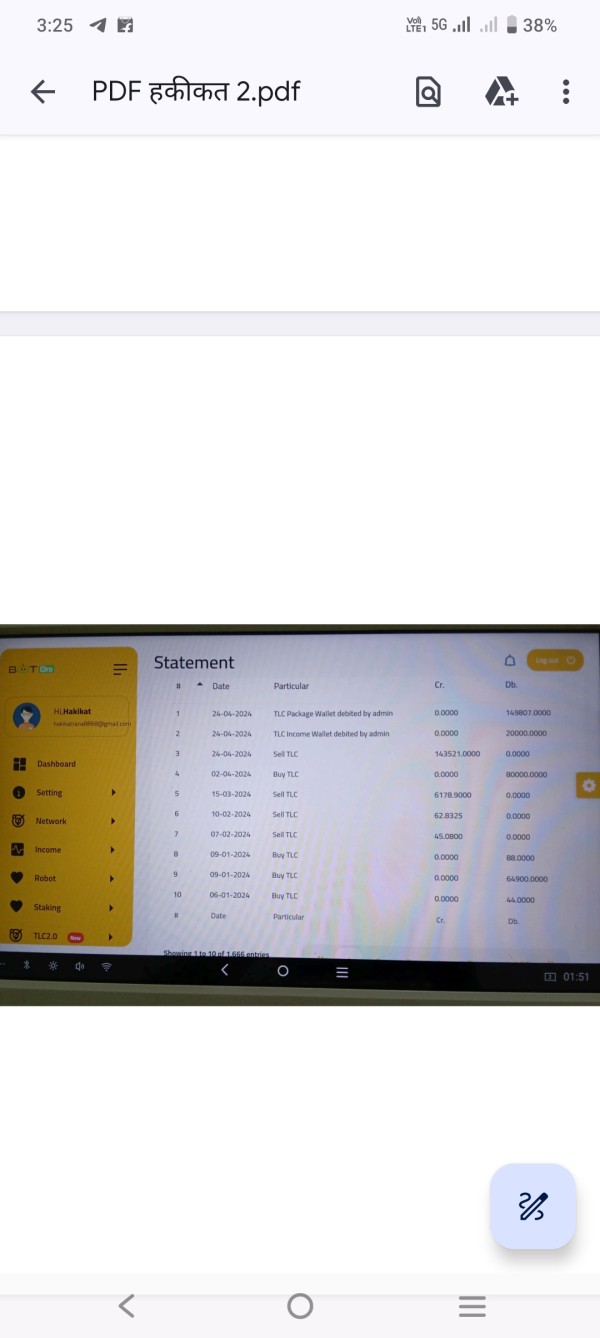

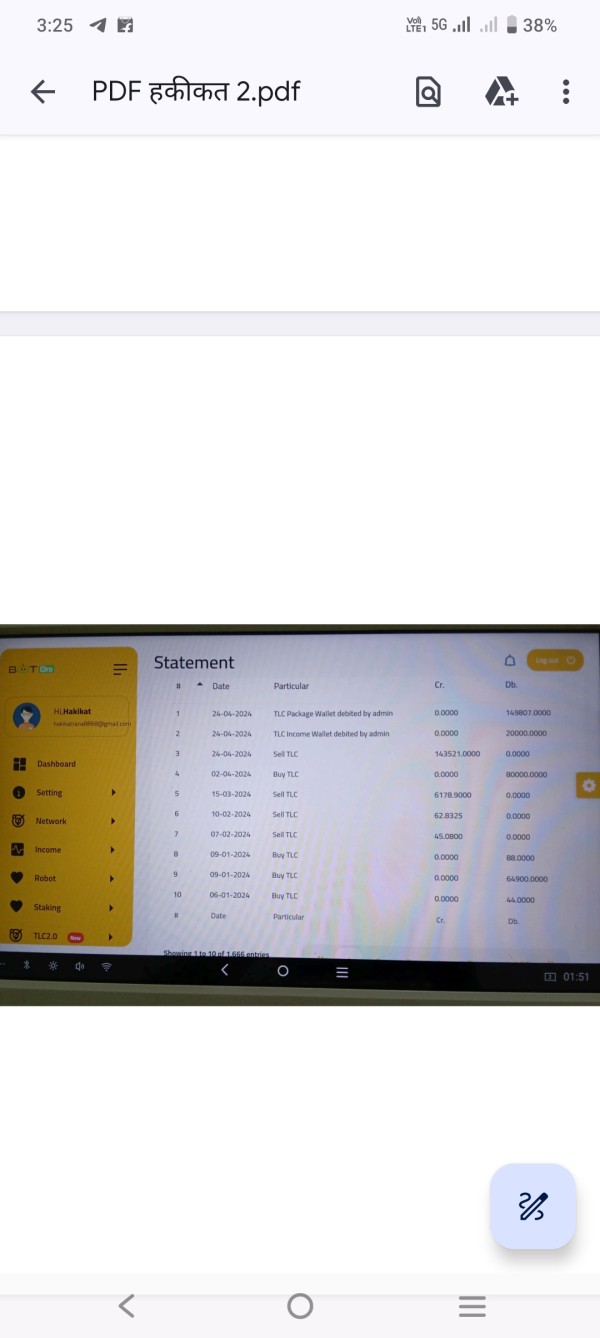

User feedback regarding account conditions has been mostly negative, with many reporting difficulties in understanding the true costs and limitations of their accounts only after depositing funds. The account opening process appears to lack the strong verification and documentation requirements typical of regulated brokers, which while seemingly convenient, actually represents a regulatory red flag. Many users discover hidden restrictions and fees only after they've already committed their money.

This botbro review must emphasize that the seemingly attractive minimum deposit requirement may be designed more to lower barriers for potential victims rather than to provide genuine accessibility. The lack of transparent account documentation and user complaints about hidden conditions contribute to the poor rating in this category.

BotBro's offering of trading tools and resources appears severely limited based on available information. While the platform claims to provide AI-powered trading robots and mobile trading capabilities, the actual depth and quality of these tools remain questionable.

The platform's primary selling point revolves around automated trading algorithms, yet there is no verifiable information about the sophistication, testing, or performance history of these tools. Legitimate algorithmic trading platforms typically provide extensive backtesting data, strategy explanations, and performance metrics. The absence of such documentation from BotBro raises serious questions about the existence or effectiveness of their claimed AI technology.

Educational resources, market analysis, and research tools appear to be minimal or non-existent based on user reports and available documentation. This lack of educational support is particularly concerning for a platform that targets users of all experience levels, as proper education is crucial for successful trading. Users are left to figure things out on their own without proper guidance or learning materials.

User feedback consistently points to disappointment with the platform's tool functionality and the gap between marketing promises and actual capabilities. Many users report that the automated trading features either do not work as advertised or produce consistently poor results, leading to significant losses rather than the promised profits.

Customer Service and Support Analysis (3/10)

Customer service represents one of BotBro's most problematic areas, with numerous user complaints highlighting poor responsiveness, inadequate support, and problematic handling of customer funds. Available sources indicate that users frequently struggle to reach customer support representatives when issues arise.

Response times appear to be inconsistent and often unsatisfactory, with many users reporting delays of days or weeks for responses to critical account issues. This is particularly problematic when users encounter problems with withdrawals or account access, situations that require immediate attention from legitimate brokers. Users often feel abandoned when they need help the most.

The quality of support interactions has been consistently criticized by users, with reports indicating that representatives often provide generic responses or fail to address specific concerns. More troubling are the numerous reports of customer service representatives becoming unresponsive when users attempt to withdraw funds or raise concerns about trading performance. Many users report feeling like they're talking to robots rather than helpful human representatives.

FraudRecoveryExperts and other sources have documented cases where BotBro's customer service has been implicated in deliberately obstructing user attempts to recover their funds, which aligns with typical scam operation tactics rather than legitimate customer support practices. This pattern suggests intentional deception rather than poor service quality.

Trading Experience Analysis (4/10)

The trading experience offered by BotBro falls significantly short of professional standards, with multiple aspects contributing to user dissatisfaction and financial losses. While the platform offers mobile trading capabilities, the overall execution and reliability of the trading environment raise serious concerns.

Platform stability and execution quality appear to be inconsistent based on user reports. Many traders have experienced issues with order execution, slippage, and platform connectivity, though specific technical performance data is not readily available from official sources. The lack of transparent performance metrics is itself a red flag in the trading industry.

The automated trading features, which represent BotBro's primary value proposition, have received particularly negative feedback from users. Rather than generating the promised profits, many users report consistent losses and poor algorithmic performance. The absence of customizable trading parameters or risk management tools further limits the platform's utility for serious traders.

Mobile trading functionality, while present, appears to lack the sophisticated features and reliability expected from professional trading platforms. User interface design and functionality have been criticized as basic and potentially confusing for both novice and experienced traders. Many users struggle to navigate the platform effectively, leading to mistakes and frustration.

This botbro review emphasizes that the trading experience is further compromised by the platform's questionable business practices and lack of regulatory oversight, making any trading activity inherently risky regardless of technical performance. Users risk losing money not just from bad trades, but from the platform itself.

Trustworthiness Analysis (2/10)

BotBro's trustworthiness rating represents the most critical concern for potential users, with multiple sources indicating serious questions about the platform's legitimacy and intentions. The platform has been explicitly identified by FraudRecoveryExperts and other review sources as being associated with scam networks, which represents an immediate and severe trust deficit.

The absence of regulatory authorization from any recognized financial authority eliminates the basic foundation of trust that legitimate brokers establish through compliance and oversight. Without regulatory backing, users have no institutional protection for their funds or recourse in case of disputes. This means users are essentially gambling with their money without any safety net.

Company transparency is virtually non-existent, with limited information available about ownership, operational structure, or physical business locations. This opacity is characteristic of fraudulent operations that seek to avoid accountability and regulatory scrutiny. Legitimate companies are proud to share their credentials and background information.

The platform's industry reputation has been severely damaged by numerous allegations of fraudulent behavior, including reports of fund theft, misleading marketing practices, and deliberate obstruction of user withdrawals. According to available sources, BotBro has received a trust score of only 58 out of 100, indicating significant reliability concerns. This low score reflects widespread user dissatisfaction and concern about the platform's practices.

Third-party investigations and user testimonials consistently point to predatory business practices designed to extract funds from users rather than provide legitimate trading services. The pattern of complaints and the platform's responses align closely with known scam operation methodologies.

User Experience Analysis (3/10)

Overall user satisfaction with BotBro is predominantly negative, with the majority of documented user experiences highlighting frustration, financial losses, and feelings of deception. The trust score of 58 reflects moderate to poor user confidence, though even this rating may be artificially inflated by fake reviews common among fraudulent platforms.

User interface design and platform usability appear to be secondary considerations, with many users reporting confusion and difficulty navigating the platform effectively. The registration and verification processes, while seemingly streamlined, lack the robust security measures expected from legitimate financial service providers. Users often find the platform harder to use than advertised.

The fund management experience represents a particular source of user dissatisfaction, with numerous reports of difficulties withdrawing funds, unexpected fees, and account restrictions that prevent access to deposited money. These issues align with typical scam platform tactics designed to retain user funds regardless of trading performance. Many users report feeling trapped once they've deposited money.

Common user complaints center around the gap between marketing promises and actual results, with many users reporting that the automated trading features consistently lose money rather than generate the promised profits. The platform's handling of these complaints has been characterized as dismissive and unresponsive, further contributing to user dissatisfaction. Users feel deceived by promises that never materialize into real results.

For users seeking automated trading solutions, this botbro review strongly recommends considering regulated alternatives with transparent track records and proper oversight. The risk profile of BotBro makes it unsuitable for users at any experience level who value fund security and legitimate trading opportunities.

Conclusion

This comprehensive botbro review reveals a platform that poses significant risks to potential users and fails to meet basic standards for legitimate trading services. While BotBro may appear attractive due to its low minimum deposit and zero commission structure, these features are overshadowed by serious concerns about the platform's legitimacy, regulatory status, and business practices.

The platform is not recommended for any user category, particularly beginners who may be attracted by promises of easy passive income. Experienced traders should also avoid BotBro due to the lack of regulatory protection and the numerous red flags identified in this analysis. The risks far outweigh any potential benefits the platform might offer.

The main advantages of zero commission trading and accessible minimum deposits are far outweighed by critical disadvantages including lack of regulatory oversight, association with scam networks, poor customer service, and numerous user complaints about fund recovery difficulties. Potential users should prioritize regulated brokers with transparent operations and verified track records over platforms like BotBro that present substantial financial and security risks.