Regarding the legitimacy of EPFX forex brokers, it provides FSCA and WikiBit, (also has a graphic survey regarding security).

Is EPFX safe?

Pros

Cons

Is EPFX markets regulated?

The regulatory license is the strongest proof.

FSCA Forex Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

TX3 MARKETS GLOBAL (PTY) LTD

Effective Date: Change Record

2023-10-17Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

NORWICH PLACE WEST 2ND FLOORCNR 5TH AND NORWICHSANDOWN, SANDTON2196Phone Number of Licensed Institution:

1616607510Licensed Institution Certified Documents:

Is EPFX A Scam?

Introduction

EPFX is a forex broker that has emerged in the competitive landscape of online trading, offering a range of financial instruments including forex, commodities, cryptocurrencies, and stock CFDs. With a minimum deposit requirement of just $25, EPFX aims to attract both novice and experienced traders. However, the proliferation of unregulated brokers in the forex market has made it crucial for traders to carefully evaluate the legitimacy and reliability of any broker before committing their funds. This article will provide a comprehensive analysis of EPFX, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety measures. The investigation draws on various online resources, including user reviews and regulatory information, to present a balanced view of EPFX's credibility.

Regulation and Legitimacy

Regulation is a critical factor in assessing the safety of a forex broker. EPFX claims to be regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Sector Conduct Authority (FSCA) in South Africa. Regulatory oversight is essential as it ensures that brokers adhere to strict standards that protect traders from fraud and malpractice.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001308208 | Australia | Verified |

| FSCA | 53180 | South Africa | Verified |

EPFX's regulation by ASIC is particularly noteworthy, as ASIC is recognized for its stringent regulatory framework and rigorous enforcement of compliance standards. This regulation mandates that brokers maintain sufficient capital reserves, segregate client funds, and provide transparent pricing. However, there are concerns regarding the broker's operational history and any potential lapses in compliance. Some reviews suggest that EPFX may have a limited track record, which raises questions about its long-term reliability.

Company Background Investigation

EPFX was established in 2023 and operates under the ownership of EPFX Pty Ltd, which is registered in South Africa. The company's registered address is located at 1 Hood Avenue, Rosebank, Johannesburg, Gauteng, 2196. The ownership structure and management team details are somewhat opaque, as there is limited information available regarding the backgrounds of the individuals behind EPFX. This lack of transparency can be a red flag for potential investors, as reputable brokers typically provide detailed information about their management teams and their qualifications.

The company's website claims a commitment to offering a secure trading environment, yet the absence of comprehensive information about its history and ownership may lead to skepticism regarding its legitimacy. A broker's transparency is crucial in building trust with clients, and EPFX's limited disclosure could be perceived as a lack of accountability.

Trading Conditions Analysis

EPFX offers a variety of trading accounts, including raw spread accounts, zero commission accounts, and hybrid accounts. The spreads can be as low as 0.0 pips, which is attractive for traders looking to minimize costs. However, the overall fee structure and any hidden costs associated with trading on the platform need careful scrutiny.

| Fee Type | EPFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 1.0 pips |

| Commission Model | $0 (Zero Commission) | $5 - $10 per trade |

| Overnight Interest Range | Varies | Varies |

While EPFX advertises competitive trading conditions, traders should be aware of any unusual fees that may apply, particularly withdrawal fees, which can add to the overall cost of trading. The broker's withdrawal policies have been noted in some reviews as potentially problematic, with clients reporting delays and additional charges that were not clearly disclosed upfront.

Customer Funds Security

The safety of customer funds is paramount when evaluating a broker. EPFX claims to implement security measures such as segregating client funds from company funds and offering negative balance protection. However, the effectiveness of these measures can only be assessed through user experiences and historical performance.

In terms of fund security, EPFX's compliance with regulatory requirements suggests a degree of protection for client funds. Nonetheless, concerns have been raised regarding the broker's operational practices and any past incidents that may have compromised client security. A thorough investigation into any historical issues related to fund safety or disputes is essential for potential clients.

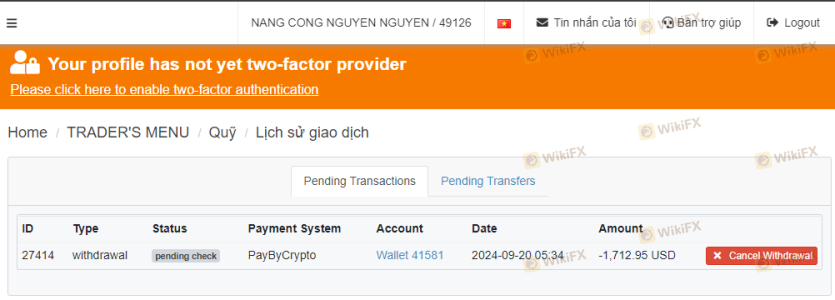

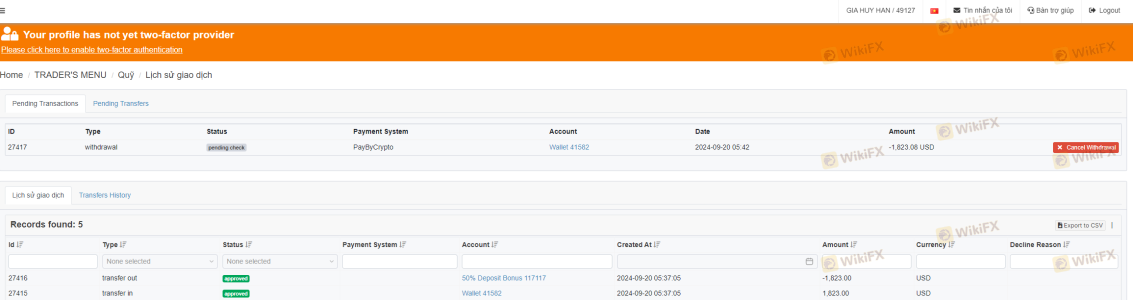

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of EPFX reveal a mixed bag of experiences, with some users praising the platform's ease of use and competitive trading conditions, while others report significant issues, particularly with withdrawals and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow or Unresponsive |

| High-Pressure Sales Tactics | Medium | Inconsistent Support |

| Lack of Transparency | High | Limited Information |

Common complaints include difficulties in withdrawing funds and a perceived lack of transparency in fee structures. Some users have reported feeling pressured to deposit more funds after initial investments, which is a tactic often associated with less reputable brokers. One notable case involved a trader who experienced significant delays in accessing their funds after multiple withdrawal requests, highlighting potential issues within EPFX's operational procedures.

Platform and Trade Execution

The trading platforms offered by EPFX include MetaTrader 4, MetaTrader 5, and cTrader, all of which are widely regarded in the trading community for their functionality and user experience. However, the quality of trade execution and the presence of slippage or order rejections must also be evaluated.

Users have reported varying experiences regarding order execution, with some noting that the platforms perform well during high volatility, while others have experienced slippage that negatively impacted their trading strategies. The potential for platform manipulation, although not explicitly reported, remains a concern given the competitive nature of the forex market.

Risk Assessment

Using EPFX comes with inherent risks that traders must consider. While the broker is regulated, the combination of limited historical performance, mixed customer feedback, and potential withdrawal issues raises several red flags.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Recent establishment raises concerns |

| Fund Safety | Medium | Segregated accounts, but past issues |

| Customer Support | High | Reports of slow response times |

To mitigate risks, traders should conduct thorough research, utilize demo accounts to familiarize themselves with the platform, and maintain a cautious approach when investing significant capital.

Conclusion and Recommendations

In conclusion, while EPFX presents itself as a regulated broker with competitive trading conditions, several factors warrant caution. The lack of extensive historical data, mixed customer experiences, and potential issues with fund withdrawals raise concerns about the broker's reliability.

For traders considering EPFX, it is advisable to proceed with caution, particularly if they are new to forex trading. It may be beneficial to explore alternative brokers with a more established track record and transparent operational practices. Recommended alternatives could include brokers with strong regulatory oversight, positive user reviews, and a proven commitment to customer support and fund safety.

Ultimately, thorough due diligence and a careful assessment of personal risk tolerance are essential for making informed trading decisions in the ever-evolving forex market.

Is EPFX a scam, or is it legit?

The latest exposure and evaluation content of EPFX brokers.

EPFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EPFX latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.