Is InterMax safe?

Pros

Cons

Is Intermax Safe or a Scam?

Introduction

Intermax is a forex broker operating primarily in the foreign exchange market, established in 2018 and based in Saint Vincent and the Grenadines. As the forex trading landscape becomes increasingly crowded with various brokers, it is essential for traders to carefully evaluate their options to avoid potential pitfalls. The importance of this evaluation lies in the fact that the forex market, while offering opportunities for profit, also presents risks, particularly when dealing with unregulated brokers. In this article, we will investigate whether Intermax is a safe trading option or a potential scam. Our investigation is based on a comprehensive review of various online sources, user feedback, and regulatory information, allowing us to present a balanced assessment of Intermax's credibility.

Regulation and Legitimacy

When assessing the safety of a forex broker, regulatory oversight is a critical factor. A regulated broker is subject to the stringent rules and guidelines set by financial authorities, which helps protect traders from fraud and ensures fair trading practices. Unfortunately, Intermax operates without any valid regulatory oversight, which raises significant concerns about its legitimacy and the safety of traders' funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The lack of regulation implies that Intermax is not held accountable by any financial authority, increasing the risk for traders. In the absence of regulatory oversight, there are no guarantees regarding the broker's operations or the protection of client funds. This is particularly concerning given that unregulated brokers often lack transparency and can engage in unethical practices without repercussions.

Company Background Investigation

Intermax was founded in 2018 and has since positioned itself as a forex broker catering to various trading needs. However, the company's background raises several questions about its credibility. With limited information available about its ownership structure and management team, potential clients may find it challenging to ascertain the broker's reliability.

The management team's qualifications and experience are crucial indicators of a broker's trustworthiness. Unfortunately, details about the individuals behind Intermax remain obscure. This lack of transparency can be a red flag for traders, as it suggests that the broker may not be forthcoming with essential information that could impact clients' trading experiences.

Furthermore, the absence of a well-documented history and clear operational practices makes it difficult to evaluate Intermax's long-term viability. In an industry where trust is paramount, the lack of information about the company's background raises legitimate concerns about whether Intermax is safe to trade with.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for traders looking to maximize their potential returns. Intermax has various trading fees and conditions that warrant scrutiny. The broker utilizes the MetaTrader 5 platform, which is widely regarded for its advanced features and capabilities. However, the overall cost structure and any unusual fees associated with trading on this platform must be carefully examined.

| Fee Type | Intermax | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1-2 pips | 1-3 pips |

| Commission Model | No commission | Varies |

| Overnight Interest Range | Not specified | Varies |

While Intermax does not charge commissions, the spreads on major currency pairs are relatively standard. However, the absence of clear information regarding overnight interest rates raises questions about potential hidden costs. Traders should be cautious and fully understand the fee structure before engaging with Intermax to avoid unexpected charges.

Client Funds Security

The safety of client funds is a paramount concern for any trader. Intermax's approach to securing client funds is a crucial aspect of evaluating whether it is safe to trade with them. Unfortunately, the broker does not provide sufficient information regarding its fund security measures, including whether client funds are held in segregated accounts or if there are any investor protection policies in place.

The lack of transparency surrounding these crucial safety measures is concerning. Traders should be aware that without proper safeguards, their funds may be at risk in the event of financial difficulties faced by the broker. Furthermore, there have been reports of customer complaints regarding withdrawal issues, which raises questions about the broker's reliability when it comes to returning clients' funds.

Customer Experience and Complaints

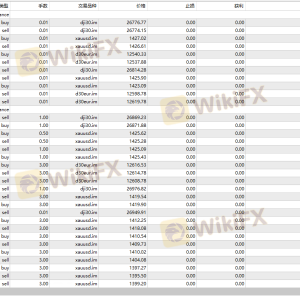

User feedback is a valuable source of information when assessing a broker's credibility. In the case of Intermax, there have been multiple complaints regarding withdrawal issues and the handling of client accounts. Many users have reported difficulties in withdrawing their funds, often citing vague excuses from the broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Bans | High | Poor |

These complaints indicate a troubling pattern that suggests potential issues with customer service and fund management. For instance, some users have claimed that their withdrawal requests were denied after they made profits, leading to distrust and frustration. Such experiences highlight the need for caution when considering whether Intermax is safe for trading.

Platform and Trade Execution

The trading platform is a crucial aspect of any broker's offering. Intermax utilizes the MetaTrader 5 platform, which is known for its advanced features and user-friendly interface. However, the performance and reliability of the platform are essential for traders to execute their strategies effectively.

Traders have reported mixed experiences regarding order execution quality, with some indicating instances of slippage and rejected orders. These issues can significantly impact trading performance, especially in volatile market conditions. Additionally, the absence of clear information about the broker's practices raises concerns about the potential for platform manipulation.

Risk Assessment

Engaging with any forex broker involves inherent risks, and Intermax is no exception. The lack of regulation, transparency issues, and customer complaints contribute to a higher risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Fund Security Risk | High | Lack of transparency |

| Customer Service Risk | Medium | Poor response to issues |

To mitigate these risks, traders should conduct thorough research and consider starting with a small deposit to gauge the broker's reliability. Additionally, diversifying investments across multiple platforms can help spread risk and protect capital.

Conclusion and Recommendations

In conclusion, while Intermax presents itself as a forex broker with a range of trading options, significant concerns about its regulatory status, transparency, and customer feedback suggest that it may not be a safe choice for traders. The absence of regulation, coupled with numerous complaints regarding withdrawal issues, raises red flags that potential clients should consider seriously.

For traders seeking reliable alternatives, it is advisable to explore brokers that are regulated by reputable financial authorities and have a proven track record of customer satisfaction. Options such as brokers regulated by the FCA or ASIC can provide a safer trading environment. Ultimately, the decision to engage with Intermax should be made with caution, keeping in mind the potential risks involved.

Is InterMax a scam, or is it legit?

The latest exposure and evaluation content of InterMax brokers.

InterMax Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

InterMax latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.