Is DRC safe?

Business

License

Is DRC Safe or Scam?

Introduction

DRC, a forex broker based in Argentina, positions itself as a trading platform offering a range of financial instruments, including forex, indices, cryptocurrencies, and agricultural commodities. Established in 2019, DRC has attracted attention from traders looking for new opportunities in the forex market. However, as with any financial service, it is crucial for traders to carefully assess the credibility and safety of forex brokers before committing their funds. The forex market is rife with potential scams and unregulated entities, making it imperative for traders to conduct thorough due diligence. This article aims to evaluate whether DRC is a safe trading option or a potential scam by examining its regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

The regulatory landscape for forex brokers is a critical factor in determining their legitimacy and safety. DRC is currently unregulated, which raises significant concerns about the protection and rights of its clients. Regulatory oversight is essential as it ensures that brokers adhere to specific standards and practices that protect investors. Below is a summary of the regulatory information pertaining to DRC:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Argentina | Unverified |

The lack of a regulatory license means that DRC does not fall under the jurisdiction of any financial authority that could provide oversight or recourse in the event of disputes or financial issues. This absence of regulation is alarming, as it leaves traders without legal protection should any problems arise. Moreover, unregulated brokers often operate with higher risks, as they are not bound by the same standards as their regulated counterparts. Traders should be particularly cautious when dealing with brokers that lack proper regulatory oversight, as this could lead to potential financial loss.

Company Background Investigation

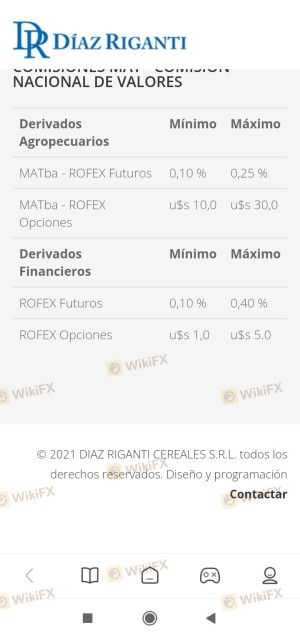

DRC was founded in 2019 and is based in Argentina, where it offers various trading services. The company operates under the name "Díaz Riganti Cereales S.R.L." and is primarily focused on the local market. However, the relatively short history of DRC raises questions about its stability and reliability. A thorough examination of the company's ownership structure reveals limited transparency regarding its management team and their professional backgrounds. This lack of information can be concerning for potential investors, as it makes it difficult to assess the competence and integrity of those running the brokerage.

Furthermore, the company's transparency in terms of information disclosure is also lacking. Reliable brokers typically provide comprehensive details about their operations, including information about their management team, financial health, and operational practices. In DRC's case, the absence of such disclosures raises red flags about its commitment to transparency. Overall, the limited history and unclear ownership structure of DRC contribute to the uncertainty surrounding its legitimacy, leading many to question, "Is DRC safe?"

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is crucial. DRC presents a diverse range of financial instruments, but its fee structure and trading conditions warrant careful scrutiny. The broker's overall costs include spreads, commissions, and overnight interest rates, which can significantly impact profitability. Below is a comparative overview of DRC's core trading costs:

| Fee Type | DRC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Medium |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | Unclear | Clear |

The high spreads associated with DRC may deter traders, as this can lead to increased trading costs and reduced profitability. Additionally, the lack of clarity regarding the commission model raises concerns about potential hidden fees that could impact overall trading costs. Traders should be cautious and ensure they fully understand the fee structure before opening an account with DRC. The overall lack of transparency in trading conditions further fuels the question of whether DRC is safe for trading.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. DRC's measures for safeguarding client funds are critical to assess. The broker claims to utilize SSL encryption and secure servers to protect personal data; however, the absence of regulatory oversight raises concerns about the effectiveness of these measures. Proper fund protection typically includes segregated accounts, investor protection schemes, and negative balance protection policies.

Unfortunately, DRC does not provide adequate information regarding its fund safety measures, leaving clients vulnerable to potential financial risks. The lack of segregation of client funds implies that in the event of financial difficulties faced by DRC, clients may not have their funds protected. Furthermore, the absence of any historical issues or disputes regarding fund safety does not necessarily indicate a secure environment, as it could simply reflect the broker's short operational history. Overall, without robust protection measures in place, traders should approach DRC with caution and consider the risks involved in trading with an unregulated broker.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. In the case of DRC, user experiences appear to be mixed, with several complaints surfacing related to poor customer service and issues regarding fund withdrawals. Common complaint patterns include delays in processing withdrawals and unresponsive customer support. Below is a summary of the main complaint types and their severity assessments:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service | Medium | Unresponsive |

One notable complaint involved a user who reported that DRC deducted all their funds without explanation, highlighting potential operational issues within the brokerage. Such complaints raise serious concerns about the broker's trustworthiness and call into question whether DRC is safe for trading activities. The company's response to these complaints has been criticized, with many users expressing frustration over the lack of timely support and resolution.

Platform and Trade Execution

The trading platform offered by DRC plays a significant role in the overall trading experience. Users have reported mixed reviews regarding the platform's performance and stability. Issues such as slippage, order rejections, and delayed execution have been noted, which can significantly affect trading outcomes. A reliable trading platform should provide a seamless experience with minimal disruptions.

Additionally, there are concerns about possible signs of platform manipulation, which can lead to unfair trading conditions for clients. Traders should be vigilant and monitor their experiences closely when using DRC's platform, as any inconsistencies in order execution could indicate deeper issues within the brokerage.

Risk Assessment

Using DRC as a forex broker involves several risks that potential clients should be aware of. The lack of regulatory oversight, combined with the broker's unclear fee structure and mixed customer feedback, contributes to an overall high-risk environment. Below is a summary of the key risk categories associated with trading with DRC:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection. |

| Financial Risk | Medium | High spreads and unclear fees. |

| Operational Risk | High | Issues with withdrawals and support. |

To mitigate these risks, potential clients should conduct thorough research before engaging with DRC. It is advisable to start with a small deposit if choosing to trade with this broker, allowing traders to gauge the service quality and operational reliability before committing larger sums.

Conclusion and Recommendations

In conclusion, the analysis of DRC raises significant concerns regarding its safety and legitimacy. The lack of regulation, combined with questionable trading conditions, poor customer feedback, and potential operational risks, suggests that traders should exercise extreme caution when considering this broker. While DRC may offer a range of trading instruments, the potential for financial loss and operational issues makes it a risky choice.

For traders seeking reliable alternatives, it is recommended to consider brokers with strong regulatory oversight, transparent fee structures, and positive customer reviews. Brokers such as IC Markets, XM, and Tickmill are known for their robust regulatory frameworks and customer protection measures, making them safer options for traders. Ultimately, the question remains: Is DRC safe? Based on the evidence presented, it is advisable for traders to look elsewhere for their forex trading needs.

Is DRC a scam, or is it legit?

The latest exposure and evaluation content of DRC brokers.

DRC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DRC latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.