Is FX Sign safe?

Pros

Cons

Is Fx Sign Safe or Scam?

Introduction

Fx Sign is an online forex and CFD broker that has been operational since 2015. With its headquarters purportedly in Saint Vincent and the Grenadines, it positions itself as a platform catering to a diverse range of traders, offering access to forex, commodities, cryptocurrencies, and more. As the forex market continues to attract traders worldwide, the importance of thoroughly evaluating the credibility and safety of brokers like Fx Sign cannot be overstated. Traders need to be vigilant, as the market is rife with both legitimate opportunities and potential scams. This article aims to provide a comprehensive assessment of Fx Sign's safety and legitimacy using a combination of qualitative analysis and structured information.

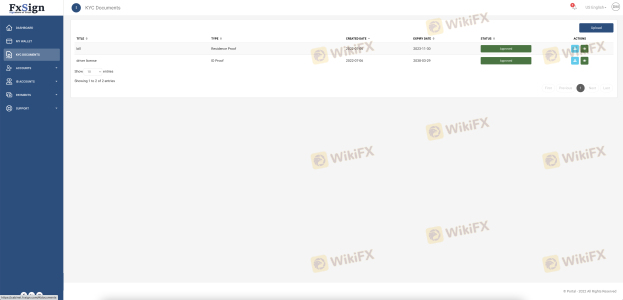

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its legitimacy and safety. Fx Sign claims to be registered with the Financial Services Authority (FSA) of Saint Vincent and the Grenadines. However, the regulatory framework in this jurisdiction is known for being lax, and there is little oversight of financial activities. This raises significant concerns about the broker's operational integrity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | 1740 | Saint Vincent | Not verified |

The SVG FSA does not impose stringent regulations compared to more reputable authorities like the FCA in the UK or ASIC in Australia. Consequently, the lack of a strong regulatory framework can lead to potential risks for traders, as they may not have access to protections typically offered by regulated brokers, such as negative balance protection or compensation schemes in case of insolvency. This absence of robust regulation is a significant red flag when evaluating whether Fx Sign is safe.

Company Background Investigation

Fx Sign was established in 2015, with claims of initial operations in Bulgaria and subsequent expansions into other regions, including the UAE and Turkey. However, the broker's history raises questions about its transparency and legitimacy. The lack of clear information regarding its ownership structure and management team further complicates matters.

When evaluating the management team, it is essential to consider their backgrounds and experience in the financial industry. Unfortunately, detailed information about the individuals behind Fx Sign is scarce. This opacity can be a warning sign, as reputable brokers typically provide comprehensive details about their management and operational structure.

Moreover, the broker's website has undergone changes, including periods where it was listed for sale, which adds to the skepticism surrounding its credibility. In a market where trust is paramount, the lack of transparency and clarity in Fx Sign's operations raises significant concerns about whether Fx Sign is safe for traders.

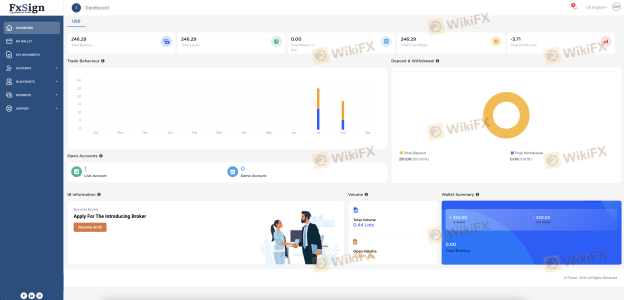

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for assessing its overall value proposition. Fx Sign presents itself with a low minimum deposit requirement of just $1, which may attract novice traders. However, the overall fee structure and trading conditions warrant closer scrutiny.

| Fee Type | Fx Sign | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.3 pips | 1.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | High | Moderate |

While the spreads offered by Fx Sign appear competitive, it is essential to consider the potential hidden costs that may not be immediately apparent. For instance, the broker charges significant fees for withdrawals, which can be as high as 7% for credit card transactions and $39 for wire transfers. These fees can significantly erode trading profits, making it crucial for traders to understand the complete cost structure before engaging with the platform. Such high fees and the potential for unexpected charges raise questions about whether Fx Sign is safe for long-term trading.

Client Fund Security

The safety of client funds is paramount when evaluating a broker's credibility. Fx Sign claims to implement various security measures, including the isolation of client funds and SSL encryption for data protection. However, the lack of a clear policy regarding negative balance protection and investor compensation schemes is concerning.

Traders must be aware that if a broker is unregulated, there is no guarantee that their funds are protected in the event of insolvency or fraudulent activity. Historical complaints regarding difficulties in withdrawing funds from Fx Sign further exacerbate these concerns. In a market where financial security is crucial, the absence of robust measures to protect client funds leads to serious questions about whether Fx Sign is safe to trade with.

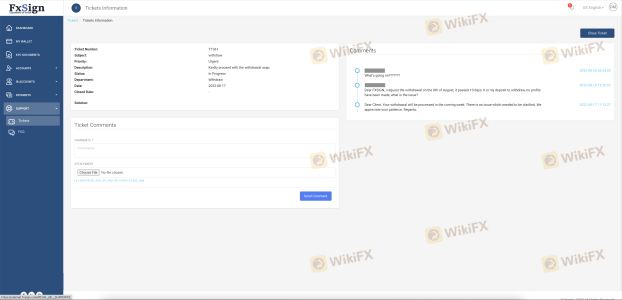

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into the operational quality of a broker. Reviews of Fx Sign reveal a mixed bag of experiences, with a notable number of complaints regarding withdrawal issues and poor customer service. Common themes in these complaints include difficulties in processing withdrawals, high fees, and inadequate responses from customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| High Fees | Medium | Inconsistent |

| Customer Support | Medium | Limited Availability |

For instance, several users report being unable to withdraw their funds despite multiple requests, with some alleging that the broker imposes excessive fees or delays their withdrawal requests without explanation. Such patterns of complaints raise significant concerns about the reliability and trustworthiness of Fx Sign, leading to further skepticism about whether Fx Sign is safe for traders.

Platform and Trade Execution

The trading platform is a critical component of a broker's offering, and Fx Sign utilizes the widely recognized MetaTrader 5 (MT5) platform. While MT5 is known for its robust features and user-friendly interface, the overall performance of Fx Sign's execution quality warrants careful evaluation.

Reports from users indicate mixed experiences regarding order execution, with some traders experiencing slippage and delays during volatile market conditions. Additionally, the absence of transparent information about the broker's order execution policies raises concerns about potential manipulation or unfair practices. In an industry where execution speed and reliability are crucial, any signs of issues can lead to doubts about whether Fx Sign is safe for trading.

Risk Assessment

Trading with Fx Sign involves several risks that traders should carefully consider. The broker's lack of regulation, high withdrawal fees, and mixed customer feedback contribute to an elevated risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Financial Risk | Medium | High fees and withdrawal issues may affect profitability. |

| Operational Risk | Medium | Mixed execution quality and customer service issues. |

To mitigate these risks, traders should conduct thorough research, consider using a demo account to familiarize themselves with the platform, and be cautious with the amount of capital they invest. It is advisable to limit exposure and consider alternative, more regulated brokers to ensure a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence presented raises significant concerns about the safety and legitimacy of Fx Sign. The lack of robust regulation, high fees, and a mixed reputation among customers suggest that traders should approach this broker with caution. While Fx Sign offers a low entry point and a popular trading platform, the potential risks associated with trading on this platform cannot be overlooked.

For traders seeking a reliable and safe trading environment, it is advisable to consider alternatives that are well-regulated and have a proven track record of transparency and customer satisfaction. Brokers regulated by reputable authorities like the FCA or ASIC can provide a higher level of security for traders. Ultimately, the question remains: Is Fx Sign safe? Based on the available evidence, it is prudent for traders to exercise caution and seek out more trustworthy options.

Is FX Sign a scam, or is it legit?

The latest exposure and evaluation content of FX Sign brokers.

FX Sign Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FX Sign latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.