Regarding the legitimacy of DMM FX forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is DMM FX safe?

Pros

Cons

Is DMM FX markets regulated?

The regulatory license is the strongest proof.

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

株式会社DMM.com証券

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都中央区日本橋2-7-1Phone Number of Licensed Institution:

03-3517-3280Licensed Institution Certified Documents:

Is DMM FX A Scam?

Introduction

DMM FX is a forex broker that positions itself as a reliable trading platform within the global foreign exchange market. Established in 2013 and headquartered in Sydney, Australia, DMM FX is part of the DMM Group, a well-known conglomerate in the online trading sector. As forex trading continues to gain popularity, traders must exercise caution when choosing a broker, as the industry is rife with scams and unreliable platforms. Evaluating a broker's legitimacy involves examining its regulatory status, company background, trading conditions, and customer experiences. This article aims to provide a comprehensive assessment of DMM FX, utilizing various sources and criteria to determine whether it is a trustworthy broker or a potential scam.

Regulation and Legitimacy

Regulation is a crucial aspect of any forex broker's credibility, as it ensures that the broker adheres to specific standards and practices designed to protect traders. DMM FX claims to be regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Services Agency (FSA) in Japan. The following table summarizes the core regulatory information for DMM FX:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Verified |

| FSA | N/A | Japan | Verified |

The importance of regulation cannot be overstated, as it provides a safety net for traders in the event of broker insolvency or malpractice. ASIC is known for its stringent regulatory requirements, which include maintaining adequate capital reserves and ensuring transparency in operations. However, some sources have raised concerns about DMM FX's compliance history, with reports of user complaints and regulatory scrutiny, suggesting that while the broker may be regulated, its track record is not entirely pristine.

Company Background Investigation

DMM FX has its roots in the larger DMM Group, which has a diversified portfolio that includes online trading, e-commerce, and entertainment. The broker's establishment in 2013 marked its entry into the competitive forex market. The management team comprises professionals with extensive experience in finance and trading, which adds a layer of credibility to the broker. However, the company's transparency regarding its ownership structure and operational practices has been called into question. While the DMM Group is a reputable entity, the specific operational practices of DMM FX may not always align with the group's standards.

The level of information disclosed on the broker's website is relatively high, with details about trading conditions, fees, and available instruments. However, some traders have noted that the information may not always be comprehensive, leading to potential misunderstandings about the services provided. Overall, while DMM FX has a solid foundation, the lack of clarity in certain areas raises some red flags.

Trading Conditions Analysis

DMM FX offers a range of trading conditions that are generally competitive within the industry. The broker operates on a commission-free model, relying instead on spreads to generate revenue. However, traders should be aware of any unusual fees that may apply. The following table compares the core trading costs associated with DMM FX against industry averages:

| Fee Type | DMM FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.7 pips | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by DMM FX are relatively low, particularly for major currency pairs, which can be advantageous for traders looking to minimize costs. However, some users have reported hidden fees and unexpected charges, which could indicate a lack of transparency in the broker's fee structure. Traders should carefully review the terms and conditions to ensure they fully understand the costs involved.

Client Funds Security

The security of client funds is a paramount concern for any trader. DMM FX has implemented several measures to safeguard client capital, including segregating client funds from the company's operational funds. This practice is essential in protecting traders' investments in case of the broker's financial difficulties. Additionally, DMM FX claims to offer negative balance protection, ensuring that traders cannot lose more than their deposited amount.

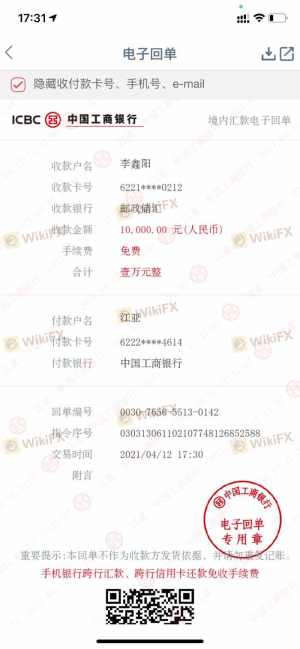

However, there have been reports of issues related to fund withdrawals, with some clients experiencing difficulties in accessing their money. Such incidents raise questions about the broker's reliability and the effectiveness of its security measures. A thorough examination of the broker's history concerning fund safety and any past controversies is essential for potential clients.

Customer Experience and Complaints

Customer feedback is a critical indicator of a broker's reliability and service quality. DMM FX has received mixed reviews from users, with some praising its competitive spreads and user-friendly platform, while others have raised concerns about customer service and withdrawal issues. The following table summarizes the primary complaint types associated with DMM FX:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Service | Medium | Inconsistent |

| Hidden Fees | High | Lack of Clarity |

Typical cases include traders who reported being unable to withdraw their funds after multiple requests, often citing vague explanations from customer support. These experiences highlight the importance of assessing a broker's responsiveness and reliability in handling client concerns.

Platform and Trade Execution

DMM FX offers a trading platform that is generally well-regarded for its user experience and functionality. The platform's performance, stability, and execution quality are crucial for traders looking to capitalize on market movements. Most reviews indicate that DMM FX provides a robust trading environment, with minimal slippage and a low rejection rate for orders. However, some users have reported instances of platform manipulation, raising concerns about the integrity of the trading environment.

Risk Assessment

Using DMM FX carries certain risks, as is the case with any forex broker. The following risk assessment card summarizes key risk areas associated with trading with DMM FX:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Mixed reviews on compliance |

| Fund Withdrawal Issues | High | Reports of difficulties |

| Customer Service Responsiveness | Medium | Inconsistent support |

To mitigate these risks, traders should conduct thorough research, maintain realistic expectations regarding potential returns, and consider using risk management strategies such as stop-loss orders.

Conclusion and Recommendations

In conclusion, while DMM FX presents itself as a legitimate forex broker with regulatory backing and competitive trading conditions, potential clients should exercise caution. Reports of withdrawal issues, hidden fees, and mixed customer experiences suggest that there may be underlying problems that warrant further investigation. Traders should carefully assess their risk tolerance and consider their trading goals before engaging with DMM FX.

For those seeking reliable alternatives, brokers with strong regulatory oversight, transparent fee structures, and positive customer reviews may be more suitable. Always ensure to conduct thorough due diligence before committing to any trading platform.

Is DMM FX a scam, or is it legit?

The latest exposure and evaluation content of DMM FX brokers.

DMM FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DMM FX latest industry rating score is 6.79, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.79 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.