Is Chelsea Trust safe?

Business

License

Is Chelsea Trust A Scam?

Introduction

Chelsea Trust is a broker that positions itself within the forex market, offering services for trading various financial instruments, including currencies, cryptocurrencies, and CFDs. As the trading landscape becomes increasingly crowded, traders must exercise caution when evaluating forex brokers. The potential for scams and unregulated entities is high, and it is crucial for investors to ensure that they are dealing with a trustworthy platform. This article investigates the credibility of Chelsea Trust by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory framework governing forex brokers is vital in ensuring the safety of traders' funds and the integrity of trading practices. Chelsea Trust claims to operate in multiple jurisdictions, including Germany, Ireland, Singapore, and South Africa. However, it does not appear to be registered with any significant regulatory authority in these regions, raising serious concerns about its legitimacy.

Core Regulatory Information

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of a valid regulatory license is a significant red flag. Regulated brokers are subject to strict compliance standards, which include maintaining segregated accounts for client funds and adhering to transparency requirements. Chelsea Trust's lack of regulation means that clients have little recourse in the event of disputes or financial losses. Additionally, negative reviews from regulatory bodies, such as the CNMV in Spain, which has flagged Chelsea Trust for fraudulent activities, further complicates its credibility.

Company Background Investigation

Understanding the history and ownership structure of Chelsea Trust is essential for assessing its reliability. Unfortunately, information regarding the company's founding, development, and ownership remains sparse. The lack of transparency about the company's management team and their professional backgrounds raises concerns about accountability. A credible broker would typically provide detailed information about its leadership and their qualifications, which Chelsea Trust fails to do.

Moreover, the absence of a physical address or contact information on its website adds to the uncertainty surrounding Chelsea Trust. This lack of transparency is concerning, as it makes it difficult for potential clients to verify the legitimacy of the broker. In conclusion, the companys opaque background and absence of regulatory oversight suggest that traders should be wary of engaging with Chelsea Trust.

Trading Conditions Analysis

When evaluating a broker, it's crucial to understand the trading conditions and fee structures they offer. Chelsea Trust presents a tiered account system with varying minimum deposit requirements, ranging from $1,000 for a standard account to $50,000 for an exclusive account. However, the lack of transparency regarding spreads, commissions, and other trading costs raises questions about the overall cost of trading with Chelsea Trust.

Core Trading Cost Comparison

| Cost Type | Chelsea Trust | Industry Average |

|---|---|---|

| Spread for Major Pairs | High | Moderate |

| Commission Model | Unclear | Clear |

| Overnight Interest Range | Unspecified | Specified |

The potential for high spreads and unclear commission structures can significantly impact trading profitability. Traders may find themselves facing unexpected costs, which could diminish their returns. Moreover, the unregulated status of Chelsea Trust means that there is no oversight to ensure fair trading practices, further complicating the trading experience.

Customer Fund Safety

The safety of customer funds is paramount when choosing a forex broker. Chelsea Trust's approach to fund security is a crucial aspect to consider. The absence of clear policies regarding fund segregation or investor protection raises alarms. Regulated brokers typically ensure that client funds are held in separate accounts to protect them in case of insolvency.

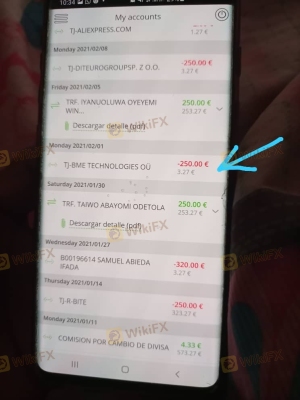

Without such measures, clients of Chelsea Trust may find their investments at risk. The lack of information on negative balance protection also adds to the concerns regarding fund security. Historical complaints about the broker's practices indicate that clients have faced challenges when attempting to withdraw their funds, further emphasizing the potential risks associated with trading on this platform.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the overall experience of trading with Chelsea Trust. Numerous reviews indicate a pattern of negative experiences among users, with common complaints focusing on withdrawal issues, poor customer service, and lack of transparency.

Major Complaint Types and Severity Assessment

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | High | Poor |

| Misleading Information | Medium | Inconsistent |

For instance, many users have reported significant delays in processing withdrawal requests, with some claiming that their funds were effectively trapped within the platform. This pattern of complaints suggests a concerning trend that potential clients should consider when evaluating whether Chelsea Trust is safe.

Platform and Trade Execution

The performance and reliability of the trading platform are critical factors for traders. Chelsea Trust offers its proprietary trading platform, but concerns have been raised regarding its stability and user experience. Reports of slippage and order rejections have surfaced, indicating potential issues with trade execution quality.

Such problems can severely impact a trader's ability to execute strategies effectively. Furthermore, any signs of platform manipulation or unfair practices could exacerbate the risks associated with trading on this platform.

Risk Assessment

Using Chelsea Trust comes with inherent risks that traders must carefully consider. The lack of regulation, coupled with negative customer feedback and issues surrounding fund safety, contributes to a heightened risk profile.

Key Risk Areas Summary

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Fund Safety Risk | High | No clear protection |

| Customer Service Risk | Medium | Poor response rates |

To mitigate these risks, potential clients should conduct thorough research, consider using regulated alternatives, and remain vigilant about their trading practices.

Conclusion and Recommendations

In summary, the investigation into Chelsea Trust raises significant concerns about its legitimacy and safety. The broker's unregulated status, lack of transparency, and negative customer experiences suggest that traders should exercise extreme caution. There is a strong indication that Chelsea Trust may not be a safe option for trading, and potential clients should be wary of the risks involved.

For traders seeking reliable alternatives, it is advisable to consider regulated brokers with a proven track record and transparent practices. Engaging with a trustworthy broker can enhance the trading experience and provide a greater sense of security in managing investments.

Is Chelsea Trust a scam, or is it legit?

The latest exposure and evaluation content of Chelsea Trust brokers.

Chelsea Trust Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Chelsea Trust latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.