Is Cowtrading Wealth safe?

Business

License

Is Cowtrading Wealth a Scam?

Introduction

Cowtrading Wealth is an online trading platform that positions itself within the competitive landscape of the forex market. It claims to offer access to various trading instruments, including forex pairs, commodities, and indices, while promoting attractive trading conditions such as high leverage. However, in the highly volatile and sometimes opaque world of forex trading, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy of any broker they consider engaging with. This article aims to provide a comprehensive analysis of Cowtrading Wealth, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. Our investigation is based on a review of multiple online sources, including trader feedback, regulatory bodies, and financial analysis platforms, ensuring a balanced perspective on whether Cowtrading Wealth is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a trading platform is a fundamental factor in determining its legitimacy. Regulatory bodies enforce rules and standards that protect traders and ensure fair trading practices. In the case of Cowtrading Wealth, it is noteworthy that the broker operates without any recognized regulatory oversight.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of a regulatory license raises significant concerns regarding the safety of funds and the overall integrity of the trading platform. Regulatory authorities such as the Financial Conduct Authority (FCA) in the UK and the Securities and Exchange Commission (SEC) in the US impose strict guidelines that brokers must follow. These regulations are designed to protect traders from fraud, manipulation, and other unethical practices. The lack of oversight for Cowtrading Wealth suggests that traders may be exposed to higher risks, including the potential for fraudulent activities.

Furthermore, reports have indicated that Cowtrading Wealth may have been flagged as a "suspicious clone" of legitimate brokers, which heightens the need for caution. Given these regulatory concerns, it is essential for prospective traders to consider whether Cowtrading Wealth is safe before investing their hard-earned money.

Company Background Investigation

Cowtrading Wealth was founded relatively recently, with reports indicating it has been operational for about 1-2 years. The broker claims to be based in the United Kingdom, yet there is little transparency regarding its ownership structure and management team. A lack of information about the individuals behind the company is a red flag, as reputable brokers typically provide clear details about their management and operational practices.

Moreover, the company's website lacks essential information that would help establish credibility, such as the qualifications and experience of its management team. This absence of disclosure can lead to doubts about the broker's legitimacy and the safety of its trading environment.

The overall transparency level of Cowtrading Wealth is low, which is concerning for potential investors. Without clear information about the company's history, ownership, and operational practices, traders may find it challenging to ascertain the reliability of the broker. In an industry where trust is paramount, this lack of transparency is a significant warning sign.

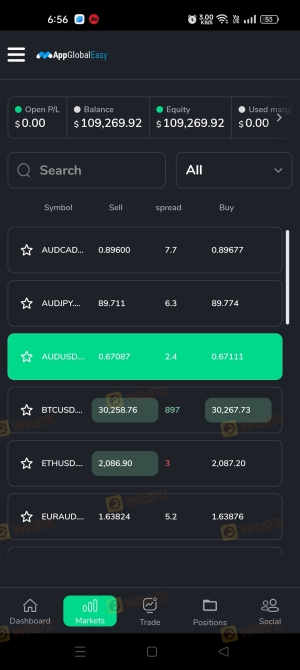

Trading Conditions Analysis

When evaluating a trading platform, understanding the cost structure is crucial. Cowtrading Wealth offers competitive trading conditions, including high leverage of up to 1:500, which can be enticing for traders looking to maximize their potential returns. However, this high leverage also comes with increased risk, particularly for inexperienced traders.

| Cost Type | Cowtrading Wealth | Industry Average |

|---|---|---|

| Main Currency Pair Spread | Not Specified | Varies |

| Commission Model | No Commissions | Varies |

| Overnight Interest Range | Not Specified | Varies |

The absence of clear information regarding spreads and commissions raises concerns about hidden fees that may not be immediately apparent to traders. Furthermore, the lack of transparency surrounding overnight interest rates and other potential costs can lead to unexpected expenses for traders, further complicating the trading experience.

Traders should be wary of brokers that do not clearly disclose their fee structures, as this can indicate a lack of integrity. The potential for hidden charges can significantly impact a trader's profitability and overall trading strategy. Therefore, it is essential to assess whether Cowtrading Wealth is safe in terms of its trading conditions before committing funds.

Client Funds Security

Client funds' safety is a critical aspect of any trading platform. Cowtrading Wealth has not provided substantial information regarding its security measures to protect clients' funds. In regulated environments, brokers are typically required to segregate client funds from their operational funds, ensuring that traders' money is secure even in the event of the broker's insolvency.

Additionally, reputable brokers often implement investor protection schemes that provide further safety nets for traders. However, Cowtrading Wealth's lack of regulatory oversight raises questions about whether such protections are in place.

Historically, there have been instances where unregulated brokers have mismanaged client funds, leading to significant financial losses for traders. Without clear information regarding fund security measures, it is difficult to ascertain whether Cowtrading Wealth is safe for traders looking to protect their investments.

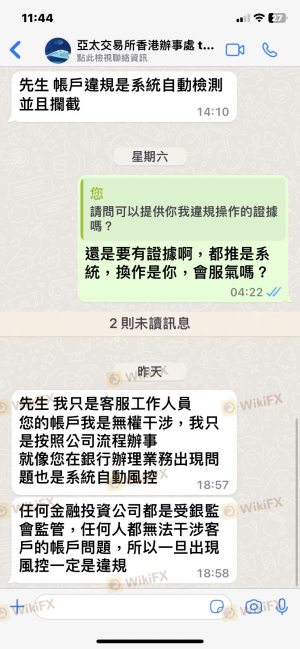

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability and service quality. Reviews of Cowtrading Wealth reveal a concerning trend of negative experiences among clients. Common complaints include difficulties with fund withdrawals, poor customer service, and a lack of responsiveness from the support team.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Transparency Issues | High | Poor |

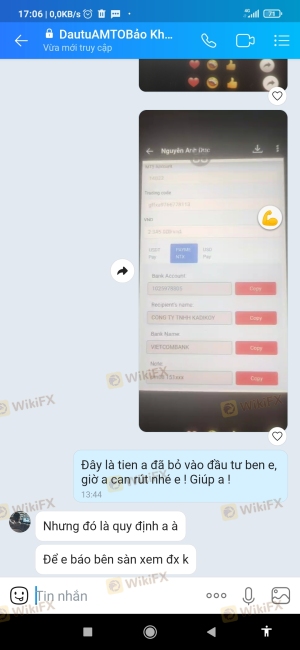

Several users have reported being unable to withdraw their funds, with some alleging that they were asked to pay additional fees before withdrawals could be processed. Such practices are often indicative of potential scams, as they create barriers for clients attempting to access their funds.

One typical case involved a trader who deposited a significant amount but faced repeated requests for additional payments under various pretexts before being ultimately unable to withdraw their funds. These patterns of complaints raise serious concerns about whether Cowtrading Wealth is safe for traders.

Platform and Execution

The trading platform offered by Cowtrading Wealth is another critical aspect of the overall trading experience. Users have reported mixed experiences regarding the platform's performance, with some claiming it is prone to glitches and instability.

Effective order execution is vital in forex trading, where market conditions can change rapidly. Reports of slippage and rejected orders have surfaced, suggesting that traders may face challenges when attempting to execute their strategies.

If there are signs of platform manipulation or technical issues, it could indicate a lack of professionalism on the part of the broker, further questioning the safety of trading with Cowtrading Wealth.

Risk Assessment

Engaging with Cowtrading Wealth presents several risks that potential traders should carefully consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Financial Risk | High | Potential for hidden fees and withdrawal issues. |

| Operational Risk | Medium | Platform instability and execution issues. |

To mitigate these risks, traders should conduct thorough research, consider using demo accounts to test the platform, and avoid investing more than they can afford to lose. It is also advisable to seek out alternative, regulated brokers that offer better security and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that Cowtrading Wealth raises several red flags that warrant caution. The lack of regulatory oversight, transparency issues, negative customer feedback, and potential financial risks indicate that this broker may not be safe for traders.

For those considering trading with Cowtrading Wealth, it is essential to weigh the potential benefits against these risks. We recommend that traders explore alternative options with established, regulated brokers that provide a safer trading environment and better customer support.

Ultimately, while Cowtrading Wealth may offer appealing trading conditions, the associated risks and lack of transparency make it a questionable choice for traders seeking a reliable and secure trading platform.

Is Cowtrading Wealth a scam, or is it legit?

The latest exposure and evaluation content of Cowtrading Wealth brokers.

Cowtrading Wealth Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Cowtrading Wealth latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.