Is Driss IFC safe?

Pros

Cons

Is Driss IFC A Scam?

Introduction

Driss IFC is a newly established brokerage firm that entered the forex market in 2024, offering a wide range of trading services across various financial instruments, including forex, stocks, indices, commodities, and cryptocurrencies. As the forex market continues to attract traders seeking profit opportunities, it becomes crucial for these individuals to thoroughly evaluate the credibility of their chosen brokers. The potential for scams and fraudulent activities is a significant concern in the industry, making it essential for traders to exercise caution and conduct comprehensive research before committing their funds. This article aims to provide an objective analysis of Driss IFC, combining narrative content with structured information to assess its legitimacy and reliability.

To gather insights about Driss IFC, we analyzed the top search results regarding the broker's reputation, regulatory status, user reviews, and overall market presence. This evaluation framework encompasses various aspects, including regulatory compliance, company background, trading conditions, customer experiences, and risk assessments. By taking a holistic approach, this article seeks to equip traders with the information they need to make informed decisions regarding their investments with Driss IFC.

Regulation and Legitimacy

Regulation is a critical aspect of any brokerage's credibility, as it ensures that the firm adheres to specific operational standards designed to protect traders' interests. Driss IFC claims to be regulated by the Financial Crimes Enforcement Network (FinCEN) in the United States. However, it is essential to note that FinCEN is primarily a financial intelligence agency and does not provide the same level of investor protection as other regulatory bodies, such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC).

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FinCEN | N/A | United States | Registered |

The lack of a robust regulatory framework raises concerns about the safety of traders' funds. While Driss IFC is registered, the absence of comprehensive oversight means that there are no stringent requirements in place to ensure fair trading practices or protect clients' investments. This situation can lead to potential risks, including the possibility of unfair treatment or difficulties in resolving disputes. As such, traders should approach Driss IFC with caution, understanding that the broker's regulatory status does not guarantee the same level of security and accountability offered by more reputable regulatory authorities.

Company Background Investigation

Driss IFC Limited was registered in Colorado, USA, on June 12, 2024. The company has a minimalist online presence, and its official website does not provide detailed information regarding its ownership structure or the management team. The lack of transparency raises questions about the broker's legitimacy and operational practices.

The management team's background and professional experience are critical factors in assessing a brokerage's reliability. However, the absence of publicly available information about the individuals behind Driss IFC makes it challenging to evaluate their expertise and qualifications. This opacity can be a red flag for potential investors, as reputable brokers typically provide clear information about their leadership and organizational structure.

Furthermore, the company's brief history in the market does not instill confidence, as new and unregulated brokers have been known to engage in questionable practices. The lack of transparency and information disclosure can hinder traders' ability to make informed decisions, further complicating the evaluation of Driss IFC's credibility.

Trading Conditions Analysis

Understanding the trading conditions offered by Driss IFC is vital for potential investors. The broker offers a diverse range of financial instruments, particularly emphasizing cryptocurrencies, with claims of supporting over 350 digital currencies. However, the overall fee structure and trading costs remain unclear, as the official website does not disclose specific information regarding spreads, commissions, or other trading fees.

| Fee Type | Driss IFC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Structure | N/A | Varies by broker |

| Overnight Interest Range | N/A | 0.5%-2% |

The lack of clarity surrounding the broker's fees is concerning, as traders need to be aware of all potential costs associated with their trades. Unusual or hidden fees can significantly impact profitability and overall trading experience. Moreover, the absence of detailed information on spreads and commissions could indicate that Driss IFC may not be as competitive as other brokers in the market.

Customer Fund Safety

The security of customer funds is a paramount concern for any trader. Driss IFC's measures for safeguarding client funds are not well-documented, leading to uncertainty regarding the broker's commitment to fund protection. Generally, reputable brokers implement strict fund segregation policies, ensuring that client deposits are kept separate from the company's operating funds. This practice protects traders' investments in the event of the broker facing financial difficulties.

Additionally, investor protection measures, such as negative balance protection, are essential for minimizing risks. Without clear information on whether Driss IFC offers these safeguards, traders may be exposed to significant financial risks. Historical incidents of fund security issues or disputes can further impact a broker's reputation, making it imperative for potential clients to assess these factors before proceeding with investments.

Customer Experience and Complaints

Customer feedback is a valuable source of information for assessing a broker's reliability and service quality. Reviews regarding Driss IFC indicate a range of experiences, with many users expressing concerns about withdrawal difficulties and the overall responsiveness of customer support. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Limited |

| Customer Support Delays | High | Poor |

Several users reported being unable to withdraw their funds, with claims that the platform became unresponsive after initial deposits were made. These types of complaints are serious and can indicate potential fraudulent practices or operational inefficiencies within the brokerage.

For instance, one user reported a successful withdrawal request that never arrived in their wallet, raising suspicions about the broker's legitimacy. Such experiences contribute to an overall negative perception of Driss IFC and highlight the importance of thorough research before engaging with the platform.

Platform and Trade Execution

The performance and reliability of the trading platform are crucial for a positive trading experience. Driss IFC claims to offer a proprietary trading app; however, there is limited information available regarding its performance, stability, and user experience. Traders must consider factors such as order execution quality, slippage rates, and the possibility of order rejections when evaluating a broker.

Without concrete data on these aspects, it is challenging to ascertain whether Driss IFC provides a competitive trading environment. Reports of platform manipulation or technical issues can severely impact traders' ability to execute trades effectively, further complicating the evaluation of the broker's overall reliability.

Risk Assessment

Engaging with Driss IFC presents several risks that potential investors should be aware of. The overall risk profile of the broker can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Lack of robust regulatory oversight raises concerns. |

| Fund Security | High | Unclear fund safety measures may expose clients to losses. |

| Customer Support | Medium | Complaints regarding withdrawal issues and support responsiveness. |

To mitigate these risks, traders are advised to conduct thorough research, establish clear communication with the broker, and consider starting with a small investment to gauge the platform's reliability before committing larger sums.

Conclusion and Recommendations

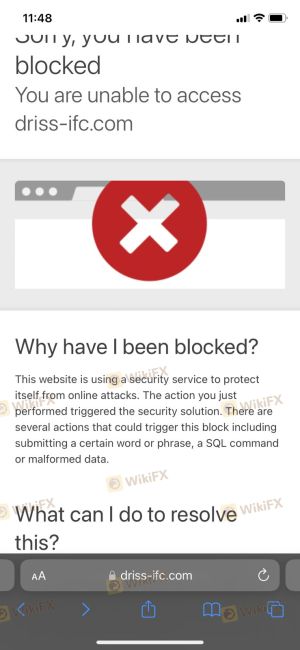

In conclusion, the analysis of Driss IFC raises several red flags that indicate potential issues with the broker's legitimacy and reliability. The lack of comprehensive regulation, transparency regarding trading conditions, and numerous negative customer experiences suggest that traders should exercise extreme caution when considering this brokerage.

While Driss IFC offers a diverse range of trading products, the absence of regulatory safeguards and the prevalence of complaints about fund withdrawals and customer support should serve as significant warning signs. For traders seeking safer alternatives, it is advisable to consider well-established, regulated brokers with a proven track record and positive user reviews.

In summary, potential clients should prioritize brokers that provide clear information on regulatory compliance, transparent fee structures, and robust customer support to ensure a secure trading experience.

Is Driss IFC a scam, or is it legit?

The latest exposure and evaluation content of Driss IFC brokers.

Driss IFC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Driss IFC latest industry rating score is 1.30, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.30 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.