Is SCC safe?

Business

License

Is SCC Safe or Scam?

Introduction

SCC, a forex broker operating in the foreign exchange market, has attracted attention from traders seeking lucrative investment opportunities. However, the influx of new brokers in the market has made it essential for traders to carefully evaluate the credibility and safety of these platforms. The growing number of scams and unregulated brokers poses significant risks, making due diligence crucial for anyone considering trading with SCC. This article aims to provide an objective assessment of SCC's legitimacy, focusing on its regulatory status, company background, trading conditions, and overall safety measures. Our investigation is based on a review of multiple sources, including regulatory databases, user feedback, and expert analyses.

Regulation and Legitimacy

One of the most critical aspects of assessing whether SCC is safe or a scam is its regulatory status. A regulated broker is typically subject to oversight by a reputable financial authority, which can provide a level of security for traders' funds. Unfortunately, SCC does not hold any licenses from top-tier regulators, leaving its legitimacy in question. Below is a summary of the regulatory information for SCC:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that SCC is not required to adhere to stringent financial standards, which could potentially expose traders to various risks. Without oversight, traders may find it challenging to recover funds in the event of a dispute or fraud. Furthermore, the lack of a regulatory framework raises concerns about the quality of services provided by SCC, including pricing transparency and execution reliability. Given these factors, it is advisable for potential clients to approach SCC with caution and consider the implications of trading with an unregulated broker.

Company Background Investigation

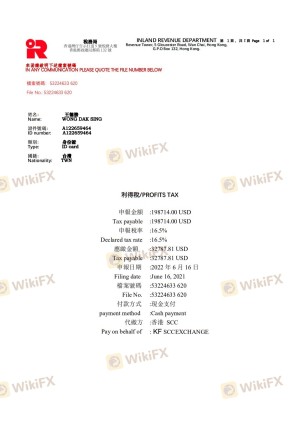

SCC's history and ownership structure play a significant role in evaluating its credibility. Established in Hong Kong, the broker claims to offer a range of financial instruments, including forex, commodities, and indices. However, details regarding its ownership and management team remain vague, which raises transparency concerns. A thorough background check reveals that the broker has not disclosed any meaningful information about its founders or executives, making it difficult to assess their qualifications and experience in the financial industry.

Moreover, the company's operational address, listed as 19F, Keen Hung Commercial Building, 80 - 86 Queen's Road East, Hong Kong, is often cited in discussions about unregulated brokers. This lack of transparency could indicate that SCC is attempting to obscure its true nature. In light of these findings, potential traders should be wary of engaging with a broker that lacks a clear and verifiable company background, as this is often a red flag in the forex trading world.

Trading Conditions Analysis

When evaluating whether SCC is safe, it is essential to analyze its trading conditions, including fees, spreads, and commissions. Generally, a broker's fee structure should be competitive and transparent to foster a trustworthy trading environment. However, SCC's fees and trading conditions appear to be less favorable compared to industry standards. Below is a comparison of SCC's core trading costs:

| Fee Type | SCC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3.0 pips | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | 2.0% | 1.0% |

The high spread on major currency pairs indicates that traders may face increased costs when executing trades, which can significantly impact profitability. Moreover, the lack of a clear commission structure raises questions about hidden fees that might be levied on traders. Such practices are often associated with unregulated brokers, which can further undermine the trustworthiness of SCC. Therefore, potential clients should carefully consider these trading conditions before deciding to engage with the broker.

Client Fund Security

The safety of client funds is paramount when assessing whether SCC is safe or a scam. A reputable broker should implement strict measures to ensure the security of traders' deposits. However, SCC has not provided any information regarding its fund segregation practices, investor protection mechanisms, or negative balance protection policies.

In the event of insolvency or fraud, clients may find it challenging to recover their funds without these safeguards in place. Historical reports of funds being mismanaged or lost with unregulated brokers further emphasize the risks associated with trading through platforms like SCC. Without adequate protections, traders could be left vulnerable to significant financial losses, reinforcing the notion that SCC may not be a safe trading option.

Client Experience and Complaints

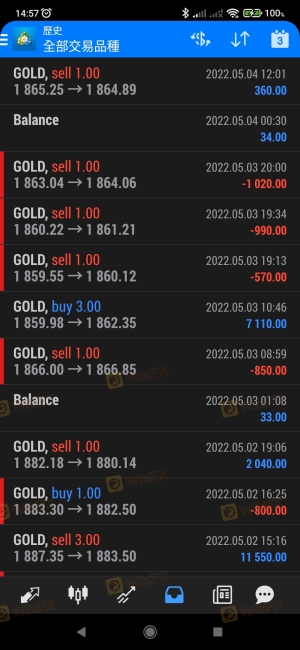

Analyzing customer feedback and complaints is crucial to understanding the overall experience of trading with SCC. Many users have reported difficulties in withdrawing funds, a common issue with unregulated brokers. Below is a summary of the main complaint types associated with SCC:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Unresponsive |

| Misleading Information | High | No clarification given |

Several users have shared their experiences of being unable to withdraw their funds, often citing excessive fees or account restrictions as barriers. Additionally, complaints about unresponsive customer support highlight a lack of commitment to addressing client concerns. Such patterns of behavior are indicative of a potentially fraudulent operation, further questioning whether SCC is safe for traders.

Platform and Trade Execution

The performance and reliability of a trading platform are essential factors in determining whether a broker is trustworthy. SCC's platform has received mixed reviews regarding its stability and user experience. Traders have reported issues with order execution, including slippage and rejection of orders during volatile market conditions. These issues are concerning, as they can lead to significant financial losses.

Moreover, there have been allegations of potential platform manipulation, where traders suspect that the broker may intervene in trades to the detriment of clients. Such practices are common in fraudulent schemes and further underscore the risks associated with using SCC as a trading platform. Potential traders should be cautious and consider these factors when evaluating whether to trade with SCC.

Risk Assessment

In summary, the overall risk associated with trading through SCC can be categorized into several key areas. Below is a risk scorecard that summarizes the primary risks:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Risk | High | Lack of fund protection |

| Operational Risk | Medium | Issues with execution |

| Customer Service Risk | High | Poor response to complaints |

Given these risks, it is advisable for potential traders to exercise extreme caution when considering SCC as a trading option. Engaging with an unregulated broker can expose traders to significant financial risks, and the lack of transparency only compounds these concerns.

Conclusion and Recommendations

Based on the evidence presented, it is clear that SCC raises several red flags that suggest it may not be a safe trading option. The absence of regulation, combined with poor customer feedback and questionable trading conditions, indicates that traders should be wary of engaging with this broker.

For those looking to trade in the forex market, it is recommended to consider alternatives that are regulated by reputable authorities, such as the FCA or ASIC. Brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback are more likely to provide a secure trading environment. In conclusion, potential traders should carefully weigh their options and prioritize safety when selecting a forex broker.

Is SCC a scam, or is it legit?

The latest exposure and evaluation content of SCC brokers.

SCC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SCC latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.