Is DeltaFX safe?

Software Index

License

Is DeltaFX Safe or a Scam?

Introduction

DeltaFX is a forex broker that has been operational since 2009, positioning itself as a player in the competitive forex market. With a wide range of trading instruments including currency pairs, commodities, and cryptocurrencies, DeltaFX aims to attract both novice and experienced traders. However, the importance of thoroughly evaluating forex brokers cannot be overstated. Traders must ensure that their chosen broker is not only reliable but also compliant with regulatory standards to protect their investments. In this article, we will conduct a comprehensive analysis of DeltaFX, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our evaluation will rely on multiple sources, including user reviews and regulatory databases, to provide a balanced perspective on whether DeltaFX is safe or potentially a scam.

Regulation and Legitimacy

The regulatory environment for forex brokers is crucial in determining their legitimacy and safety. A reputable broker should be regulated by a recognized financial authority that imposes stringent guidelines to protect traders' funds. DeltaFX claims to be registered in Saint Vincent and the Grenadines; however, this jurisdiction is known for its lax regulatory framework, raising concerns about the broker's legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Authority (FSA) | Not Applicable | Saint Vincent and the Grenadines | Unverified |

Despite DeltaFX's claims of regulation, numerous reviews indicate that it does not hold a valid license from any major regulatory body, such as the FCA in the UK or ASIC in Australia. This lack of oversight means that traders have no recourse if issues arise, making it imperative for potential clients to consider the risks involved. The absence of regulatory protection raises significant red flags, leading many to question whether DeltaFX is safe for trading.

Company Background Investigation

DeltaFX Ltd., the company behind the brokerage, has been in operation since 2009. Its headquarters are reportedly located in Geneva, Switzerland, but the broker operates primarily out of Saint Vincent and the Grenadines. The ownership structure and management team of DeltaFX remain somewhat opaque. There is limited information available about the individuals behind the company, which contributes to the skepticism surrounding its operations.

The lack of transparency regarding the management team is concerning. A reputable broker typically provides detailed information about its executives, including their professional backgrounds and qualifications. In contrast, DeltaFX's website lacks this crucial information, making it difficult for traders to assess the experience and credibility of its leadership. Without a clear understanding of the company's governance, potential clients may question whether DeltaFX is safe for their investments.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. DeltaFX claims to provide competitive spreads and leverage options; however, the specifics are often vague. The broker offers various account types, including nano, standard, and VIP accounts, with minimum deposits starting as low as $1, which is unusually low compared to industry standards.

| Fee Type | DeltaFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (up to 6 pips) | 1-2 pips |

| Commission Model | None | Varies (often $5-$10 per lot) |

| Overnight Interest Range | Not disclosed | 2-5% |

The absence of transparency regarding overnight interest rates and commission structures could lead to unexpected costs for traders. Additionally, the high leverage of up to 1:1000 can be enticing but also poses significant risks, especially for inexperienced traders. High leverage can amplify losses just as easily as it can increase profits, making it critical for traders to understand the implications of their trading choices. Given these factors, it becomes increasingly important to question whether DeltaFX is safe for trading.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. DeltaFX claims to adhere to certain safety measures, but the lack of regulation raises questions about the effectiveness of these measures. There is no evidence to suggest that DeltaFX maintains segregated accounts for client funds, which is a standard practice among regulated brokers. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, providing an additional layer of protection.

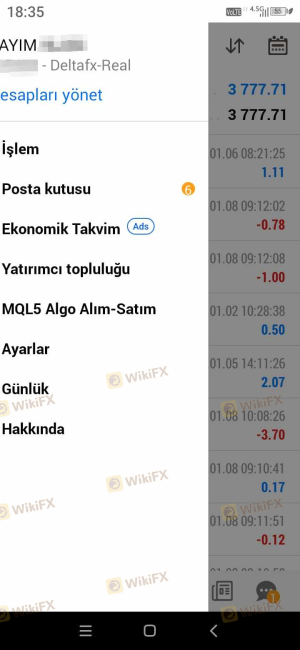

Moreover, the absence of investor protection schemes means that traders have no guarantee of fund recovery in the event of insolvency. Historical complaints about DeltaFX indicate issues with fund withdrawals, where clients have reported difficulties accessing their money. Such incidents further diminish confidence in the broker's ability to safeguard client investments, prompting serious concerns about whether DeltaFX is safe.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability. Reviews of DeltaFX reveal a pattern of complaints related to withdrawal issues and poor customer service. Many users report that their funds were either delayed or inaccessible, leading to frustration and distrust.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Service | Medium | Slow to Respond |

| Account Blocking | High | No Clear Explanation |

Two notable cases include traders who reported being unable to withdraw their funds despite multiple requests, and others who experienced account blocks without clear reasons. These issues reflect a troubling trend and raise questions about the broker's commitment to customer satisfaction and security. As such, prospective clients should carefully consider these experiences when determining whether DeltaFX is safe.

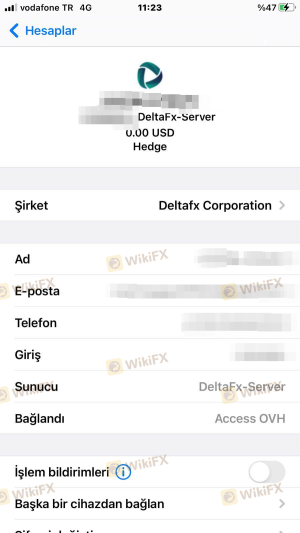

Platform and Trade Execution

The trading platform offered by DeltaFX is MetaTrader 4 (MT4), a widely used platform known for its user-friendly interface and robust features. However, the performance and reliability of the platform are critical for successful trading. Reports suggest that while the platform is generally stable, there have been instances of slippage and order rejections, which can severely impact trading outcomes.

Traders have expressed concerns about the execution quality, particularly during volatile market conditions. Any signs of platform manipulation, such as unjustified price spikes or execution delays, can further erode trust in the broker. Therefore, it is essential for traders to scrutinize these aspects when evaluating whether DeltaFX is safe for their trading activities.

Risk Assessment

Engaging with DeltaFX presents several risks that traders should be aware of. The lack of regulation, combined with a history of customer complaints, creates a high-risk environment. Traders must assess their risk tolerance and consider the potential implications of trading with an unregulated broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight or protection |

| Fund Safety Risk | High | Lack of segregated accounts |

| Execution Risk | Medium | Potential for slippage and order rejections |

To mitigate these risks, traders are advised to conduct thorough research, start with small investments, and consider using risk management tools such as stop-loss orders. By being proactive, traders can better protect themselves from the inherent risks associated with trading through DeltaFX.

Conclusion and Recommendations

In conclusion, the evidence suggests that DeltaFX raises significant concerns regarding its safety and legitimacy. The lack of regulatory oversight, combined with numerous customer complaints, points to a potentially risky trading environment. While the broker offers attractive trading conditions, the absence of transparency and security measures makes it difficult to recommend DeltaFX confidently.

For traders seeking a safer alternative, it is advisable to consider brokers that are regulated by reputable authorities such as the FCA or ASIC, which provide stronger investor protections. Ultimately, potential clients should weigh the risks carefully and ask themselves: Is DeltaFX safe? The answer, based on current evidence, leans toward caution.

Is DeltaFX a scam, or is it legit?

The latest exposure and evaluation content of DeltaFX brokers.

DeltaFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DeltaFX latest industry rating score is 2.30, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.30 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.