Is AE GLOBAL safe?

Pros

Cons

Is AE Global Safe or a Scam?

Introduction

AE Global, a relatively new player in the forex trading market, has attracted attention due to its aggressive marketing strategies and promises of high returns. Established in 2022, AE Global positions itself as a brokerage offering a range of financial instruments, including forex, stocks, and CFDs. However, the rise in popularity of online trading has also led to an increase in fraudulent activities, making it crucial for traders to thoroughly evaluate the legitimacy of brokers before committing their funds. This article aims to provide an objective analysis of AE Global by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

To assess AE Global's credibility, we utilized a comprehensive investigative approach, analyzing online reviews, regulatory databases, and expert opinions. The evaluation framework includes key aspects such as regulatory compliance, transparency, customer service, and user experiences.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety for traders. Regulated brokers are subject to oversight by financial authorities, which helps protect investors from fraud and malpractice. Unfortunately, AE Global lacks any regulatory licenses from recognized financial authorities, raising significant red flags about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of regulation means that AE Global operates without the necessary oversight to ensure fair trading practices and the safety of client funds. This unregulated status is concerning, especially given that many reputable brokers are licensed by authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). The lack of a regulatory framework leaves traders vulnerable to potential fraud, as there are no legal protections in place should disputes arise or if the broker fails to honor withdrawal requests.

Company Background Investigation

AE Global claims to be operated by AE Global Link Company Limited, but there is a notable lack of transparency regarding its ownership and operational history. The company's website provides minimal information about its management team or corporate structure, which is a common characteristic of fraudulent brokers. Without clear details about who runs the company and their qualifications, it becomes difficult for traders to assess the broker's reliability.

Moreover, the company does not disclose its physical address or any contact information beyond a generic email, further obscuring its legitimacy. A legitimate brokerage typically provides detailed information about its management team, including their backgrounds and professional experiences, to instill confidence in potential clients. Unfortunately, AE Global falls short in this regard, contributing to the perception of it being a potentially fraudulent entity.

Trading Conditions Analysis

Understanding a broker's trading conditions is essential for evaluating its overall cost structure and potential profitability. AE Global's website lacks clarity regarding its fees, spreads, and commissions, which are critical for traders to make informed decisions. The absence of this information raises concerns about hidden fees that could affect a trader's bottom line.

| Fee Type | AE Global | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Not Specified | 1-1.5 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Varies |

The lack of transparency in trading conditions is alarming, as it suggests that AE Global may impose unfavorable terms on its clients. Traders typically expect clear information about spreads, commissions, and any applicable fees before opening an account. The absence of such details can lead to unexpected costs, making it difficult for traders to assess the true cost of trading with AE Global.

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. Regulated brokers are required to implement measures such as segregated accounts to protect clients' deposits. Unfortunately, AE Global does not provide any information regarding its fund security measures, which raises serious concerns about the safety of clients' money.

Traders should be wary of brokers that do not offer segregated accounts or investor protection schemes. Without these safeguards, there is a risk that AE Global could misuse client funds or become insolvent, leaving traders with little recourse to recover their investments. Furthermore, the absence of any historical data regarding fund security issues or disputes only adds to the uncertainty surrounding AE Global's operations.

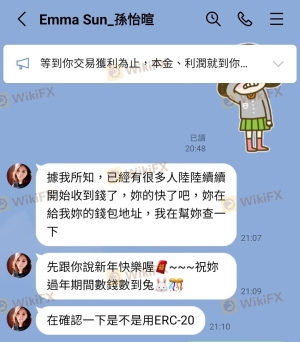

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Numerous online reviews of AE Global reveal a pattern of negative experiences, with many traders reporting difficulties in withdrawing funds and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | Medium | Slow Response |

Common complaints include delays in processing withdrawal requests and unhelpful customer service representatives. In some cases, traders have reported waiting months to access their funds, which is a significant concern for anyone considering trading with AE Global. These issues highlight the potential risks of using an unregulated broker, as there is no accountability to ensure that client funds are handled appropriately.

Platform and Trade Execution

A broker's trading platform is crucial for executing trades efficiently. AE Global claims to offer the widely-used MetaTrader 4 platform, but there are significant concerns regarding its functionality. Reports from users indicate issues with platform stability, order execution delays, and instances of slippage.

The lack of transparency surrounding the platform's capabilities raises questions about AE Global's operational integrity. Traders should be able to rely on their broker's platform for seamless trading experiences, and any signs of manipulation or technical failures can severely impact trading outcomes.

Risk Assessment

Using AE Global poses several risks for traders. The lack of regulation, unclear trading conditions, and negative customer experiences collectively indicate a high-risk environment.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight or protection for client funds |

| Financial Risk | High | Potential hidden fees and unfavorable trading terms |

| Operational Risk | Medium | Issues with platform stability and order execution |

To mitigate these risks, traders should consider using regulated brokers with transparent practices and robust customer support. It is advisable to conduct thorough research and seek out brokers with positive reputations and strong regulatory oversight.

Conclusion and Recommendations

In conclusion, AE Global raises numerous red flags that suggest it may not be a safe option for traders. The lack of regulation, transparency issues, and negative customer feedback indicate that there are significant risks involved in trading with this broker.

Traders should exercise caution and consider alternative options that offer better security and reliability. Recommended alternatives include established brokers with strong regulatory oversight and positive user experiences. Overall, it is prudent to prioritize safety and due diligence when selecting a forex broker.

Is AE Global safe? Based on the evidence presented, it is clear that traders should approach this broker with skepticism and consider more reputable alternatives to protect their investments.

Is AE GLOBAL a scam, or is it legit?

The latest exposure and evaluation content of AE GLOBAL brokers.

AE GLOBAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AE GLOBAL latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.