Is Core Financial safe?

Pros

Cons

Is Core Financial A Scam?

Introduction

Core Financial, a forex brokerage established in 2022 and headquartered in Comoros, positions itself as a global online trading platform offering various financial instruments, including forex, CFDs, commodities, and indices. With the rise of online trading, many investors are drawn to platforms like Core Financial, lured by the potential for high returns. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The importance of thorough research cannot be overstated, as the wrong choice could lead to significant financial losses. This article seeks to objectively evaluate the safety and legitimacy of Core Financial by examining its regulatory status, company background, trading conditions, client fund security, customer experience, platform performance, and overall risk assessment.

Regulation and Legality

The regulatory environment in which a broker operates is crucial for ensuring investor protection and maintaining market integrity. Core Financial is currently unregulated, which raises significant concerns regarding its legitimacy and the safety of traders funds. Below is a summary of the regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Comoros | Not Verified |

The absence of a regulatory body overseeing Core Financial means that it does not adhere to any strict compliance standards. This lack of oversight can lead to increased risks for traders, as unregulated brokers may engage in unethical practices without the fear of repercussions. In contrast, brokers regulated by top-tier authorities such as the FCA in the UK or ASIC in Australia are required to follow stringent rules to protect investors. The lack of regulation also means that there are no investor compensation schemes in place, leaving clients vulnerable in case of broker insolvency or fraudulent activity.

Company Background Investigation

Core Financial's brief history raises questions about its stability and reliability. Founded in 2022, the brokerage is relatively new in the competitive forex market. The ownership structure is not clearly disclosed, which is a red flag for potential investors. A transparent ownership structure typically indicates that a company is confident in its operations and is willing to be held accountable.

Moreover, the management team's background is not well-documented, which makes it challenging for prospective clients to evaluate their expertise and experience in the financial industry. A knowledgeable management team is essential for maintaining a broker's credibility and ensuring that it operates ethically. The lack of information regarding the management's qualifications and past experiences further complicates the trustworthiness of Core Financial.

Transparency is a critical factor in assessing any financial institution. Core Financial's website does not provide comprehensive information about its services, fees, or trading conditions. This lack of clarity can lead to misunderstandings and mistrust among clients, making it imperative for potential traders to exercise caution.

Trading Conditions Analysis

Understanding a broker's trading conditions is vital for evaluating its overall value proposition. Core Financial offers various trading instruments, but the details regarding its fee structure are concerning. The absence of a clear explanation of costs can lead to unexpected charges and dissatisfaction among clients.

| Fee Type | Core Financial | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 0.5 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 3% |

The lack of specific information regarding spreads and commissions is alarming. In the forex industry, spreads typically range from 0.5 to 1.5 pips for major currency pairs, and commissions can vary widely depending on the broker. Core Financial's failure to provide this information raises concerns about potential hidden fees that could significantly affect trading profitability.

Moreover, the absence of clear overnight interest rates indicates a lack of transparency in how the broker manages positions held overnight. This can lead to unexpected costs for traders and may indicate that Core Financial does not prioritize client interests.

Client Fund Security

The safety of client funds is a primary concern for any trader. Core Financial's lack of regulation raises serious questions about its fund security measures. A reputable broker typically employs strict security protocols, including segregating client funds from operational funds and offering negative balance protection.

Core Financial's website does not provide clear information on whether it implements such measures. The absence of details regarding fund segregation and investor protection policies is a significant concern. Without these safeguards, traders may find their funds at risk in the event of the broker's financial instability or misconduct.

Additionally, there have been no reported incidents of fund security breaches or disputes involving Core Financial, but this lack of history does not equate to safety. The absence of a regulatory framework makes it difficult to ascertain the broker's reliability in managing client funds.

Customer Experience and Complaints

Customer feedback is a crucial aspect of assessing a broker's reliability. However, reviews for Core Financial are limited, and the absence of detailed testimonials makes it challenging to gauge client satisfaction.

Common complaint patterns in the forex industry include issues related to withdrawal difficulties, poor customer service, and unexpected fees. Without a robust customer support system, traders may struggle to resolve issues promptly, leading to frustration and potential financial losses.

| Complaint Type | Severity | Company Response |

|---|---|---|

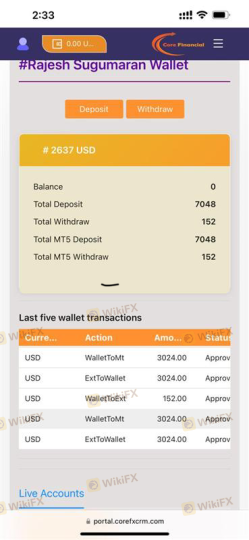

| Withdrawal Issues | High | Unresponsive |

| Customer Service | Medium | Slow Response |

| Fee Transparency | High | No Clear Policy |

The lack of responsiveness to complaints can indicate deeper issues within the brokerage, such as inadequate operational practices or a focus on profits over client satisfaction.

Platform and Execution

The trading platform's performance is critical for a successful trading experience. Core Financial does not appear to offer widely-used platforms like MetaTrader 4 or 5, which are standard in the industry. The absence of a reliable platform raises concerns about order execution quality, slippage, and potential manipulation.

Traders need platforms that provide stable performance, quick order execution, and minimal slippage. If the platform is unreliable, traders may face difficulties in executing trades at desired prices, leading to potential losses.

Risk Assessment

Engaging with an unregulated broker like Core Financial presents several risks. The lack of oversight, unclear fee structures, and limited customer support contribute to a high-risk environment for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the risk of fraud. |

| Fund Security Risk | High | Lack of fund segregation and protection policies. |

| Execution Risk | Medium | Uncertainty regarding platform reliability and order execution. |

To mitigate these risks, traders should consider using regulated brokers with established reputations, transparent fee structures, and robust customer support systems.

Conclusion and Recommendations

In conclusion, Core Financial raises several red flags that warrant caution. The lack of regulation, unclear trading conditions, and limited customer feedback suggest that this broker may not be a safe choice for traders.

For those considering trading with Core Financial, it is advisable to explore other options that provide a more secure trading environment. Reputable brokers regulated by top-tier authorities can offer better protection for your investments. Some alternative brokers include OANDA, IG, and Forex.com, which are known for their regulatory compliance and strong customer support.

Ultimately, thorough research and careful consideration are essential when choosing a forex broker. Ensuring that your broker is regulated and transparent can help safeguard your investments and enhance your trading experience.

Is Core Financial a scam, or is it legit?

The latest exposure and evaluation content of Core Financial brokers.

Core Financial Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Core Financial latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.