Is Forex Wise Investments safe?

Business

License

Is Forex Wise Investments Safe or a Scam?

Introduction

Forex Wise Investments is a relatively new player in the forex market, established in 2021, claiming to offer a range of trading services including forex, commodities, and cryptocurrencies. As the forex trading landscape grows increasingly complex and competitive, traders must exercise caution when selecting brokers. The potential for scams and unregulated entities makes it essential for investors to conduct thorough research and due diligence. This article aims to provide an objective assessment of Forex Wise Investments, exploring its regulatory status, company background, trading conditions, customer experiences, and overall safety. The evaluation is based on a comprehensive analysis of various sources, including user reviews, regulatory disclosures, and expert assessments.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety of a forex broker. A regulated broker is subject to oversight by relevant financial authorities, which helps ensure that they adhere to industry standards and protect clients' funds. In the case of Forex Wise Investments, it has been noted that the broker is not regulated by any recognized financial institution. This lack of regulation raises significant concerns about the safety of funds and the legitimacy of its operations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

Without proper regulatory oversight, traders face higher risks, including the potential for fraud and the inability to recover funds in case of disputes. Regulated brokers are required to maintain segregated accounts for client funds, ensuring that these funds are protected in the event of bankruptcy or insolvency. However, Forex Wise Investments lacks this critical safeguard, making it imperative for traders to question is Forex Wise Investments safe for trading.

Company Background Investigation

Forex Wise Investments presents itself as a UK-based broker, but there is limited information available about its ownership structure and management team. The company's website does not provide comprehensive details about its founders or key personnel, which is a red flag for potential investors. Transparency is crucial in the financial services industry, and a lack of information can lead to distrust among potential clients.

The absence of a clear history or established reputation further complicates the evaluation of this broker's credibility. In the forex trading environment, established brokers often have a track record of compliance and customer service, which can be verified through third-party reviews and regulatory filings. In contrast, Forex Wise Investments short operational history raises concerns about its long-term viability and commitment to ethical trading practices. Therefore, potential investors must carefully consider whether Forex Wise Investments is safe before committing any capital.

Trading Conditions Analysis

The trading conditions offered by Forex Wise Investments are another critical aspect to evaluate. Reports indicate that the broker claims to provide competitive spreads and various account types. However, the absence of clear information regarding fees and commissions on its website makes it difficult for traders to assess the overall cost of trading.

| Fee Type | Forex Wise Investments | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 2-5% |

Unusual fee structures can be a warning sign for potential scams. For instance, if a broker imposes high withdrawal fees or complex conditions for accessing funds, it could indicate an attempt to limit client access to their money. Traders should be wary of any broker that does not provide transparent cost structures, as this can lead to unexpected expenses and dissatisfaction. Thus, assessing whether Forex Wise Investments is safe involves closely examining its fee policies.

Customer Fund Safety

The safety of customer funds is paramount in forex trading. A reliable broker should implement robust security measures, including segregated accounts, investor protection schemes, and negative balance protection policies. Unfortunately, Forex Wise Investments has not disclosed any information regarding such safety measures. The lack of clarity around how client funds are managed and protected raises significant concerns.

Moreover, the absence of regulatory oversight means that traders have minimal recourse in the event of fund mismanagement or fraud. If a broker is not regulated, it may not be held accountable for any financial misconduct, leaving clients vulnerable to losing their investments without any legal protection. This situation amplifies the need for potential clients to verify whether Forex Wise Investments is safe before investing any money.

Customer Experience and Complaints

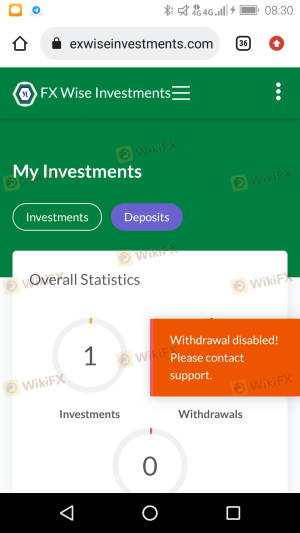

Customer feedback plays a crucial role in assessing the reliability of a broker. Reviews and testimonials can provide insights into the experiences of other traders, highlighting any recurring issues or complaints. In the case of Forex Wise Investments, there have been reports of difficulties in withdrawing funds, with some users claiming that their withdrawal requests were ignored or delayed for extended periods.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor Response |

Such complaints are alarming and suggest that the broker may not prioritize customer service or fund accessibility. A broker's ability to respond to customer inquiries and resolve issues is a critical indicator of its reliability. If users consistently report negative experiences with withdrawal processes, it raises questions about the broker's operational integrity and whether Forex Wise Investments is safe for trading.

Platform and Execution

The performance and reliability of a trading platform are essential for a smooth trading experience. Forex Wise Investments claims to offer popular trading platforms, but there is limited information available regarding their functionality and user experience. Traders should be cautious if the broker does not provide clear details about the platform's features, stability, and execution quality.

Additionally, issues such as slippage and order rejections can significantly impact trading outcomes. If a broker is known for manipulating prices or executing orders unfavorably, it can lead to substantial losses for traders. Therefore, assessing the platform's reliability is crucial in determining whether Forex Wise Investments is safe for trading.

Risk Assessment

In evaluating the overall risk associated with Forex Wise Investments, several factors must be considered. The lack of regulation, transparency, and customer complaints all contribute to a higher risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No regulatory oversight |

| Fund Security | High | Lack of information on fund protection |

| Customer Service | Medium | Poor response to complaints |

Given these risk factors, potential traders should exercise extreme caution. It is advisable to conduct thorough research and consider alternative, more reputable brokers that offer regulatory protection and a solid track record.

Conclusion and Recommendations

In conclusion, the analysis of Forex Wise Investments raises significant concerns about its legitimacy and safety. The lack of regulatory oversight, transparency regarding fees, and troubling customer complaints suggest that this broker may not be a safe choice for traders. Therefore, it is crucial for potential clients to carefully consider whether Forex Wise Investments is safe before investing.

For traders seeking reliable alternatives, it is recommended to explore established brokers with strong regulatory frameworks, transparent fee structures, and positive customer feedback. Prioritizing safety and security in forex trading is essential for protecting investments and ensuring a positive trading experience.

Is Forex Wise Investments a scam, or is it legit?

The latest exposure and evaluation content of Forex Wise Investments brokers.

Forex Wise Investments Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Forex Wise Investments latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.