Is DingXin safe?

Pros

Cons

Is Dingxin Safe or Scam?

Introduction

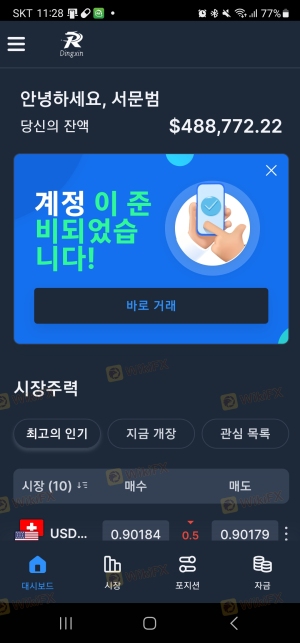

Dingxin is a relatively new player in the forex market, having been established in 2023 and headquartered in Canada. As the forex trading landscape continues to expand, the need for traders to carefully evaluate their brokers has never been more critical. With numerous reports of scams and fraudulent activities in the industry, ensuring the safety and legitimacy of a trading platform is paramount for protecting ones investments. This article aims to provide an objective analysis of Dingxin, assessing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on various credible sources, including user reviews, regulatory information, and industry assessments.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most vital aspects to consider when determining its safety. A well-regulated broker is typically subject to stringent oversight, which helps protect traders from fraud and ensures fair trading practices. In the case of Dingxin, it operates without valid regulatory oversight, raising significant concerns about its legitimacy and the safety of traders' funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0557432 | USA | Unauthorized |

Dingxin is marked as "unauthorized" by the National Futures Association (NFA), indicating that it does not possess the necessary regulatory approvals to operate legally. This lack of regulation is alarming, as it leaves traders without the protections typically afforded by regulatory bodies, such as fund segregation and dispute resolution mechanisms. Furthermore, Dingxin's operations have been flagged for suspicious activities, including complaints about withdrawal issues, which further tarnish its reputation in the forex market. Therefore, it is crucial for prospective traders to exercise caution when considering whether "Is Dingxin safe?"

Company Background Investigation

Dingxin was founded in 2023 and has quickly attracted attention for its diverse range of tradable assets, including forex, stocks, commodities, and cryptocurrencies. However, the companys brief history raises questions about its stability and reliability. The ownership structure of Dingxin is not transparently disclosed, which is concerning for potential investors who seek accountability and clear lines of responsibility within the organization.

The management team behind Dingxin has not been widely publicized, and there is limited information available regarding their professional backgrounds and experience in the financial industry. This lack of transparency can be a red flag for traders who prioritize working with established firms that have a proven track record. Moreover, the absence of detailed disclosures regarding its business practices and financial health further complicates the assessment of its safety. Consequently, traders must critically evaluate the question: "Is Dingxin safe?" based on the available information.

Trading Conditions Analysis

Dingxin offers a variety of trading accounts with a minimum deposit requirement of $100 and leverage up to 1:1000. However, the overall fee structure and trading conditions warrant scrutiny. The broker claims to provide competitive spreads and commission structures, but there is limited transparency regarding these costs, which can significantly impact trading profitability.

| Fee Type | Dingxin | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | $10-$30 | $5-$15 |

The spreads on major currency pairs, such as EUR/USD, are reported to be higher than the industry average, which raises concerns about the cost-effectiveness of trading with Dingxin. Additionally, the broker imposes withdrawal fees of $30, which is considered steep compared to other brokers in the industry. These fees can accumulate quickly and deter traders from making withdrawals, leading to potential disputes. Thus, when assessing "Is Dingxin safe?", traders should carefully consider these trading costs and their implications for overall profitability.

Customer Fund Safety

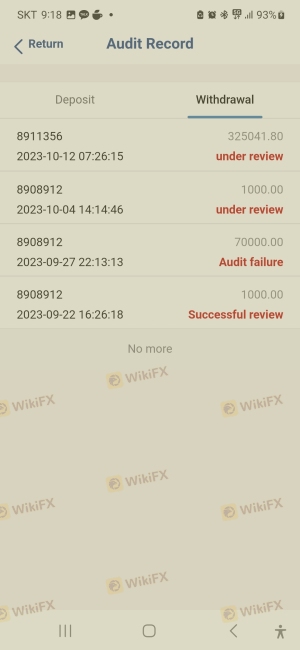

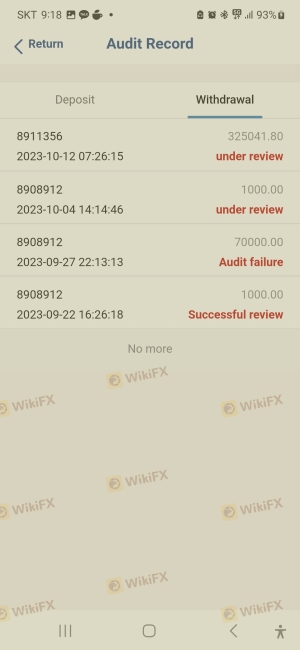

The safety of customer funds is a critical aspect of any trading platform. Dingxin's lack of regulatory oversight raises significant concerns about its fund security measures. Typically, regulated brokers are required to implement strict policies regarding fund segregation, ensuring that client funds are kept separate from the companys operational funds. However, Dingxin does not provide clear information about its fund protection policies, leaving traders vulnerable.

Moreover, the absence of investor protection schemes, such as those offered by regulatory bodies, puts clients at risk. There have been numerous complaints from users regarding their inability to withdraw funds, which is a significant warning sign. Traders should be wary of platforms that do not have a solid track record of safeguarding customer deposits. Therefore, when considering "Is Dingxin safe?", the answer appears to lean towards caution.

Customer Experience and Complaints

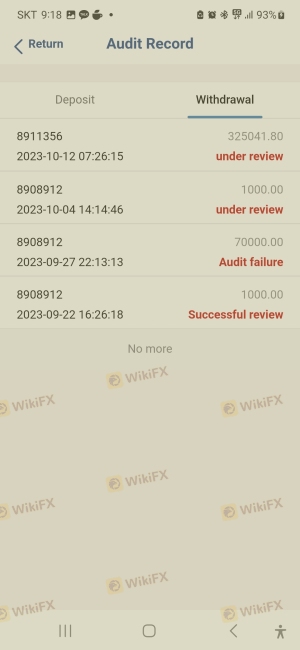

Customer feedback is a valuable indicator of a broker's reliability. Dingxin has received mixed reviews from users, with many highlighting issues related to withdrawal difficulties and poor customer service. Common complaints include the inability to access funds, lack of communication from support staff, and unfulfilled promises regarding trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| Customer Service Quality | Medium | Inconsistent |

| Transparency Concerns | High | Poor |

Typical cases involve users reporting that they have deposited funds but faced obstacles when attempting to withdraw their earnings. In some instances, traders have claimed that Dingxin representatives became unresponsive when issues arose, exacerbating their frustrations. These experiences contribute to the growing skepticism surrounding Dingxin's credibility. Thus, potential clients must weigh these concerns when pondering, "Is Dingxin safe?"

Platform and Trade Execution

The trading platform offered by Dingxin includes a web-based interface and the popular MetaTrader 4 (MT4). While MT4 is known for its robust features and user-friendly interface, user reviews suggest that Dingxin's platform may suffer from performance issues, including occasional downtime and slow order execution.

Traders have reported experiencing slippage and rejected orders, which can be detrimental to trading strategies, especially in volatile market conditions. Such issues raise further questions about the reliability of Dingxin's trading infrastructure. Therefore, traders should critically evaluate whether "Is Dingxin safe?" in terms of platform performance and execution quality.

Risk Assessment

Using Dingxin as a trading platform presents a variety of risks that traders should consider. The lack of regulation, high withdrawal fees, and numerous customer complaints indicate a higher risk profile compared to well-regulated brokers.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | Medium | High withdrawal fees and spreads |

| Operational Risk | High | Platform performance issues |

To mitigate these risks, traders are advised to conduct thorough research, start with a small investment, and avoid depositing large sums of money until they are confident in the platform's reliability. It is essential to remain vigilant and informed about potential red flags when evaluating "Is Dingxin safe?"

Conclusion and Recommendations

In conclusion, the evidence suggests that Dingxin poses significant risks for traders. The lack of regulatory oversight, combined with numerous customer complaints regarding withdrawal issues and platform performance, raises serious concerns about its legitimacy. Consequently, it is prudent for traders to approach Dingxin with caution and consider alternative brokers that offer robust regulatory protections and positive customer feedback.

For those seeking reliable alternatives, brokers regulated by top-tier authorities such as the FCA or ASIC are recommended. These platforms typically provide better transparency, customer service, and overall security for traders. Ultimately, when evaluating "Is Dingxin safe?", it is advisable to err on the side of caution and thoroughly research any broker before committing funds.

Is DingXin a scam, or is it legit?

The latest exposure and evaluation content of DingXin brokers.

DingXin Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DingXin latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.