Core Financial 2025 Review: Everything You Need to Know

Executive Summary

This core financial review looks at a financial advisory firm that has gotten a lot of attention in the industry. The attention hasn't been positive, though. Core Financial shows a mixed picture based on regulatory sources and user feedback, so potential clients need to think carefully about this company. The firm works as a financial advisory service provider. It focuses mainly on retirement planning and complete financial management solutions for people who want long-term financial guidance.

FINRA regulatory records show that Core Financial has legitimate licensing credentials (CRD#: 151044 / SEC#: 8-68330). This gives the company legal standing to operate in the United States financial services sector. However, user reviews on platforms like Glassdoor show a worrying picture, with many reviewers calling the company a "scam operation." This big difference between regulatory approval and user feelings creates a complex situation that potential clients must handle carefully.

The firm targets people who want comprehensive financial planning services. These clients are usually approaching retirement or need sophisticated wealth management strategies. Core Financial says it builds long-term relationships with clients. The company positions itself as a partner in achieving financial security and retirement goals through personalized advisory services.

Important Notice

This core financial review uses publicly available information from regulatory databases, user reviews, and company materials. Readers should know that Core Financial operates under FINRA regulation within the United States market. This evaluation mainly reflects the U.S. operational framework. Different regulatory environments may apply in other jurisdictions, and potential clients should verify current licensing status in their specific location.

Our evaluation method relies on user feedback, regulatory information, and available company documentation. However, detailed information about specific trading conditions, platform tools, and comprehensive service offerings was limited in available sources. Prospective clients should strongly consider conducting independent research and requesting detailed information directly from the company before making any financial commitments.

Rating Framework

Broker Overview

Core Financial operates as a financial advisory firm within the United States financial services landscape. Specific founding details were not available in source materials, though. The company has established itself as a provider of comprehensive financial planning services, with particular emphasis on retirement planning and long-term wealth management strategies. According to available company information, Core Financial positions itself as a relationship-focused advisory service that emphasizes the importance of building trust and understanding with clients over extended periods.

The firm's business model centers around providing personalized financial guidance designed to help clients achieve their retirement and wealth accumulation goals. This approach involves developing comprehensive financial strategies tailored to individual client circumstances, risk tolerance, and long-term objectives. The company appears to target clients who require sophisticated financial planning beyond basic investment advice. It focuses on those with complex financial situations or substantial assets requiring professional management.

From a regulatory perspective, Core Financial maintains proper licensing through FINRA, holding credentials under CRD#: 151044 / SEC#: 8-68330. This regulatory standing provides the legal framework for the company to offer financial advisory services within the United States market. However, the contrast between regulatory approval and user feedback creates an interesting dynamic that potential clients must carefully consider when evaluating the firm's suitability for their financial planning needs.

Regulatory Jurisdiction: Core Financial operates under FINRA supervision within the United States market. The firm maintains proper licensing credentials for financial advisory services. The firm's regulatory status appears current and in good standing according to available records.

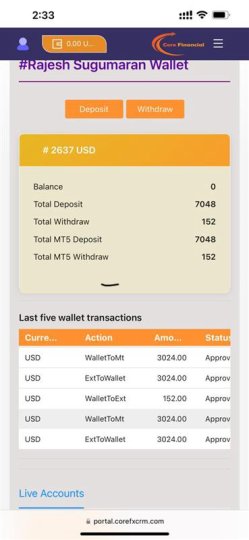

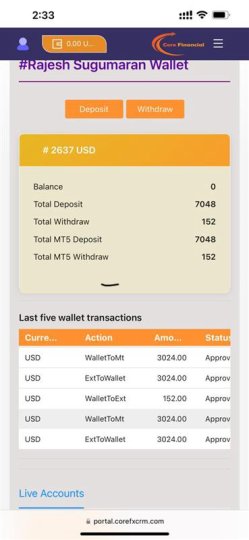

Deposit and Withdrawal Methods: Specific information regarding funding methods and withdrawal procedures was not detailed in available source materials. Potential clients should request comprehensive information about available funding options directly from the company.

Minimum Deposit Requirements: Source materials did not specify minimum account funding requirements or initial investment thresholds for Core Financial's services.

Bonus and Promotional Offers: No information regarding promotional offers, bonuses, or special incentives was available in the reviewed materials.

Tradeable Assets: Detailed information about specific investment products, asset classes, or trading instruments offered by Core Financial was not available in source documentation.

Cost Structure: Fee schedules, commission structures, and ongoing service costs were not specified in available materials. This represents a significant information gap for this core financial review.

Leverage Ratios: No information regarding leverage options or margin requirements was found in source materials.

Platform Options: Specific details about trading platforms, software solutions, or technological infrastructure were not available in reviewed documentation.

Regional Restrictions: Geographic limitations or service availability restrictions were not specified in available materials.

Customer Service Languages: Language support options for customer service were not detailed in source documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: N/A)

The evaluation of Core Financial's account conditions proves challenging due to limited available information in source materials. Traditional account analysis typically examines factors such as account type variety, minimum deposit requirements, account opening procedures, and special features designed to accommodate different client needs. Unfortunately, comprehensive details about these fundamental aspects were not available in the materials reviewed for this assessment.

Without specific information about account structures, it becomes impossible to evaluate whether Core Financial offers competitive minimum deposit requirements. We also can't tell if the company provides account types suitable for different investor profiles. The absence of detailed account opening process descriptions also prevents assessment of user experience during the initial client onboarding phase.

Industry standards typically include various account types such as individual, joint, retirement, and corporate accounts, each with specific features and requirements. However, Core Financial's specific offerings in this regard remain unclear based on available documentation. This information gap represents a significant limitation for potential clients attempting to understand what account options might be available to them.

The lack of detailed account condition information also extends to special features that modern financial advisory firms often provide. These include Islamic-compliant accounts, specialized retirement planning accounts, or accounts designed for high-net-worth individuals. Without this fundamental information, potential clients cannot adequately assess whether Core Financial's account structures align with their specific needs and preferences.

Evaluating Core Financial's tools and resources proves impossible based on available source materials. Specific information about research capabilities, analytical tools, educational resources, and technological offerings was not documented. Modern financial advisory firms typically provide comprehensive suites of tools designed to support client decision-making and ongoing financial education.

Standard industry offerings usually include market research reports, economic analysis, portfolio management tools, risk assessment calculators, and retirement planning software. However, Core Financial's specific capabilities in these areas remain undefined based on available documentation. This absence of information prevents meaningful comparison with industry standards or competitor offerings.

Educational resources represent another critical component of comprehensive financial advisory services. These typically include webinars, market commentary, financial planning guides, and investment education materials. The availability and quality of such resources at Core Financial cannot be assessed due to insufficient source material detail.

Technological infrastructure and automation capabilities also remain unclear. This prevents evaluation of whether Core Financial provides modern digital tools that clients increasingly expect from financial advisory services. This includes mobile applications, online portfolio access, automated rebalancing tools, and digital communication platforms that facilitate ongoing client-advisor interaction.

Customer Service and Support Analysis (Score: N/A)

Customer service evaluation for Core Financial faces significant limitations due to insufficient detailed feedback in available source materials. While user reviews on Glassdoor indicate general dissatisfaction, specific information about service channels, response times, service quality metrics, and support availability was not adequately documented.

Comprehensive customer service analysis typically examines multiple contact channels including phone support, email communication, live chat capabilities, and in-person consultation availability. However, Core Financial's specific service delivery methods and availability schedules remain unclear based on available information.

Response time metrics provide crucial insights into service efficiency and client prioritization, but these were not available in source materials. Industry benchmarks typically measure initial response times, resolution timeframes, and escalation procedures, but Core Financial's performance in these areas cannot be assessed without additional data.

The quality of customer service interactions also remains unclear, including staff knowledge, problem-solving capabilities, and client satisfaction outcomes. While negative user sentiment is evident from Glassdoor reviews, specific service quality indicators and detailed customer experience descriptions were not sufficiently detailed in available materials to provide comprehensive analysis.

Trading Experience Analysis (Score: N/A)

Trading experience evaluation for Core Financial cannot be completed due to insufficient information about platform capabilities, execution quality, and trading infrastructure. Available source materials did not provide details about trading platforms, order execution procedures, or technological capabilities that would enable meaningful assessment of the trading environment.

Platform stability and execution speed represent critical factors for any financial services provider. However, specific performance metrics or user experience data regarding Core Financial's trading infrastructure were not available in reviewed materials. This prevents evaluation of whether the firm provides reliable and efficient trading capabilities.

Order execution quality could not be assessed due to lack of specific data in source materials, including fill rates, slippage metrics, and execution speed benchmarks. These factors significantly impact client outcomes and satisfaction but remain unmeasurable based on available information.

Mobile trading capabilities and platform functionality across different devices also remain unclear. This prevents assessment of whether Core Financial provides modern, accessible trading solutions that meet contemporary client expectations for flexibility and convenience.

Trust and Reliability Analysis (Score: 4/10)

Core Financial's trust and reliability assessment reveals a complex situation requiring careful consideration. On the positive side, the firm maintains proper regulatory standing through FINRA, holding legitimate credentials under CRD#: 151044 / SEC#: 8-68330. This regulatory approval indicates compliance with industry standards and legal requirements for operating as a financial advisory service within the United States market.

However, user feedback presents significant concerns that substantially impact the overall trust assessment. Reviews on Glassdoor consistently characterize Core Financial as a "scam," indicating serious user dissatisfaction and trust issues. This stark contrast between regulatory approval and user sentiment creates a challenging evaluation scenario that potential clients must carefully consider.

The absence of detailed information about fund security measures, client asset protection protocols, and transparency practices further complicates the trust assessment. Modern financial advisory firms typically provide comprehensive information about client asset segregation, insurance coverage, and security procedures, but such details were not available for Core Financial in reviewed materials.

Company transparency regarding operations, fee structures, and business practices also appears limited based on available information. This lack of transparency, combined with negative user feedback, significantly impacts the overall trust and reliability rating despite the firm's regulatory standing.

User Experience Analysis (Score: 3/10)

User experience evaluation for Core Financial reveals predominantly negative sentiment based on available feedback sources. Glassdoor reviews consistently express dissatisfaction, with multiple users characterizing the company as a "scam operation." This widespread negative feedback indicates significant user experience issues that potential clients should carefully consider.

The severity and consistency of negative user feedback suggests systemic issues with service delivery, communication, or business practices that impact client satisfaction. While specific details about user interface design, ease of use, or operational efficiency were not available in source materials, the general sentiment indicates substantial user experience challenges.

Registration and verification processes, fund management procedures, and ongoing service interactions could not be evaluated due to insufficient detail in available materials. However, the negative user sentiment suggests that these fundamental service delivery aspects may not meet client expectations or industry standards.

Common user complaints appear to center around concerns about the company's legitimacy and business practices. However, specific operational issues or service delivery problems were not detailed in available source materials. This core financial review must therefore rely primarily on general sentiment indicators rather than specific user experience metrics.

Conclusion

This core financial review reveals a complex and concerning picture that potential clients must carefully consider. While Core Financial maintains proper regulatory credentials through FINRA, the overwhelming negative user feedback raises significant red flags about the company's operations and client satisfaction levels. The stark contrast between regulatory approval and user sentiment creates a challenging evaluation scenario.

Based on available information, Core Financial cannot be recommended for typical retail investors or individuals seeking reliable financial advisory services. The consistent characterization of the company as a "scam" by multiple users on Glassdoor represents a serious concern that outweighs the positive aspects of regulatory compliance. Potential clients considering Core Financial should exercise extreme caution and conduct thorough independent research.

The primary advantage of Core Financial appears to be its focus on comprehensive financial planning and retirement services, backed by proper regulatory licensing. However, these potential benefits are significantly overshadowed by trust and reliability concerns evidenced by negative user feedback. The lack of detailed information about services, fees, and operational procedures further complicates the evaluation and suggests limited transparency in business practices.