- Stay updated on changes:

- Regularly check financial news regarding FX Sign or other concerned brokers.

Industry Reputation and Summary

User feedback regarding FX Sign reflects widespread concerns about fund safety and withdrawal complications. A notable user remarked:

"I struggled for months to withdraw my money. The fees were exorbitant, and support was nonresponsive."

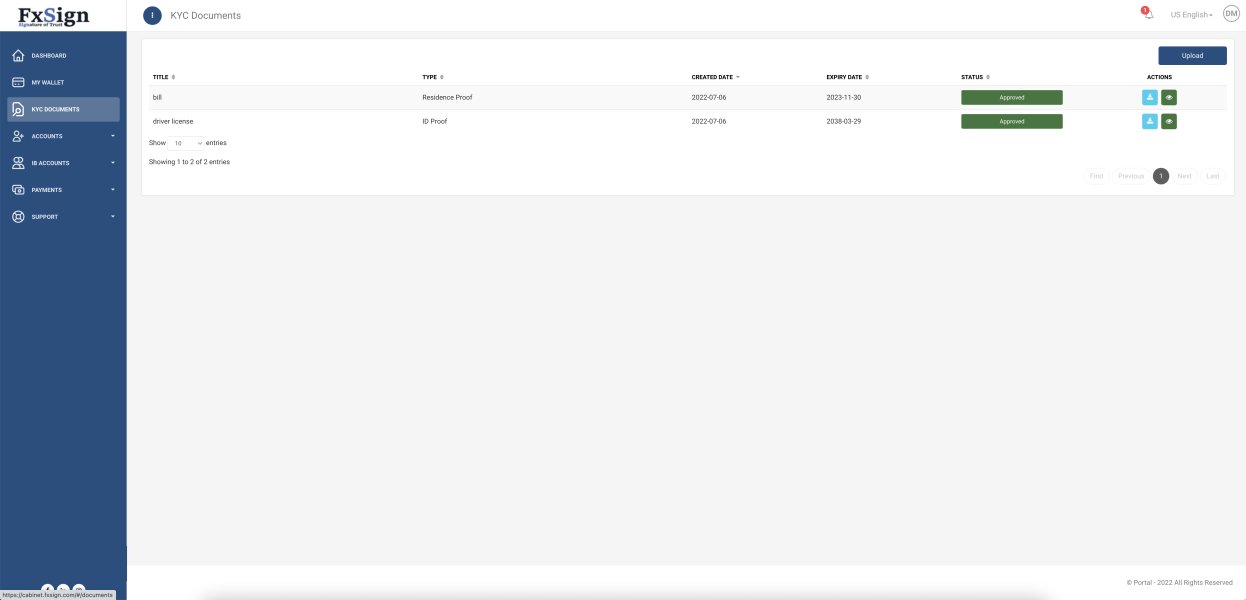

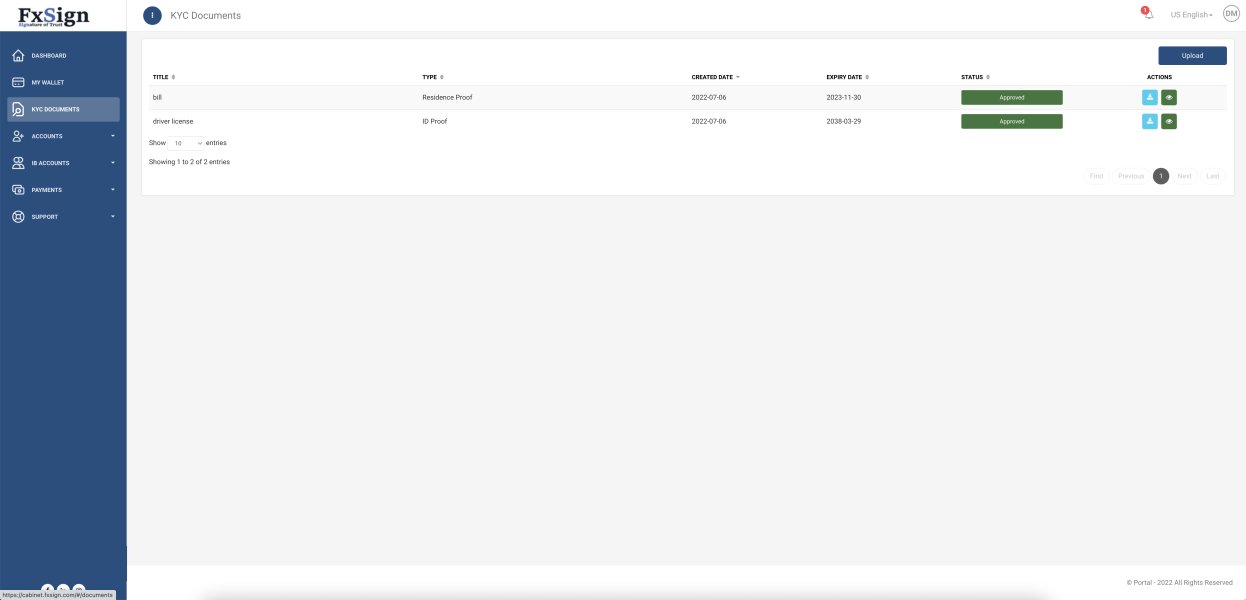

The importance of self-verification cannot be overstated in the current regulatory landscape.

Trading Costs Analysis

Advantages in Commissions

FX Sign markets itself as a low-cost brokerage, with minimal trading commissions when compared to many industry players. The appeal of low trading costs attracts cost-conscious beginners.

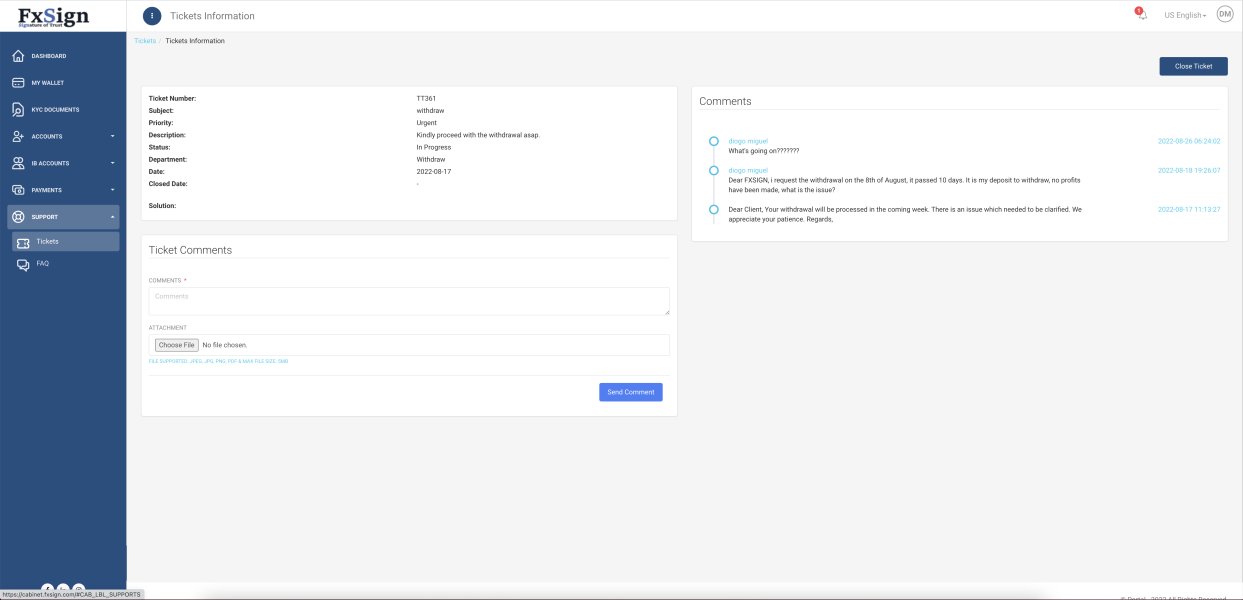

The "Traps" of Non-Trading Fees

However, many user complaints highlight the hidden withdrawal fees, which can reach up to 5% for various withdrawal methods, such as PayPal and cryptocurrency, with some users reporting fees like $30 for standard withdrawals. One user lamented:

"They took $30 just to withdraw my own money, on top of slashing my profits with hidden fees."

Cost Structure Summary

While beginning traders may appreciate the low commissions, the high withdrawal costs can significantly erode any perceived cost benefits, leading to frustration and dissatisfaction among users.

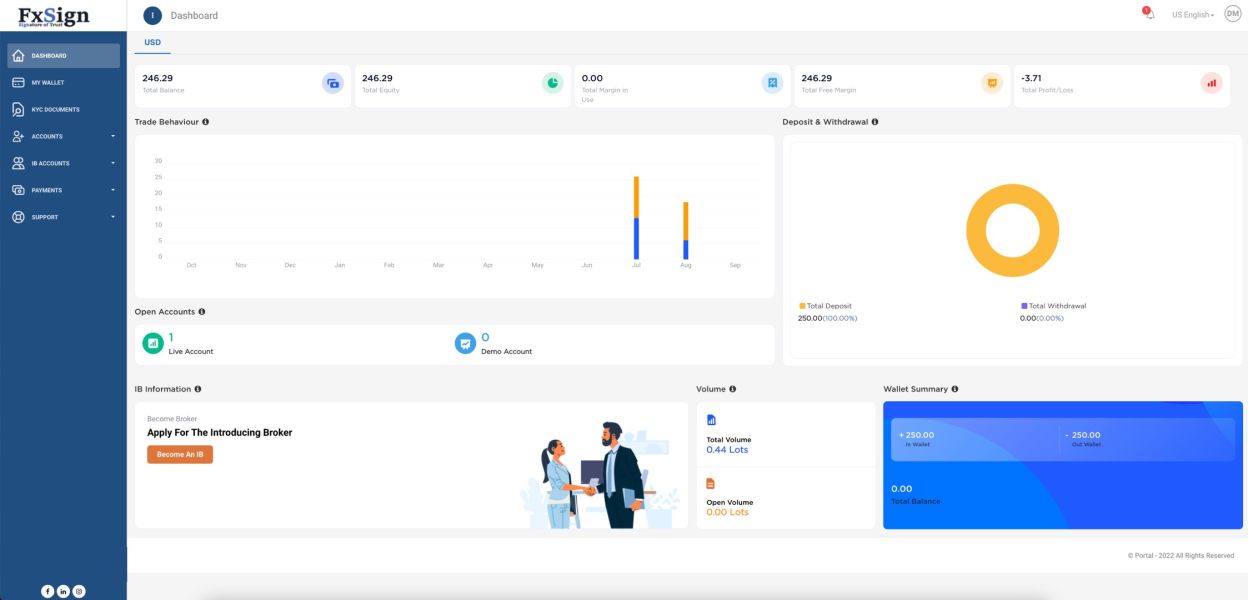

FX Sign operates on the MetaTrader 5 platform, which is favored for its robust features, including advanced charting capabilities and usability across multiple devices. This diversity offers traders flexibility, as MT5 is available on both mobile and desktop.

Despite the strong foundation of the MT5 platform, educational resources remain scarce, limiting novice traders' ability to advance their skills. When interrogated about available learning materials, one user stated:

"There‘s hardly any useful training, only basic tutorials that don’t help monitor the market."

The MT5 interface receives mixed reviews from users—while the tool itself is powerful, FX Sign's lack of support diminishes the overall user experience.

User Experience Analysis

User Feedback Spectrum

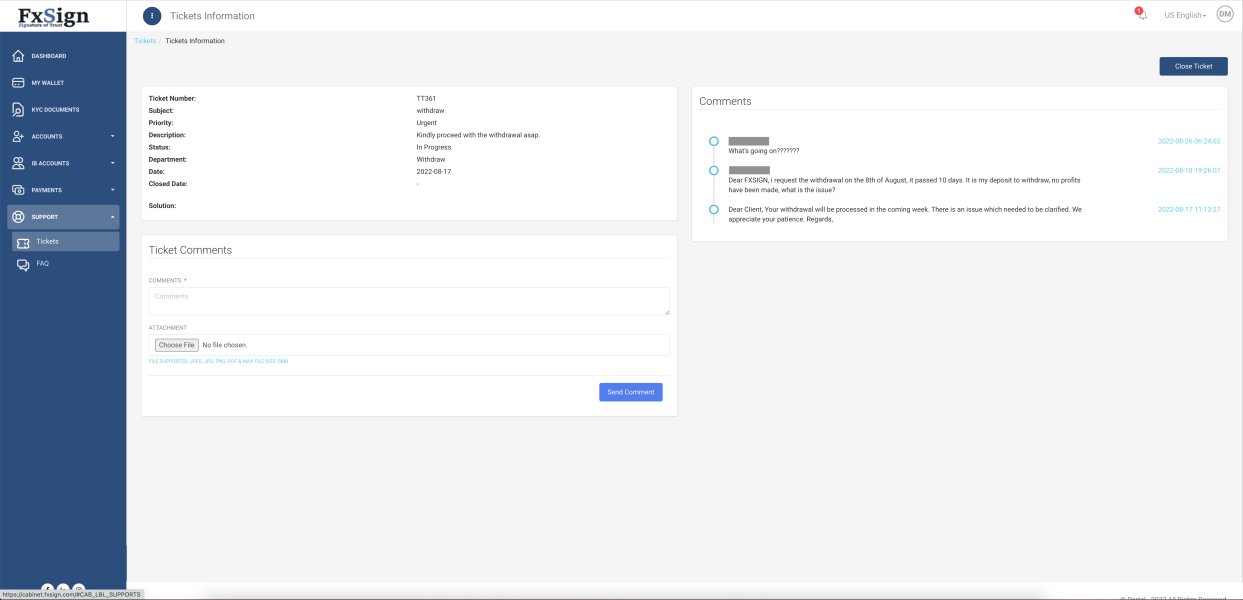

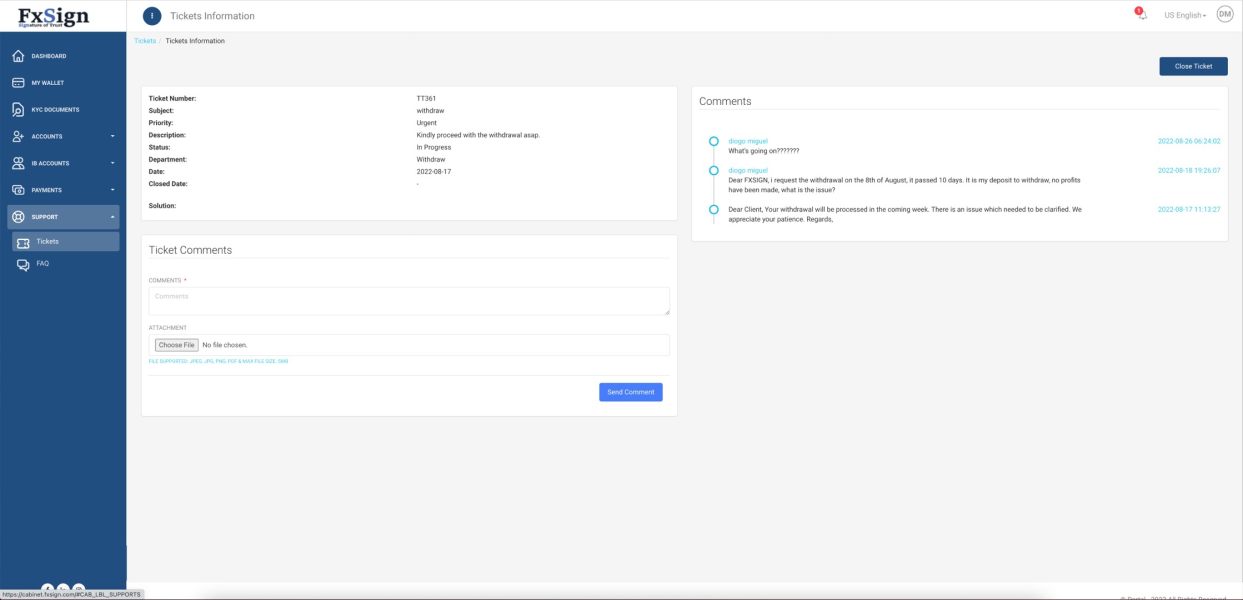

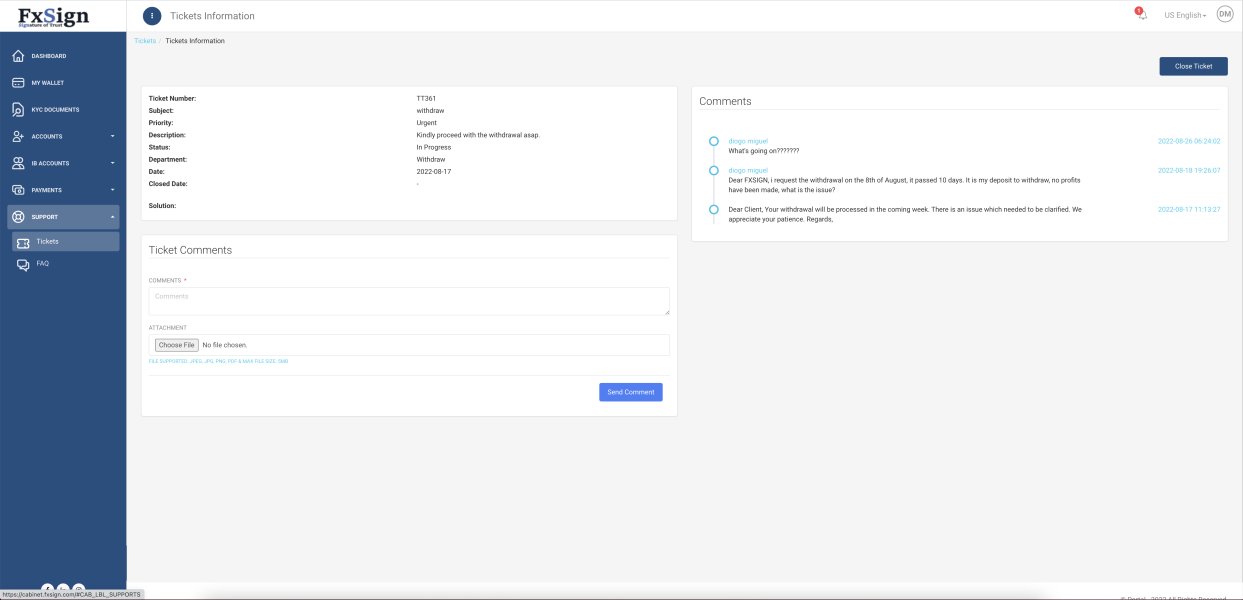

User experiences at FX Sign appear to run the spectrum from some initial success with trades to major frustration during the withdrawal process. Many report a concerning lack of customer support and responsiveness, with one user highlighting:

"After making a profit, I couldn't get anyone on support to help me withdraw."

Usability Challenges

The platform's usability has been deemed satisfactory overall; however, the latency in online customer service leaves much to be desired, which can exacerbate the difficulties when trying to manage accounts.

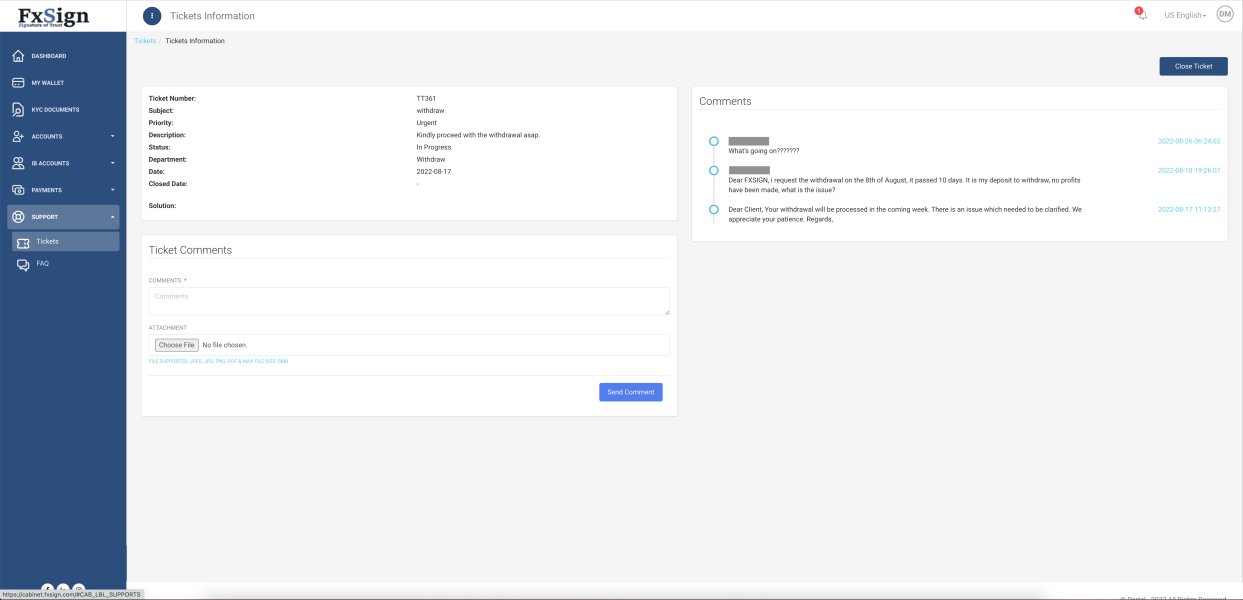

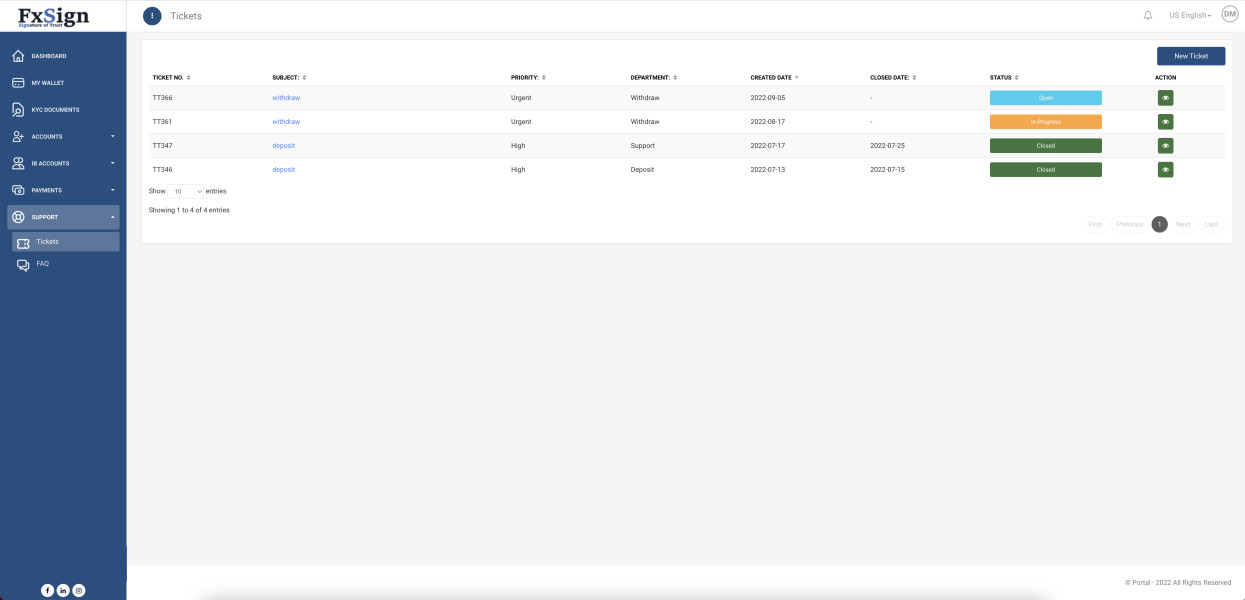

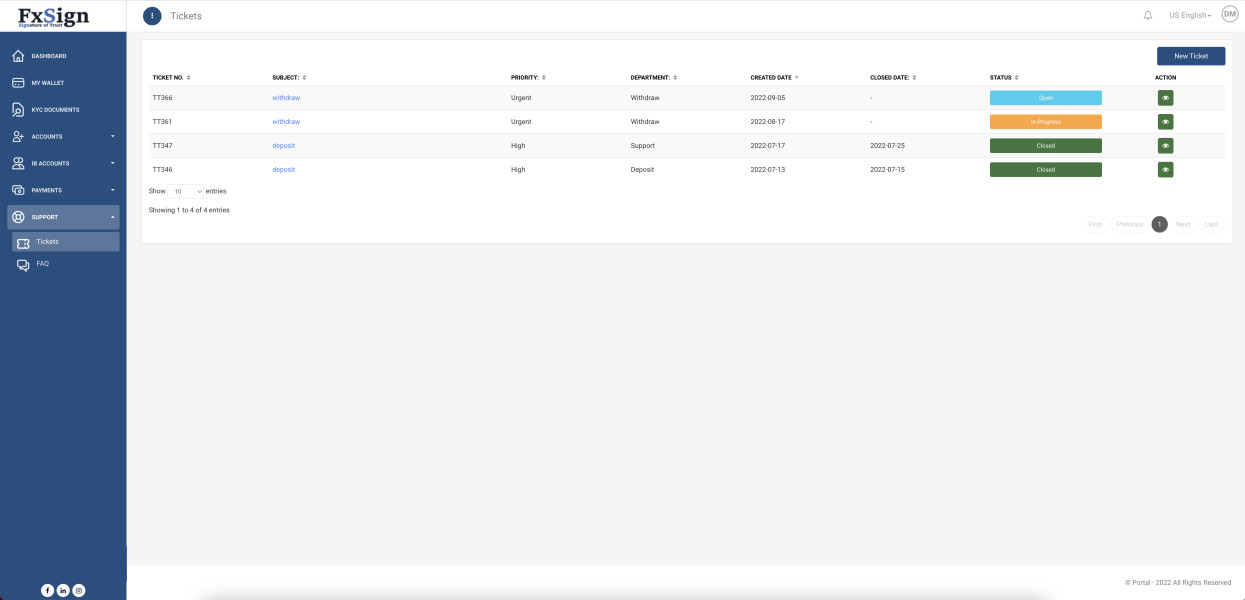

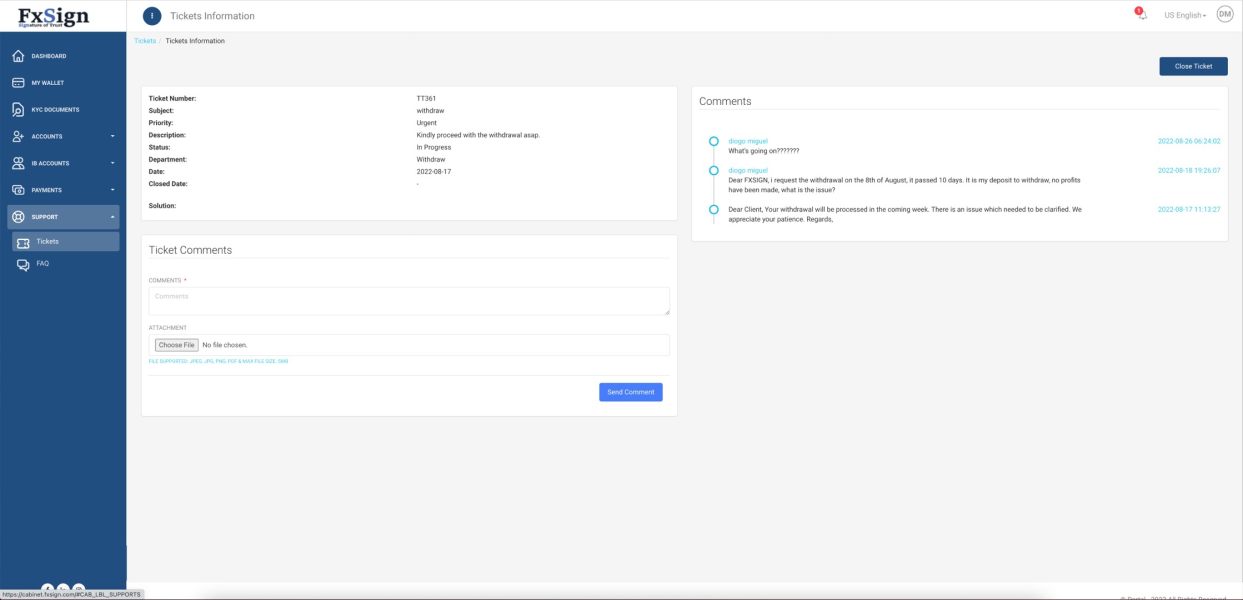

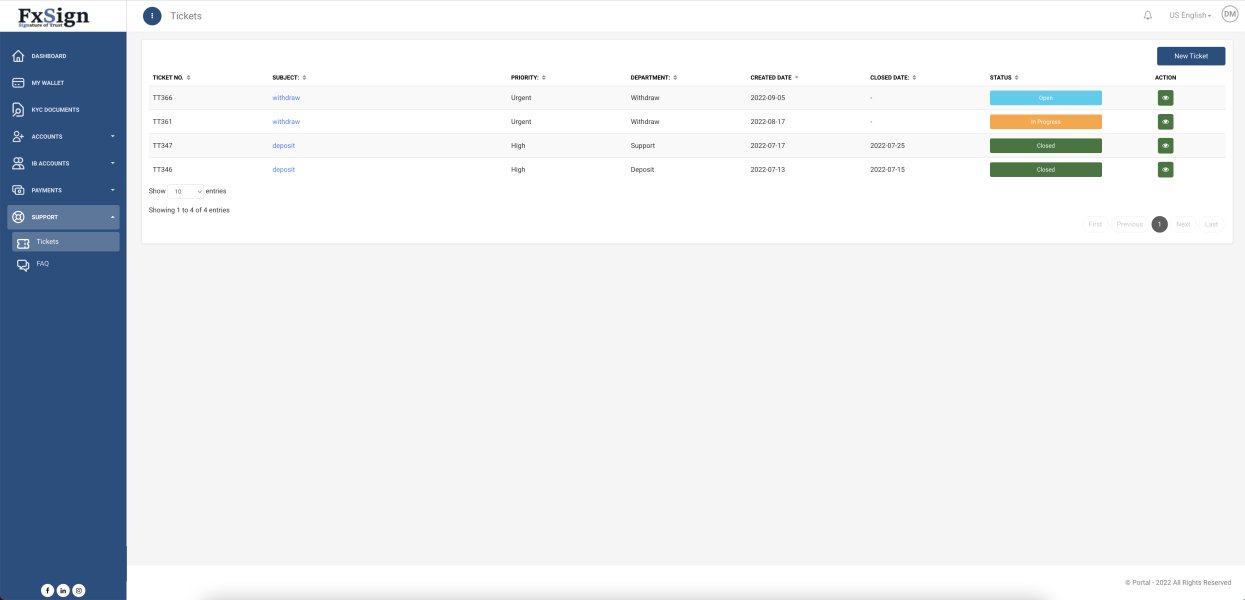

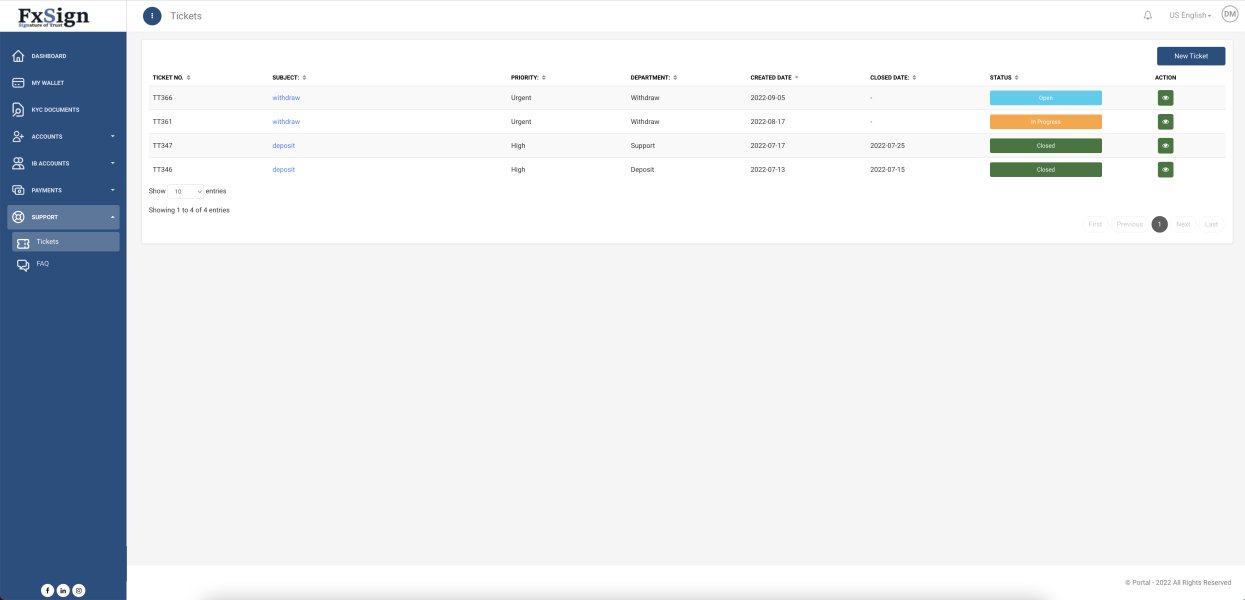

Customer Support Analysis

Response Times and Quality

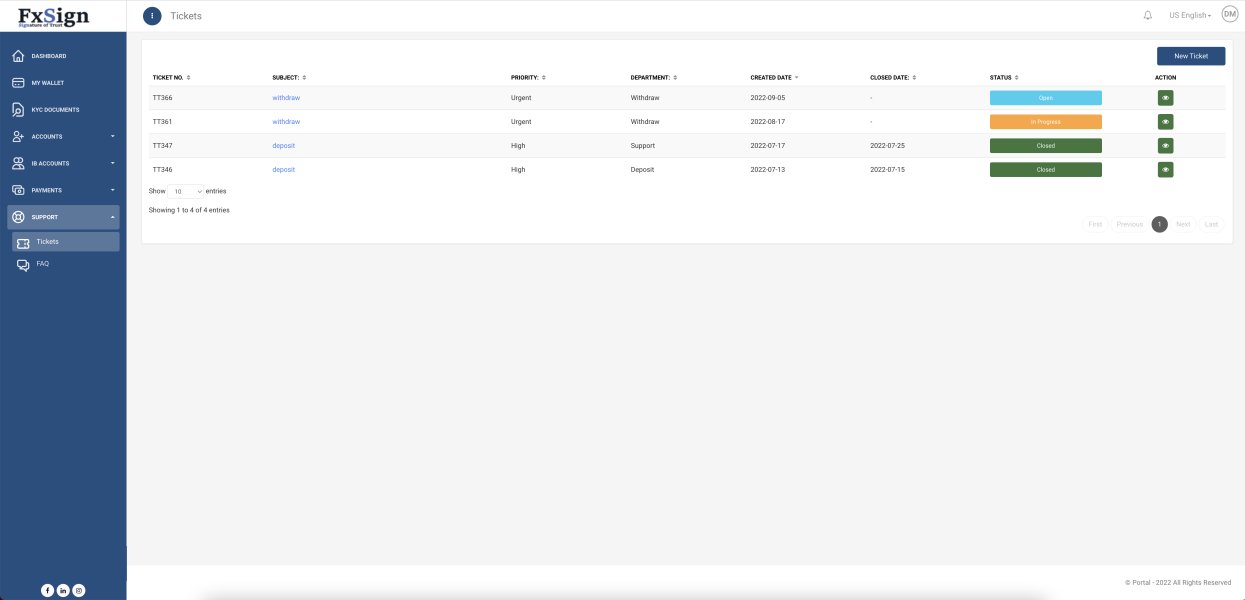

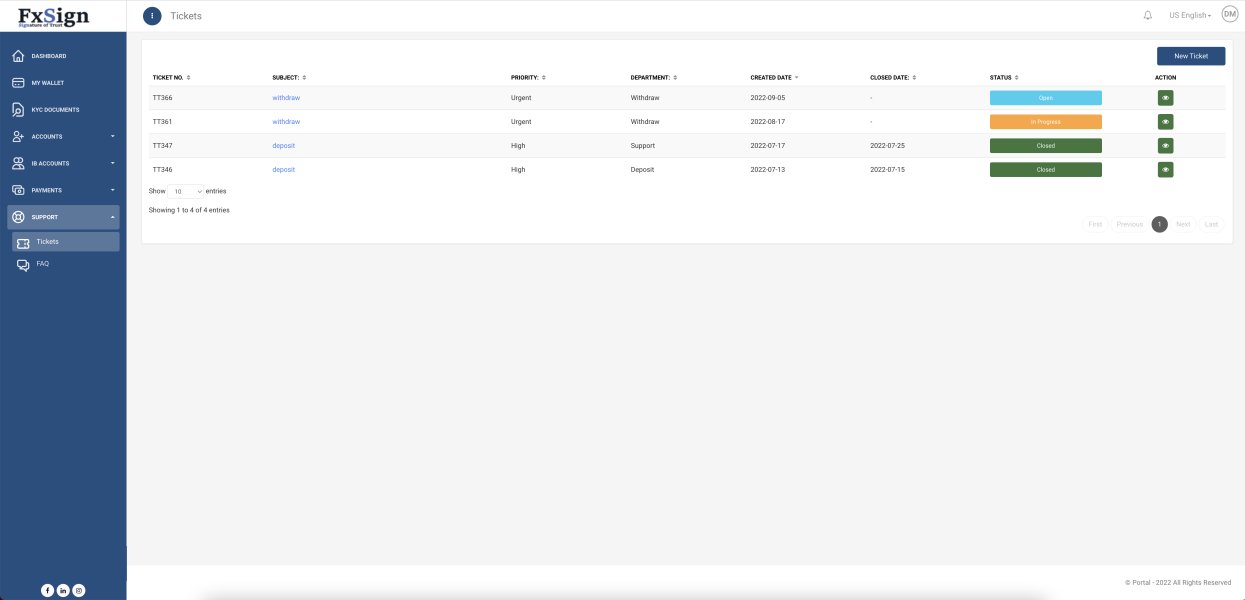

Reports from users about FX Sign's customer support reveal a troubling trend; many have found it difficult to reach assistance or obtain timely responses, often reporting long wait times or no response at all.

Evaluating Support Channels

Despite claims of 24/7 support via various channels (email, live chat, phone), user sentiment reflects doubt about the effectiveness or reliability of these channels. In the absence of reliable support, traders may feel vulnerable.

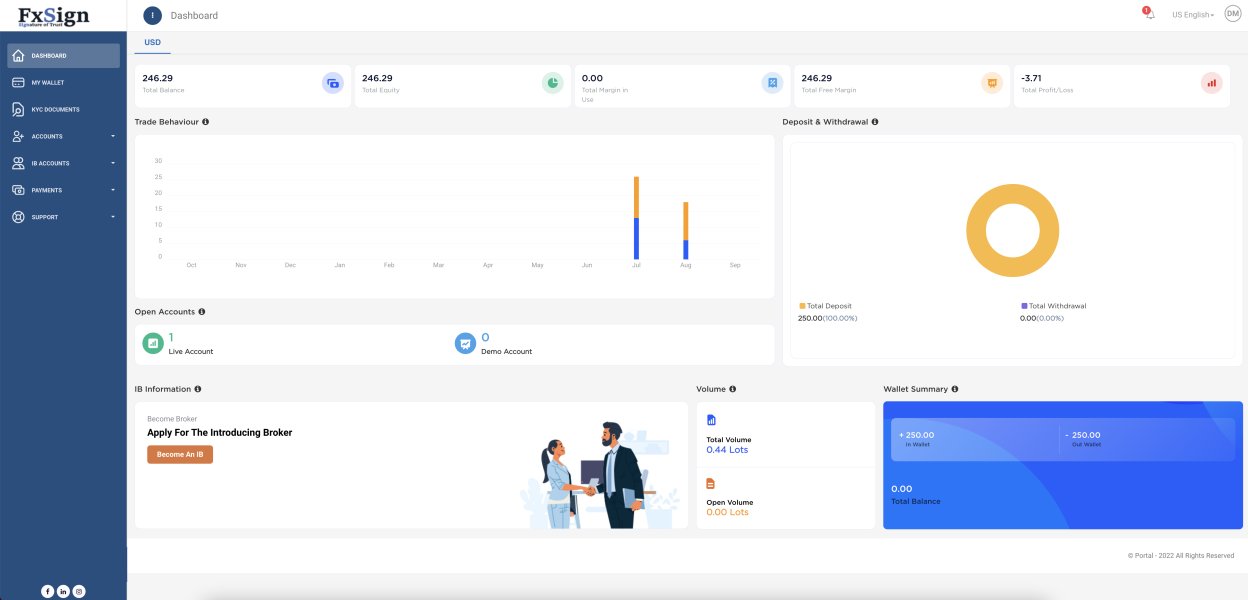

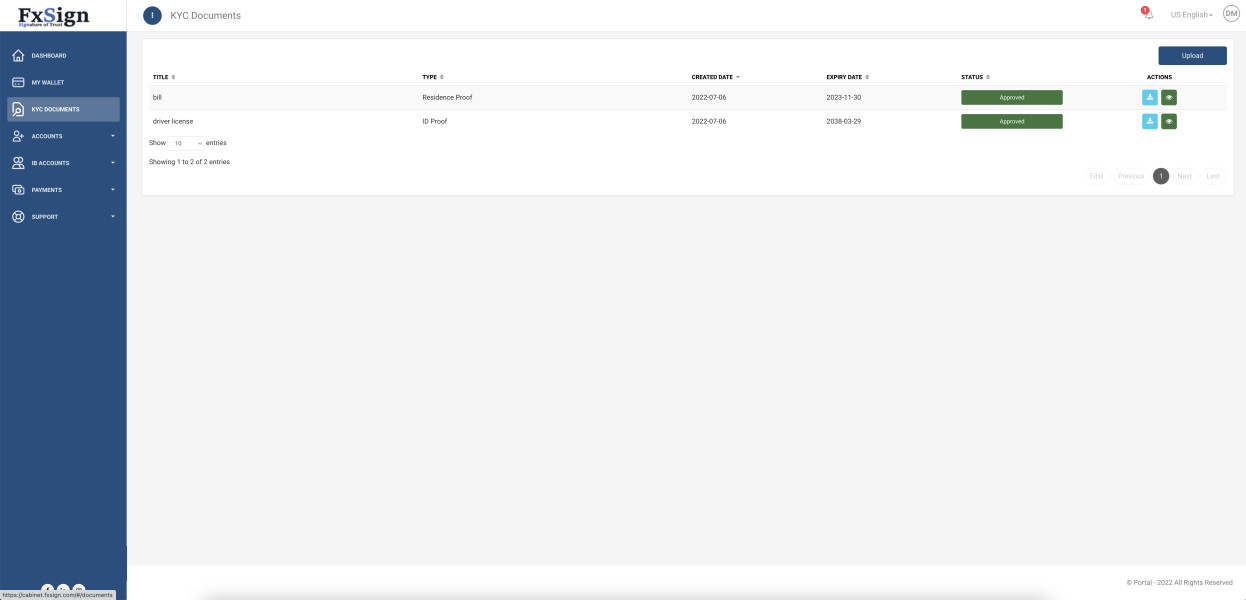

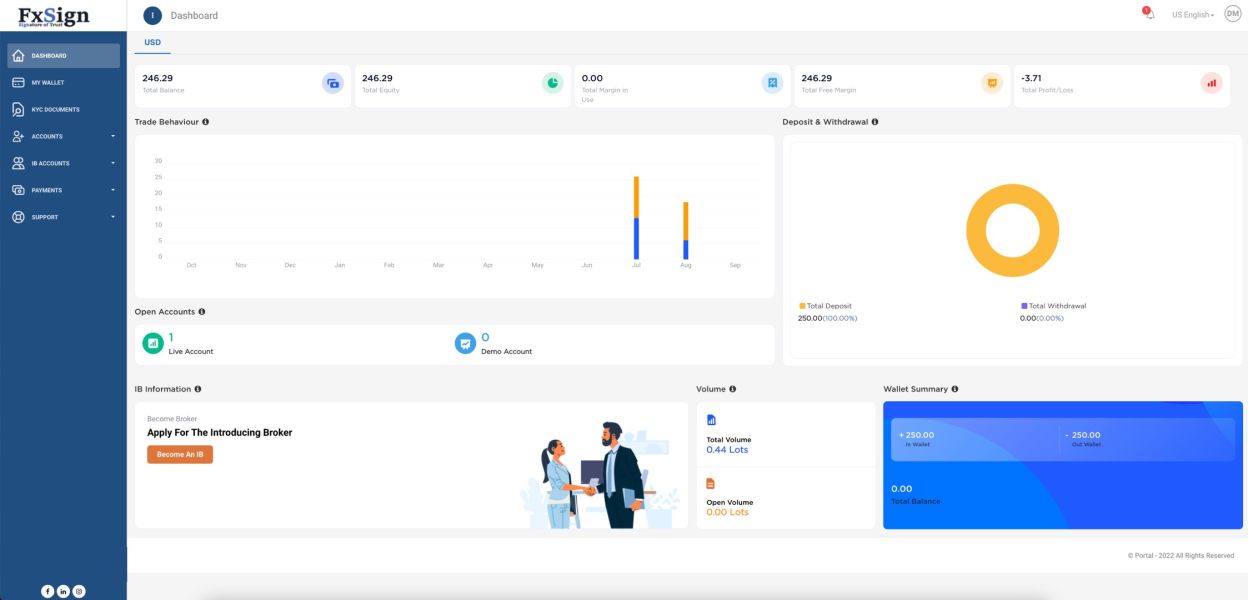

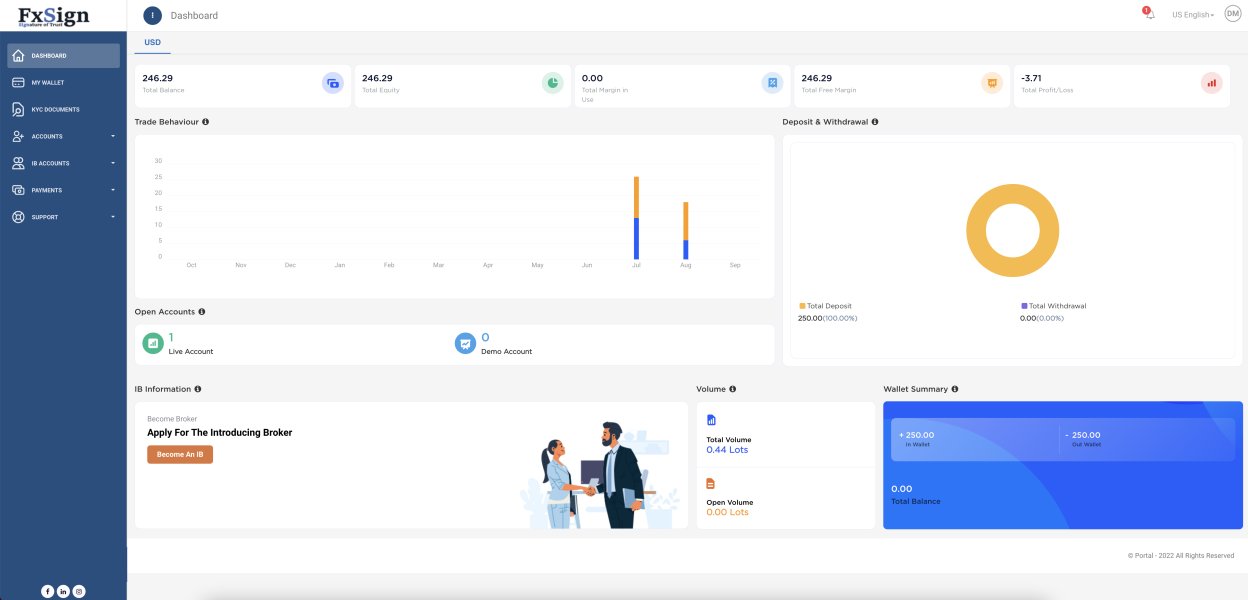

Account Conditions Analysis

Initial Investments Required

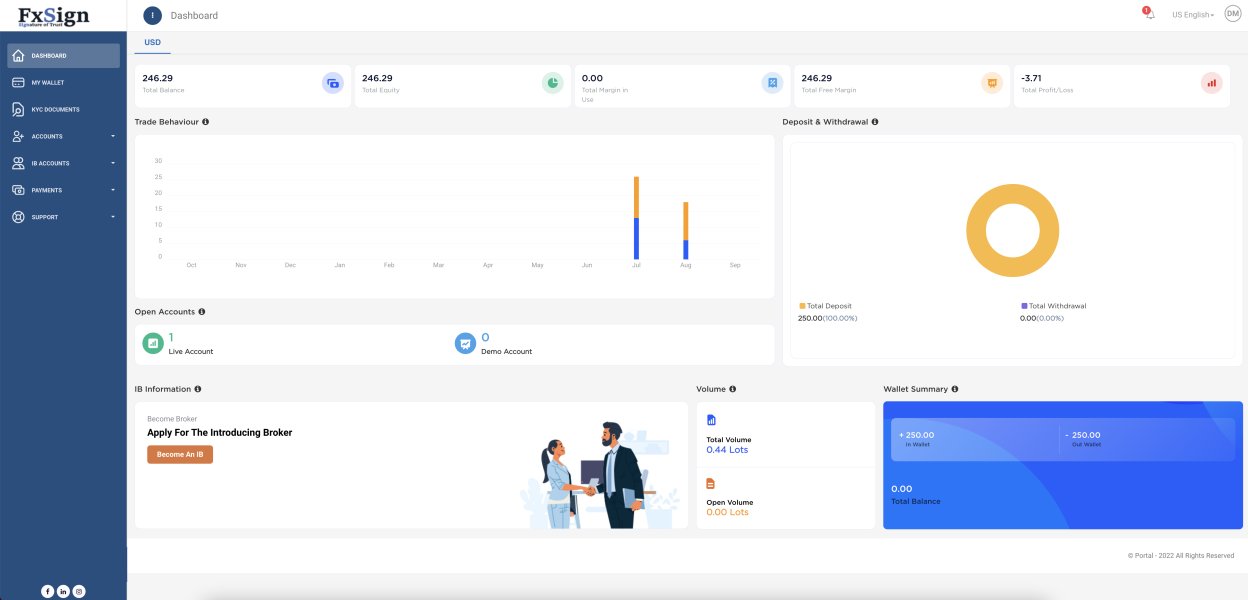

FX Sign offers several account types with varying minimum deposits—ranging from a mere $1 for a cent account up to $5000 for institutional accounts. However, the higher-end accounts boast significantly tighter spreads, starting at 0.1 pips.

Other Conditions

Users experiences point towards a high barrier to decent service, with many feeling that maximum leverage options come with inherent risks. An overwhelming majority of feedback expresses concern regarding how these account conditions influence overall trading safety.

Conclusion

In summary, FX Sign presents itself as a low-cost forex brokerage with a variety of trading instruments appealing to new traders. However, its lack of regulation and numerous complaints about fund safety and withdrawal issues render it a risky choice for trading. New traders seeking low entry options should tread lightly and consider thoroughly the potential risks involved, while more experienced traders are likely to seek safer, more reliable alternatives.